Articles

Choosing to Enjoy It

At my 11-year-old daughter, Mia Sarah's, bridging ceremony from elementary to middle school, a friend was complaining about the traffic and how much he hates driving his daughter to school.

Warren Buffett and the Berkshire Hathaway Paradox

Trip to Omaha has everything and nothing to do with Warren Buffett. The main event that draws everyone to Omaha – the Berkshire Hathaway (BRK) annual meeting – is actually the least important part.

Redefine “value” in this era of the US stock market

Do we need to redefine “value” in this era of the US stock market, or should we continue to sit on the sidelines if traditional metrics show equities to be overvalued?

A Brief Rant on Tesla & Musk

Last week, I received a lot of responses to my article about Tesla. They ranged from “Stop spewing your anti-right propaganda and stick to data” to “You don’t like Tesla stock. Are you saying your next car won’t be a Tesla?”

Current thoughts on Tesla

Tesla market value of $780 billion mostly reflects Elon's future dreams, not car sales. The reality? Only $100-180 billion tied to the actual vehicle business.

Europe Can’t Hide Behind America Anymore

Americans have always outspent Europe on defense, but to be fair, we have a currency advantage. Our military might elevated our currency to reserve status.

IMA’s March 2025 Client Dinner Video

Once a year, my company, IMA, hosts a dinner for our clients. Most of them live outside of Denver—and many outside the U.S.—so this event gives us a rare and meaningful chance to meet face-to-face, often for the first time, and really get to know each other.

The Reputational Bankruptcy of the American Dollar

The US dollar will likely continue to get weaker, which is inflationary for the US. Let me start with some easily identifiable reasons.

Tariffs, Debt, and a Recession by Design

Trump's tariff decisions are unilateral – even though the Constitution clearly places that power in Congress’s hands. Why does he behave like a king?

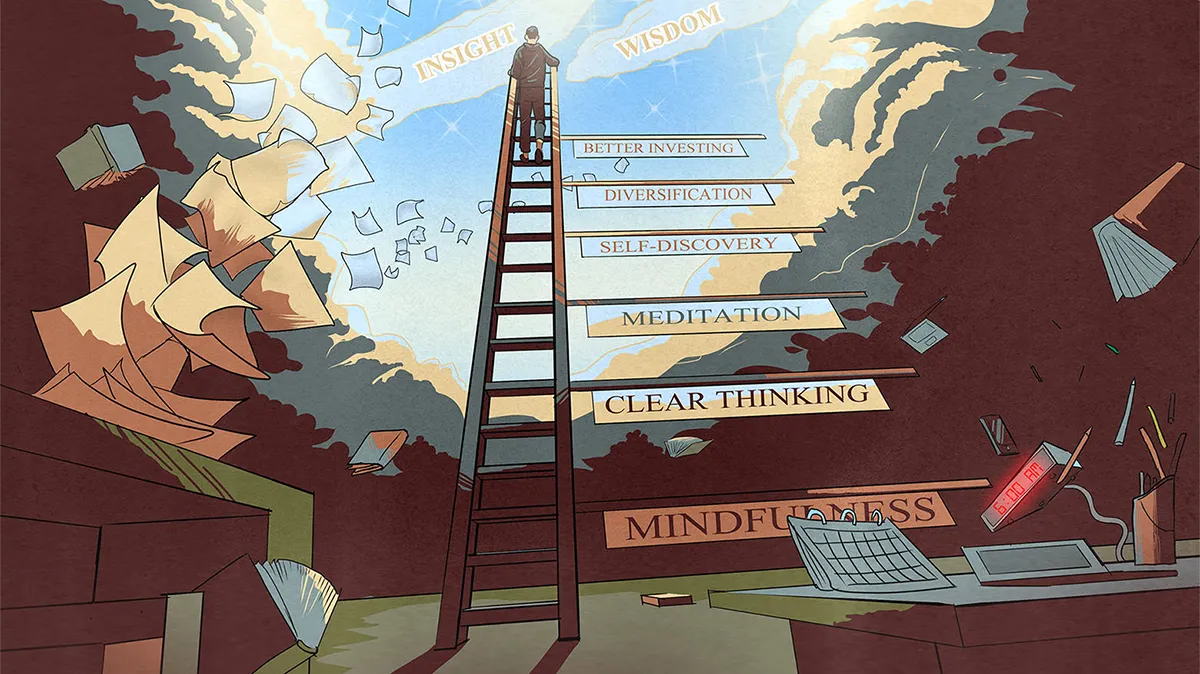

The Paranoid Russian Jew Approach to Investing

When asked about his money manager, our long-term client Ed, who became a dear friend, proudly stated, “My money is managed by a paranoid Russian Jew.” This perfectly sums up our approach to investing.

A Value Investing Lesson from the Blackjack Table

Over a lifetime, active value investors will make hundreds, often thousands of investment decisions. Not all of those decisions will work out for the better.

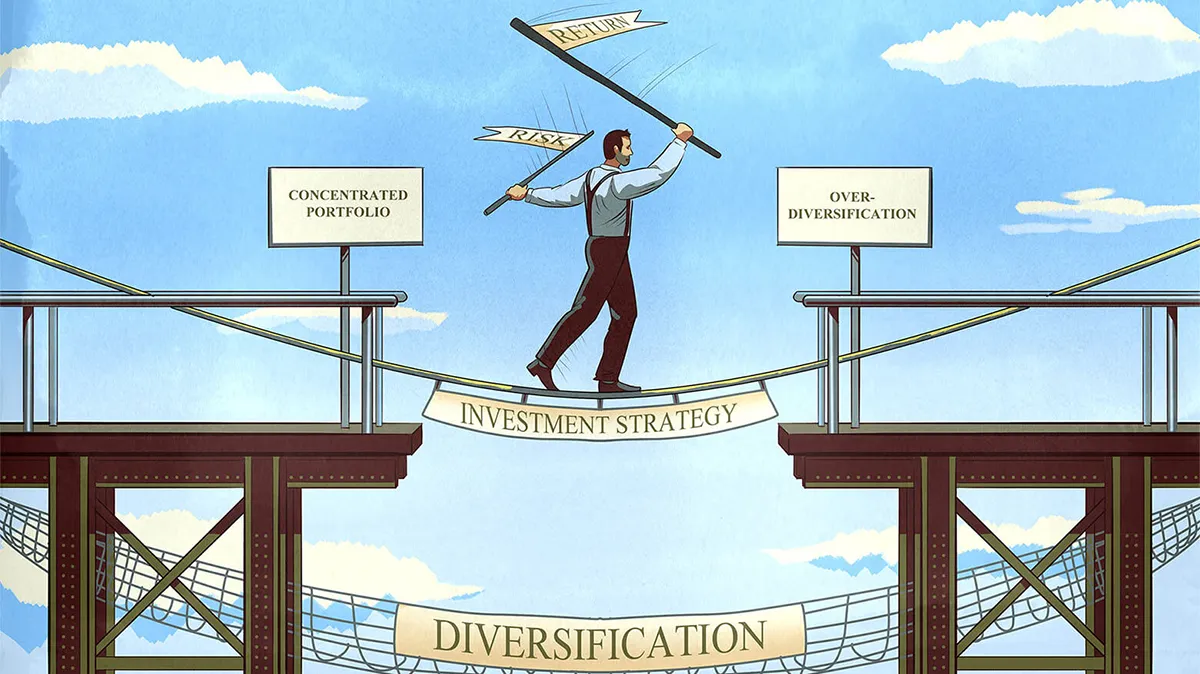

Q&A Series: Diversification and Position Sizing in Investing

Today's excerpts from Q&A session I held in Omaha focuses on crucial investment strategies: diversification and position sizing in investing.

The Hidden Advantages of Investing from NOT New York City

What are the hidden advantages of living away from “noisy” investing centers like New York?

Money Managers Are Not Factory Workers

One of the biggest hazards of being a professional money manager is that you are expected to behave in a certain way.

The Super Bowl Is a Tradition

The beauty and embarrassment of writing is that your past essays can be easily unearthed and brought to the present. ...

DeepSeek Breaks the AI Paradigm

I’ve received emails from readers asking my thoughts on DeepSeek. I need to start with two warnings. First, the usual one: I’m a generalist value investor, not a technology specialist, so my knowledge of AI models is superficial. Second, and more unusually, we don’t have all the facts yet.

Escaping Stock Market Double Hell

Over the last few years, our portfolio has skewed more international. Today, if you only invest in the US, you're experiencing two stock market hells.

Embracing Stock Market Stoicism

2024 brought me back to a core Stoic principle that I hold close to my heart: the dichotomy of control. We can apply it in investing.

Thoughts from the Consumer Electronics Show

My son Jonah and I were at CES (the Consumer Electronics Show) in Las Vegas. I wanted to attend CES to shake myself out of my comfort zone.

Q&A Series: Money Habits for Kids and the Power of Writing

In this Q&A excerpt, we'll explore teaching money habits to young people and how writing has improved my investment approach.

The Impact of Higher Interest Rates on the Economy – AI Edition

I asked AI to educate and entertain my readers with a radio show-style dialogue based on my essay - The Impact of Higher Interest Rates on the Economy.