Vitaliy Katsenelson

Embracing Stock Market Stoicism – Ep 244

2024 brought me back to a core Stoic principle that I hold close to my heart: the dichotomy of control. We can apply it in investing.

The Super Bowl Is a Tradition

The beauty and embarrassment of writing is that your past essays can be easily unearthed and brought to the present. ...

Thoughts from Consumer Electronics Show – Ep 243

My son Jonah and I were at CES (the Consumer Electronics Show) in Las Vegas. I wanted to attend CES to shake myself out of my comfort zone.

DeepSeek Breaks the AI Paradigm

I’ve received emails from readers asking my thoughts on DeepSeek. I need to start with two warnings. First, the usual one: I’m a generalist value investor, not a technology specialist, so my knowledge of AI models is superficial. Second, and more unusually, we don’t have all the facts yet.

Escaping Stock Market Double Hell

Over the last few years, our portfolio has skewed more international. Today, if you only invest in the US, you're experiencing two stock market hells.

Embracing Stock Market Stoicism

2024 brought me back to a core Stoic principle that I hold close to my heart: the dichotomy of control. We can apply it in investing.

Thoughts from the Consumer Electronics Show

My son Jonah and I were at CES (the Consumer Electronics Show) in Las Vegas. I wanted to attend CES to shake myself out of my comfort zone.

Q&A Series: Money Habits for Kids and the Power of Writing – Ep 242

In this Q&A excerpt, we'll explore teaching money habits to young people and how writing has improved my investment approach.

Managing a Million: What Would I Do Differently? – Ep 241

Warren Buffett has stated multiple times that if he could manage a very small amount of money today, he would be able to return more than 50% per year to shareholders. If you managed a million dollars of only your own money, would you do it differently?

Q&A Series: Money Habits for Kids and the Power of Writing

In this Q&A excerpt, we'll explore teaching money habits to young people and how writing has improved my investment approach.

The Impact of Higher Interest Rates on the Economy – AI Edition

I asked AI to educate and entertain my readers with a radio show-style dialogue based on my essay - The Impact of Higher Interest Rates on the Economy.

The Impact of Higher Interest Rates on the Economy – AI Edition – Ep 240

I asked AI to educate and entertain my readers with a radio show-style dialogue based on my essay - The Impact of Higher Interest Rates on the Economy.

Navigating Market Cycles: From Bulls to Nvidia – AI Edition – Ep 239

I asked AI to transform my essays into a radio show-style conversation. In this episode, topic is stock market math, sideways markets, the role of P/E in market cycles, impact of interest rates on P/E, economic analysis, Magnificent Seven stocks, NVIDIA, and a lot more.

Navigating Market Cycles: From Bulls to Nvidia – AI Edition

I asked AI to transform my essays into a radio show-style conversation. In this episode, topic is stock market math, sideways markets, the role of P/E in market cycles, impact of interest rates on P/E, economic analysis, Magnificent Seven stocks, NVIDIA, and a lot more.

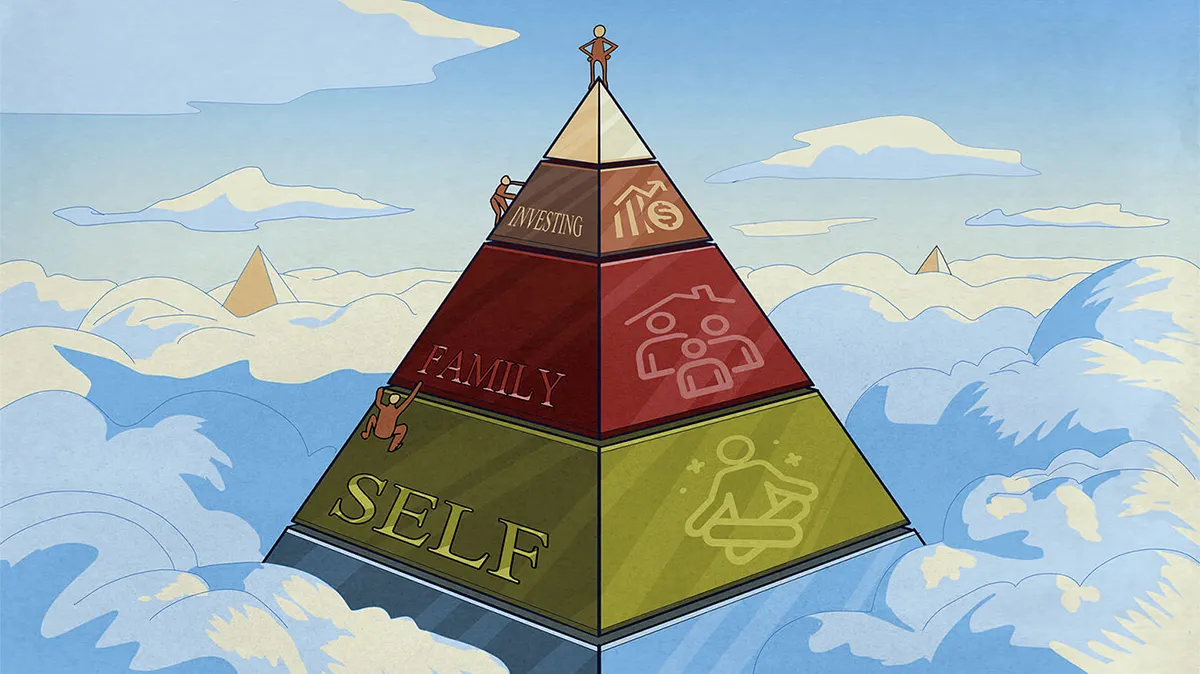

A Balanced Life: My Approach – Ep 238

How do you balance your life between being an investor, running a firm, writing and other aspects of your life such as your family?

Managing a Million: What Would I Do Differently?

Warren Buffett has stated multiple times that if he could manage a very small amount of money today, he would be able to return more than 50% per year to shareholders. If you managed a million dollars of only your own money, would you do it differently?

Choosing an Investment Manager: Beyond Warren and Charlie – Ep 237

If you were obliged to invest all your assets with one person and you couldn’t choose Warren or Charlie, whom would you pick?

A Balanced Life: My Approach

How do you balance your life between being an investor, running a firm, writing and other important aspects of your life such as your family?

Q&A Series: On Parenting and Personal Growth – Ep 236

I wanted to share excerpts from a Q&A session I held in Omaha. This excerpt focuses on parenting and personal growth.

Challenging Investment Rules and Key Investor Traits – Ep 235

What’s a famous investment rule I don’t agree with? Which key characteristics should a good investor have?

Choosing an Investment Manager: Beyond Warren and Charlie

If you were obliged to invest all your investable assets with one person and you couldn’t choose Warren or Charlie, whom would you pick?