Vitaliy Katsenelson

How a Stock Market Turns Investors Into Gamblers – Ep 32

What do a degenerate gambler and a stock market investor have in common? Vitaliy discusses this question, using a real estate example. You can read this article online at:

Is Tesla Theranos or Apple? (Part 2 of “Tesla, Elon Musk, and the EV Revolution”) – Ep 31

In this podcast, Vitaliy further explores Tesla, electric vehicles, and the role Elon Musk plays in the company today and tomorrow. Can traditional auto companies disrupt themselves and catch up to Tesla? Is autopilot really viable? And is Elon Musk a...

The EV Paradigm Shift (Part 1 of “Tesla, Elon Musk, and the EV Revolution”) – Ep 30

You don't fully know a company until you buy its stock. This recently happened to Vitaliy, except he didn't buy a stock, he bought a car: a Tesla. In this episode, Vitaliy takes the listener under the hood of how electric vehicles represent a tectonic...

Tesla, Elon Musk and the EV Revolution

In late June 2019, I bought a Tesla Model 3. Most people would just enjoy driving such a car. Not me – I wrote about it for two or three hours a day.

The Making of CAPITALISTIC PIG – Ep 29

When a young Vitaliy found out that a relative of his had secretly emigrated from the USSR to the United States, his first reaction was to brand her as a traitor. But years later, Vitaliy came to the US himself and never looked back. In this episode...

My Single Greatest Achievement

My son Jonah is taking a gap year after graduating high school and will spend the next two semesters in Israel. Before Jonah boarded the plane, we exchanged letters. What he wrote to me stands above anything else I have accomplished in my life. This is my single greatest achievement.

My Personal Manifesto – Ep 28

The book that has had the biggest impact on Vitaliy this past year is Mark Manson’s The Subtle Art of Not Giving a F*ck. He loved this book so much he read it twice – that was not enough. Then he listened to it twice on Audible. But to really...

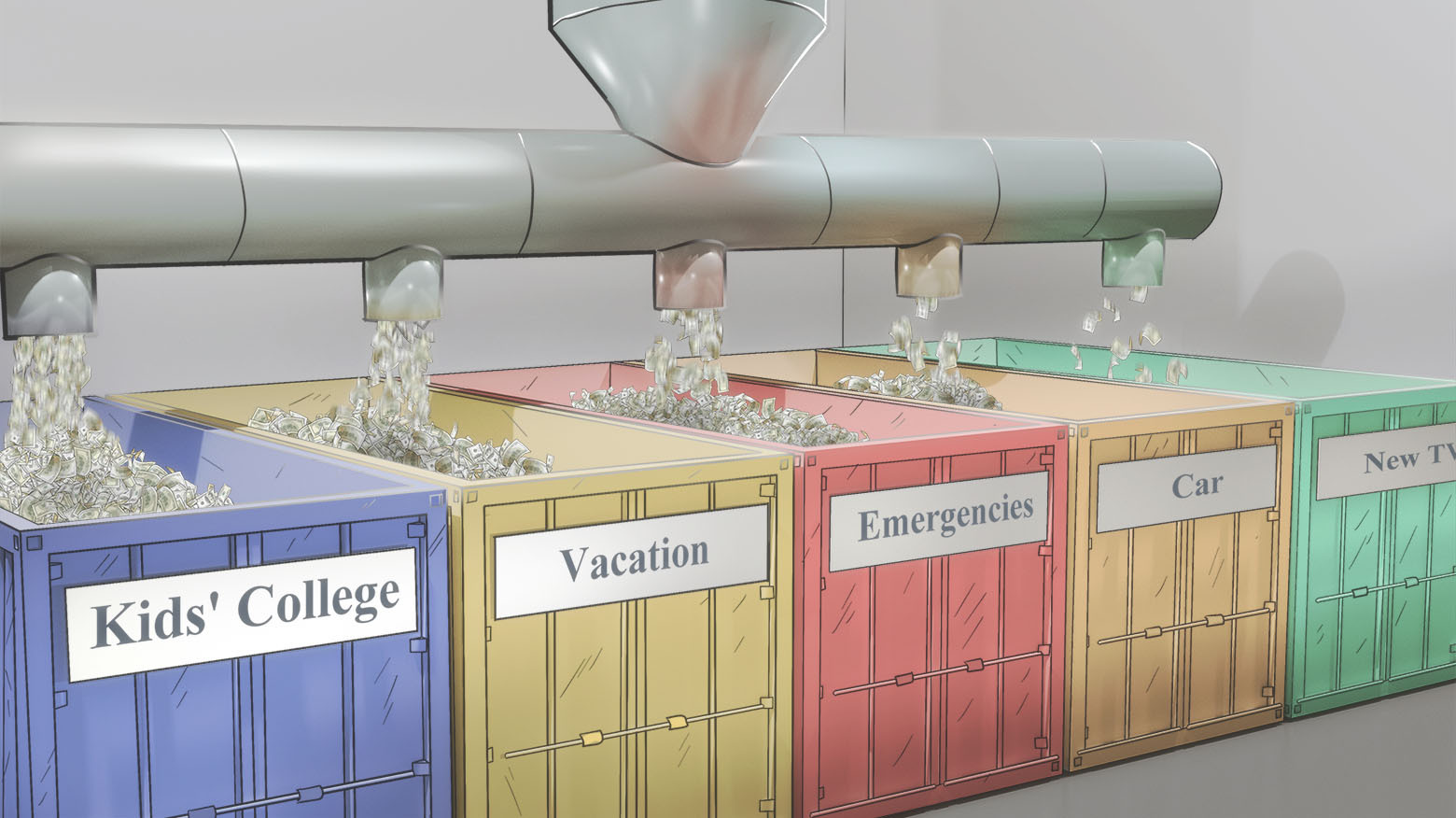

Personal Finance Advice That Changed My Life – Ep 27

One of the best wedding gifts Vitaliy received was lunch with his friend, Mark. Vitaliy reflects on the financial advice Mark gave me then and how it could help young people like his son Jonah settle into adulthood with a lot more forward-thinking....

Personal Finance Advice That Changed My Life

Today I am going to write about a topic I have never written about before: personal finance. I am writing about this not so much for you, faithful reader, as for my kids.

Beats and Misses, Seen and Unseen – Ep 26

Investors love focusing on short-term results, arguing that long-term success is built out of a series of short-term successes. But is that really the best way to invest? And if a company is focused on constantly beating quarterly metrics, is it a...

How Franz Liszt Has Revolutionized Piano and Classical Music – Ep 25

Imagine that Intel released a processor that was 100 times faster than anything made previously. An amazing invention on its own, but useless without software developers who could make full use of this new technology. In the 19th century, piano...

The Subtle Nuances of Softbank – Ep 24

Vitaliy's firm has been invested in SoftBank since 2015, despite the constant criticism of the stock. Why? In this episode, Vitaliy explores the loss of nuance amongst many of today's market analysts that leads to incorrect conclusions about company...

The Subtle Nuances of Softbank

It seems that Softbank stock has been hated and misunderstood every day we’ve owned it – until recently.

How Emotional Intelligence Can Make You a Better Investor – Ep 23

A knee surgeon can't decide to operate only on right knees because he previously had a few mishaps with the left side. But investors can do just that: They can pick their battles and avoid problems they're unlikely to solve correctly. Listen to...

Transgender Trees, Homelessness, and a Dare in San Francisco

I was on a trip to San Francisco with my kids. As I am flipping through the memory bank, I am shocked at how many experiences we packed into three days.

Soul in the Game – Ep 22

Nassim Taleb, author of "The Black Swan," also coined the concept of "the artisan" – the person who has "soul in the game" when it comes to their work. But what does being an artisan mean when it comes to investing? Vitaliy and IMA founder Michael...

These Simple Tips Can Make You a Better Investor

The stock market is not your friend. Instead, the market awakens a dangerous emotion — fear. Fear is not your friend, either. Here are some simple tips that can make you a better investor.

Here’s Why Pharmacy Stocks Are a Bargain Right Now – Ep 21

Judging by how pharmacy and drug-distribution stocks have performed the last several years, you'd think they were on the edge of going out of business. But nothing is further from the truth. Hear Vitaliy explain what makes these stocks a great buy in...

My Personal Manifesto

The book that has had the biggest impact on me the past year is Mark Manson’s The Subtle Art of Not Giving a F*ck. I wrote a 7.000 words review, it has turned into a personal manifesto.

Should You Invest in Marijuana Stocks? Ep – 20

As marijuana is becoming legalized in more and more states, many investors have considered investing in what is projected to be a booming industry. But should you invest in marijuana stocks? Here's Vitaliy's take. You can read this article online...

Should You Invest in Marijuana Stocks?

What do you think about investing in marijuana stocks? We think making money on marijuana (cannabis with high content of intoxicating THC) and hemp (cannabis that contains low content of THC) will be very difficult.