Vitaliy Katsenelson

For Investors, Discovering Truth Takes Time – Ep 19

"Time discovers truth," said Seneca – and he may have been speaking about the market (if by "truth" he meant "accurate valuation"). Listen to Vitaliy explain why. You can read this article online at: Disclosure:

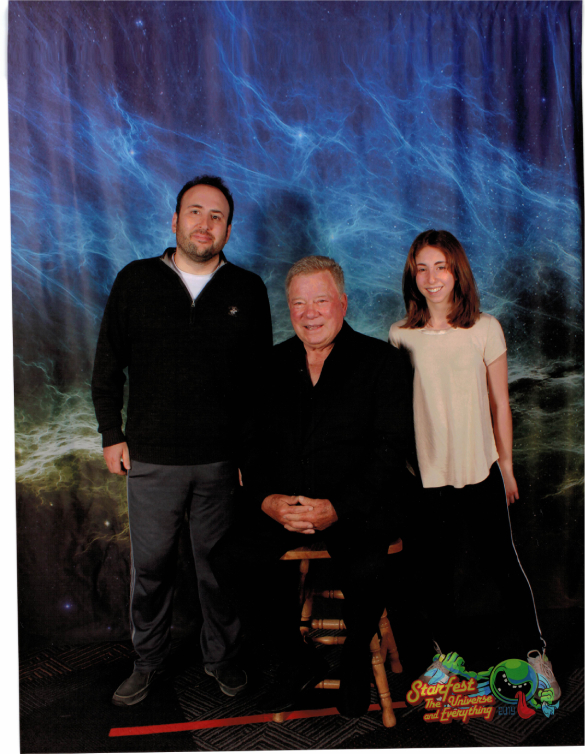

Looking for Denny Crane at a Star Trek Convention

My daughter Hannah and I visited the Star Trek convention in Denver to meet William Shatner because of his role of Denny Crane.

Was the Uber IPO a Success?

The media often portrays a successful IPO as one that opens 30-100% above its set price and finishes the day up, however this is not beneficial to the company itself. We can look at the Uber IPO from a different perspective.

Here’s Why Pharmacy Stocks Are a Bargain Right Now

Why pharmacy stocks are a good investment right now? Let's take a look at two specific companies, McKesson and Walgreens Boots Alliance.

Investment Lessons Learned from the Poker Table – Ep 18

Having the second best hand in poker is dangerous: You're likely to go all in, and you may win, but you also risk losing it all. There's a lot of this going on in the investing world. Listen to Vitaliy explain the problem – and the solution. You can...

The VC Bubble Is Putting Established Companies at Risk – Ep 17

Continuously low interest rates can create bubbles – and there's evidence that we're living through a venture capital bubble today. The problem is that when this bubble bursts, it won't just affect companies that are relying on VC funding to stay...

The Venture Capital market Bubble Is Putting Established Companies at Risk

Low interest rates have been in place for over a decade and while they have created a bubble in the venture capital market, they have also caused some companies to rely on the kindness of future capital markets and become "Ponzi-like" companies.

Being A Father – Ep 16

What's better: leaving your children with $100M after you pass away, or leaving them with fond memories of your time together? Sparked by an unexpected comment from a millionaire's son, Vitaliy ponders this question. You can read this article online...

Idealist, I Am

My wife and I recently watched a Ukrainian comedy series. A history teacher is caught on video delivering a passionate ...

Is Value Investing Dead? – Ep 15

Value investors have underperformed over the past decade and many are starting to succumb to the allure of growth stocks. But is that because value investing is dead? Or is there another, more worrying reason? You can read this article online at:

Is Value Investing Dead?

According to many market commentators, value investing doesn’t work the way it used to, and some tout statistics that growth has outperformed value over the last decade. Is value investing dead?

Letter to a Young Investor – Ep 14

What advice would Vitaliy give to a young, aspiring value investor today? The same advice he'd give his younger self as he was just graduating college. Hear Vitaliy say what he wishes he'd heard when he first began his career as an investor. You can...

Letter to a Young Investor

To quote Mark Twain, don’t let schooling interfere with your learning. I recall that when I graduated from university, I was feeling invigorated by Modern Portfolio Theory (MPT).

The True Value of Macro Forecasting – Ep 13

Market forecasting is like weather forecasting: It has a short shelf life and is therefore of little use. But there is a place for macro forecasting in investing. Listen to Vitaliy explain what that place is. You can read this article online at:

Money Managers Are Not Factory Workers – Ep 12

It's the 21st century, but money managers still follow an office culture straight out of Henry Ford's early-1900s assembly line days. Is this hurting how money managers choose stocks? And how could they do better? Listen to Vitaliy discuss these...

Who Am I (and my composers)? – Ep 11

Vitaliy has long considered himself more American than Russian, so why does he feel that it's the Russian composers (like Rachmaninoff and Tchaikovsky) that speak to his soul? Vitaliy explores this question - and Rachmaninoff's Piano Concerto Number 4...

Who Am I? (and my composers)

Someone recently asked whether I think of myself as Russian, or American. My initial response (without thinking) was – American. But as I gave this question more thought I realized that the answer is more complex.

Why I No Longer Mind Losing an Argument – Ep 10

Dale Carnegie's "How to Win Friends and Influence People" was one of the first American capitalist books to be translated in post-Soviet Russia. But it took Vitaliy many years to fully absorb the lessons Carnegie teaches in it. Listen to Vitaliy's key...

50 Shades of Warren Buffett or Next Year In Omaha – Ep 9

Is the Berkshire Hathaway Annual Meeting really about Warren Buffett? With another annual meeting coming up, Vitaliy reflects on over a decade of making his pilgrimages to Omaha. You can read this article online at:

Softbank will succeed even if its WeWork investment doesn’t work out – Ep 8

Is SoftBank setting itself up for failure by investing in WeWork? Despite his apprehension regarding WeWork, Vitaliy isn't worried. Hear his take on it & the reasoning behind his investing firm's decision to hold SoftBank stock. You can read this...

Softbank Will Succeed Even If Its WeWork Investment Doesn’t Work Out

My firm is not as big a fan of WeWork as Softbank's CEO, Masayoshi Son, and we have doubts about WeWork's ability to make money. We have watched Son make investment decisions for Softbank, and we believe he has integrity, intelligence, and follows a deliberate process.