Vitaliy Katsenelson

Is it a Bull, Bear or Cowardly Lion Market?

Are we in a bull, a bear, or a cowardly lion market? As we will see, the answer can make a huge difference in your investment portfolio.

Active Trader Magazine Interview

I was interviewed by Active Trader Magazine. What do I know about trading? Absolutely nothing!

Starbucks International Growth

I was surprised to find very few Starbucks (SBUX) shops in Vienna. Despite traveling extensively around the city I counted only two.

Jackson Hewitt – To Be or Not to Be?

The certainty that we have to file a tax return every year, that the number of tax returns is rising, tax preparation is getting more complex and thus despite availability of tax preparation software more and more people outsource their tax preparation peaked my interest in Jackson Hewitt.

Katsenelson Predicts

I find January to be one of the most difficult months for long-term investors. In the spirit of the fine American tradition of making New Year’s resolutions, we feel a need to make a resolution for the stock market in the form of a prediction.

Patience and More Patience

This market requires patience and more patience. Identify high quality companies you want to own, determine at what price and wait.

Interview with Advisor Perspectives

After I wrote the profit margin article for Barron’s couple of weeks ago, I received many inquiries asking me to identify which sectors were the least and the most impacted by rise of corporate profit margins.

Down to the Last Drop of Profit Growth (in Barron’s)

STOCKS ARE ALLEGEDLY CHEAP NOW, at 17 times 2007 earnings. And they are cheap by historical standards.

What does Hank know?

Hank Greenberg, the ex-chairman of AIG (AIG), the guy who made AIG what it is today, hired an investment banker to help him figure out what the company is worth.

BusinessWeek Video Interview

I talked to Jim Ellis at BusinessWeek about my book Active Value Investing. As you will see, if you tie my hand I'd go mute.

Bank of America – The Contrarian

I welcome the Bank of America (BAC) acquisition of Countrywide (CFC), as for the first time as I can remember BAC acts as a contrarian investor.

Creator of Incentives

When I was in the third grade, growing up in Murmansk, a city above the Polar Circle in (then) communist Russia, my buddy and I decided to start a business.

Dragged Down by IRS and IRS is Your Friend

Jackson Hewitt (JTX) declined significantly yesterday on news the IRS proposed regulation to ban refund anticipation loans, or RALs.

Will Gold Shine Again?

This article was originally called Will Gold Shine Again? It was excerpted from my book Active Value Investing and appeared in the Rocky Mountain News.

Denver Post Article: One step up, one step back

Denver Post wrote an article about my book Active Value Investing. The question that comes to mind - what am I doing reading my own book?

The Making of Capitalistic Pig I am Today

I spent my youth in Murmansk, a city in the northwest part of Russia. Murmansk owes its existence to the port that, due to the warm Gulf Stream, doesn’t freeze during the long winters, providing unique access to Russia from the north.

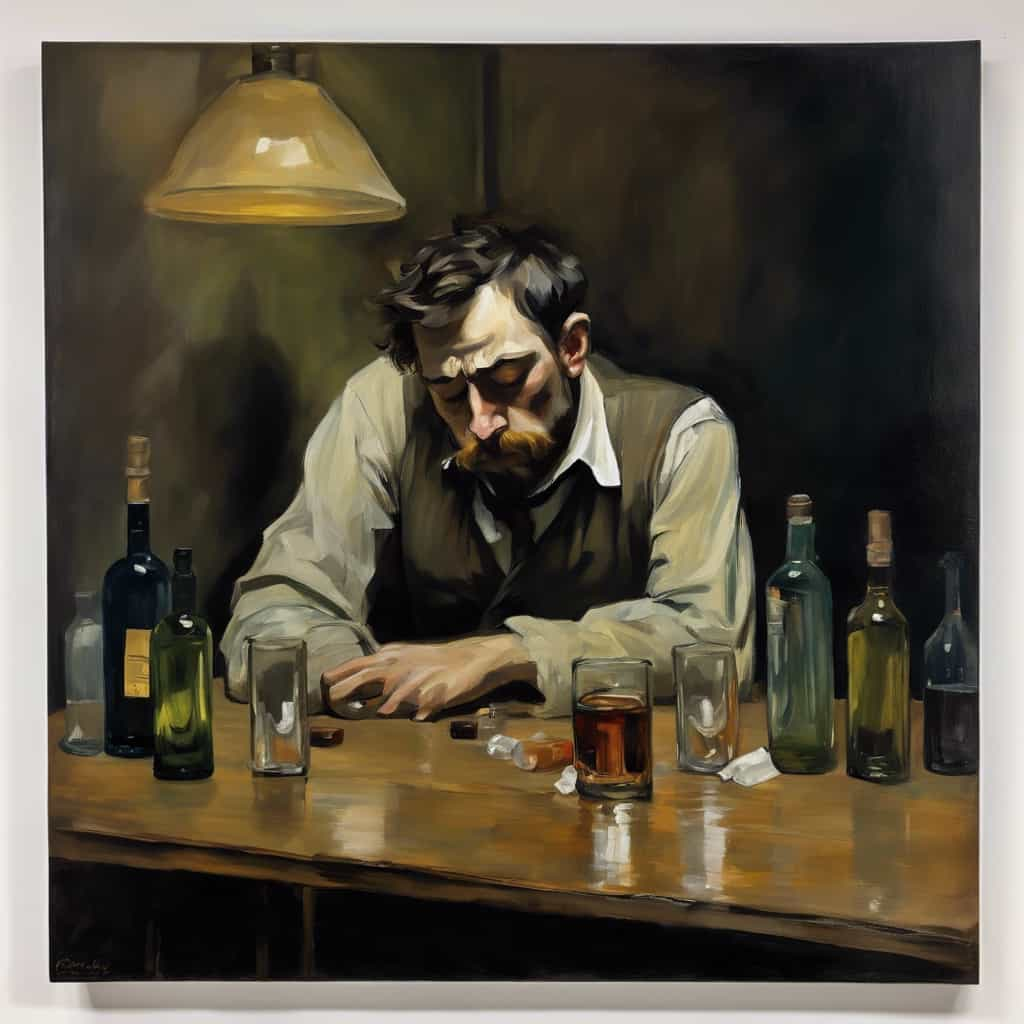

Russia’s Depressing Story

After 16 years of almost no contact with my Russian high school and college friends I stumbled on Odnoklassniki.ru, a website very similar to Classmates.com.

Joseph A. Banks – Another Quarter, Same Great Story

Jos A. Bank (JOSB) reported decent numbers yesterday: sales grew 10%. It's not a blow out number but a respectable number for this environment.

Citigroup – As Good As it Gets?

Who would have thought that an almighty Citigroup (C ) would be taking out a sub-prime no-income verification $7.5 billion convertible preferred loan from Abu Dhabi?

Interview With Vitaliy Katsenelson by Philip Durell and Bill Mann

In October, I had a great pleasure to be interviewed by two of my favorite Motley Fools: Philip Durell advisor to Motley Fool Inside Value newsletter and Bill Mann co-advisor to Motley Fool Hidden Gems newsletter.

Interviewed By George at Fat Pitch Financials

I was interviewed by George who runs Fat Pitch Financials and Value Investing News. George also reviewed my book.