Uncategorized

See You in Omaha 2011

It is time again for the annual trip to Warren Buffett’s Omaha to Berkshire Hathaway annual meeting. Warren Buffett over the years was turned into god.

My 10 Favorite/Important Articles from 2010

Here are my 10 most favorite/important articles from 2010, all of them are still relevant today.

The Little Book of Sideways Markets is Out!

The Little Book of Sideways Markets is officially out. It was a fun and interesting project. I took Active Value Investing, completely rewrote the first half of the book.

Microsoft Debt Issuance Makes Zero Economic Sense

Microsoft will use the sales proceeds to repay short-term debt. If it was any other company I’d ignore this headline as a daily noise as this kind of things happens all the time.

Investing in Range-Bound Markets

Here is my article on range-bound markets in NAPFA magazine: Investing in Range-Bound Markets by Vitaliy N. Katsenelson (published in ...

See You In Omaha and More Random than Usual Thoughts

It’s time for the annual trip to Omaha. For many, it’s a worshipful pilgrimage, as they hang on every word coming out of the Oracle’s mouth as the Gospel of Eternal Truth.

Travel (Mis) Adventure

I was invited to speak to the CFA Society of Bermuda. My wife and I decided to make a mini kids-free vacation out of it.

Even Capitalist Pigs Should Love Bank Regulation

I am a Capitalist Pig, and proud of it, thus you would not expect me to support government interference and more strenuous regulation of financial institutions – after all, capitalism (free markets) and tight regulation don't mix well.

Chinese Quest for Shortcut to Greatness

The Chinese economy must be getting out of control, because the Chinese government is doing the unthinkable: It is desperately trying to put the brakes on the economy.

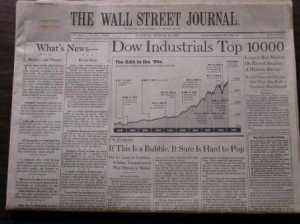

Welcome to Another Lost Decade

The stock market’s performance over the next decade will be very similar to the one since 2000: the WSJ appropriately named it “the lost decade.”

Barron’s: Economic Steroids Are Toxic, Too

The global economy is like a marathon runner who ran too hard and hurt himself. This runner has been injected with some industrial-quality steroids

China vs. the World

Investors have a healthy distrust, and rightly so, of governments running banks in the US and UK, but for a very strange reason are comfortable with the Chinese government wheeling and dealing with Chinese banks.

Dubai’s Shot to the Moon

Dubai’s plan to diversify away from petrochemicals made sense. Maybe it is even destined to become the Las Vegas of the Middle East, the Mecca of business travel and luxury.

Will Japan drive our interest rates higher?

In investing, it's important to think unconventionally and creatively while at the same time considering risks - no matter how remote or unmanageable they are.

Obama’s First Econ Lesson

Education is expensive, consumes a lot of time and the payoff is not worth the trouble. This is a very early wake up call on socializing medical care in the US.

The Next Great Bubble: China

After the bubbles in technology, housing, and commodities, we saw the mother of all bubbles: the one in global liquidity. The world economy seemed to require bubbles for its continued functioning.

Interview with Advisor Perspectives

I was interviewed by terrific Robert Huebscher at Advisor Perspectives. We've revisited my range-bound markets thesis, possible economic scenarios for our economy, and discussed global economy including Europe, Russia, Middle East, and of course China.

Forbes Video Interview: Dotcom portfolio

I was interviewed by Forbes in early October. I discussed my favorite "dotcom" portfolio of stocks.