Year: 2021

This Holiday, Will Mr. Market Eat Too Much Pi? – Ep 143

There is a cryptocurrency, also named Omicron, that was up 900% on the day the new COVID-19 variant was publicized. Try as he might, Vitaliy cannot figure out what would have caused this crypto to spike that day. He muses that Mr. Market must be so...

Welch vs Bezos – Ep 142

During his tenure, Jack Welch built GE into an earnings estimates-beating-machine. There's just one problem with that: it leads to extreme short-termism, and ultimately the misallocation of capital. Contrast this with Jeff Bezos' approach of...

This Holiday, Will Mr. Market Eat Too Much Pi?

There happens to be a cryptocurrency, one of thousands, that is also named Omicron. I still cannot grasp the logic behind it, but that cryptocurrency was up 900% on the day the South African variant was christened. There must have been a trading algorithm or a lot of bored investors looking for the next gamble, to drive something seemingly worthless up 900%.

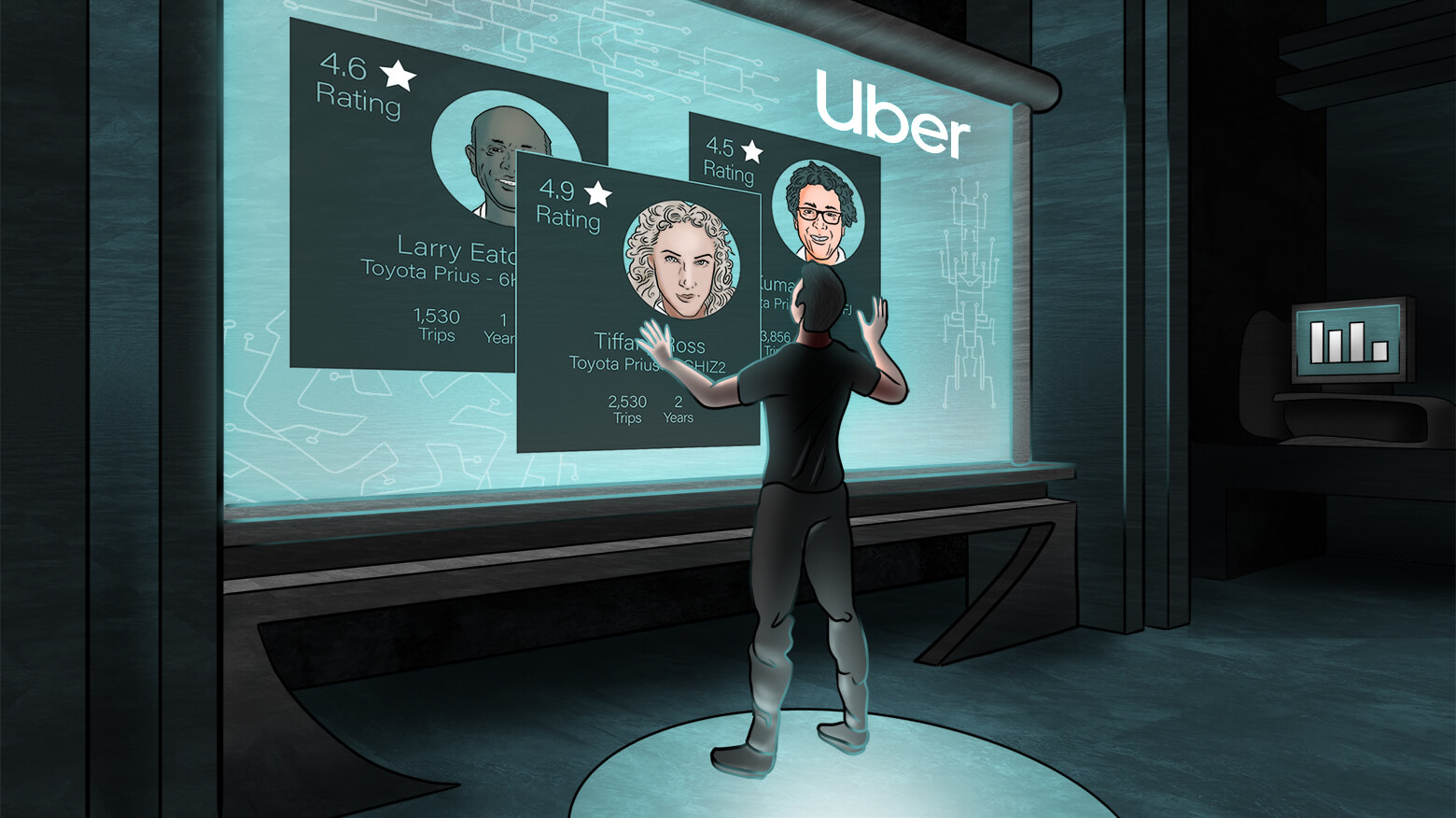

Our Analysis of UBER (Updated) – Ep 141

Vitaliy re-shares and updates his analysis of Uber, and why it remains an attractive investment. He provides a mental model of how to analyze companies that may appear expensive but have yet to reach escape velocity in their cost structure and have a...

Inflation Update: Not Transitory Yet! – Ep 140

We are experiencing a perfect storm of inflation, formed by seemingly small factors. Each on its own may not be particularly significant, but once combined they result in an event that significantly exceeds the sum of all parts. Vitaliy provides an...

Inflation Update: Not Transitory Yet!

Today we are experiencing a perfect storm of inflation. A perfect storm is formed by seemingly small factors. Each one on its own may not be particularly significant, but once combined they result in an event that significantly exceeds the sum of all parts. I provide an update on my previous two inflation articles, and the risks I see on the horizon in the next few quarters.

Inflation Update: Not Transitory Yet!

Today we are experiencing a perfect storm of inflation. A perfect storm is formed by seemingly small factors. Each one on its own may not be particularly significant, but once combined they result in an event that significantly exceeds the sum of all parts. I provide an update on my previous two inflation articles, and the risks I see on the horizon in the next few quarters.

Beloved Country. Unloved Hedge. (Updated) – Ep 139

Vitaliy re-shares his 2020 musings on the US Dollar, and its role in the world, and gold, and its role in IMA portfolios. You can read this article online here:

US and China: In the Foothills of Cold War (Updated) – Ep 138

Vitaliy updates listeners on his views about the US and China, and includes his previous article going over the risks posed by tensions between the two nations. He also discusses and shares an update on IMA's investment in defense stocks, in light of...

Beloved Country. Unloved Hedge. (Updated)

My thinking on gold, the US Dollar, our national debt and our reserve currency status has not really changed much since August 2020, except that at IMA we have been increasing our exposure to foreign companies whose business is not tied to the US. We still have a small hedge in gold – I am as unexcited about it as I was when I wrote this article.

Our Analysis of UBER (Updated)

I re-share and update my analysis of Uber, and why it remains an attractive investment. I provide a mental model of how to analyze companies that may appear expensive but have yet to reach escape velocity in their cost structure and have a large market addressable market that they’ll likely dominate.

US and China: In the Foothills of Cold War (Updated)

In this article, I update my views about the US and China, and include my original article going over the risks posed by tensions between the two nations. I also discuss and share an update on IMA's investment in defense stocks, in light of the current geopolitical climate.

Homophobic Arbitrage – Ep 137

Vitaliy recounts the time he and his brother Alex were stranded in Key West without a hotel room for a night. Every hotel had no vacancy, except one "all male" hotel. Vitaliy tells the story of their pleasant stay there, and how investors can profit...

Let’s keep humans at the heart of hiring practices – Ep 136

The Financial Times recently published an article about Vitaliy's travails in recruiting. After sharing the article, Vitaliy expands on what he learned about recruiting, teams, and culture since becoming CEO of IMA. Letter to a Young Investor link: ...

Let’s Keep Humans At The Heart Of Hiring Practices

The Financial Times recently published an article about my travails in recruiting. After sharing the article, I expand on what I learned about recruiting, teams, and culture since becoming CEO of IMA.

Winning the Ovarian Lottery

“At least a billion people on earth at this moment who would consider their prayers answered if they could trade places with you.” – Sam Harris

Rooting For The Underdog – Ep 135

For the longest time, Vitaliy's son Jonah would beat his younger sister Hannah at just about everything. That all changed when we watched The Queen’s Gambit earlier this year. Here's the story. Enjoy! Long essay link: James Clear's Post: Santa Fe...

The Softer Side of Value Investing – Ep 134

Culture matters. In this podcast, Vitaliy shares how he evolved from an analyst purely focused on numbers to an investor and CEO focused on people. Using two stories from IMA's own past, Vitaliy recounts how running the business made him a better...

The Softer Side of Value Investing

Culture matters. I share how I evolved from an analyst purely focused on numbers to an investor and CEO focused on people. Using two stories from IMA's own past, I recount how running the business made me a better investor.

Rooting For The Underdog

For the longest time, my son Jonah would beat his younger sister Hannah at just about everything. That all changed when we watched The Queen's Gambit earlier this year.

Unconditional Love – Ep 133

In this podcast, Vitaliy recounts the first time he felt fear. Not the fear of losing his own life, but the fear a parent feels when their kids are at risk. Vitaliy remembers this harrowing episode, and what it taught him about being a parent....