March 2023 (Update)

It has been nearly 3 years since I wrote this, but my thinking has not really changed much, except that we have been increasing our exposure to foreign companies whose business is not tied to the US. Recent events at home and abroad have made me even less optimistic about our political leadership and the dollar.

August 2020

I usually love writing. I get up early every morning, make a cup of coffee, put on my headphones, and look forward to discovering what my subconscious will surprise me with.

Not this time.

I hated every minute I spent working on this article.

There are many reasons for this.

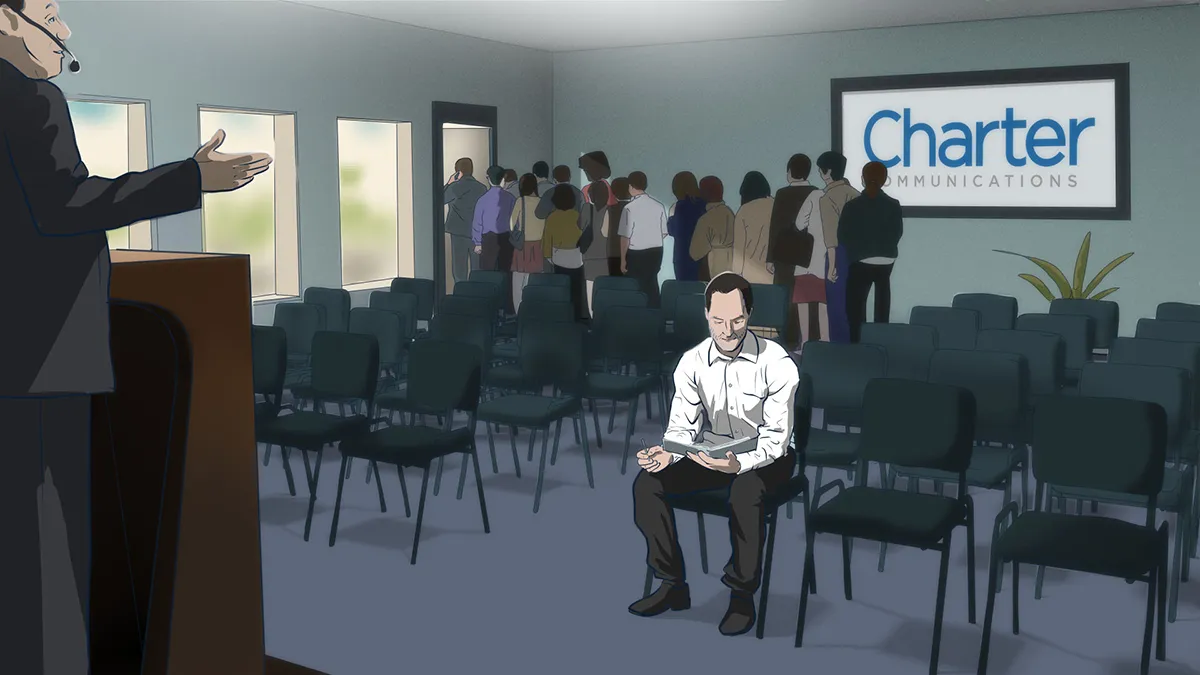

A few times, as I wrote, I got close to a line I don’t like to cross – the politics line. I rarely discuss politics even with my friends. I have occasional political discussions with my kids (I try to show them all sides). I don’t allow broadcasts of political debates in IMA hallways. They don’t have the intellectual rigor we require in our research. They bring unwanted toxicity, resolve nothing, and nobody’s mind ever gets changed.

I block most political discussions from my daily life and focus on things that have a shelf life longer than an overripe banana (things like books).

But writing this piece (client letter) was particularly painful because it made me think more about the negative changes that are happening to the country I love.

Why write it, then?

I am not writing this to vent my frustration (I scream into my pillow for that) or to provide a recipe of what must be done (you’ve got TV talking heads for that). I really didn’t want to write about our national failings, but I have a pragmatic reason for doing so: As the world around us changes, we need to keep making changes to our portfolio. The coronavirus has compressed years of changes into months. It may be the straw that broke an aging, overconfident camel’s back.

Beloved Country. Unloved Hedge.

I remember reading in January about the virus infecting China and catching myself thinking “This is a China problem; these viruses don’t come to the US.” Today as I consider this line of thinking I realize it is insanely naïve, ridden with arrogance, and very dangerous.

If I was the only one infected by such thinking, I’d take a mental note not to do it again, or maybe I’d be lying on the couch sharing it with my shrink, not writing about it. But this arrogant thinking has infected the whole country and most importantly our government. I am not talking about our virus response, or the tensions between liberty, commerce, and public health. I am talking about something else.

This arrogance was not built up out of thin air.

The US truly has so many advantages the rest of the world does not. It is flanked by two oceans, and it has two friendly neighbors, the polite one in the north and the fun one in the south. It has an abundance of fertile ground to feed itself and enough other natural resources to be independent from the rest of the world. It has not fought a war on its own territory with a foreign power in over two hundred years.

It is the world’s largest democracy (measured by GDP; India is the largest by population). It is the cradle of technological innovation – every piece of technology that sits on my desk has its roots in the US.

It is for these reasons that the US dollar became the world’s reserve currency.

America’s competitive advantages are rooted in its geography, but the reason the dollar became the global reserve currency is that the US had the world’s largest, strongest (steadily growing and conservatively financed) economy and a stable political system (the US Constitution is a big help here).

Let’s zoom in on this point for a minute. Despite your ability to touch the green US dollar in your wallet, it is just a piece of paper that is worth something only if you and everyone around you believes in it. After World War II, the world believed in it.

People basically looked at the places where they lived and at America, and many of them concluded that the US was the safest place to keep their savings. They didn’t have to worry that if they put their money in the US dollar it would lose its value. The dollar was not going to be diluted by hyperinflation or burned up by a foreign or civil war. The political system was stable and strong, and people didn’t have to worry that at some point they wouldn’t be able to take their money out of US banks and bring it home.

However, currency is a very nebulous concept. It’s a story, and one that is not rooted in nature; it is completely based on mass perception.

This brings us back to arrogance.

The problem with arrogance is that it changes your behavior. You start believing that you are very special for reasons that are not grounded in reality. You start believing that bad things happen only to other people and nations because they are not as special as you. You can do anything you want – borrow and spend as much as you like – and nothing bad will happen to you. This behavior in turn starts to undermine the core reasons why people trusted your country and currency to begin with.

This is exactly what is now happening to the US. In 2020 the ratio of our debt to the output of the economy (debt to GDP) is likely going to exceed 120% (and might be as high as 130%). You can blame the virus for some of that, but the national debt had been going up steadily every single year. We ran huge budget deficits in bad times and in good times, long before the virus came on shore.

In 2000, only 20 years ago, our debt was $6 trillion – a 30% debt to GDP. It was $14 trillion in 2010 and $23 trillion in 2019, increasing $1 trillion a year while the US economy was booming. Or maybe that is why the US economy was booming. We were charging a trillion a year, year after year, on our national credit card to buy things and to engineer this growth. By 2019, ten (!) years after the Great Financial Crisis, the Fed was still running quantitative easing.

In 2019 debt to GDP was over 100%, eclipsing the EU’s ratio of 86%.

(Yes, the capitalist US was more indebted than the “socialist” EU). We have not acutely felt that debt burden, because interest rates declined over the last two decades.

Then the virus arrived.

The US has spent 12% of GDP (so far) to keep the economy afloat during the shutdown – twice as much in terms of GDP as the rest of the world, four times as much as the largest European countries, three times as much as Japan.

Our debt has skyrocketed by another … maybe $6 trillion – too soon to tell. The Fed already owned $2.5 trillion of our government bonds in 2019, and now it owns $3.7 trillion of our fine paper and is a buyer of our corporate bonds and ETFs. Stocks are likely to be next.

Credit rating agencies have already put our AAA-rated debt on “negative watch,” signaling a possible downgrade. Countries like the US that borrow in their own currency don’t default on their debt, at least not by failing to make payments. Instead, we’ll “honor” our obligations through massive money printing, which could bring massive inflation and tank the US dollar (who wants to own a currency that buys less and less?). God help you if you reached for yield and loaded up on long-term bonds (a trade that minted money for the last 30 years). Long-term bonds will be widow-makers.

But our large debt pile is only part of the story. In the largest economy in the world, the staunchest advocate of free markets, the cost of money (arguably the most important commodity) is set by a dozen economists. (Think about that when you hear the US calling another nation a manipulator of its currency.)

In 2020 the social fabric of our society is tearing apart. It is our tribe against their tribe. Every time you think the toxicity of our politics cannot get any worse, it does. Unlike in the country that came together during World War II or 9/11, this time the coronavirus has pulled us further apart. It doesn’t look like the outcome of the 2020 elections will change that, and so the inertia of the last 20 years will persist.

Our foreign policy. Nobody knows what it is. The only time we hear about it is when we bicker with our neighbors and allies, bomb some country in the Middle East most Americans cannot find on a map, ratchet up tensions with China, or for the nth time slap sanctions on Russia.

The world used to look at the US as the global leader, as a moral compass. Let me put it this way. If Martians landed on the Earth today and took a careful look at our behavior, I don’t think they’d conclude that we are the shining light of democracy.

This is incredibly difficult to write, but bad things don’t just happen in other countries; they can happen here too. The US response to COVID-19 is a visceral reminder of that. We’d like to believe that the US is special, and it is special to us, but the laws of physics are not suspended here, and neither are medical and economic principles.

Though the US dollar is unlikely to lose its reserve currency status in the immediate future – for no other reason than that there are no better alternatives (every contender has problems of its own) – the strength we’ve seen over the last decade will likely fade in the rear-view mirror.

The virus has accelerated trends already in place – it has hastened the beginning of the end of globalization. Globalization was a tailwind to the US dollar in its role as the central medium of global exchange, and deglobalization (localization) has the opposite effect. We are also wading (and are already knee deep) into a cold war with China (a topic for separate discussion). We are waging a technological cold war with them and vice versa.

The dollar’s decline may mean higher prices, higher inflation (we are a net importer), and higher interest rates (the Fed will try to squash interest rates, until it cannot).

In our portfolio we are already partially positioned for this shift, by owning foreign stocks – a weaker dollar means their earnings will go up in the US dollar terms.

But there is another thing we can do – buy gold.

That’s something we have resisted doing for a long time. (I expressed my thoughts on gold here in October 2019.) There are so many reasons why I don’t want to like gold: I have no idea how much it is worth (it doesn’t have cash flows); it is a medieval relic; it has no productive value – it just sits in the vaults of central banks or stashed under mattresses.

Gold is hedging us against two scenarios: a weaker US dollar and the debasement of all currencies – the dollar declines but so do other currencies. Dollar outflows will be looking for homes. Some will flow into euros, British pounds, and Swiss francs, and some into gold – an incorruptible asset class (central banks and politicians cannot create more gold).

In the past our justification for not owning gold was that we’d rather own good companies, and we’ll continue to do that. Gold will become just another position in our portfolio – an unloved hedge.

Despite the somber voice of this letter. The US is not turning into Zimbabwe anytime soon. Yes, we’ll have challenges, but we’ll get through it. The British Pound was the world’s reserve currency for over a century, until the dollar unseated it about seventy years ago. The United Kingdom is still thriving today even despite going through a messy divorce (Brexit) with its European neighbors.

Yes, the US will have challenges, but we’ll adapt to them. At IMA, we’d just like to do it early.

Key takeaways

- Writing this piece was painful as it forced me to confront negative changes in the country I love, but it’s necessary to consider these shifts as we adjust our portfolio – essentially creating a “country hedge”.

- The US’s advantages have bred a dangerous arrogance, leading to behavior that undermines the very reasons for global trust in the country and its currency.

- Our national debt has skyrocketed, potentially threatening the dollar’s status as the world’s reserve currency – a key factor in considering a “country hedge”.

- The coronavirus has accelerated existing trends, including deglobalization and tensions with China, further necessitating a “country hedge” in our investment strategy.

- Gold, despite my reluctance, is becoming an important “country hedge” in our portfolio – protecting against both a weaker US dollar and the potential debasement of all currencies.

Cryptocurrency is more of a bet than a hedge…

Why you don”t hedge with digital gold – cryptocurrency?