Vitaliy Katsenelson

The Boulevard of Broken Charts

Markets are efficient, or so we’ve been told. I am not here to put a rebuttal to this academic nonsense, but let me give you one of the core reasons why markets are and will remain inefficient: because human beings are efficient.

VALUEx Vail 2011

VALUEx Vail is designed for serious PROFESSIONAL investors to share ideas, learn from one another experiences, all while enjoying each others company and fun activities in the beautiful Colorado mountains.

I am back!

I am back! It was an amazing trip. It started with Warren Buffett’s Omaha. I flew into Omaha on Thursday morning, and a few hours later received a call from the CFA Society of Nebraska, asking me to give a talk to their members.

Microsoft Just Pulled Another “Microsoft” with its Purchase of Skype

"Microsoft is near a deal to buy Skype for $8.5 billion." Microsoft is pulling another "Microsoft", though this time it may actually succeed.

Quarterly Letter – Q1 2011 – Part 1

I’d like to share excerpts from our quarterly letter we send to our clients. I’m not sharing the full letter, we are still accumulating shares in some stocks.

See You in Omaha 2011

It is time again for the annual trip to Warren Buffett’s Omaha to Berkshire Hathaway annual meeting. Warren Buffett over the years was turned into god.

Buffett, Sokol, Caesar’s wife must be above suspicion

Some investors expressed concerns about Mr Sokol’s actions. Any time you buy stock in a company which your employer then buys just does not smell right.

Video from China/Japan Presentation and DC Trip

I had been in DC a few times before but never really had time to see the city. I took my almost-ten-year-old son Jonah with me on this trip, and we had an amazing experience.

China – The Mother of All Gray Swans / Japan – Past The Point of No Return

Overcapacity + late-stage growth obsessive 1998 - 2008, economy grew at 10% a year. China's customers are overleveraged and are deleveraging.

Fed’s Shortcut to Greatness

The bad economist confines himself to the visible effect, the good economist takes into account both the effect that can be seen and those effects that must be foreseen.

Margin Shrinkage – It Can Happen to You

Profit margins are a tick away from all-time highs and are creating the impression of cheap equity valuations. But that impression is a mirage, because today’s generous margins are destined to shrink.

Set the Bar High

The world today is riddled with unique economic, political, and demographic risks. Finding attractively priced assets that will perform well in spite of these challenges is excruciatingly difficult.

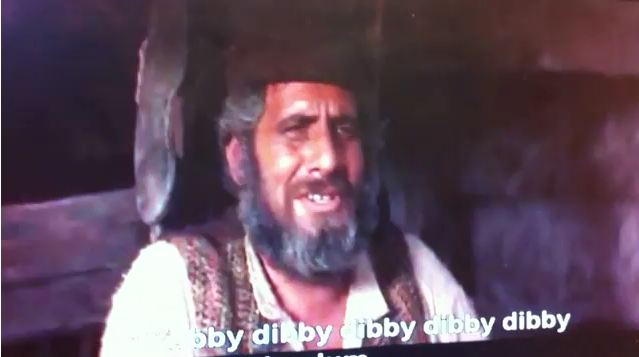

What Fiddler on the Roof has to do with Value Investing

My interview with Forbes' John Dobosz on what value investing and Fiddler on the Roof have in common.

$1.3 Billion Burj Khalifa 2.0 is Brilliant!

Earlier this week we saw reports that “Beijing authorities plan to build a "seven-star hotel" modelled after Dubai's Burj Khalifa - the world's tallest building - in a $1.3 billion joint project with Saudi Arabia.”

Interview with Adviser Perspectives

To paraphrase Nassim Taleb, "Giving interviews is the art of repeating oneself without anyone noticing." With the new book out, I have the pleasure and the opportunity to perfect that art.

My 10 Favorite/Important Articles from 2010

Here are my 10 most favorite/important articles from 2010, all of them are still relevant today.

Interview with Manual of Ideas

Exclusive Interview with Vitaliy Katsenelson, CIO of Investment Management Associates and Author of The Little Book of Sideways Markets.

I had in depth audio interview with Jim Puplava

I had a pleasure of being interviewed by Jim Puplava, it is a lengthy and in depth interview about The Little Book of Sideways Markets.

David Rosenberg and Barron’s

David Rosenberg, ex-Chief Economist with Merrill Lynch, now with Gluskin Sheff, kindly mentioned my book in his research on Monday.

The Little Book of Sideways Markets is Out!

The Little Book of Sideways Markets is officially out. It was a fun and interesting project. I took Active Value Investing, completely rewrote the first half of the book.