I am traveling this weekend to our nation’s capital with my almost-10-year-old son, Jonah. I’m giving a speech on Monday at the Johns Hopkins University Applied Physics Lab (the presentation will be across the street from the Pentagon. The following weekend I am taking my wife to Kansas City, where we’ll take a much-needed break from our two wonderful kids, and then I’ll do a presentation for the CFA Society, Kansas City on April 4th.

Fed’s Shortcut to Greatness

There is only one difference between a bad economist and a good one: the bad economist confines himself to the visible effect; the good economist takes into account both the effect that can be seen and those effects that must be foreseen… the bad economist pursues a small present good that will be followed by a great evil to come, while the good economist pursues a great good to come, at the risk of a small present evil.

–Frederic Bastiat (1801-1850)

Nothing defined Alan Greenspan’s tenure as chairman of the Federal Reserve Bank more than his wholehearted embrace of capitalism. With early roots in his 30-year association with the novelist and philosopher Ayn Rand, that faith grew into an unconstrained confidence in the free market and deregulation to steer the economy and ward off crises.

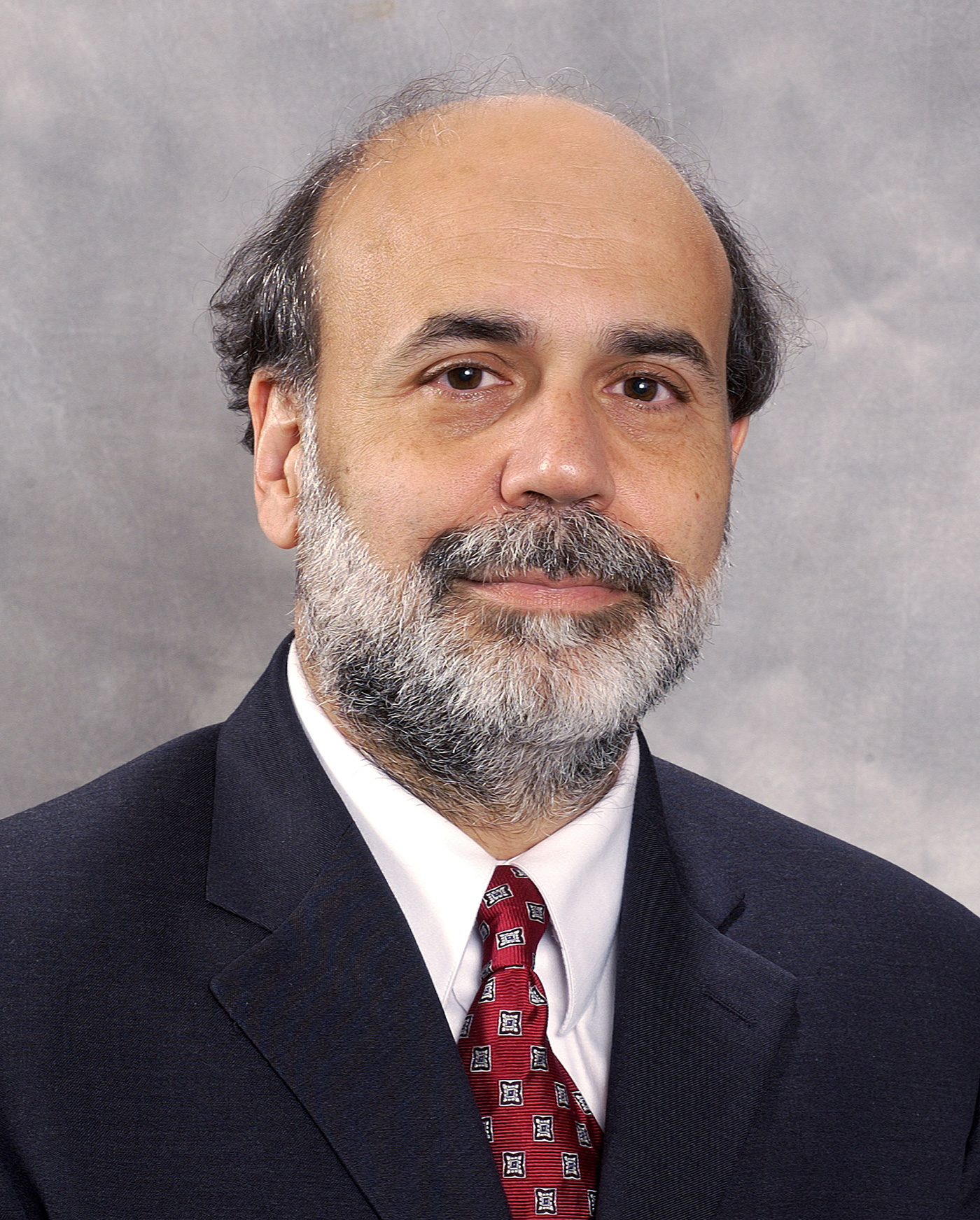

According to a current Fed governor, however, both Greenspan’s Fed and the Fed today have not been the stalwarts of capitalism that the Maestro believed them to be.

On March 7th, I had the great pleasure of listening to Thomas Hoenig speak at the Colorado CFA Society forecast dinner. Hoenig, the only member of the Federal Reserve Board of Governors who I respect, is the board’s lone rational dissenting voice.

After his speech, a lengthy Q&A, and a short conversation with him, I left the event even more impressed with him.

Hoeing was equally critical of both the Fed’s zero-interest rate policy and of QE2. He said these policies encourage speculation and don’t allow for price discovery, and consequently they lead to imbalances, unintended consequences, and misallocation of resources.

He said it is important to judge QE2’s success over the right time frame, one long enough to encompass not just its stimulative benefits but also its consequences. (In other words, there is a good reason why we don’t judge steroids solely based on what they do for an athlete’s performance during the race, ignoring the strokes and other health problems they often cause after the race).

Throughout his speech, Hoenig warned that there are no shortcuts to greatness in monetary policy. The Fed’s intervention in the economy will have unintended consequences, and it is impossible to know where they’ll show up. For example, Hoenig recalled that the Fed lowered the interest rate to 1% in 2003 and, though the economy was improving, kept rates low levels for over a year in order to bring unemployment below 6.5%. The asset bubble that deflated in the financial crisis resulted, and today unemployment is 10%.

Hoenig’s comments are extremely important. I too believe that the Fed’s actions in 2003 played a very large role in the subsequent real estate bubble, financial crisis, and today’s high unemployment, but this was the first time I’ve heard such an admission come directly from a Fed governor. To the contrary, Greenspan has been outspoken in denying the role he and the Fed played in the crisis.

Hoeing said he questions whether quantitative easing, which failed in Japan, will work in the US. He bluntly stated that too-big-to-fail financial institutions like Citigroup, Wells Fargo, JPMorgan Chase, and others should be broken up. (I argued that point in this article.) Commercial banks are in charge of our domestic and international payments system, but their access to FDIC insurance and the Fed’s discount window (use of which swelled from $900 million to $3 trillion over the last two years), constitutes “an enormous protection” to the financial sector, encouraging risk-taking through an implicit guarantee in the event of a crisis or failure.

Smaller institutions that don’t have access to the Fed’s fund window have to compete in that space, and they start behaving and taking risks as if they have access to the window. The walls between commercial and investment banks have been demolished, Hoenig argued, and the two functions within banks are now joined at the hip. In the wake of this crisis, Hoeing said we did the same things we did after previous crises: added supervision and regulation and raised capital requirements. But history suggests that as time goes by we’ll forget about the crisis and history will repeat itself, he said – unless we break up too-big-to-fail institutions.

It is a fundamental tenet of American capitalism that central planning of economies doesn’t work in the long term, whether in Soviet Union historically or in China today. But I often wonder: How is the Fed’s Board of Governors – the proverbial 12 guys in a room – any different than the 24 guys in a room who make up the Chinese politburo? The non-democratic Chinese may have a few more levers to push – an ability to force banks to lend, for example – but short of that, how is the Fed’s micromanagement of interest rates any different from China’s? After Hoenig came off the stage, I posed the question to Hoenig, and I asked him point-blank whether the Federal Reserve is an anti-capitalistic entity.

To my shock, Hoenig agreed with me: The Fed is anti-capitalistic.

I went further. In the midst of the 2008 financial crisis, to prevent the freezing up of the US financial system and possible bank runs, the Fed put in place QE1 – it purchased over a trillion dollars of mortgage and agency debt. Like J.P. Morgan in the pre-Fed era, the Fed was the lender of last resort. But QE2 is drastically different from QE1, because the banking system is far from choking, and now the Fed’s goal is to lower unemployment and grow the economy at a higher rate (here is my article on QE2).

I asked Hoenig if he thinks the Fed should stick to its mission as lender of last resort, as it was during QE1, letting the free market set interest rates. He looked at me with an expression that implied he couldn’t have said it better himself and agreed.

I am very familiar with confirmation bias, our desire to seek out people with whom we agree. But Hoenig is not your usual person; he is member of the Federal Reserve Board of Governors, and he disagrees with almost everything that institution does.

Hoeing’s courage and principled vision elevate him to the status of a “good economist,” as defined by Frederic Bastiat over 150 years ago. Let’s hope that his voice, in a room full of bad economists, does not fall entirely on deaf ears.

On Media

My witty, fast-thinking friend Jeff Macke is back on the horse. Jeff used to cohost Fast Money on CNBC; he is now cohosting a show on Yahoo called Breakout. On his first show he had Jim Rogers, who is worried about high corporate profit margins, and wants to shut down the Fed. As you’ll see from the article attached, I am not a big Fed fan either. I wish Jeff good luck; he is very talented and will make that show a must-watch.

Yahoo, despite semi-failing in its core business, has done a great job producing TechTicker, hosted by Aaron Task and Henry Blodget. I watch it religiously. Since it is a web-only show, TechTicker is not constrained by the traditional “We have to go to commercial” TV format, and thus guests speak in full sentences, not sound bites.

This brings me to James Altucher, who was on TechTicker on Monday, arguing that “The media owes everyone an apology for over-hyping the Japan nuclear crisis.” I “met” James in 2004 when I started to writing for The Street.com, and he was writing for it as well. Actually, met is the not the right word: we communicated by instant messenger for six years until we met face to face last year. James is brilliant (I don’t say it lightly – he is a nationally ranked chess master). I don’t agree with everything he writes, but I still read everything he writes. He is one of the most original thinkers I’ve ever met, a serial entrepreneur (he started StockPickr.com, which he sold to TheStreet.com, which later ran into the ground), a hedge fund manager, and a prolific writer (he has written five books).

A few months ago James started a blog, Altucher Confidential, which is the only nonfinancial blog I read every day. No, he did not kidnap my children. Just read it and you’ll see why I love his writing.

0 comments