I know, I may sound like I’m beating a dead horse how much printer cartridge can one spill over China? – but I have a very high burden of proof to overcome.

Let me demonstrate it by this analogy: Let’s rewind 20 years. It is 1989 and I am writing that the Japanese economy is on the verge of severe decline. I’m facing a lot of skepticism. Most people are calling me crazy and throwing heavy objects at me. After all, the Japanese are on top of the world. Their economy has been a consistent grower for decades, with a rate of growth that trumps that of the US and Europe. Japan has the manufacturing thing nailed – they are simply better and more efficient at it than us. Magazines and newspapers swarm with stories about Japan, how hard working they are, how unique their culture is (we of course, feel inferior, as lazy Americans). Japanese exports significantly exceed their imports, generating huge capital-account surpluses – they are swimming in dollars and buying up America. Every other restaurant in Hawaii serves sushi and menus are in English and Japanese (not Spanish). I may be exaggerating with the last part, a little, but not much.

So, in 1989, who am I to poke holes in Japanese grandness and predict their malaise. Japan could do no wrong. Of course, we know how that story played out: a bust of a major banking/real estate bubble, a contracting economy for almost two decades, accompanied by deflation, ballooning debt, etc.

Fast-forward, and China today is where Japan was in the late ’80s, except with the greater political instability that comes with a semi-controlled economy and the lack of a social safety net (read: jobless, hungry people don’t write angry letters, they riot).

Since China can do nothing wrong, everything I write about it is met with skepticism. Today China projects to the world a similar image as Japan did in the 1980s. My personal favorite is the incredible spectacle of the Chinese Summer Olympics opening ceremony: the elegant, wonderfully choreographed performance by fifteen thousand people, the marvels of modern technology (the 500-foot LCD screen comes to mind here), the virtually unlimited budget of the Chinese government, and seven years of preparation created a spectacular event that will be hard for any nation to follow. (I feel bad for Russia and England, who will be putting on their Olympic spectacles next).

Lately, the Chinese economy has been impressing us with its growth: it was growing when the rest of the world was contracting, fast. But Chinese economic structure is not is not superior to the West’s; the Chinese can just cook GDP numbers better and control their economy more effectively through forced lending and spending.

However, these short-term advantages come with long-term consequences – there will be a steep price to pay for them; there always is. I’ve written a lot about this (here and here). Instead I’ll quote James Grant, the publisher of Grant’s Interest Rate Observer. Jim is providing the latest issue of his newsletter free, and I encourage you to download it and read his article on China – it is excellent! (Full disclosure: I’ve never met James and have not been recruited to plug his newsletter).

Here are a few quotes from his article – many things you’ve heard from me before, but he finds a way to say them better:

“In the 1930s, Western intellectuals persuaded themselves that the Soviet economic model was depression-proof. Today, not a few investors marvel at the vigor of the modified communist economic model of the People’s Republic.

“A superb primer on the risks of China’s go-for-broke lending drive was published by Fitch Ratings on May 20. Is it not passing strange, the agency asks, that Chinese lending is accelerating even as Chinese corporate profits are shrinking? ‘Ordinarily, falling corporate earnings are met with tightened lending, but in China, precisely the reverse is evident. . . .’ You would expect—and Fitch does anticipate—that the borrowers of these trillions of renminbi are not so profitable as they were in the boom, and some will therefore struggle to service their debts.”

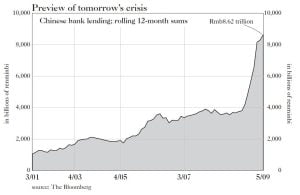

I think this chart, also excerpted from Grant’s Interest Rate Observer, tells the full story of the quality of China’s latest growth and its lending habits (lending has doubled over a span of a few quarters!):

“The Shanghai A-share market jumped by 65% in the first half, to a level that fixes its value at 31 times trailing net income, up from 12.8 times at the October lows. Chinese M-2 was 25.7% larger in May than it was a year before.

“Examining, first, the track of Chinese bank lending and, second, the trend in Chinese nonperforming loans, the seasoned reader will remember … Drexel Burnham Lambert. In the mid-to-late 1980s, the American junk bond market combined breakneck growth with muted default rates. The secret, fully revealed during the subsequent bear market, was that the default rates were a direct product of the issuance rates. Borrowers didn’t default because of—to adapt the Fitch formulation to that earlier time—the ‘pervasive rolling over and maturity extension of bonds as they fell due.’ Drexel failed when the junk market did.

“It’s no small thing that China is especially enamored of the shot-and-a-beer-for-breakfast approach. Nothing about China is small or insignificant nowadays, since the Chinese economy is actually growing. It might, indeed, account for 74% of worldwide GDP growth in the three years to 2010, the International Monetary Fund estimates.”

Finally, the most important part:

“Since 2005, China has generated 73% of the global growth in oil consumption and 77% of the global growth in coal consumption.” [emphasis are mine]

Need I say more?

Beating a Dead Horse (to Death) Part 2

My “Beating the Dead Horse” article ended with a very insightful conclusion “Need I say more?”. I received a dozen emails that said – you DO need to say more. So here I am saying more:

What do we take out of this? The Chinese ascent over last decade has lowered the degree of separation between China and the global economy. What happens in China doesn’t stay in China (not anymore); it spills over to the rest of the world.

Today, Chinese economic growth is the force pushing the global economy. The quality of this growth, however, is low as it is predicated on massive (forced) lending and thus unsustainable. As Chinese growth slows, China will turn from a wind into sails of global economy to its anchor. The impact will be felt in many, often unsuspected places.

It will tank the commodity markets, commodity producers and commodity exporting nations. Let’s take oil, for instance. As incremental demand from China collapses, oil prices will follow, taking the Russian economy with it, as Russia is for the most part a one-trick-petrochemical-pony. According to GavKal Research China accounts for 15% of Brazil’s exports (up from 1.5% a decade ago), significantly impacting the economy of that South American nation..

Demand for industrial goods will fall off the cliff. China consumed a lot of those goods – $550 billion worth annually (also according to GaveKal Research). So if Caterpillar expects to sell more of its yellow earthmovers to China, it will have put that thought on hold for awhile. (Side note: CAT’s CEO expects CAT’s earnings “$8 to $10 per share within five years if the world economy recovers”. Let me put it into a proper context: in 2007-2008 circa when its margins and sales were at all time high, double their historical average, CAT earned about $5.50 a share. Good luck!)

Finally, Chinese appetite for our fine currency will diminish, driving the dollar lower against the renminbi and boosting our interest rates higher. No more 5% mortgages and 6% car loans.

Identifying bubbles is a lot easier than timing them. An astute observer could have seen the Japanese bubble developing in 1986, 1987 and 1988, but he would have been “wrong” until 1989. Now sprinkle on top of this the Chinese government’s willingness to do anything in its power to postpone the bursting of the bubble and the complexity of timing increases exponentially.

Those of you who are familiar with my writing on this subject may rightfully accuse me of beating a dead horse – or in this case a dead dragon. But I firmly believe that those who invest in China or ignore the consequence of very likely Chinese economic malaise do so at great peril.

0 comments