Stock Analysis

On AI Eating The World

Instead of joining the chorus of false certainty, let me offer you a crayon-level framework for thinking about it. I am going for vaguely right, not precisely wrong.

The Church of Climate and the Law of Unintended Consequences

When policies are judged by intentions rather than outcomes, you get Germany closing nuclear plants only to burn more coal.

Our Sistine Chapel: Long-Term Investing in Quality and Kindness

Warren Buffett calls Berkshire Hathaway his Sistine Chapel. This analogy haunted me for years until I realized we are building the exact same thing at IMA. It took me a decade to put into words, but I finally narrowed our firm’s entire reason for existence down to just two words. They sound simple, but living up to them is the hardest thing we’ve ever done.

Living and Investing with Intention

As an investor, being intentional about identifying assumptions is extremely important. When you're mindless, you accept things as they are without realizing you're walking on thin ice while everyone else thinks it's solid ground.

Quality Matters: From Paris to Portfolios

Today I am a different (hopefully better) investor than I was five, ten, twenty years ago; as I look at the biggest changes, it is my focus on quality investing and being extremely selective and uncompromising when it comes to quality.

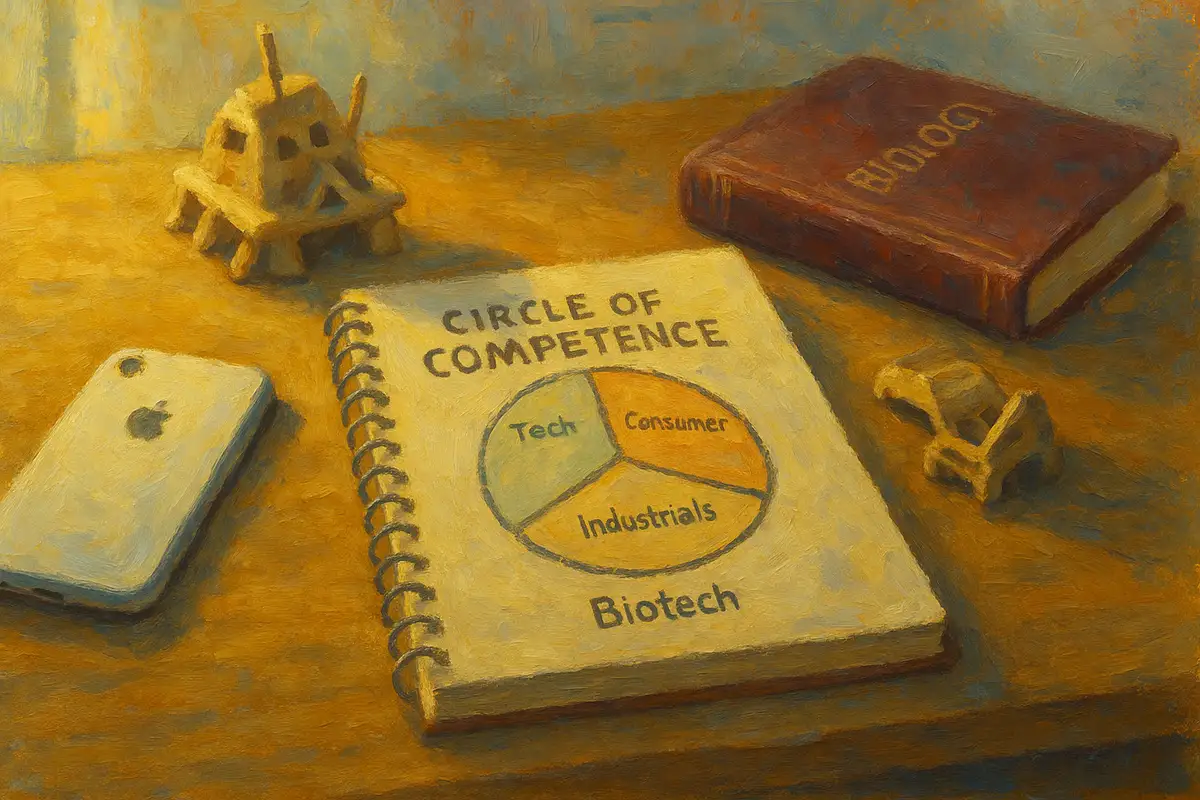

Q&A Series: Research Process, Evaluating Country Risk and Tech Investments

Today we'll delve into my research process, how I assess country risk for investments and why some investors avoid technology stocks

Omaha 2026 Breakfast + Get Together

If you’re making the pilgrimage to Omaha for the Berkshire Hathaway Annual Meeting, I’d love to see you there. Every year, thousands of value investors gather to celebrate the wisdom of Buffett and Munger, but my favorite part has always been connecting with readers and friends over coffee.

London and Scotland: Musicals, Markets, and Memories – Part 3

Our London and Scotland trip blended investing, art, friendship, and father-son memories that made the journey unforgettable.

The Ability to Suffer – Part 2

One important quality great management must have is the ability to suffer, doing the right thing when everyone else is chasing easy gains.

The Art of Rational Irrationality – Part 1

I explore what Rolex’s lasting value and Fever Tree’s stock reveal about quality, patience, and playing the long game in business and investing.

My Article in The Wall Street Journal

When I had the chance to tour an Amazon fulfillment center in Denver, I jumped at the opportunity. What I found was both more remarkable and more unsettling than I had imagined.

Why Smart Investors Should Sit Out the AI Arms Race

The hype around investing in AI feels real, but like every revolution, it’s easy to forget that not every gold rush makes its miners rich.

Cost-Plus Capitalism: Lessons from HII and the Future of Naval Shipbuilding (Part 5)

At HII’s shipyard, I saw how cost-plus capitalism shapes naval shipbuilding: scarce automation, labor shortages, and incentives that reward rising costs.

Why We Bought Aker BP: A Technology-First Oil Company (Part 4)

I stumbled on Aker BP completely by accident. I knew the Lundins had sold Lundin Energy to Aker BP (a Norwegian oil company) and were large shareholders, but I’d never looked at the stock.

Skin in the Game, Steam in the Ground (Part 3)

How I invest begins with trust: every decision is made with my client in mind, focused on long-term survival rather than chasing short-term benchmarks.

Inside Baseball: How We Build Portfolios (Part 2)

Our investment process took a significant step forward by assigning ratings to our companies and help us substantially improve our portfolio construction.

Skating on Thin Ice: Discipline, Doubt, and the Long Game (Part 1)

Our portfolios performed well in 2025, but the market feels like a lake warming in the spring. I want to share my thoughts on why we must be disciplined when skating on thinning ice.

On Books, Music, and Investing

Today, we’re diving into two questions from readers that are close to my heart, which of my books is my personal favorite and why, and is there a similarity between classical music and investing for me?

Q&A Series: Managing Market Pressures and Evaluating Serial Acquirers

I held a Q&A session with readers a while back. In this email, we'll discuss how to handle market pressures and our view on serial acquirers.

Warren Buffett and the Berkshire Hathaway Paradox

Trip to Omaha has everything and nothing to do with Warren Buffett. The main event that draws everyone to Omaha – the Berkshire Hathaway (BRK) annual meeting – is actually the least important part.

Redefine “value” in this era of the US stock market

Do we need to redefine “value” in this era of the US stock market, or should we continue to sit on the sidelines if traditional metrics show equities to be overvalued?