Stock Analysis

Managing a Million: What Would I Do Differently?

Warren Buffett has stated multiple times that if he could manage a very small amount of money today, he would be able to return more than 50% per year to shareholders. If you managed a million dollars of only your own money, would you do it differently?

Choosing an Investment Manager: Beyond Warren and Charlie

If you were obliged to invest all your investable assets with one person and you couldn’t choose Warren or Charlie, whom would you pick?

Challenging Investment Rules and Key Investor Traits

What’s a famous investment rule I don’t agree with? Which key characteristics should a good investor have?

The Infinite Game in Telecom

CHTR, just like Comcast, showed only a very slight decline in broadband customers in the quarter. Most of the decline came from the US government removing subsidies for rural customers.

The Hidden Risk in “Religion” Stocks

A basic property of religion is that the believer takes a leap of faith: to believe without expecting proof.

The Best and Worst Investment Decisions I’ve Made

I’m going to share stories about my best and worst investment decisions. But don’t worry, this isn’t just a brag-and-cringe session about making or losing money.

Trump’s call for a bitcoin strategic reserve is a very bad idea

At the end of July, Donald Trump went full Bitcoin. He wants the US to become a “Bitcoin superpower”; he promised to build a Bitcoin strategic reserve.

Unpacking Buffett’s Investment Philosophy: A Personal Perspective

How does our investment approach stack up against Warren Buffett’s? Answering this question gives me a chance to dissect Buffett’s famous investment principles and compare them to our own strategy.

The Eclectic Value Investor

How do I describe myself as an investor? This question provides an opportunity to delve into what I mean by being an “eclectic value investor with a slight touch of dogmatism.”

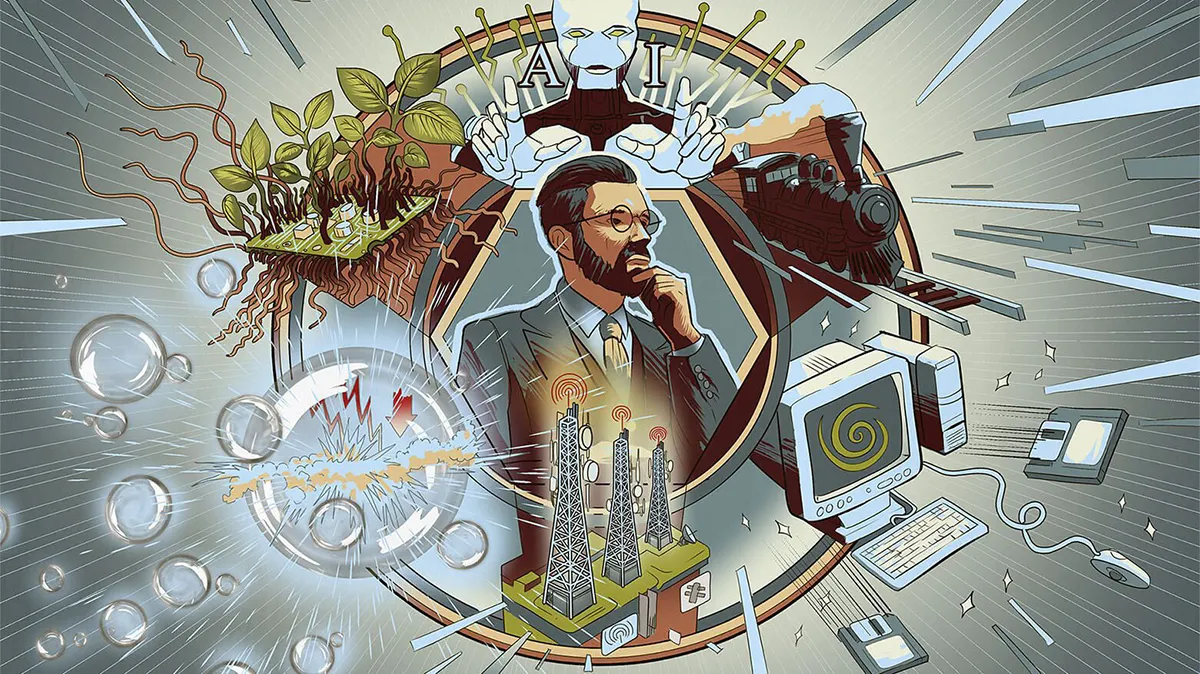

The AI Revolution

The discussion of AI quickly falls into a domain bordering on Sci-Fi. My thoughts here are only marginally shaped by scientific facts.

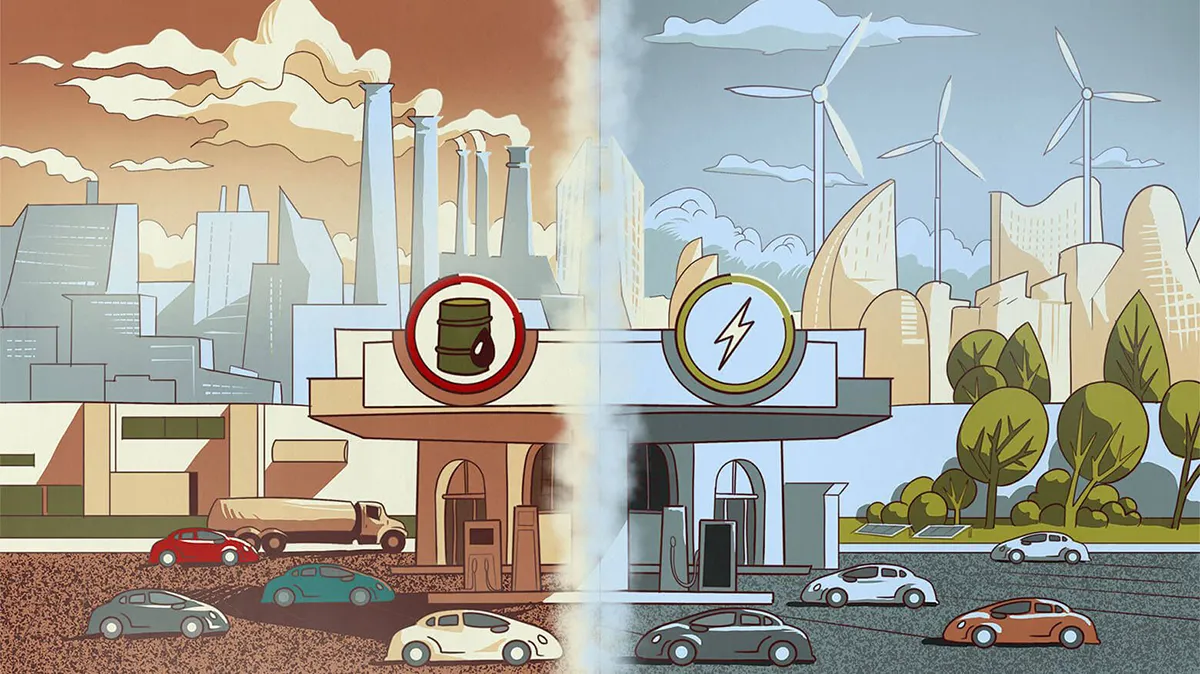

The EV Industry Landscape

As a part of a summer letter to IMA clients, I will discuss investments in the EV industry, spurred by the following question from a client.

Lessons from History’s Technology Booms

The technology at the core of the mania is different every time. What doesn't change over time is human emotion – the fear of missing out and then the fear of loss.

The Magnificent 7 and the Dangers of Market Hype

Despite the S&P 500 showing gains in the mid-teens, the average stock on the market is either up slightly or flat for the year.

Understanding Today’s Economic Landscape

Interest rates that stay low and actually keep declining for almost a quarter of a century slowly propagate deep into the fabric of the economy.

From Bull to Sideways Markets to Nvidia

I discussed my condensed views on the stock market, economy, and our investment strategy in a letter to IMA clients.

Traditions, Investment Conferences and Presentations

Investment conferences are the constants in my life. This year, we heard 24 presentations in three days at VALUEx Vail.

The Slippery Slope of Student Loan Forgiveness – Edition 2024

My daughter Hannah was just accepted to University of Denver. She might take out student loans. Why wouldn’t she?

Hedging the Portfolio with Weapons of Mass Destruction

Uber's business is doing extremely well. It has reached escape velocity – the company's expenses have grown at a slow rate while its revenues are growing at 22% a year.

From Twinkies to Rolexes (IMA Client Dinner 2024 Video)

Once a year, we host what the IMA team gently calls “client appreciation week.” This week is very special to me, as I get to meet people who have entrusted their life savings to us.

Cable Stocks Keep Getting Punched in the Mouth

Despite weakness in cable stock prices, our thesis on Charter Communications (CHTR) and Comcast (CMCSA) has not really changed. We made a small, superficial change in the portfolio.

My Appearance on John Oliver’s Last Week Tonight (Kind of)

This past Sunday, I received a text from a friend who told me he saw me on John Oliver's "Last Week Tonight" show on HBO.