Stock Analysis

The World Is Becoming Desperate About Deflation

The Great Recession may be over, but eight years later we can still see the deep scars and unhealed wounds ...

SoftBank’s Big Plan For A Smarter Internet Is Brilliant

Masayoshi Son doesn’t do anything small nor does he do things in a simple way. A few months ago SoftBank ...

Don’t Blame Amazon for The Ice Age in Retail

In my latest 2 minutes and 29 seconds of fame, I was on Fox Business discussing why Amazon should not ...

Why Amazon Will Not Kill This Business

Tesco is a great example of how one should be very careful judging a company’s fundamental performance by looking solely ...

It’s Not Just Amazon’s Fault

Retail stocks have been annihilated recently, despite the economy eking out growth. The fundamentals of the retail business look horrible: ...

The Warren Buffett & Charlie Munger Show

A friend told me that he doesn’t go to the Berkshire Hathaway annual meeting – or what is also known ...

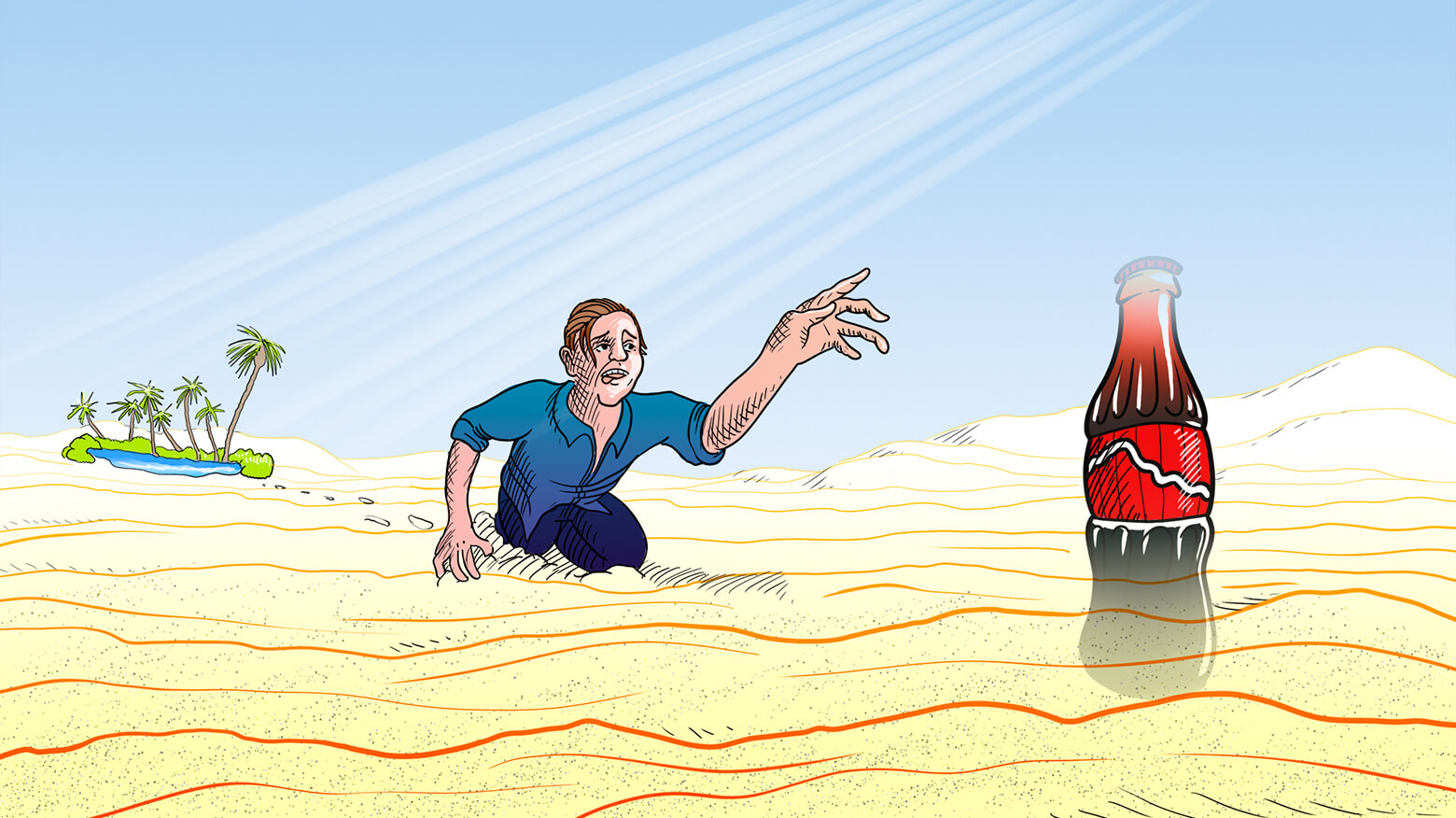

Good Companies Don’t Always Make Good Stocks

I was recently going through a new client’s portfolio and found it full of the likes of Coca-Cola, Kimberly-Clark and ...

Finding High-Quality Companies Today

While originally written in 2017, this article rings just as true today. We are having a hard time finding high-quality ...

How To Stay Rational In the Irrational World

We only intended to share that presentation publicly for a few weeks and already removed it. However, we encourage you to subscribe ...

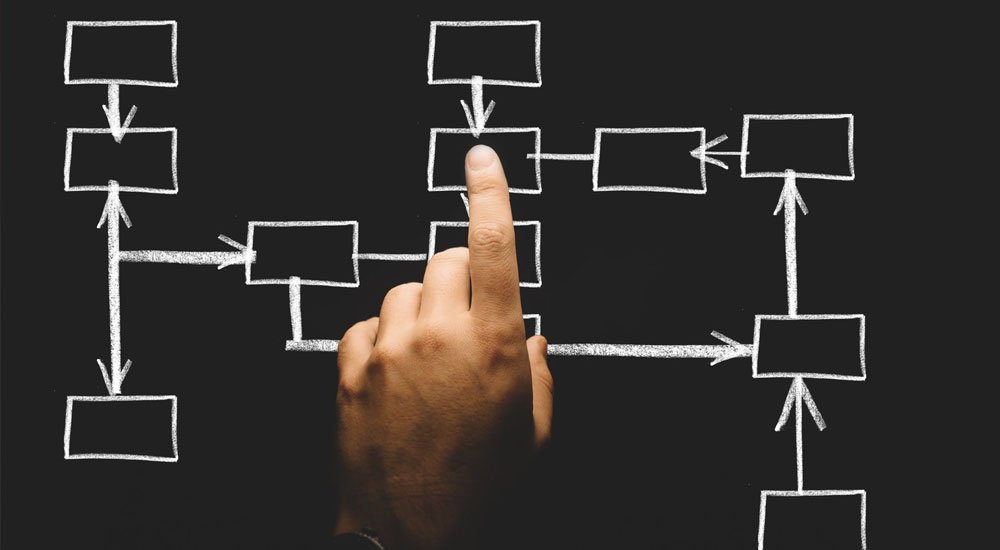

Read This Before You Buy Your Next Stock

I want to address an issue that has bothered me for a while now. When I write about stocks my ...

Why Cognizant Shines Brighter as a Stock Pick

We’ve been eyeing investment opportunities in business process outsourcing for a while; lately, our interest is on the rise because ...

The Pharma Stocks We’re Buying Now

Last week I explained why my firm is investing in pharmaceuticals stocks, despite the sector being a favorite punching bag ...

Trump Hates Them – We Love Them

A few weeks after Donald Trump was elected president of the United States, he was asked about pharmaceuticals prices. With ...

Apple vs Coke

Great Stock = Great Company + Great Valuation (Apple vs Coke) Valuation – margin of safety (discount to fair value) ...

Amgen – Biology vs. Chemistry

June 22, 2016 – Excerpt from Q2 2016 letter to IMA’s clients Purchase of Amgen: First we need to explain ...

Purchase of Allergan and Sale of Teva

June 22, 2016 – Excerpt from Q2 2016 letter to IMA’s clients To talk about our purchase of Allergan we ...

Trump. Embracing Volatility We Are

It is a new year, and my crystal ball was supposed to have become magically unfogged by the turn of ...

The Dangers of Dividend Obsession

I originally wrote this piece in 2016, but it’s just as relevant today. “This is a very bad, incoherent piece.” ...

The Persistent Problems of Presidential Elections

The election is over. I am left with two very contradictory feelings. First is one of appreciation — every four ...

Gilead, Buy HIV, Get Hepatitis C for Free

A few months ago I wrote a long article about Gilead that I wanted to title “Gilead: Buy Hepatitis C, ...

Discovering Discovery

Discovery is a media company that owns some of the most popular TV channels – Discovery, TLC, Animal Planet, Oprah ...