I had a deep, existential, meaning-of-life type of conversation with a friend of mine, another value investor. I asked him, do you want Warren Buffett’s success?

He was somewhat stunned by the question, and asked: “Is that a rhetorical question?”

It was not.

I told him about a nugget of Jewish wisdom my wife shared with me. But first, let’s revisit one of the Ten Commandments: Don’t covet. Or more precisely, don’t covet your neighbor’s wife. To be even more precise, I am not talking about outright adultery here, but rather about thoughts you may have about the desirability of your neighbor’s wife. And to make it even clearer: not my neighbor’s wife (I don’t want my neighbor reading this and getting any ideas).

Here is that practical Jewish wisdom (severely paraphrased by me). Go ahead and covet your neighbor’s wife, but don’t just covet her beautiful eyes, her soft voice, and her stunning figure. Covet her in her entirety. Don’t forget about her mother who would insist you kiss her on the lips every time you see her and who loves to dispense unlimited quantities of unsolicited advice. Or her brother who needs to get bailed of jail every other week. Don’t forget about the hours that neighbor’s wife spends in front of the mirror (forgetting about her hubby and the kids) and her weekly shopping and spa trips that would empty your bank account in a New York second.

So covet away! But covet the whole package. The antidote to coveting is holistic coveting.

So when you covet Buffett’s success, do it holistically, too. Not just the empire he built and the billions he accumulated (that he’ll give away anyway) but the life he led. When I read Alice Schroeder’s The Snowball, the main point I got out of the book was not to be like Buffett. I was lucky I read it when my kids were still young. Buffett’s obsession with the stock market was anything but healthy. He got tomorrow’s newspaper delivered to him the evening before. He spent every living moment in his study, completely neglecting his wife and children. His wife, the love of his life, could not take this anymore and left him. So, do you still covet what Buffett has?

Would Buffett have achieved the degree of financial success that he has without sacrificing his marriage or neglecting his children? We will never have an answer to this question. Maybe he could have, but he would have been a billionaire with a small b and would not have the global adulation that came with his capital B wealth.

My gut sense tells me (though it could be completely wrong) that if he was given a do-over, Buffett would not focus on embracing tech companies early in his career (i.e. buying Microsoft or Apple at IPO) and would tweak how much attention he paid to his wife and kids.

The Bright Side of Coveting

Coveting is a lot less interesting to me than its more toxic cousin, envy. Envy is coveting (desiring) what another person has and then resenting the person for that. Envy poisons people’s lives. But if we learn how not to covet, we may be able to kill envy in its tracks.

Warren Buffett nailed it when he said, “As an investor, you get something out of all the deadly sins – except for envy. Being envious of someone else is pretty stupid. Wishing them badly, or wishing you did as well as they did – all it does is ruin your day. Doesn’t hurt them at all, and there’s zero upside to it.”

Charlie Munger, Buffett’s partner, made an interesting contribution on the topic of envy:

Mozart … here’s the greatest musical talent maybe that ever lived. And what was his life like? It was bitterly unhappy, and he died young. That’s the life of Mozart. What the hell did Mozart do to screw it up? Two things that are guaranteed to create a lot of misery – he overspent his income scrupulously – that’s number one. That is really stupid. And that other thing was, his life was full of jealousies and resentments. If you overspend your income and be full of jealousy and resentments, you can have a lousy, unhappy life and die young. All you’ve got to do is learn from Mozart.

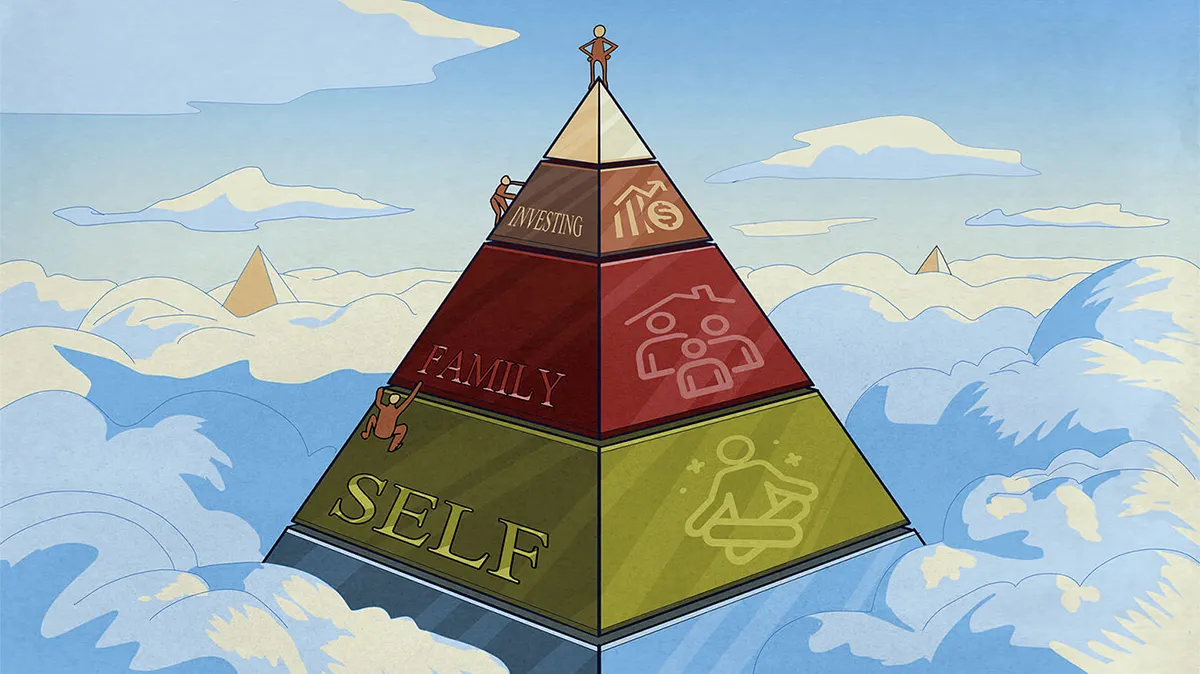

Stoics have an interesting approach to coveting (and thus envy). They apply Epictetus’ dichotomy of control (the crown jewel of Stoicism) to it. They divide things into internals and externals. Internals– our values, attitudes, behavior, and yes, desires too – are up to us. We get to make choices as to what we desire. Desires are in our immediate control.

Everything that is not up to us – and the laundry list there is very long – is external. The neighbor’s wife and Buffett’s wealth are externals. Hitching our wagon to the desire of external things beyond our control is subjecting ourselves to a miserable existence. (I discuss this subject in much greater detail in my write-up of The Subtle Art of Not Giving a F*ck.)

We have a lot of power within us to get rid of suffering if we make the decision not to want wrong things. Seneca explained it perfectly: “No person has the power to have everything they want, but it is in their power not to want what they don’t have, and to cheerfully put to good use what they do have.”

But this is where things get interesting. Stoics would recommend that you look at Buffett and desire his virtues that you admire – make them internal. I’ve talked about what I have learned from Buffett’s mistakes, but there is so much more I’ve learned from him.

Here are a few examples.

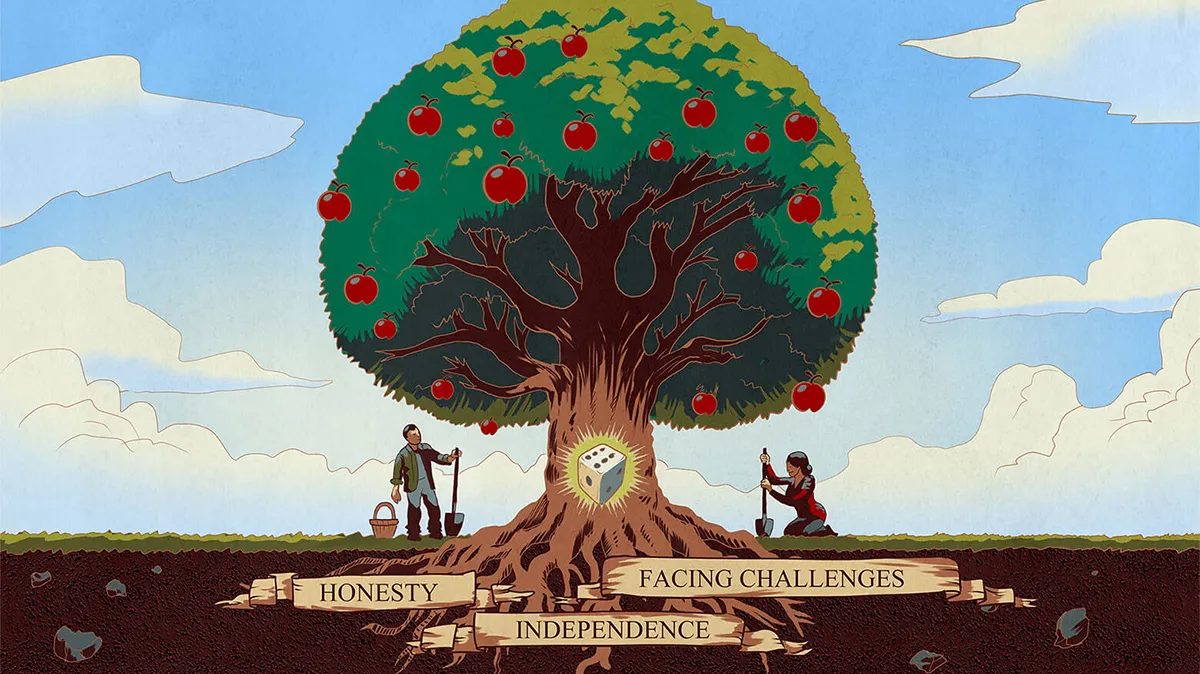

The newspaper test. How would you feel about any given action if you knew it was going to be written up the next day in the newspaper? Reputation takes a lifetime to build and five minutes to lose. In other words, always behave honorably. Always!

Buffett’s definition of success (he probably came to it later in life). Behave in a way that makes people you care about love you. He said, “If you get to my age in life and nobody thinks well of you, I don’t care how big your bank account is, your life is a disaster.”

Buffett has a friend who survived the Holocaust. When she looks at people, she only asks one question: Would they hide me? Buffett said, “When you are 70 and you look back at your life, and you have a lot of people who would hide you, then you’ll have had a very successful life.”

“Praise by name, criticize by category.” You’ll never hear Buffett speak negatively about anyone in public, and at the same time he is generous with his public praise of specific individuals.

Charlie Munger characterized Buffett as “a constant learning machine.” That is a very admirable quality. I’ve attended almost a dozen Berkshire Hathaway meetings, where Buffett and Munger answer questions from shareholders for almost six hours, taking only a lunch break. Every single time, I’ve learned something new from each of them.

Buffett had a tremendous impact on me as a writer. His annual letters, despite discussing often complex, boring finance subjects, are educational, interesting, funny, and accessible to an average reader.

And of course, he had an immense impact on me and millions of others as an investor.

By the way, if you have not read my “Six Commandments of Value Investing,” which is a chapter from the book Intellectual Investor that I may finish one day, it was heavily influenced by Buffett and his mentor Ben Graham. You can read it here.

Nice job Vitaly, enjoyable read.