What book(s) have influenced your life the most? Why?

Over the last few years two books have had a very significant impact on my life: The Subtle Art of Not Giving a F*ck, by Mark Manson, and The Guide to the Good Life, by William Irvine.

Mark Manson’s book sent me on a quest to reassess my personal values. The title misrepresents the book, whose message is not to stop caring, but if you value everything, you value nothing. We should be thoughtful and deliberate as we decide on what we value. I wrote a long essay about that; you can read it here.

William Irvine’s book introduced me to Stoicism and got me completely hooked on Stoic philosophy. Today I view Stoicism as an operating system for life.

Both books made me reevaluate what is important in life and what is not.

Do you have any quotes you live by or think of often?

I probably will have a different answer on any given day.

When I am deeply engrossed in investing, two quotes from Stoics come to mind. The first one is from Seneca: “Time discovers truth.”

I think about this one a lot when I am researching a company. The truth in this case being what the company is worth. The truth is already there, and time will eventually discover it. I just need to discover it before time does.

I also think about this quote when I have discussions or debates with people. I have stopped debating topics with people who are in the conversation just to prove their point but not to learn. Almost any conversation about politics falls into this bucket.

Another quote from Marcus Aurelius has been on my mind lately: “The object of life is not to be on the side of the majority, but to escape finding oneself in the ranks of the insane.” We are living through 1999 Dotcom-like euphoria in the stock market now (I wrote about it here). If you are not careful, the fumes of this euphoria will intoxicate you and you will eventually join “the ranks of the insane.” I am doubling, tripling down on our rational investment process.

When it comes to my personal life, I try to live by Warren Buffett’s newspaper test quote: “How would you feel about any decision if you knew it was going to be written up in the local newspaper the next day?” Decision making becomes a lot easier, and you stop making compromises with your soul. Simplifies your life, a lot.

Where did you grow up, and what was your childhood like? Did you have any particular experiences/stories that shaped your adult life?

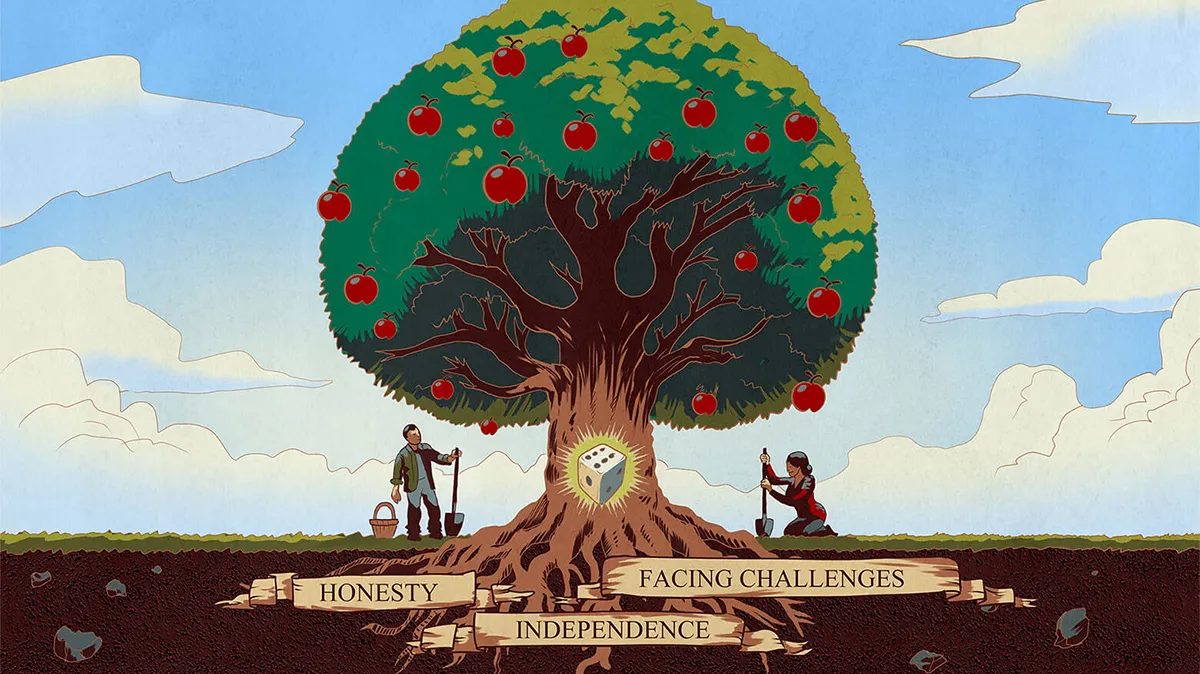

I grew up in Soviet Russia. This experience made me appreciate the rule of law and free markets. I detest corruption. To paraphrase George Orwell, corruption makes some people more equal than others. I also absolutely hated the feeling of powerlessness when certain parts of my life depended on the arbitrary decisions of others.

On the positive side, I won the lottery with my parents. They were a bit delusional, as they had this belief that I could achieve anything I put my energy into. It was a belief based on zero evidence. I was a very late bloomer. I think my 15-year-old daughter is more mature now than I was at 21. This belief in me by my parents supercharged me into what I am today.

What is something you wish you would have realized earlier in your life?

I don’t have to win every argument. Being kind is more important than having to prove to someone that you are right.

What are bad recommendations you hear in your profession or area of expertise?

Many today find a false sense of security in “diversifying” among dozens of ETFs. They find safety in numbers. But if the market is overvalued, which I believe it is, owning a lot of overvalued assets will not protect you from losses and is likely to bring you a decade of no returns.

This still bewilders me. The higher stocks go, the more excited people get about future returns. But mathematically the opposite is true. I don’t want to get too much into the weeds of the stock market, but stock prices go up in the long run for two reasons: earnings growth and how much people are willing to pay for earnings increases (the price-to-earnings ratio). Earnings on average have grown 4–6% a year or so. Over the last decade a very large portion of returns came from stocks just getting more expensive. Imagine you are rolling a large rock uphill in the fog. You don’t really know where the hill ends, but you know it does, and at some point, once you reach the top, your rock will roll down the other side. This is what happens to overvalued stocks: They get more expensive until they don’t, and then they get cheap fast and stay there. I’ve written two books on this subject. So I probably should stop before I write another one here.

Tell me about one of the darker periods you’ve experienced in life. How did you come out of it, and what did you learn from it?

Losing my mother from brain cancer when I was 11 was hard. My child mind never really accepted that I would never see her again. This experience brought me closer to my father, and I have to thank him for not being overly scarred by her death. I’m not sure I can give useful advice in this area.

Professionally, 2015 was an incredibly difficult year. I found it was important to divorce my personal self-worth (my ego) from the success (especially the temporary success) of our investment portfolios. Realizing that every investor, even great investors, have gone and will go through times when they felt dumber than a rock was a bit liberating. I learned, when I have good years, to bottle up that feeling of temporary smartness, because I’ll need to uncork it sooner than I think.

Ironically, 2015 is probably the best thing that ever happened to me professionally, as it led to the improvement of our investment process. In fact, I wrote a very lengthy essay about that in 2017, but only shared it with a very few friends and never published it – it was too painful. But I decided to include the essay in my next book, Soul in the Game. (If you’d like to be notified of its release, sign up here).

What is one thing you do that you feel has been the biggest contributor to your success so far?

I hate this type of question – by answering it I am patting myself on the back and saying that I am successful. But I’ll answer it from this perspective: I have far exceeded the expectations I had for myself when I was a teenager (though in all honesty they were incredibly low).

Two things that have contributed a lot to my success are parents and writing.

As I mentioned about my parents, I won the lottery there.

With regard to writing, I am not talking about my accomplishments in publishing books or writing articles for prestigious publications. Those things are very secondary. Writing has made me a much better thinker. Some people exercise daily; I write daily. I spend about two hours in the early morning staring at the computer and thinking. Sometimes this thinking spills into an essay, and sometimes I walk away leaving a blank page behind. But this focused thinking is responsible for any original thought I have. Writing forces me to think.

What is your morning routine? Please include the time you wake up.

Ideally, I wake at 4:30 am. Make a cup of Americano. Put my headphones on and write. I say ideally because I am paranoid about getting enough sleep. If I go to sleep late, I may allow myself to sleep late – to 5:30 or 6. But even if I get up late, I still put in an hour of writing every single day. I find that writing daily is very important to me because it is like a muscle that you want to exercise daily. Plus, to be honest, I really enjoy it.

What habit or behavior that you have pursued for a few years has most improved your life?

Writing is the most important one.

When I got into my 40s I realized that I had to pay attention to my health. When you are young you take health for granted. You assume you’ll always have it.

There are basically three things you can do for your physical health: eat and sleep well and work out.

I found that I have good willpower when it comes to abandoning bad habits (I quit smoking when I was 21 after smoking for six years – one of my proudest achievements). But I realized I need external pressure to create and stick with good habits. I tried to exercise in the past, and every single time I gave up after a month or so. Then, three years ago, I started working out with a personal trainer. My brother Alex and I meet him twice a week in the gym at the IMA office. Unless I am traveling, this workout is a non-cancellable appointment on my calendar.

I’ve also been playing with my diet. I cut out sugar (I wrote about it here). My cholesterol numbers improved tremendously.

And then there is sleep. I used to admire people who slept four or five hours a night. Like the rest of the country, I chanted the “I’ll sleep when I’m dead” mantra. After reading Why We Sleep, by Matthew Walker, I realized how important sleep is for daily productivity and for longevity. I might have gone a bit off the deep end with this – a year ago I got an Oura ring that tracks my sleep. I wrote an in-depth essay on the subject of sleep, and you can read it here.

The pandemic also made me better appreciate my mental health. I go for daily one-hour walks in the park. In the wintertime I do this during midday, but in summer I usually do it early in the morning. I listen to podcasts, earnings calls, audiobooks, or just music. Once or twice a week I take these walks with one of my friends. The pandemic turned my walks into a substitute for lunch meetings.

Finally, I’ve been meditating for about a year. I am a very light meditator; I only do it 10 minutes a day. I find that it is enough for me.

What are your strategies for being productive and using your time most efficiently?

I say “no” a lot. I don’t do “let’s meet for coffee.” I used to feel bad about being selfish with my time, but then I realized that my most important responsibility is to my immediate family and close friends. The time I spend on a “let’s meet for coffee” meeting is time taken away from a game of chess with my daughter Hannah or a walk in the park with a friend. Once I started to look at things from this perspective, any guilt I had from saying “no” dissipated.

I also realized that I can scale my writing but not my time. A few times a week I have students reach out to me for career advice. After a while I realized that I was repeating the same thing in these conversations. So I summarized my career advice in this letter for young investors, and even went a step further by creating a value investing curriculum for anyone who is interested in value investing.

Finally, I delegate a lot. I use money to buy time. I have a terrific assistant who manages my calendar and my calls. This saves me a lot of time from tasks where I add zero value.

You are a mensch, worthy of respect. I admire your writings and your life. Keep up the great work.

cs