September 2019

On Sunday we drove my eighteen-year-old, Jonah, to the airport. He is taking a gap year after graduating high school and will spend the next two semesters in Israel. He’ll be taking classes at American Jewish University, doing internships, touring Israel, and discovering himself.

After we hugged Jonah and put him on the plane, my wife looked at my daughters (Hannah – 13, Mia Sarah – 5) and said, “You are not going anywhere; you’ll be home-colleged!” I share my wife’s sentiment. Intellectually, you know that your kids will grow up, but you want to slow down the process as much as possible. Still, you know this day will come and the only thing you can do is spend as much time as you can with them while they still live under the same roof as you. And when the time comes for them to leave, you just don’t want to let them go.

After we dropped Jonah off, my wife and I took our daughters to Vail for a day, where I drowned my sorrow in pasta and ice cream (I almost never eat either; this was a major “off the wagon” moment for me).

When your kids leave for college, you somehow get to look back at your life through a different lens. You start asking yourself, did I spend enough time with them. Before Jonah boarded the plane, we exchanged letters (it was his idea); my wife and I wrote a letter to him and he wrote one to us and his sisters. There was a paragraph in his letter that put tears in my eyes:

Thank you for using your time to create great memories with me while still balancing everything else that you do… A while ago you read a book about Warren Buffett. In this book it talked about how Warren wished he had spent more time with his kids. You were worried that you weren’t spending enough time with me. Don’t worry, I can happily say that you were and are a great father. I have never in my life felt that you didn’t spend enough time with me.

This stands above anything else I have accomplished in my life. Everything else feels somehow temporary and insignificant. I remember when Jonah was a few years old, I held his tiny hand and I was thinking “What will he be like when he grows up?” I was trying to picture him as an adult – I could not. Now I see an adult, standing at 6’4, with a deep voice, a great sense of humor, curly hair, and a kind heart.

Today I look at my two girls and try to imagine them growing up. Just like with Jonah, I cannot. But they will. I have only five and thirteen years left before Hannah and Mia Sarah leave home. And though it feels far off, the time will fly, just like it did with Jonah.

Now I want to set new, higher standard for myself when I spend time with my kids. I recently read that “attention is the currency of time.” I want to make sure that when I spend time with my girls, I am there with them 100%, not thinking about a stock or a book I just read, but giving them my full attention.

My Personal Manifesto Follow-Up

I am truly humbled by the response I received to “My Personal Manifesto.” Many readers told me that this was my all-time best article (easy for me to achieve – my articles set a very low bar). I do a good chunk of my writing for a selfish reason –so I can learn. I benefited tremendously from writing this manifesto. However, the true credit goes to Mark Manson – he wrote an incredible book, The Subtle Art of Not Giving a F…ck.

If you did not have time to read all 17 pages of my manifesto, you still can; here is a link to the PDF. And you can also listen to it – we turned it into an audio-article.

Personal finance article follow-up

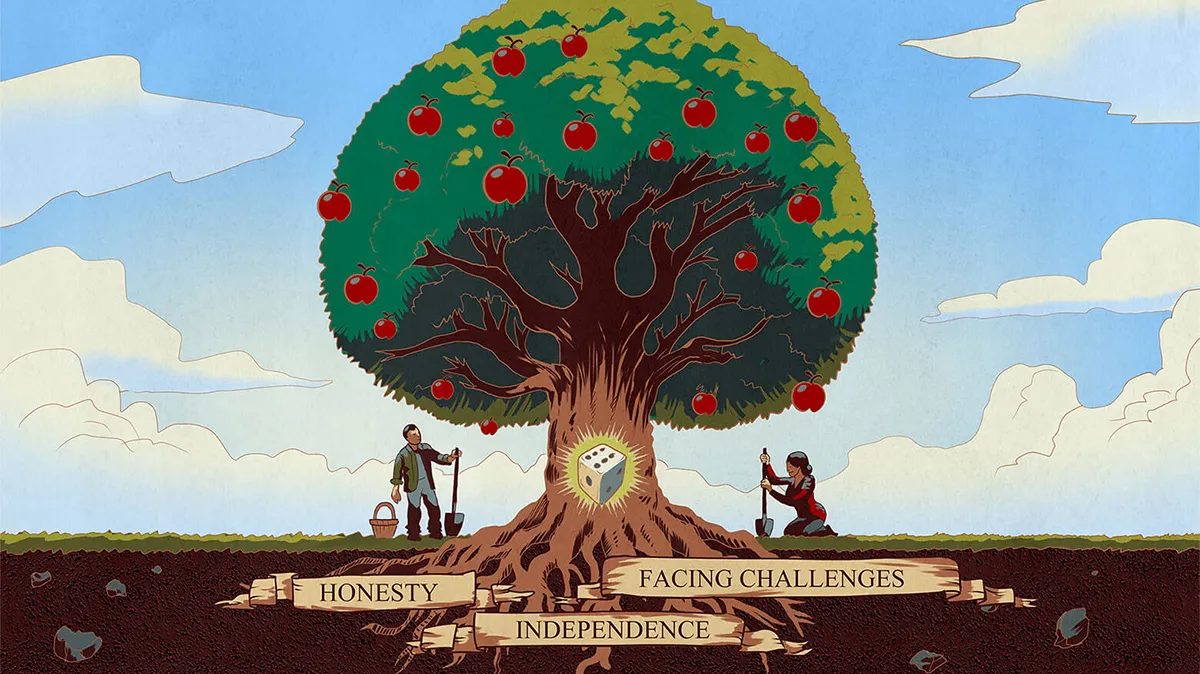

I wanted to add an important point that I forgot to include in my personal finance article. Health, time, education, and experiences are categories of spending that are important to my family, and as a consequence our budget for them is very loose. But just because they are important to us does not mean that they should be important to all my readers. Not at all. We are all different. We have different values, different financial situations, and are at different stages of our lives. My categories were examples of my family’s conscious choices.

Here is another example.

I have a friend. He is divorced and has a 21-year-old son he is very close with. He is a personal trainer and chooses to work 20 hours a week. He lives in an apartment that is slightly bigger than his car and that he shares with a roommate (his son lives on his own). He doesn’t eat out much and generally leads a very modest day-to-day lifestyle. But he loves traveling. A couple times a month he takes a three-day trip with his son to a new place in the US. They stay in cheap, $60 motels. I get the feeling that spending time with his son is the main reason why he loves to travel. He also enjoys the experience of driving and despite his modest income leases a $35,000 car every two years.

I doubt that he intentionally sat down and wrote out a budget. But he made a budget through intentional prioritization of his spending – elevating things he values and enjoys – travel and driving – and deemphasizing things that are less important to him, like food and size of his dwelling. At this point in his life he chooses to work just enough to cover his very limited needs. And here is the best part – he is incredibly happy.

Just as a reminder, Happiness = Reality minus (properly calibrated) Expectations.

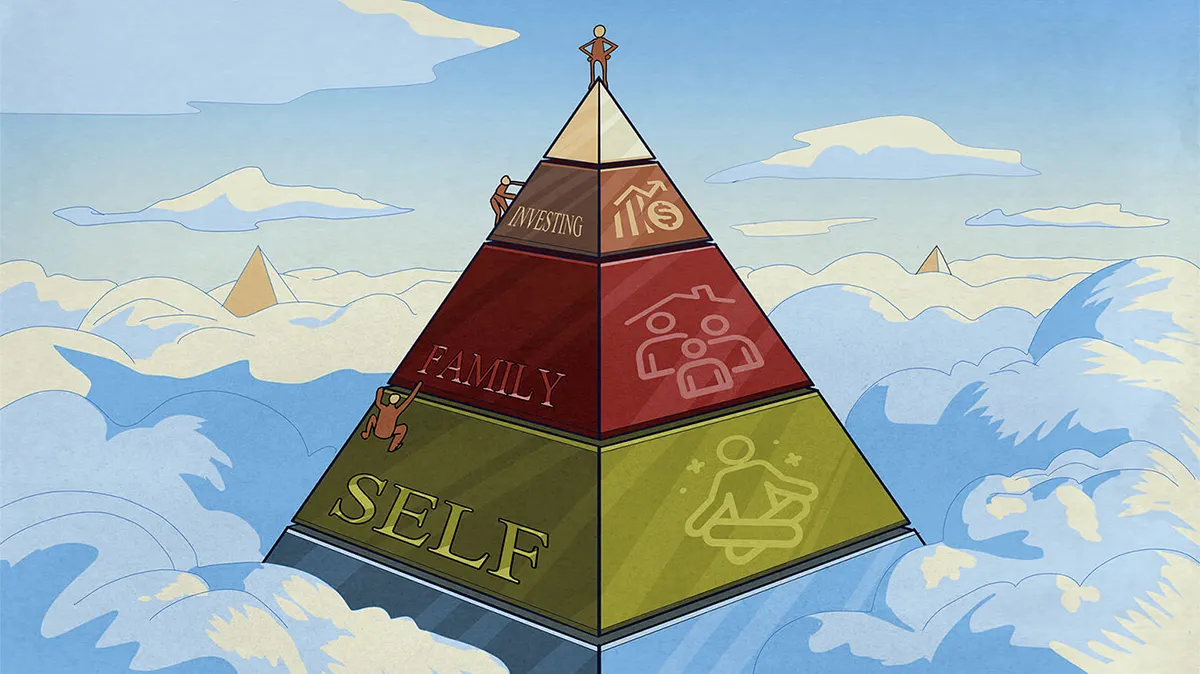

I unintentionally tied the two aforementioned articles together – our personal budget should follow our values. We need to figure out what matters to us (our values) and calibrate and prioritize our spending accordingly. After all, money buys the most when it buys things we actually value.

By the way, here is a link to the audio version of the personal finance article.

And with this I conclude my adventure into personal finance.

0 comments