Client Letter

Redefine “value” in this era of the US stock market

Do we need to redefine “value” in this era of the US stock market, or should we continue to sit on the sidelines if traditional metrics show equities to be overvalued?

Current thoughts on Tesla

Tesla market value of $780 billion mostly reflects Elon's future dreams, not car sales. The reality? Only $100-180 billion tied to the actual vehicle business.

Europe Can’t Hide Behind America Anymore

Americans have always outspent Europe on defense, but to be fair, we have a currency advantage. Our military might elevated our currency to reserve status.

The Reputational Bankruptcy of the American Dollar

The US dollar will likely continue to get weaker, which is inflationary for the US. Let me start with some easily identifiable reasons.

The Paranoid Russian Jew Approach to Investing

When asked about his money manager, our long-term client Ed, who became a dear friend, proudly stated, “My money is managed by a paranoid Russian Jew.” This perfectly sums up our approach to investing.

Escaping Stock Market Double Hell

Over the last few years, our portfolio has skewed more international. Today, if you only invest in the US, you're experiencing two stock market hells.

Embracing Stock Market Stoicism

2024 brought me back to a core Stoic principle that I hold close to my heart: the dichotomy of control. We can apply it in investing.

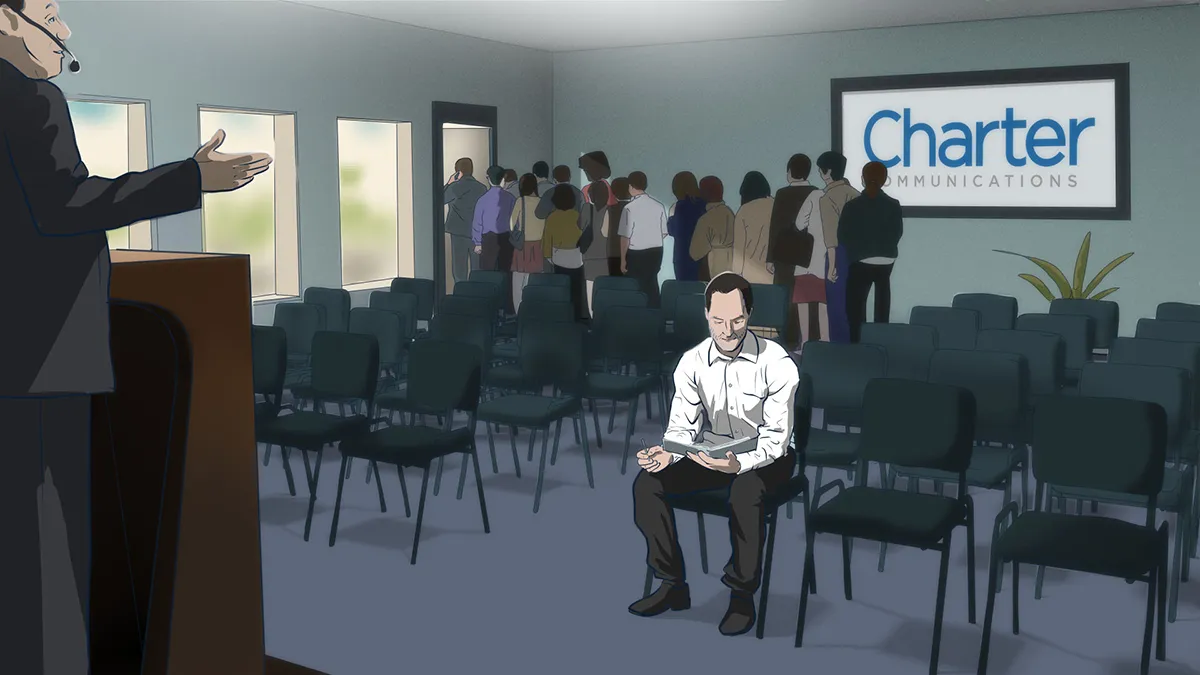

The Infinite Game in Telecom

CHTR, just like Comcast, showed only a very slight decline in broadband customers in the quarter. Most of the decline came from the US government removing subsidies for rural customers.

The AI Revolution

The discussion of AI quickly falls into a domain bordering on Sci-Fi. My thoughts here are only marginally shaped by scientific facts.

The EV Industry Landscape

As a part of a summer letter to IMA clients, I will discuss investments in the EV industry, spurred by the following question from a client.

Lessons from History’s Technology Booms

The technology at the core of the mania is different every time. What doesn't change over time is human emotion – the fear of missing out and then the fear of loss.

The Magnificent 7 and the Dangers of Market Hype

Despite the S&P 500 showing gains in the mid-teens, the average stock on the market is either up slightly or flat for the year.

Understanding Today’s Economic Landscape

Interest rates that stay low and actually keep declining for almost a quarter of a century slowly propagate deep into the fabric of the economy.

From Bull to Sideways Markets to Nvidia

I discussed my condensed views on the stock market, economy, and our investment strategy in a letter to IMA clients.

The Growing Pains of Maturity

Many times, we bought because they were in their “junior year”; this is what made them undervalued. Our research led us to the conclusion that their difficulties were transitory and that as they matured the market would revalue them.

What is the Value of Apple? How do we evaluate risk?

Today I will share the Q&A section of the letter. Every time I am almost finished with the client letter, I ask clients to send me any questions they have about their portfolio or other topics. I answer these questions in the Q&A section.

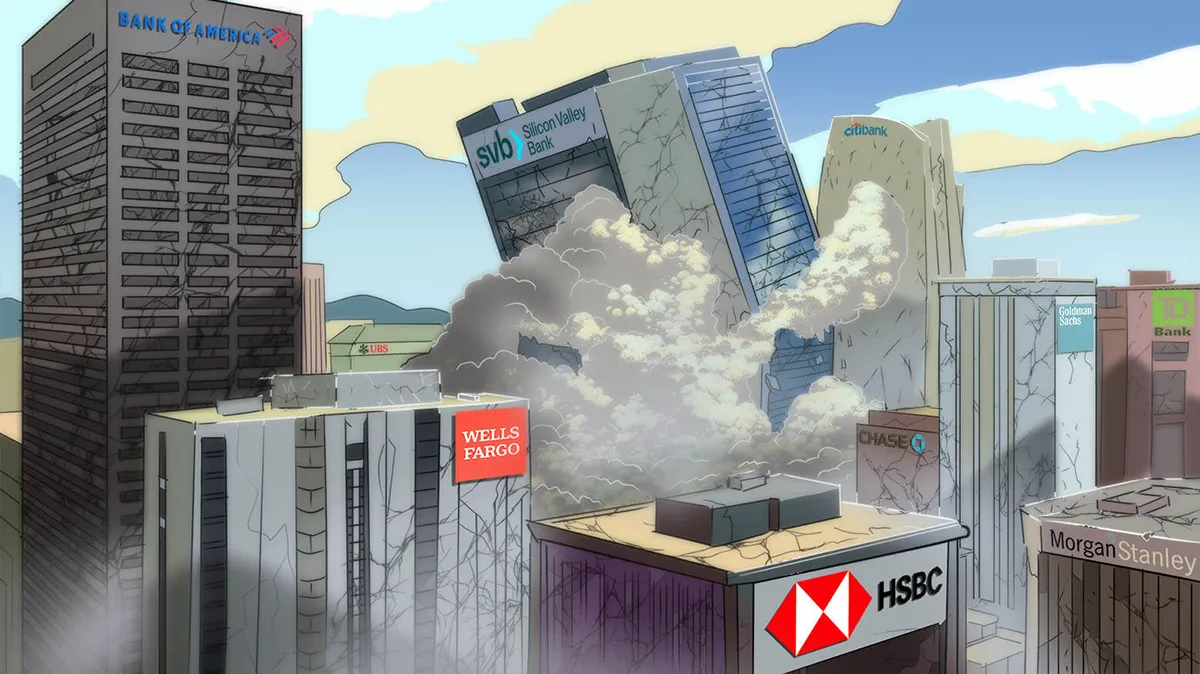

Libertarian’s (Unexpected) View on the Bailout of the Banking System

Bailout of the banking system create social tension. Eventually, bailouts introduce so much risk into the system that failures and bailouts become too costly for the society to bear, government creates draconian rules trying to prevent them in future, which in turn kills innovation and the formation of new businesses, and the result is a stagnating economy.

What to Expect After the Silicon Valley Bank Collapse

The Silicon Valley Bank collapse may be an extreme event, but it gives us a preview at a 100x magnification of what other banks are facing.

The Stock Market, The Economy, Possible Outcomes, How to Invest

This is part one of the winter seasonal letter I wrote to IMA clients, sharing my thoughts about the economy and the market. I tried something I’ve never done before. Instead of conveying my message through storytelling, I tried to compress my thoughts into short sentences…

Why we’re confident in our Charter investment

The CHTR decline may have kicked us in the face, but our extensive research is telling we’re not wrong about our Charter investment. Here’s why:

Stock Market Roller Coaster: Prepare for a Decade or Two of Disappointing Returns!

Investors who own index funds have likely strapped themselves into a giant stock market roller coaster which, to this point, has only gone up.