When asked about the future of value investing, Buffett answered: “Value investing will be fine; people will continue to do dumb things.” I agree; I came to the same conclusion when I wrote Active Value Investing almost two decades ago (before I knew how to spell AI):

No matter how much things change, they remain the same. Whether a trade is submitted through a Western Union telegram, as was often done at the turn of the nineteenth century, or through the video game look-alike screen of an online broker, as often happens today, it still has a human originating it. And all humans come with standard emotional equipment that is, to some degree, predictable. Human emotions and thus long-term market trends are here to stay. Over the years we’ve become more educated, with access to fancier, faster, and better financial tools. A myriad of information is accessible at our fingertips, with speed and abundance that just a decade ago were available to only a privileged few. But despite all that, we are no less human than we were 10, 50, or 100 years ago.

Unless technology and innovations strip away our emotions, we’ll behave like humans no matter how sophisticated we become. Unless we completely outsource all of our investment decision making to computers, markets will still be impacted by human emotions. Emotions are the price-and joy-of being human.

Buffett also said, “People are trying to outsmart each other in arenas that you don’t have to play in.” This is a good reminder that you don’t get extra points in the market for the degree of difficulty of analysis. I can instantly raise my IQ (I need as much help as I can get) by choosing problems that I can solve.

On a morbid topic of wills, Buffett opined that “if your kids are reading your will for the first time after you have died, this is a mistake that you won’t be able to correct.” He is not going to sign a will unless he shares the contents of it with his kids and gets their feedback.

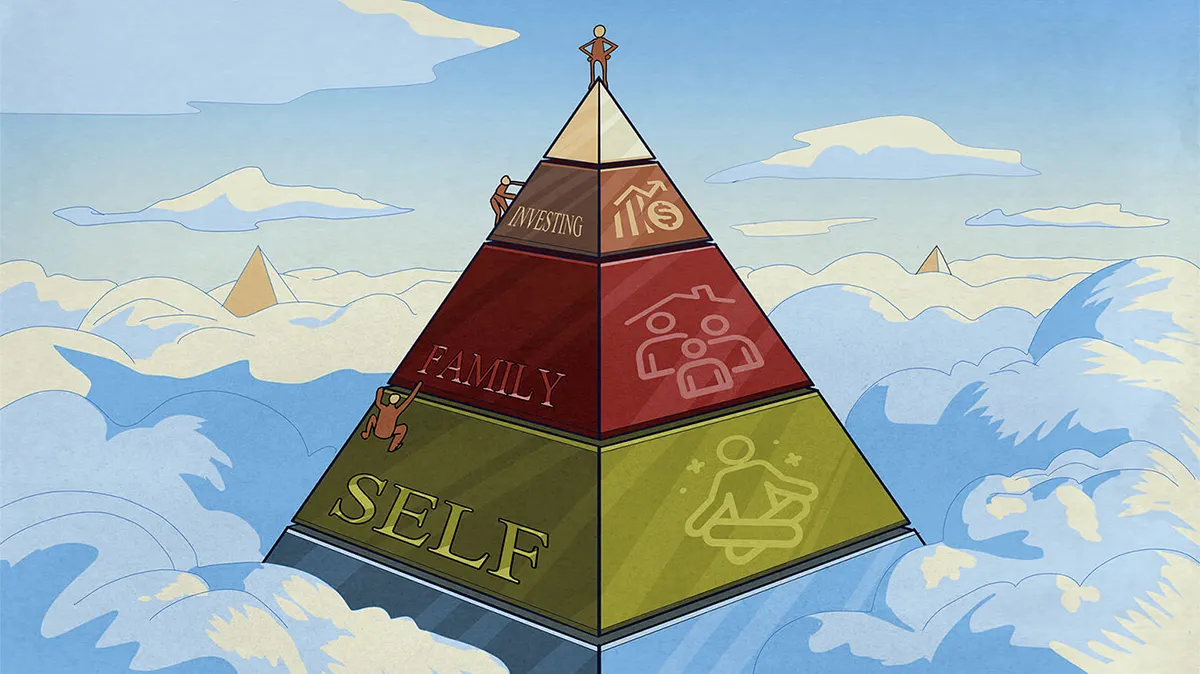

Loved this from Buffett: “If you want to know how to live your life, write your obituary and then reverse engineer it so that you can live up to it.

In addition, Buffett said: “If you want your kids to have certain values, it’s important that you live those values and talk about it.” I cannot agree more with it. This applies not just to parenting but being a boss. If I don’t practice what I preach, my employees will not take me seriously.

Buffett’s quote that stuck with me most was “I don’t know anyone who is kind to die without friends. I know plenty people with money to die without friends”. Having money only attracts friends who value you for your money. Kindness, however, has an everlasting purchasing power.

Munger’s advice for a good life: “It’s so simple to spend less than you earn, avoid toxic people, toxic activities, keep learning all your life, defer gratification because you prefer it that way, and if you do it all this way you will succeed. If not, you will need a lot of unusual luck.” Charlie doubled down on the toxic people comment: “Get them the hell out of your life.”

My favorite line from Charlie Munger was: “Practicing law today is like a pie-eating contest, where if you succeed, you get to eat more pie.”

Tom Gayner, the CEO of Markel, and I were speaking at a YPO event. Tom said, (I’m paraphrasing) “Buying low-quality companies at low prices is like hiring bad employees cheaply. You’d rather pay a bit more and hire a great employee.” I’ve been noodling about it over the last few days and I agree with this sentiment, both as a CEO and an investor.

What I’ve learned over the years is that great employees and companies (run by great people) tend to surprise you with upside. I’ve painfully learned that bad employees and companies tend to surprise you with downside (they have negative optionality embedded in them). Additionally, it’s so much easier to go through tough times with great companies and employees. I don’t want to be flippant about the price you pay; at certain prices, even great companies become bad investments, but the point still stands.

Avoiding cheap, low quality companies and hiring mediocre employees is half of the battle.

Would you like to see Buffett and Munger saying what I said they said for yourself? Watch these clips.

Thanks for sharing, Vitaly. Great piece of information to reinforce our EQ.