Arthur Brooks, in his interview with Peter Attia, which I highly recommend, provides a formula for happiness: enjoyment (pleasure + elevation in relationships), satisfaction (reward for a job well done), and purpose (meaning in life).

I was reflecting on this and realized that it aligns perfectly with my personal definition of happiness: relationships, flow, net positive. People write books on this subject; I’ll try to sum things up in a few paragraphs.

Relationships: Have good, warm, meaningful relationships with family and friends. This requires both addition and subtraction – allocating time to relationships that bring meaning and deallocating time from the ones that come with empty or, even worse, negative calories. Emphasize quality vs. quantity here. And to be happy in relationships I have to be present (mindful) – not going through life daydreaming about the past or the future.

Flow: In Soul in the Game I called it flow. Have a creative flow in activities that you love and that are meaningful to you. These are highly personal choices; for me they are: investing, writing, and running IMA.

There is a lot of subtraction in this category, too. A few years ago I identified all the activities that fell into my lap. I wrote them down in two columns: “Love doing” and “Able to delegate.” I kept the ones that I loved doing and that were important ones that I couldn’t delegate. But I delegated things like the scheduling of my appointments (this saves me at least an hour a week).

One activity that I discovered I don’t like doing is giving presentations. I don’t need to do them, but I mindlessly agreed to do them when I was asked. They occupied too much of my mental real estate as I kept thinking about them in the weeks before I had to give a speech. I realized there was a part of presentations I actually enjoy: the Q&A that follows the talk. Now, when asked to speak, I respond that I don’t do traditional presentations but love Q&A in a fireside chat type of format. To my surprise, most people welcome it.

Net positive: This is a broad category. It applies to all my main activities, relationships, and interactions with other people (including perfect strangers).

In my day job, investing, I am making a difference in the lives of IMA clients. I know, I am not saving people from burning buildings, but IMA allows people to go through their lives and not worry about their retirement or ability to pay for their grandkids’ education. I find meaning in it. Writing allows me to help people on a larger scale. I’ll be doing it even when IMA closes its doors to new investors (and at some point, it will). My articles are read by hundreds of thousands of people. Being a net positive was one of my main reasons for writing Soul in the Game. There was a lot of altruism in that two-year endeavor.

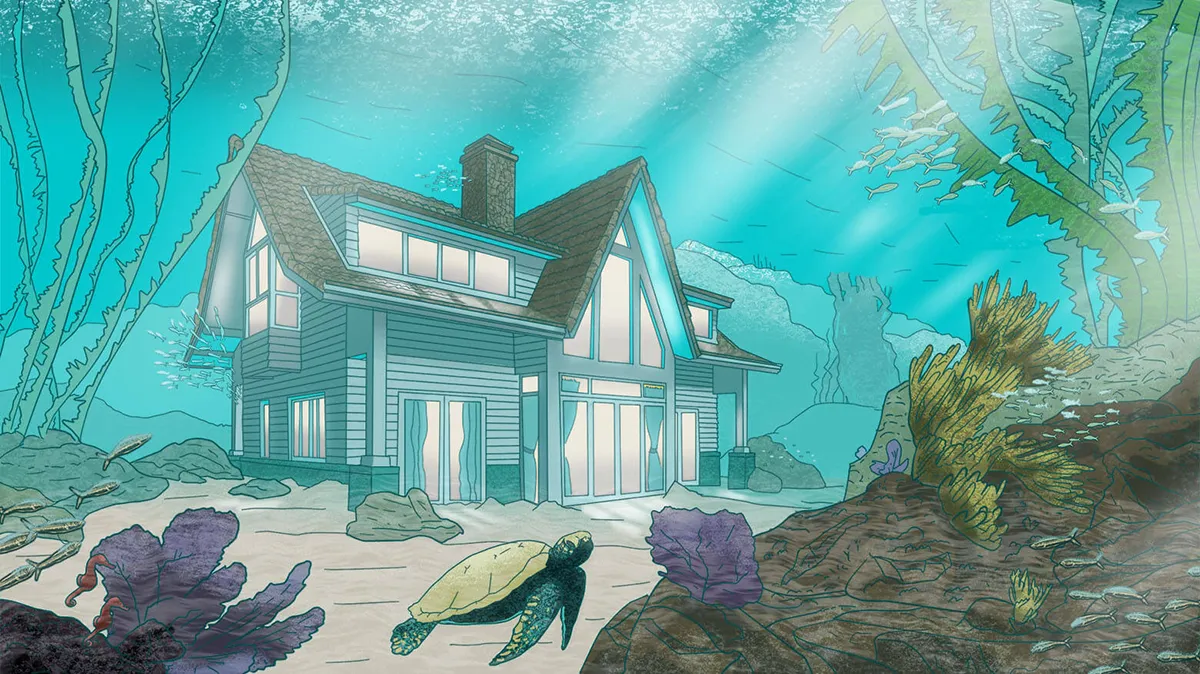

What I am about to share with you is an excerpt from a fall letter I wrote to IMA clients. It is long; therefore I’ve divided it into two sections. Today I’ll discuss the (sorry) state of the housing market; next week I’ll discuss the economy.

The Housing Market is Worse Than You Think

In this letter I’d like to explore the impact interest rates will have on the economy and especially the housing market.

Currently, the 30-year mortgage rate is pushing 7.6%, up from less than 3% a year ago, while the median house price in the US is up 37% from $320k in 2019 to $440k today. You cannot have both interest rates and housing prices making new highs. Something’s got to give.

Let’s start with new home buyers, as they’ll be impacted the most.

If you are a first-time home buyer, you don’t have home equity to roll into a new purchase. If you bought a house in 2019 for $320k (assuming you put down 20% of the purchase price as down payment), your annual mortgage payment at 4% would have been $15k.

Two years later, in 2021, you would have paid $420k for the same four walls and white picket fence (dogs, spouse and 2.5 kids sold separately). However, despite a 37% house price increase, thanks to Uncle Fed, you would have been able to finance this purchase at 3%, and your annual mortgage payment would have gone up to $17k – a manageable $2k annual increase.

As I have mentioned, today the median house price is at $440,000, but the interest rate has skyrocketed to 7.6%. Thus, if you are a first-time home buyer, the same American dream would cost you $30k a year – that is a $13k increase from just a year ago.

Let me put this in proper context – median annual household income in the US is about $75k, or about $60k after taxes. In other words, half your after-tax income is now going to servicing your mortgage if you bought today at peak home prices and rates.

It is easy to see how the combination of high prices and rising interest rates have turned the American dream of owning a home into a nightmare. For affordability to come back to 2020 at current interest rates, housing prices have to decline more than 40% to $250k. If this were to happen, anyone who bought a house since 2012 would be underwater on their initial purchase.

It is hard to envision this rapid price decline happening overnight. Just like stock prices, housing prices are set by supply and demand. But houses are not like stocks. People live in their houses, raise their kids there, create memories, and thus get emotionally attached to them. Also, many decades of declining interest rates and rising housing prices have convinced the public that increasing housing prices must be guaranteed by the US Constitution in tandem with the right to the pursuit of happiness.

When we decide to sell our house and we receive offers that are below the highest price we saw on Zillow just a few months earlier, we wait for the right, higher offer to come in. This is why the fact that we live in our houses is important – we are emotionally attached to them and want the best offer possible. This is also why housing prices are quick to move up and slow to come down. It takes multiple painful conversations with a realtor to convince us to start lowering the asking price.

This is where things get even more complicated. There are two types of sellers: people who must sell their houses (moving to a new city, lost a job, got divorced) and those who would like to sell their houses (bored with their old four walls, need a bigger or smaller house, would like their kids to go to better schools etc.). I am generalizing here.

Our house is worth what someone else is willing and able to pay for it.

Let’s contrast two transactions:

You are at a grocery store – you want to buy tomatoes, but the price of tomatoes has doubled. Your credit card company is not going to say, “Jane, you cannot buy tomatoes. They are too expensive. You cannot afford them.” Unless you are maxing out your credit limit, your credit card company doesn’t care how you spend your (borrowed) money.

This is not what happens when you take out a mortgage on your house. After being blamed for the last housing crisis, bankers became born-again bankers: they found underwriting religion. If an average consumer walks into a bank asking for a loan, this born-again banker will look at the cost of the house in relation to the buyer’s income and will politely tell the buyer to look for a cheaper house or start driving Uber on weekends.

In the past, a lateral change from one house to another did not really cost you much, other than transaction costs. However, if you refinanced your house at 3% when rates dropped, as many people did, today this lateral move would cost you dearly.

How much?

The median mortgage on a house today is about $220k, and the median home equity loan is $40k. My goal here is to be vaguely right rather than complicatedly precise, so I assume that an average homeowner owes a total of $260k for their house. If the house was refinanced at 3–4% interest rates in 2021 and 2022, then that average homeowner is paying about $13–15k a year for their house.

Unfortunately, the mortgage is attached to a house. Selling a house cancels an existing mortgage, and a new house requires a new mortgage at market rates, which today are 7.6%. Thus, this new mortgage would cost $22k a year, or a $7–9k increase. Just selling your house and moving to a similarly priced house a few blocks away would cost about 10% of your annual income! This explains why the number of transactions in the housing market has hit a multi-decade low.

(When my brother Alex, a realtor, asked me if my housing market analysis came with any good news, I told him, yes, your family loves you.)

When prices go up, people who want and must sell a house are selling with ease. As prices decline, at first only people who must sell are selling. However, as time goes by, selling becomes less and less discretionary as a desire to sell turns into a need.

People who must sell their houses will have to accept lower prices. How much lower? That is impacted not just by a seller’s willingness to accept a lower price (supply) but also by a prospective buyer’s ability to borrow (demand).

I hear this argument at times: “In the 1980s interest rates were higher than they are today, and we had a functioning housing market.” There is a substantial difference between then and now. Today the median house price in relation to median income is at the highest level in modern US history, even higher than it was at the height of the housing bubble in 2007. It is almost double the level of the early 1980s.

Side note: The situation I described above is not unique to the US. In fact, other countries, including Australia, Canada, and the UK, are experiencing much bigger housing bubbles.

Today, consumers’ discretionary income is being attacked by inflation from different directions: The cost of everything is up, from trash collection to food. Gasoline prices have declined, likely due to our tapping into our strategic oil reserve and the slowdown in the economy. Food prices are less likely to decline, though I could be wrong, since they are driven by currently elevated prices of fertilizers (I wrote about that here.)

But it doesn’t stop there. Higher interest rates make anything that needs to be financed more expensive – cars, refrigerators, iPhones, big-screen TVs, etc. Over the last decade we got spoiled by zero-percent financing. Unless interest rates go back down, those days are over.

It is important to mention that wage increases to date have lagged inflation by a large margin. The federal government has thrown a bone to retirees by promising to raise Social Security payments in 2023.

Spending is both a financial and a psychological decision. If you feel wealthy and confident in your future, you are willing to spend your savings and borrow (against future earnings) to buy stuff. The stock market decline and declining housing prices, along with rising unemployment, will undermine consumer confidence and willingness to spend. Also, falling housing prices will start to undermine the housing ATM (home equity), and rising interest rates will make borrowing against the house more expensive and reduce equity people have in their houses – thus fewer homeowners will undertake home improvement projects or tap out home equity to subsidize their day-to-day living expenses.

Stay tuned for Part 2: Recession is Coming

Key takeaways

- Housing prices have reached unsustainable levels, with the median US house price up 37% from $320k in 2019 to $440k today, while mortgage rates have skyrocketed to 7.6%.

- The combination of high housing prices and rising interest rates has made homeownership unaffordable for many, with mortgage payments potentially consuming half of the median household’s after-tax income.

- For housing prices to return to 2020 affordability levels at current interest rates, they would need to decline by more than 40%, which could leave many recent homebuyers underwater on their mortgages.

- Housing prices are slow to decline due to emotional attachment and seller reluctance, but market forces may eventually force prices down as fewer buyers can afford current prices.

- The current situation with housing prices is not unique to the US, with countries like Australia, Canada, and the UK experiencing even bigger housing bubbles.

Vitaliy: Curious to know your thoughts on Barry Habib’s thoughts on low housing supply and surging household formation and earning power swamping the effect of higher mortgage rates. He sees advantage in borrowing at a high mortgage rate now and buying. He expects rates to come down a bit in a few years which will stoke renewed buying pressures. Buyers with high mortgage rates locked in will have a chance to refinance. Here’s a link to the conversation with David Bahnsen: https://www.nationalreview.com/podcasts/capital-record/supply-demand-and-central-banking-run-amok/ Sincerely, Sal Daher

Hi Vitaliy,

Overall, I agree with what you’ve stated in your article. As usual, it is well-written and clearly stated.

I’d like to suggest that another factor in this equation is, in some markets, there is an increasing percentage of residential properties owned by investors. Investors that are renting these properties via Airbnb, or similar avenues, have a different calculus in determining a property’s value and affordability.

I would love to hear how you feel this affects your analysis.

Vitaly, thanks so much for introducing me to Alma Deutsher. OMG, my head is spinning.

As a mortgage consultant, the only correction I would make is that the borrower who finds themselves short on income would be advised to “Start driving Uber 3 years ago so we would have two years of the income on your tax returns.” Otherwise, new part-time contract jobs don’t help you qualify for a loan.

Good clarification.

Vitaliy,

A simple and logical analysis, clearly stated and very much to the point. I particularly liked your discussion of the timing and causes of these events as prices rise and rates rise, then prices fall, then rates fall. As the Fed has learned, knowing what will happen is very different from knowing when. Enjoy your writings very much. Many thanks.

Vitaliy, well said , Joe

PS : where can I find some of your thoughts on Investing , Joe ?

Joe, this website has every article I’ve ever written.

Love your articles and analysis. Incidentally, another disincentive to selling a home in California is you have property taxes assessed on the current property value in the new home whereas in your existing home those taxes cannot go up more than 2% a year thanks to Proposition 13 passed in 1978.

Thank you VK. As a proclaimed long-term value investor, is your view of housing adequately reflected in housing stocks today?