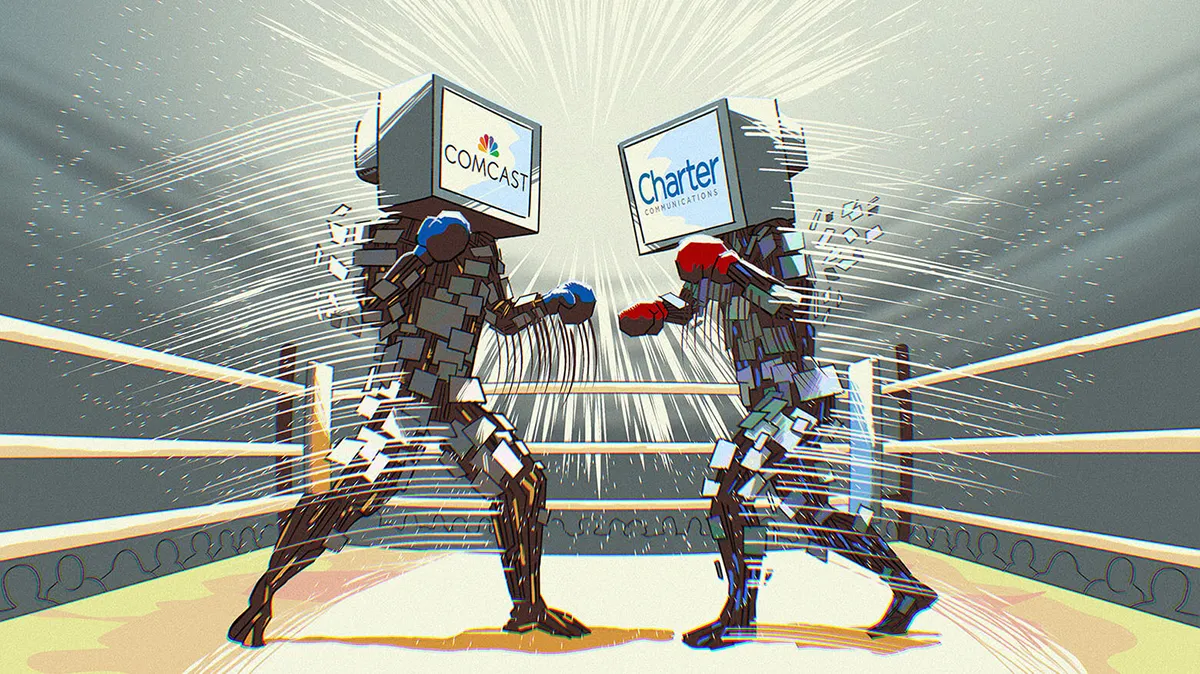

Today I am going to share an excerpt from my spring letter to IMA clients where I discuss Charter (Liberty Broadband) and Comcast, two cable stocks. This is a great example of American philosopher Mike Tyson’s saying that “Everyone has a plan until they get punched in the mouth.” I wrote about Charter a year ago – you can read that here and here; and so far, I have yet to be proven right. I am in the ring and getting punched in the mouth. I want to remind you that this is not investment advice. If you are reading it as such, please do not. In my essay “No Shortcuts to Greatness,” I explain why.

Cable Stocks Keep Getting Punched in the Mouth

Despite weakness in cable stock prices, our thesis on Charter Communications (CHTR) and Comcast (CMCSA) has not really changed. We made a small, superficial change in the portfolio – we sold Charter and bought Liberty Broadband (LBRDK). Liberty Broadband is a company controlled by John Malone, the largest shareholder of Charter, and its single biggest asset is Charter shares. Liberty trades at a significant discount, about 20%, to Charter. Owning Charter through Liberty Broadband shares adds another layer of future returns without really bringing any extra risk.

Cable companies’ main business is not selling TV services. Though TV service accounts for a good chunk of their revenues, they make very little money from it. Most of the value in this business is captured by content providers – ESPNs and HBOs. Broadband (providing internet service) is the biggest source of their cash flows. This business has stalled over the last year and a half, and the subscriber count has actually declined, though only very slightly (a tiny fraction of a percent) in the last quarter.

Our thesis on these companies is as follows:

First, the broadband business is going through payback for pandemic growth. It grew significantly during Covid, and this growth came in part at the expense of today’s growth.

Second, fixed wireless by T-Mobile has been responsible for taking a disproportionate share of DSL customers, who in the past would switch to cable and were responsible for a good chunk of growth. Fixed wireless, which is basically mobile internet, is an inferior technology to cable and is constrained by the scarcity of the wireless spectrum it is using to roll it out. It is a cheaper but lower-quality product.

Urban customers that cable companies are losing to fixed wireless are very price-sensitive, but cable companies will likely get them back in the future as they become dissatisfied with the fickleness of the wireless product. The stocks should work out even if this doesn’t happen.

Third, cable companies are rolling out wireless services, which are growing at a rate of 30–50% per year. Since cable companies’ customers have multiple mobile lines per household, the size of the addressable market for wireless is several times the size of its cable customer base. For instance, Charter has about 30 million broadband customers, thus the size of the addressable wireless market for Charter is 60–90 million wireless lines. Of course, cable companies will not be able to get 100% penetration in wireless, but at 25–40% penetration they are going to enjoy a significant boost to their cash flows.

Cable companies have a significant structural cost advantage in this business, as they can utilize their broadband infrastructure (fixed cost) and, at the same time, purchase buckets of minutes and broadband from wireless providers to fill gaps in rural areas where they lack coverage.

This point is very nuanced and very important but usually missed: Cable companies are taking advantage of the fact that wireless companies have to maintain a nationwide network and provide services in both high- and low-density areas, although the majority of their profits come from customers in high-density areas. Cable companies have strong networks in high-density areas and therefore only need to purchase buckets of broadband from wireless providers in low-density (rural) areas.

Thus, cable companies have a structural advantage here and are mercilessly taking market share from wireless companies like Verizon and AT&T. I would not want to own a wireless stock in this fight. Wireless service offered by cable companies is priced lower than identical service offered by AT&T or Verizon and will become a significant cash contributor over time and further reduce churn of the broadband business.

Fourth, the churn of existing customers is extremely low, which is why we are not overly concerned about competition from wireless.

Fifth, cable companies’ cash flows are temporarily depressed, as they are in the middle of a nationwide upgrade of their networks, which will put their network speeds on a par with fiber, with high speeds in both directions (download and upload). This upgrade will increase the IQ of the network and result in significant cost savings, a better product (allowing them to increase their prices once upgrades are done), and an improvement in the already broad moat around their businesses.

It is also important to note that all major cable companies are undergoing this upgrade to new technology nationwide, thus it will likely spur the development of new products that will take advantage of the much higher and bidirectional speeds.

Charter Communications is a more levered entity than Comcast, and thus its stock is more sensitive to short-term good or bad news flow. We are not worried about Charter’s debt – it has very stable and growing cash flows, and its debt maturities are smartly spread out long into the future. These companies should double or triple from today’s valuations.

Both Charter (Liberty) and Comcast have their strengths and weaknesses. As I have mentioned, Comcast has less debt and a more diversified revenue stream (it also owns NBC, Universal Studios, and amusement parks). We are not overly excited about the prospects for Comcast’s other (non-broadband) businesses. Brian Roberts, Comcast’s chairman, is the company’s largest shareholder (that is a good thing), but he has a mixed capital allocation record. We are taking a dual-stock approach to investing in cable – we own two smaller positions in two companies.

Q&A

A client inquired why we are not buying regional banks, which are cheap, and why we are not buying commodity stocks, or stocks in industries that will benefit from re-electrification (the US and Europe have old electrical infrastructure which is in dire need of replacement).

I welcome these inquiries. I like when clients are engaged with their portfolios. I also love when clients do their homework and read my letters (this is why I am going to answer these questions here).

There are usually reasons why we don’t own a stock or sector. For instance, regional banks (and banks in general) scare us because of their exposure to commercial real estate and other loans. We have had a financial system flooded by liquidity and a benign economy over the last decade that has not been tested by a recession. A year ago we had a small preview of what can happen to banks when interest rates go up. We have not seen what is going to happen to their credit losses when unemployment goes up a percent or two. This is why in most accounts we only own one bank, which mostly does factoring (very low-risk, short-term) loans.

We are not big fans of commodity businesses and rarely find a company whose management is good at capital allocation in this space. We have exposure to natural gas and oil in your portfolios through very special companies that are superbly managed. We have yet to find a commodity company we like outside of the ones we own.

We would have liked to get exposure to gold through gold royalty companies – they have a similar business model to Blackstone Minerals: They don’t mine but receive a portion of gold company revenues from particular mines. Unlike gold miners, they have a high return on capital and historically have had better management. (I am generalizing here a bit.) However, the market recognized the superiority of the business model of these companies, and thus they are expensive. Being a good business is not good enough for us; a stock also has to be undervalued.

This quarter we spent a considerable amount of time looking at a company whose revenues are linked to commodities but that has a high return on capital (not a royalty company) and doesn’t excavate minerals. We decided we’d want to buy it at a 40% lower price. It went on our watch list.

Regarding re-electrification of the US and Europe, we are in the process of analyzing a company that plays a role in this space, but we haven’t finished our research.

Another client sent me some stock ideas. Thank you!

There are literally tens of thousands of stocks out there, and we may miss some. Send your ideas. Here is the promise I’ll make: I’ll take a look (more like glance) at your stock tips, but I may not reply – I simply don’t have the time.

Key takeaways

- Cable stocks like Charter Communications and Comcast have faced challenges, but the fundamental investment thesis remains intact, with broadband services being their main value driver.

- The cable stock investment strategy now includes Liberty Broadband, which offers exposure to Charter at a discount, potentially enhancing future returns without significantly increasing risk.

- Cable stocks are navigating temporary headwinds, including post-pandemic normalization and competition from fixed wireless, but have structural advantages in their wireless offerings that could drive future growth.

- The ongoing network upgrades by cable companies, while temporarily depressing cash flows, are expected to strengthen their competitive position and potentially lead to new revenue streams.

- Despite short-term volatility, cable stocks like Charter (Liberty) and Comcast are viewed as potentially undervalued, with expectations of significant appreciation from current levels.

Great article. I also religiously read your newsletter and appreciate your balanced take on life and the markets. One thing I think you are missing in the cable battles is the customer service and support delivery mechanisms. I work in tech and support and customer service with cable providers is abysmal. They have automated their way completely out of reasonableness. The measure of how satisfied you are with your internet provider has nothing to do with upload or download speeds; it comes down to how quickly you can get a credible response from technical support/help desk when it is broken or help from billing support when you have question about your charges. They do not seem to even care about this part of their business. EVERYONE that I speak with dreads having to call the cable internet provider because it will take hours on hold and will result in an experience you will come to dread. If they don’t address this, customers will churn.

I am not a client but religiously read your articles.

I just want to mention something about the broadband business of cable.

We are getting only the internet through our cable provider (cut the TV subscriptions about 2 years ago). Our provider is Spectrum (used to be Time Warner) and they charge us $80/month for 210 Mbps download and 10 Mbps (we don’t care much about upload speeds)

About 3 months ago a rival company laid the fiber optic cable in our neighborhood. A company called Ripple Fiber and they say the charge is $50/month for 250 Mbps and 50 Mbps for download and upload. we signed up. They have not gone live yet, but a whole lot of the neighborhood signed up. So Spectrum with it’s coax cable has competition now.

While I am still on Spectrum cable, once the fiber goes live, I may not be their customer. I am wondering how prevalent will this be as cable is no longer the monopoly for the broadband. Competition is good for consumer (me), not for Spectrum or Ripple fiber.