Stock Analysis

How Emotional Intelligence Can Make You a Better Investor

Investors enjoy the unique luxury of choosing problems that let them maximize the use of not just their IQ but also their EQ — emotional intelligence.

Unraveling the Mystery of Oil and the Swiss Franc

The collapse of oil prices and jump in the Swiss franc have forced me to puzzle over these weighty questions.

Buying Warren Buffett, Richard Branson and Steve Jobs at a Discount

What would you get if you crossed Warren Buffett, Richard Branson and Steve Jobs? Answer: Masayoshi Son, the Korean-Japanese, University of California, Berkeley–educated founder of one of Japan’s most successful companies, SoftBank Corp.

Bad News at Tesco Could Be Good News for Investors

Although Tesco’s business is doing worse today than it was even six months ago, things are not as bad as you’d infer from the stock price or from reading the financial press.

Putin’s World: Why Russia’s Showdown with the West Will Worsen

I was perplexed by how the Russian people could possibly support and not be outraged by Russia’s invasion of Ukraine.

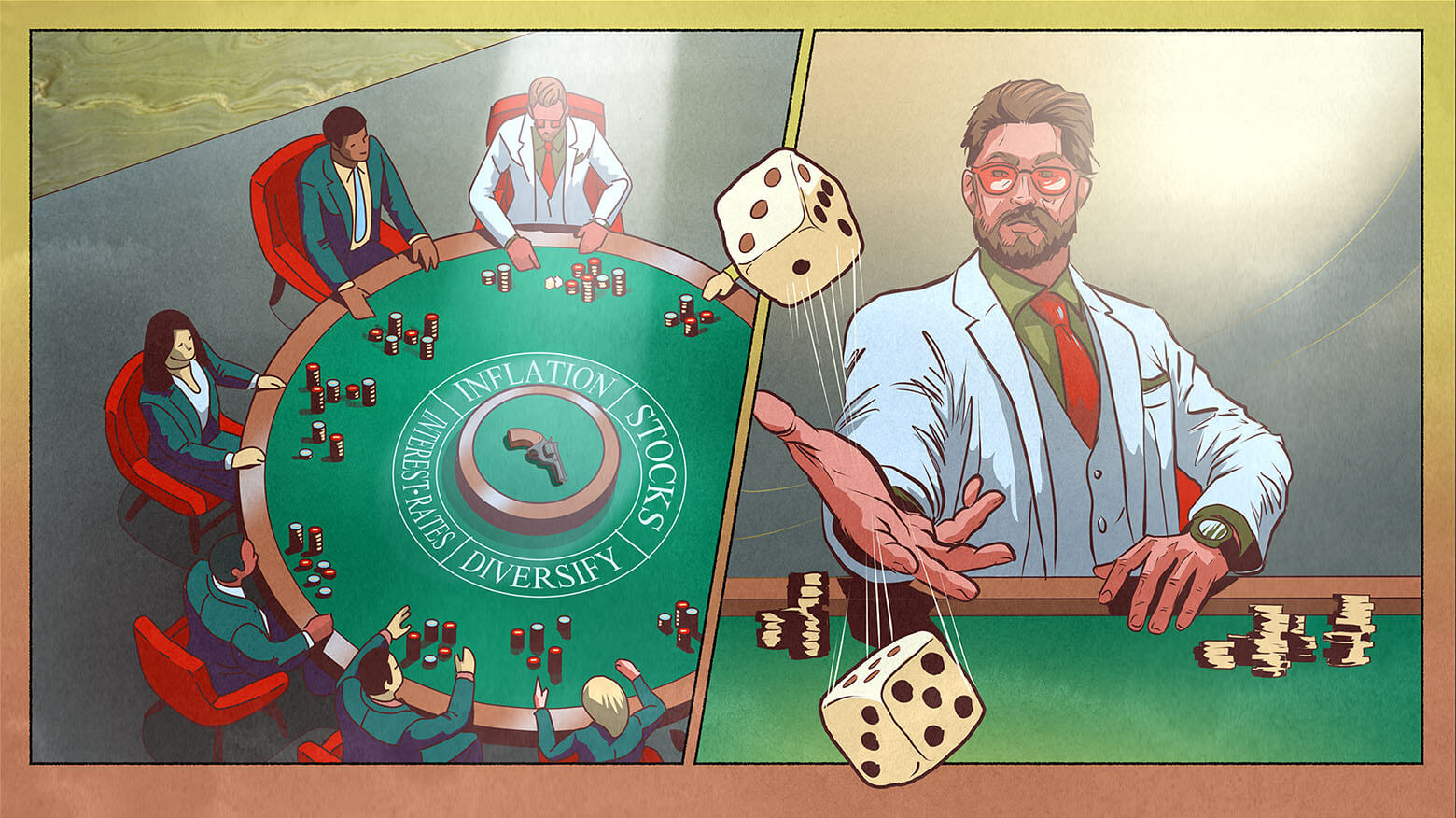

Investment Lessons Learned from the Poker Table

“I don’t know.” These three words don’t inspire a lot of confidence in the messenger and probably will not get me invited onto CNBC, but that is exactly what I think about the topic I am about to discuss.

Making Money by Agreeing to Disagree

It is very comfortable and enjoyable to own a company everyone loves. You can brag about it to your neighbor, bring it up at social gatherings.

To Infinity and Beyond? Don’t Be Surprised If the U.S. Stock Market Cracks

In 1986 Jeremy Grantham started to warn his firm’s clients about the eventual bursting of the Japanese stock bubble.

The True Value of Macro Forecasting

How much time a value investor should spend on macro forecasting? Usually macro forecasting is frowned upon in the value investing community.

The Apple Brand

Apple’s research and development expense was up 27% last quarter. Annualized, it is running at $5.7 billion.

Warren Buffett, Coca-Cola and the Not-So-American Dream

I am going to Omaha for the Berkshire Hathaway annual meeting. But this is the first time that I find myself respecting Mr. Buffett a little bit less than the year before.

Behind the Ugly Red Door: Finding Value in an Overpriced Market

The difference in valuation between the cheapest stocks and the rest of the market is the smallest in more than 20 years, the market is overpriced.

Will Russia Go to War Over Ukraine? Don’t Bet on It

It is hard for me to see a full-blown war between Russia and Ukraine. There are so few cultural differences between these two countries.

How I Bought the Internet — and You Can Too

A few months ago my firm bought the Internet. Let me explain: When people think about the Internet, they imagine an enormous network of millions of servers.

Additional Thoughts on The Fed Model and Profit Margins

The Fed Model is extremely important, because I vividly remember how low interest rates and the Fed Model were used as propaganda tool.

The Not-So-Big Picture on Financial Models

Rarely do I disagree with fellow investor and financial blogger Barry Ritholtz, but the time has finally come. Last week Barry wrote a column for Bloomberg View.

Practitioners, Prognosticators and Portfolio Pain

I spend a lot of time looking for new stocks, either by screen or by reading or talking to other value investors. We are all having a hard time finding many stocks of interest.

A Few Simple Rules For Money Managers

As a parent the hardest thing to do is not to be a hypocrite. You tell your kids to do one thing – the right thing – but you don’t stick to your own advice.

Qualcomm’s Competitive Advantages Are Too Numerous to Ignore

When we stumbled on Qualcomm, we could not believe what we saw. The San Diego–based chipmaker should double its earnings over the next four years.

The Blessing of a Declining Stock Price

After I told my father what I am about to tell you, he called me a charlatan.

What I Learned from the J.C. Penney Fiasco

In this article I would like to put salt in the open wound and talk about what I learned from the J.C. Penney fiasco.