Stock Analysis

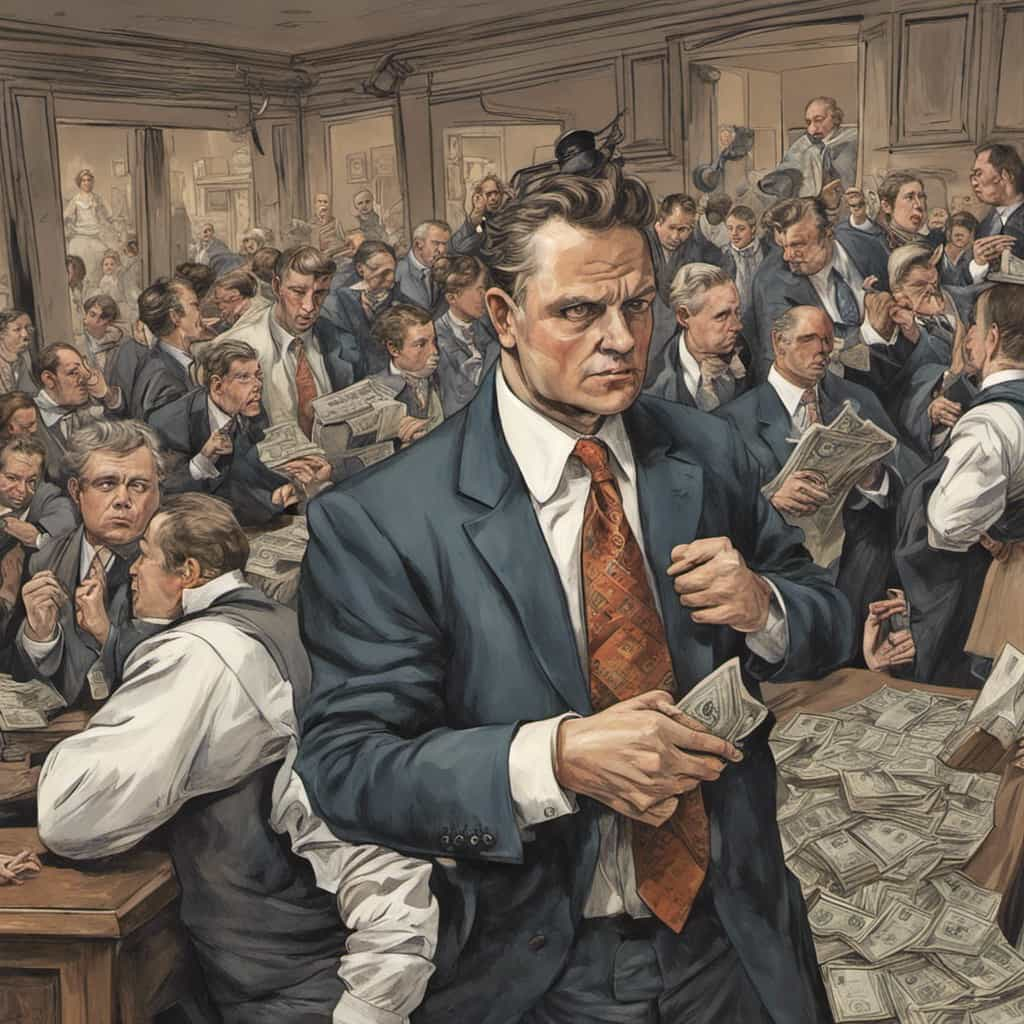

Jackson Hewitt an Opportunity?

Soon after we purchased Jackson Hewitt (JTX), offices of one of their franchisees was raided by the U.S. Justice Department; the franchisee was accused of falsifying tax returns for thousands of taxpayers.

Time to Be Downbeat About Wal-Mart?

When I bought Wal-Mart (WMT) a bit more than a year ago, I wrote an article for Financial Times where I laid out my theses.

First Marblehead – a Value But Not for Light Hearted

I've been a big fan of First Marblehead's (FMD) stock for couple months now, and it looks like an incredible value today, trading somewhere around 7-8 times earnings.

Navigating In “Interesting Times”

The Federal Reserve’s latest move was to encourage lending, not to stimulate borrowing. The Chinese curse comes to mind here – may you live in an interesting time.

Goodbye Moto, Hello Nokia!

It seems that Motorola (MOT) comes out with a good handset that everybody wants every five years or so. Considering that, we have a couple more years to go until the company will have another blockbuster handset again.

You call that a sell-off?

I am arguing that yesterday's selloff is not a watershed event and basically a non event. Jeff Macke called the article a very Russian one, when I inquired why he explained "My ancestors ate frozen wood while staving off Napoleon.

Motorola’s Loss, Nokia’s Gain!

After Motorola (MOT) threw in the towel on making money in cell phones this year, is it a good buy?

Good Company vs. Good Stock

In the long run, the performance of a stock in isolation is the product of fundamentals and valuation.

The Truth Is In…

I say "in writing veritas." MarketWatch asked me to write an article about one's investment strategy in the interest rate environment on the horizon.

Fortune’s June 25 issue

Fortune's June 25 issue has come out with the top picks for Growth & Income, Bargain Growth, Small Wonders and Deep Value.

Subprime Downgrade… more to come?

There was an interesting article in the WSJ on Moody’s downgrading 131 bonds backed by a pool of subprime mortgages.

Meet Your New Local Banker – China

The Financial Times reports China's largest bank, ICBC, announced its intentions to get into the banking business in the US.

The Joseph A. Banks Machine!

The Joseph A. Banks (JOSB) selling machine is kicking on all cylinders - yesterday’s quarterly numbers were proof of that.

More than just keeping up with the Dow Joneses

As the mutual fund industry has grown, the desire for short-term gratification has altered the focus, turning an investment business into a marketing one.

First Marblehead: Attractive Opportunity

In this article I made an argument that despite high uncertainty surrounding First Marblehead's (FMD) business at nine times earnings, it is a very attractive opportunity. Here are some additional points that I omitted in the article:

First Marblehead Shouldn’t Be Jealous of Sallie

May 31, 2007 - The Motley Fool

Investors love certainty. Their affection for uncertainty ranks with their fondness for a visit to the dentist for a root canal on Christmas Day.

However, great investment opportunities are created when certainty takes a vacation. In the case of First Marblehead (NYSE: FMD), certainty took an extended sabbatical. The stock dropped over 20% when two of its largest customers -- JPMorgan Chase (NYSE: JPM) and Bank of America (NYSE: BAC), together representing roughly 44% of sales -- announced with a private equity firm their intention to buy Sallie Mae (NYSE: SLM), First Marblehead's largest competitor. Uncertainty brings fear, which in turn brings opportunity -- First Marblehead is trading at about eight to nine times earnings!

Laws of Economics

The laws of economics are pretty much intact in the rest of the world; a global low interest rate environment has driven an increase in debt consumption and rising interest rates will have their impact globally.

Barney Frank Keep Your Hands Off (please)

Barney Frank’s plan to shift legal liability to the investors who buy mortgage-backed securities is one of the stupidest decisions that came out of Capitol Hill since… well, ever.

Love Serenades and New Flings

I sang love serenades for Abbott Labs' (ABT) stock for a long time. Call me materialistic, but my love for stocks is not ‘til death do us part,’ it is conditional of fundamentals staying intact and of valuation - it has to be undervalued.

Russia? Think Again

As you look at the high-flying Russian stock market, you may feel like you want some of it. But before you dive into Russia consider this: as it is, Russia is a dysfunctional play on high oil prices as well as commodities. It is no less bureaucratic than it was some fifteen years ago.

Between the Lines

I was very amused by the interview given by the CEO of Countrywide (CFC). If you read between the lines of what he said he was pleading for the Fed to lower rates.