Stock Analysis

Our Sell Discipline

How our selling practice differs between high-growth companies with long runways for compounding and slow-growth companies.

The Renaissance of Pipelines

At first, investors loved them. Then, they hated them. Now, investors have left them for dead. Oil and gas pipeline companies are anything but popular. But they are essential businesses, with rising free cash flow and substantial dividend yields.

Value & Growth Demagogues

I have a problem with both value- and growth investing demagogues. While value demagogues tend to believe any company that trades at a P/E above the market average is too frothy, growth demagogues claim that price doesn't matter.

McKesson: Amazon Will Not Throw This Drug Railroad Off The Tracks

Amazon.com has announced an online pharmacy offering. How big of a punch could this be to drug distributors McKesson, Cardinal Health and AmerisourceBergen?

Letter from the Value Investing Mental Asylum or How I Embraced Stoics

Albert Einstein defined insanity as “doing the same thing over and over again but expecting a different outcome.” I can relate to this on some level. I share with you why I am not writing this from a mental asylum. I found solace in Stoicism.

Free Value Investing Curriculum for College Students

An announcement that should be of interest if you are a college student with a passion for value investing.

Svenska Handelsbanken and How to Use Book Value

I discuss our investment in Swedish bank Svenska Handelsbanken, and what makes their culture so unique. Then give a short explanation on when book value works as a measure of intrinsic value, and why it often doesn't.

Defense Stocks

I wrote this before the war in Ukraine began. The thesis of this article has become even more pronounced since ...

Tesla’s Stock Price Discounts Temporal Wormhole into the Future

Low interest rates have messed with the temporal properties of the market and created a wormhole in time and in Tesla’s stock.

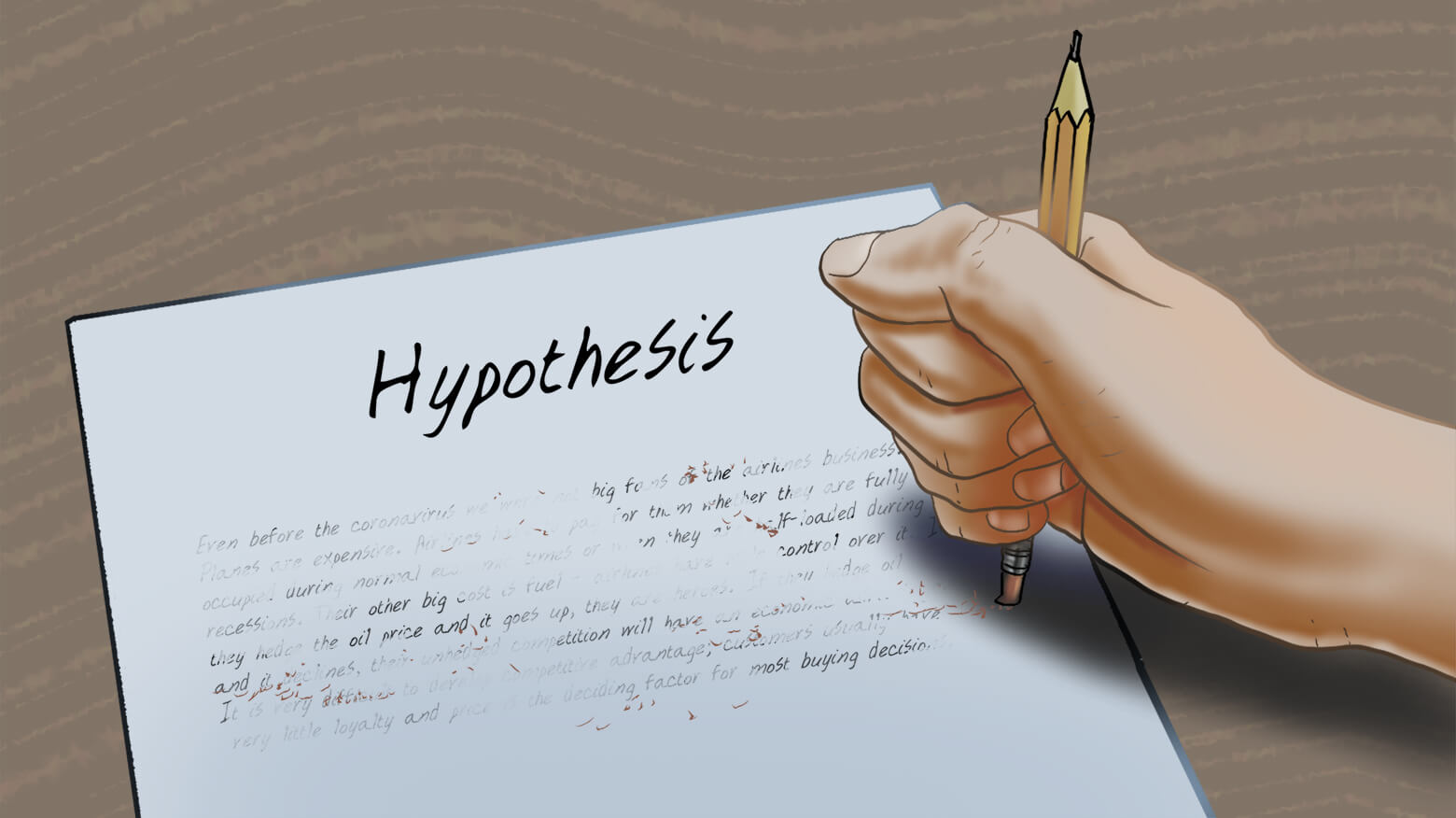

When the Facts Change, We Change Our Minds (Anatomy of a Sale)

Even before the coronavirus we were not big fans of the airlines stocks. Planes are expensive. Airlines have to pay for them whether they are fully occupied during normal economic times or when they are half-loaded during recessions.

Uber Eats: Delivering Food and My 4 Seconds of Fame on PBS (not PBS Kids, unfortunately)

I was on PBS NewsHour talking about Uber Eats and the food delivery business (you can watch it here). When ...

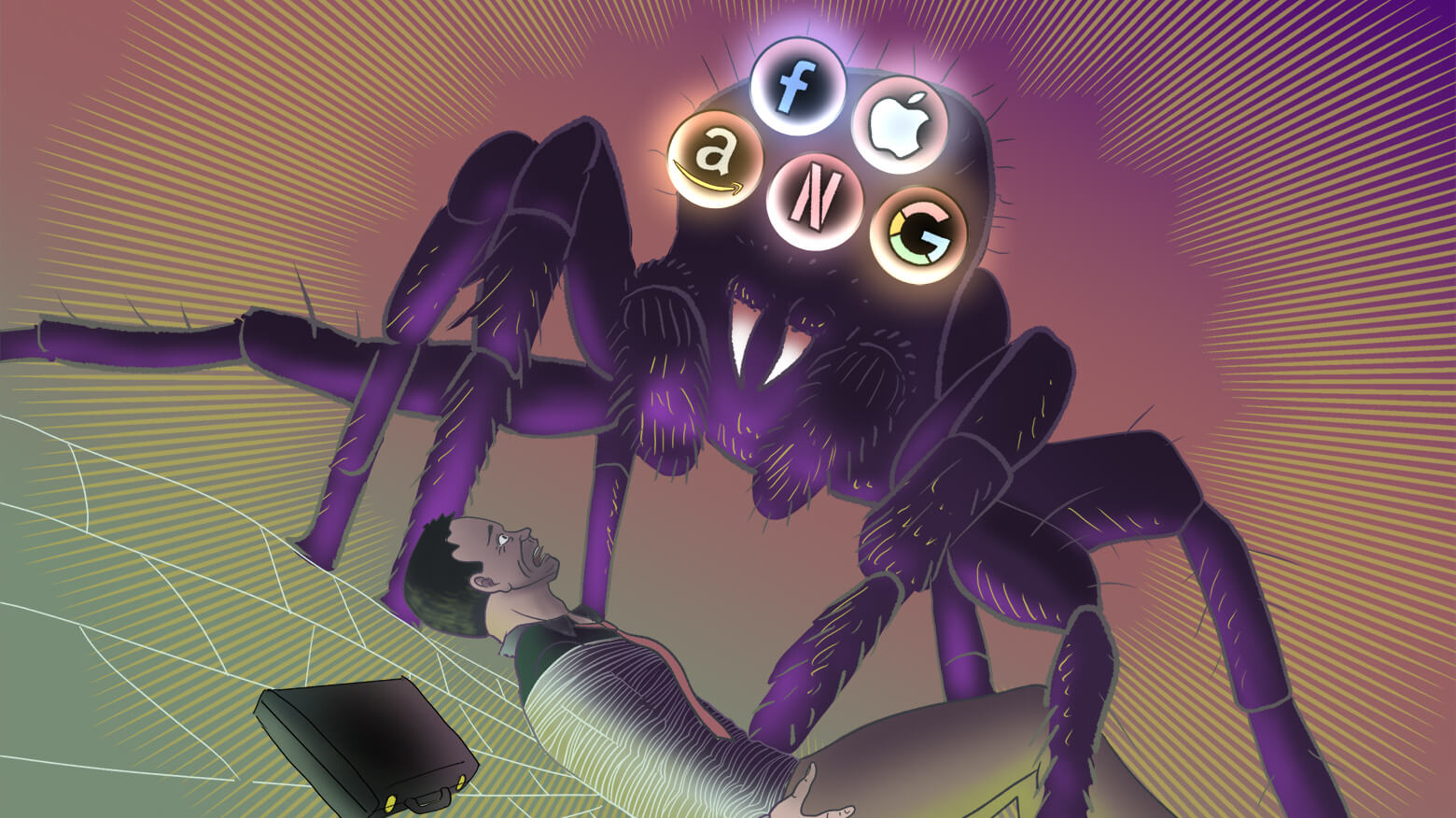

Nifty FANGAM and Other “One Decision” Investment Strategies

In early January we would not have guessed the stock market would be at today’s level, there must be more to the stock market than FANGAM.

The Fischer Random Chess Stock Market

There is a parallel between today’s stock market and Fischer random chess. The last time we faced a global pandemic was in 1918. The only common denominator between now and then is that humans have not really changed that much – it takes a few millennia to rewire our DNA and thus our fundamental behavior.

Why The Survival Of Traditional Carmakers Is Far From Certain

Traditional carmakers do have strengths in designing, assembling, and marketing cars. They can afford to make an enormous investment in EV and absorb the losses that come with them. But will they?

The All-Terrain Dividend Portfolio

I was finally able to do something I have tried to do but could not for ten years! We have built a dividend portfolio that’s “all-terrain” and that yields … well, you’ll have to read to the end to find out.

Our Thinking About Coronavirus Has Evolved

Our thinking about coronavirus has evolved significantly over the last few weeks. Our initial optimism that it would send us into a mild recession was proven wrong by our government’s inept response – the extra time that we were given was wasted.

Never Let a Good Crisis Go to Waste

I discussed with Andrew Horowitz this recession and why it's a good crisis, and not like any other previous one we've experienced.

Surviving The Coronavirus Crash: ‘You Make Most of Your Money in a Bear Market; You Just Don’t Realize it at the Time’

Especially in this coronavirus market crash, we continue to seek out what we always look for globally — high-quality businesses that we can buy at a significant discount to fair value.

Markets in Turmoil: Our Game Plan for Crisis

A letter we sent to clients about how we are responding to the recent market selloff. We are anything but celebrating the toll coronavirus will take on human life and the global economy, we are embracing this crisis as an opportunity to increase the long-term returns of our portfolio.

What Would Ben Graham Do in Today’s Market?

I stumbled on a column by the wonderful Wall Street Journal columnist Jason Zweig, titled “What Benjamin Graham Would Tell You to Do Now: Look in the Mirror.”

Russia & Saudi Play a Dangerous Game of Chicken

Saudi Arabia announced that it will increase oil production from 9.7 million barrels a day to 10 million and then to 12 million if needed. This news alone sent the oil price down 20% – and the whole stock market with it.