Stock Analysis

Why My Firm Sold Short-Term Bond ETFs and Bought U.S. Treasury Bills

Recently my firm replaced all of our short-term bond exchange-traded funds with U.S. Treasury bills. The core motive for this decision was not to pick up a few points of extra yield, though that’s a nice bonus.

What Would You Get if You Crossed Warren Buffett, Richard Branson and Steve Jobs? (Updated)

When we bought SoftBank a few years ago it was relatively unknown to most US investors. Some of our clients even thought it was a bank. Today Softbank is a daily staple in the business news.

London Value Conference Presentation (Q&A)

I had the pleasure of speaking at the London Value Conference, which was a terrific, first-rate event. I did not make a formal presentation; instead I did Q&A with my friend, the wonderful David Shapiro.

Socially Irresponsible Investing

Socially responsible investing. Awesome! What’s not to love – your capital doesn’t just enrich your life, it also flows only to companies that do social good.

Why I Canceled My Tesla Model 3 Order

I visited the Tesla store to check out the Model 3 but it was not available to view or test drive, now I'm considering cancelling my order on the Tesla Model 3 and buying a used Model S or waiting for an electric car from another manufacturer.

Exxon Mobil Think Again

General Electric's collapse taught investors a lesson: buying a company based on past reputation and dividend yield is risky. ExxonMobil, another formerly respected American icon, has been in self-liquidation for the past 10 years.

How The Stock Market Turns Investors Into Gamblers

People tend to forget that stock prices fluctuate due to many factors and not necessarily the true value of the stock. It is important to focus on the actual value of the company when investing in stocks rather than the market prices to avoid becoming a "degenerate gambler".

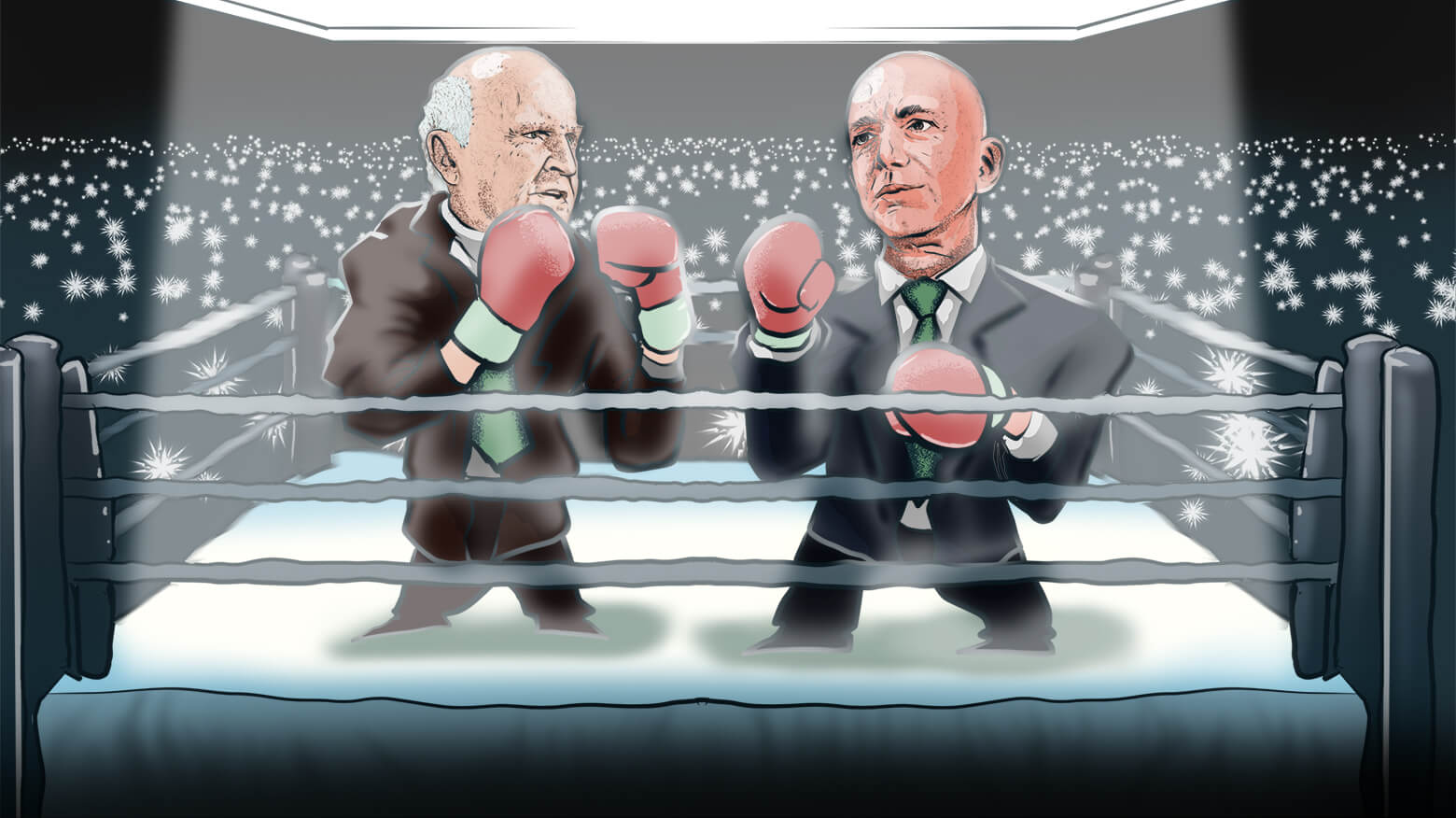

Welch vs Bezos – The Dangers of Investing in General Electric

A lot of times I won’t have an insight into a business because I don’t understand it or because it’s too complex. General Electric is a great example. As a value investor I should be all over this iconic stock, which is making a generational low.

Amazon Is Not a Threat to This Industry

Amazon's entrance into the US healthcare market caused stocks in the healthcare sector to drop, but upon further investigation it became evident that these concerns were overblown.

The Invisible Hand: Balancing Supply and Demand in a Capitalist Economy

How the Federal Reserve's quantitative easing has mutated the DNA of the global economy, and how well-meaning economists running central banks don't know the correct price of money or the consequences of their actions.

What Will The Stock Market Do Next?

I want to let you in on a small Wall Street secret: No one knows what the stock market will do next.

Antifragility and Value Investing – Part 2

In addition to our traditional quality analysis, which falls into three buckets (business, balance sheet, and management), we also look at companies through the slightly different lens of fragility.

Antifragility and Value Investing – Part 1

What do you do when a company you own makes a large acquisition?

Cryptocurrencies Are Just Beanie Babies

This coin/blockchain mania is not much different than the Beanie Baby mania of the late 90s. Beanie Babies were released in a limited quantity (the key word), and thus the price kept going up.

Uninvestable Tesla

Tesla is an uninvestable stock for me, not just because of its high valuation but also because it fails our basic quality test, which I borrowed from Warren Buffett.

These Clues Tell You If A Company Is Making A Dumb Acquisition

As a shareholder, you do well to place more emphasis on risk than on reward. Corporate management usually does the opposite, and this is why most large acquisitions fail.

The Double Trap For Tesla Investors Predicting The Future

Before Tesla, we equated electric cars to golf carts. Tesla has shattered that image, showing that the electric car can be an equal and in many ways superior product to the ubiquitous ICE car.

Bitcoin – Millennials Fake Gold

I haven’t written anything about Bitcoin because I find myself in an uncomfortable place in agreeing with the mainstream media: It’s a bubble. Bitcoin started out as what I’d call “millennial gold” – the young generation looked at it as their gold substitute.

Apple – Not Saying Goodbye

I’ve written more articles about Apple than any other company we’ve ever owned. If I were to lie on Dr. ...

Now Apple must show what’s next after iPhone X

The iPhone X is likely to be a phenomenal success for Apple. But its success will not be driven by ...