Charter Communications (CHTR) is one of the largest cable companies in the US. In large strokes, we think of it as three businesses: cable TV, broadband internet, and wireless.

Cable TV is a high-revenue, low-margin business – most of the revenue (deservedly) goes to content providers. This business is in a mild, long-term, steady decline. Cable companies don’t mind losing this business, for several reasons: First, after you factor in the costs of customer service, this business makes very little money. Second, people who quit TV consume almost double the amount of broadband (700 gigabytes vs. 400 gigabytes a month).

Broadband internet, on the other hand, is a growing, high-margin business. It is a utility, just like water and electricity.

Wireless is a high-growing but yet to be profitable business. Unlike traditional wireless companies (think AT&T or Verizon), which encounter significant costs in building and maintaining wireless networks and spend tens of billions of dollars on wireless spectrum every few years, Charter is an MVNO – a mobile virtual network operator. It buys a bucket of bandwidth from Verizon at a wholesale price.

Charter sells wireless services only to its cable and broadband customers. Most of Charter’s wireless usage occurs at customers’ homes or offices (80%), on Wi-Fi. The incremental cost of this usage to Charter is negligible. Compared to its wireless counterparts, Charter has a lower cost of providing wireless service and thus can charge less for the service. And it does.

Though the company argues that wireless will be a profitable product in the long run, we think Charter’s mobile strategy makes sense if the business just broke even. Offering wireless services widens CHTR’s moat as it makes customers stickier (reduces churn). It also makes it difficult for wireless competitors to steal CHTR customers, as they cannot underprice CHTR’s wireless service. If wireless providers decide to go to the mattresses (wage a price war) with Charter on wireless, they’ll destroy their business, as wireless service is the largest source of their cash flows.

CHTR stock has sold off significantly from its highs. The market is worried about threats from competing technologies: 5G, fiber to the home (FTTH), fixed wireless, and satellite (we’ll discuss that one last). We spent a lot of time studying these competitive threats and concluded that they are unlikely to have a significant impact on CHTR.

All these networks/technologies look like this: a lot of fiber crisscrossing the country, which dead-ends in a neighborhood switch. This part is universal for all players other than satellites. Strategy diverges in how the signal is delivered from the neighborhood switch to the individual house – the last mile.

FTTH is bringing ethernet cable to the house. 5G bridges the last mile from the cell tower through a wireless connection. Fixed wireless does this through airwaves – a direct line-of-sight type of wireless (I am oversimplifying). Once the signal gets to our homes, most of our internet usage happens wirelessly through our Wi-Fi routers.

Each technology has its benefits and disadvantages.

Let’s start with 5G. It is exponentially better than 4G. It is faster, has less latency, and drains batteries less. But it is still constrained by the scarcity of wireless spectrum – the “air pipe.” This is why wireless providers usually limit how much you can download on your device. Typical wireless providers put a cap of 50GB a month of downloads per household. The average cable customer consumes 400GB of data if they have TV service and 700GB if they don’t. (Remember, if you don’t have TV, you stream it over the internet, and thus consume more data.) Our internet data consumption is only moving in one direction, at a very past pace, indefinitely: up! This will put further stress on the finite 5G spectrum, whereas broadband’s upward bound is virtually unlimited.

5G wireless customers will pay as much as Charter cable customers but will get 10-15x less data and slower speeds. If each 5G customer used as much internet as broadband customers, wireless providers would either go broke (they’d have to be spending hundreds of billions of dollars on new spectrum) or download speeds would slow to a crawl.

Fixed wireless doesn’t work well in congested areas where there are obstructions – houses, trees, other buildings. Its impact on CHTR will be limited.

Fiber to the home is the Cadillac of all available services. Here, the last mile is actually not fiber but ethernet cable, but nevertheless it is twice as fast as cable on download and much faster on upload. When you go to the Netflix website and click through movies you might like to watch, you are uploading instructions to a Netflix server and downloading screenshots and video clips. This upload consumes only a tiny amount of bandwidth. Once you are watching the movie, you are only downloading. Since both cable and fiber provide very fast download speeds, fiber’s relative advantage on the download side is not noticeable. Its upload advantage is not relevant for most customers, unless they are uploading large files, which most consumers don’t do.

The downside of fiber is that rollout is expensive. Telecommunication technology has made exponential leaps over the last decades. However, the technology of digging ditches and getting permits at local county offices is stuck in the mid last century.

The history of this industry is full of stories of telecom providers promising to build out their fiber networks, doing it, and then stopping short of rollout, complaining that the rate of return on invested capital is below the cost of that capital. The most infamous example is Google’s thinking it could overcome the miserable economics of fiber and failing to do so, miserably. Things have only gotten worse since – today the telecom industry is experiencing shortages of both labor and fiber.

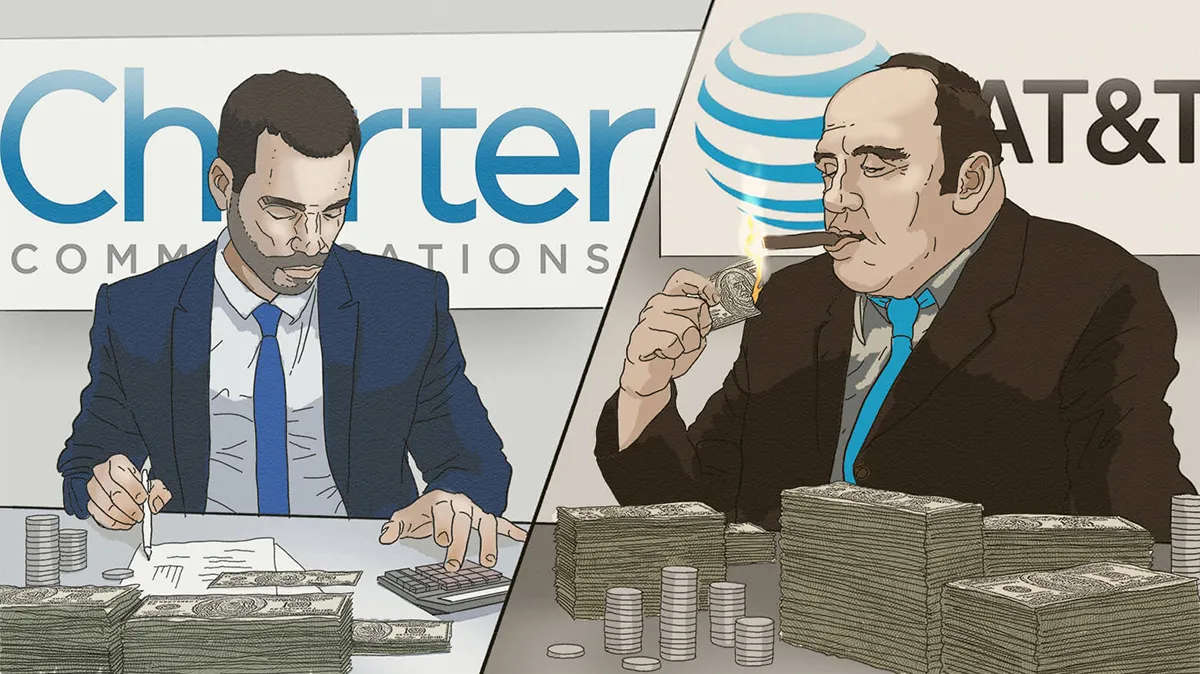

The wireless industry has a mixed track record of making rational decisions. Verizon spent billions on Yahoo! and AOL and then wrote those billions off as a bad investment a few years later. AT&T has been by far the worst offender in this space. It recently unloaded TimeWarner (a horrible $100 billion acquisition from a few years ago) into a new company and said that it would focus on its core business of wireless and fiber. We expect AT&T to do what it does best: blow a few billions of shareholder capital and then, just like Verizon, Google and others, throw in the towel on fiber to the home.

Low interest rates are more forgiving of capital misallocation than high interest rates. Thus, we don’t expect AT&T’s adventure into the fiber business to last very long. Most of AT&T’s effort is likely to focus on its DSL customers, whom it is at risk of losing to cable competitors. DSL has much lower speeds than cable or fiber.

The last competitive threat is low-orbit satellites. They are wonderful for difficult-to-reach places, but quality of service is impacted by weather (heavy clouds or rain). They have slower download speeds than cable and face similar spectrum limitations as wireless carriers. They will unlikely find widespread usage in urban areas. We don’t see them as a significant threat to cable. Charter’s revenue growth over the few quarters did slow down a few percentage points. But the slowdown was not caused by new competition but rather a lack of activity in the housing market, which resulted in lower industry churn. When people move from one house to another, they switch service providers. They usually drop DSL and choose cable. At some point the churn will pick up, but CHTR stock is undervalued even if revenue growth remains where it is today.

I’ve written many times on the importance of management – the softer side of investing. Over the last few years we have made a deliberate decision to invest in companies run by great management teams. Great management is not only important because of the value it creates, but because of the value it doesn’t destroy. Great managers make mistakes, but they’ll work day and night to fix them.

Finding undervalued, high-quality assets is difficult in this environment, and not buying them because the management did not pass the smell test requires incredible willpower and discipline.

Management is what attracted us to Charter. They have created a lot of value for shareholders, have a conservatively managed the balance sheet, bought back stock at attractive prices, and did not blow money on stupid acquisitions – yes, they did all that. What really attracted us is that they are playing a long-term game. Charter’s broadband service is priced at $60, which is $15-20 cheaper than fiber and cable competitors in other markets. They want to make it painfully uneconomical for new competitors (mainly fiber) to enter into their market. But as Charter’s CEO, Tom Rutledge, said, it’s the right thing to do for the customer.

Charter is a carnivore of its own shares: Over the last five years it bought almost half of its shares, and it will keep doing it. Charter is not shy about using debt, and it shouldn’t be – after all, it has very stable, highly recurring revenues and cash flows. It uses debt intelligently: debt maturities are spread out in small chunks into the future. If the debt market freezes and has a 2008 déjà vu moment, Charter will be able to pay off all of its debt maturities with cash on hand and its annual free cash flows.

Charter is a perfect business for an inflationary environment: Internet is a necessity, and Charter has pricing power. If it raises prices, it will not lose customers (its competitors are getting away with 20-30% higher prices). A large chunk of its costs are fixed and thus will not rise with inflation. In fact, inflation improves Charter’s cost advantage against new entrants. The bulk of its fixed costs were spent in pre-inflationary dollars and won’t rise with inflation, while a new entrant has to spend newly inflated dollars to build out its network and is thus forced to charge much higher prices to recoup those inflated costs.

Charter should have about $45-50 of immediate free cash flows per share. The stock is about $450. However, the combination of slight revenue growth and share repurchases should lead to $70-80 of free cash flows per share in three to four years. At a 13-17 price-to-free cash flow multiple we get a $900-$1,300 stock. At the current price we see essentially no downside, only upside, in Charter’s value. Let’s say it only achieves $60 of free cash flows and the market decides to give it only a 10x multiple. It will then trade at $600. Heads we win ($900-1,300); tails we don’t lose ($600).

Ironically, the worst thing that could happen to us would be for the stock to go up quickly, which would reduce the amount of its own shares it would be able to buy and thus the future free cash flow per share and upside.

Key takeaways

- CHTR stock represents a company with three main business segments: cable TV (declining but low-margin), broadband internet (growing and high-margin), and wireless (high-growth potential).

- Despite market concerns about competitive threats from 5G, fiber, and other technologies, our analysis suggests these are unlikely to significantly impact CHTR stock’s value proposition.

- CHTR stock’s current valuation doesn’t reflect the company’s strong competitive position, pricing power, and potential for growth, especially in an inflationary environment.

- Management quality is a key factor in our bullish view on CHTR stock, with leadership focused on long-term value creation through strategic pricing and aggressive share buybacks.

- We see significant upside potential for CHTR stock, with our projections suggesting a possible range of $900-$1,300 per share in 3-4 years, based on expected free cash flow growth and reasonable multiples.

Any updates thoughts on CHTR?

“…the last mile is actually not fiber but ethernet cable…” ??? What do you mean by ethernet cable?Could you clarify?

The “last mile” is where we dig with shovels and destroy the optic fiber cable. Which makes the optic fiber cable… very fragile. So, the have learned to bring the optic fiber (smaller, lighter, etc.) to a central point using deeper digs and more protection. They then use a Hub, or “star-network” for the customers in about a 1 mile radius. Now, they need a strong hub about every two square, or honycomb cells. All the feeds from this central hub have to use more durable transmission mechanisms – wires can be repaired – optic fibers, not so much, or they can use DSL (think very rural), Ethernet cord (up to about 1 Gigabit per second) or Cable (less than Ethernet capacity), or they hope 5G using wireless transmissions. Hope this helps…

Different numbers but, conceptually, your thesis also applies to Comcast (CMCSA), yes?