Jeremy Grantham, co-founder of GMO, is a voice of sanity in a world that is becoming less sane, one TikTok at a time. He wrote in his latest letter:

As for the U.S. market in general, there has never been a sustained rally starting from a 34 Shiller P/E. The only bull markets that continued up from levels like this were the last 18 months in Japan until 1989, and the U.S. tech bubble of 1998 and 1999, and we know how those ended.

The simple rule is you can’t get blood out of a stone. If you double the price of an asset, you halve its future return. The long-run prospects for the broad U.S. stock market here look as poor as almost any other time in history. (Again, a very rare exception was 1998-2000, which was followed by a lost decade and a half for stocks. And on some data, 1929, which was famously followed by the Great Depression.

I agree.

You have probably noticed that your portfolio looks nothing like the stock market or a traditional lazy, garden-variety portfolio. For the most part, it consists of undervalued cockroaches – companies that should survive anything the global environment throws at them. I know that isn’t the image you wanted to start right off with when you poured a glass of wine and sat down to read this letter.

Sorry.

But think about it: You don’t have to worry about the market and its crazy valuations. That’s your neighbor’s problem, not yours.

In building your portfolio, we are aiming for resilience. This means owning high-quality companies run by good management, companies that are undervalued, not just based on the economy and on the earnings power we see in the rearview mirror, but also going to be undervalued in an economy that is less kind or benign.

You’ll notice that defense companies play a big role in your portfolio – that is by design.

On February 24, 2022, Europe (and our investing world) changed. A territorial war that seemed impossible between civilized Western nations after WWII suddenly became a reality. While the US was spending 3% of GDP on defense, most European countries spent half or a third of that. They had been collecting a peace dividend since the collapse of the USSR. And most of their defense spending did not go into building new tanks or developing new missiles but into paying the pensions of their retired armed forces.

Russia has cancelled that peace dividend.

No matter what happens in the November election in the US, Europe is realizing that it cannot rely on the US to protect it (we are a bit on the fickle side), and it should pay for its own freedom (music to your investing ears). The eventual end of the war in Ukraine will not change this – Russia, with its imperialistic tendencies, will still be there.

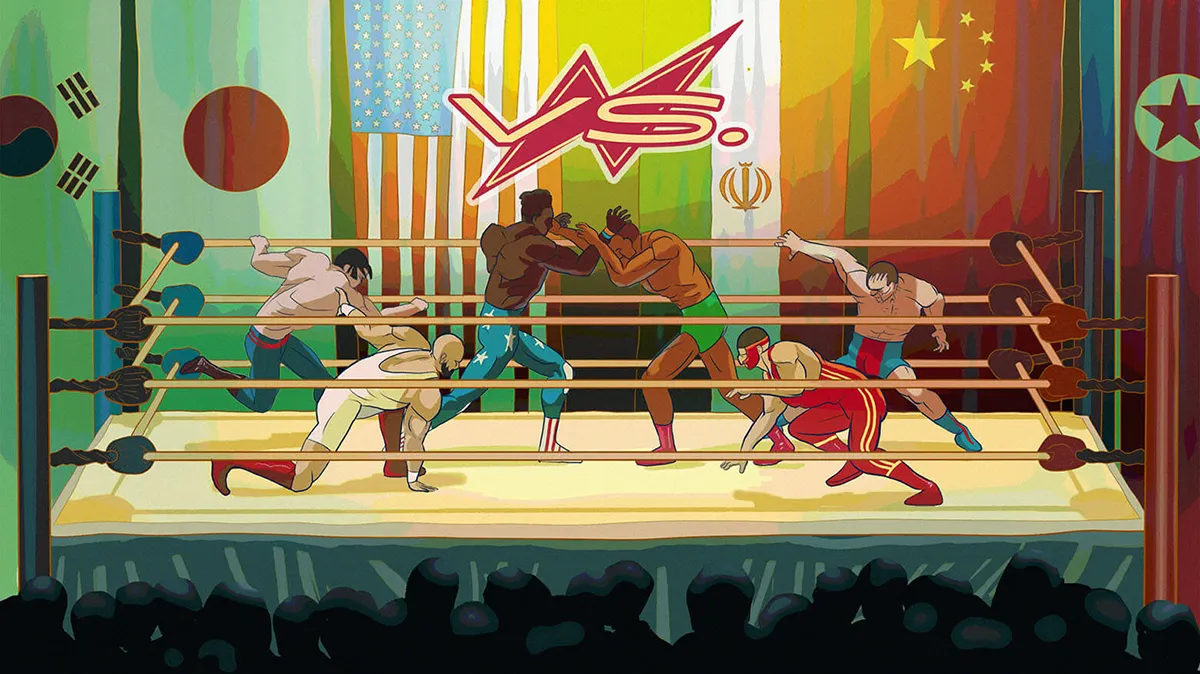

To make things worse, the world is starting to fracture into us vs. them. Roughly, us is the Western alliance plus Japan and South Korea; and them is China, Russia, North Korea, and Iran.

A lot of countries in the Middle East, Africa, and Asia – and this includes the most populous of all, India – are finding themselves in the uncomfortable place where at some point they will have to take sides. The world is once again turning into a powder keg, where every year the temperature of political tensions is rising.

While Europe is preoccupied with “Vlad the Terrible” (although he believes he is “the Great”), the US needs to worry about our recent friend China, who wants to invade an island nation. According to their constitution, the island belongs to them.

In all honesty, the world would care a lot less about a Chinese invasion of Taiwan if it were not for Taiwan Semiconductor, which makes the chips that power almost everything, from your smart toaster and that almost self-driving car to the AI that is writing this (okay, I am writing this – just wanted to make sure you were paying attention).

China is not the Soviet Union; it is the second most populous country in the world and also the second-largest economy, which also happens to house most of our industrial production, which we willingly shipped there after China joined the WTO in 2001.

Also, the US of 2024 is not the US of the 1980s. We are a highly indebted nation that is at war with itself (but that is the topic for another letter). China has its own issues; it is in the middle of the bursting of the biggest bubble in the Earth’s history and has a rapidly aging population, but that is not stopping it from growing the world’s second largest defense budget by 7.2% in 2024.

Our relationship with China is getting worse with every trade restriction. We are actively trying to deprive China from access to next generation of semiconductors and the ability to produce them.

Then there is Iran and North Korea – both are well along on their journeys to becoming nuclear nations. Iran has proven that it can make our life miserable by sponsoring terrorists around the Mideast, from Hamas to Hezbollah to the Houthis. (Note to other terrorist organizations: If your name doesn’t begin with “H,” don’t apply for Iranian funding.)

The Middle East, which was on a journey of healing with the Abraham Accords, changed, too, on October 7th. A month later, the world discovered that the Houthis (terrorists from Yemen, not the fan club of the Hootie & the Blowfish band) were well-armed by Iran and controlling the shipping lanes of the Red Sea, through which the bulk of the cargo from Asia to Europe must pass.

Armed with $20,000 drones, the Houthis have the capability to sink a ship carrying a billion dollars of cargo, yet Western navies, which have shrunk by half since the 1990s, use $2 million missiles to shoot the drones down.

Suddenly we are waking up to the new reality that ocean shipping lanes need to be protected by our navies; and, since the oceans constitute 71% of the Earth’s surface, we need many ships with guns to protect our cargo, plus new weapons to fight drones.

This paragraph from an FT article describes the sorry story state of the UK’s navy:

In 1998, the UK had three small aircraft carriers and an escort fleet of 23 frigates and 12 destroyers and the same number of attack submarines. It is now down to just 11 ageing frigates – two of which are reportedly set to be decommissioned – six destroyers and half a dozen attack submarines, also known as hunter-killers.

Yet, the UK has the largest navy in Western Europe, and it has also been spending more on defense than most large Western European countries. The US Navy is in better shape but has shrunk by about a third since the early 90s, even though today we are facing more and stronger adversaries.

During peaceful times, society understandably looks at defense spending skeptically. You have often heard rhetoric along the lines of “All this spending is just the enrichment of defense companies – the military-industrial complex.” The spending does enrich defense companies – just as when you watch cat videos on Facebook, Mark Zuckerberg and Meta shareholders all get a bit richer.

However, what we were reawakened to on February 24, 2022 is that a strong military serves as a deterrent when a dictator starts bombing your country, killing your citizens “in order to get rid of the Nazis” in your homeland. If Ukraine had been well-armed, Russia would never have tried to “denazify” it, reeducate it about its history, and force Ukrainians to speak their “real” mother tongue.

If the world only consisted of the 27 EU nations, Canada, and the US, we would not need to spend a penny on defense. But, as Charlie Munger would have said, “A few turds ruin it for the rest of us.” Thus, we are going to have to adjust and spend a larger percentage of our economy on ships, airplanes, and missiles so they can serve as a deterrent against those who don’t share our democratic values.

Since the end of the Cold War, European nations have lived in a make-believe utopian world, one that every reader of these words would love to live in, where civilized nations don’t invade each other. Hopes for the existence of this world have been shattered by Russia.

I am not a warmonger. I’d love to see our defense spending decline to zero, with the saved money going towards education and healthcare. Unfortunately, I cannot wish this into reality. Whether we own defense stocks or not, in the future, Europe and the US will likely spend a lot more money on defense, and our portfolio may as well benefit from this spending.

There are a lot of things to like about these defense businesses, as businesses. Aside from the aforementioned tailwind, which unfortunately is only getting stronger and will be blowing in revenues for a long time, these companies are either monopolies or friendly duopolies. For instance, in the US only two companies make submarines, General Dynamics (GD) and Huntington Ingles (HII); and interestingly, they construct some submarines together.

Their revenues are not cyclical and are not impacted by interest rates. In fact, there is countercyclicality to their business – today GD and HII have a hard time hiring folks who want to work in the shipyards; thus their constraint to growth is not the order backlog that is expanding with every quarter, but low unemployment. They have a good, stable, relatively high return on capital and usually good balance sheets. Their customers’ checks don’t bounce.

Yes, every Western government including our own is running a budget deficit, but safety is right at the base of Maslow’s hierarchy of human needs, right next to shelter and food. We’ll be pushing Social Security retirement to 121 before we reduce our defense budget in today’s world. Thus, global defense spending, no matter what happens to our economies, will likely be significantly higher three to five years out; and consequently, current defense-industry earnings estimates will prove to be too low.

Also, unlike software companies, which move electrons, defense companies move both electrons and atoms. It takes time to restart the defense machine, which has been mostly idle over the last three decades. Budgets need to be set, voted for, and then funded; factories need to be built (and old ones upgraded); new employees need to be hired and trained; and supply chains need to be established or strengthened.

To our surprise, we still keep learning that defense (and some industrials) companies have not fully recovered from the pandemic. Almost every European defense company discusses on their conference calls that despite growing backlogs they are still experiencing interruptions in their supply chains from small suppliers that have not yet recovered from pandemic shutdowns. Large European defense companies have established funds to bolster these suppliers’ equity and working capital.

We have probably seen the bulk of near-term appreciation for most of our defense companies. Their earnings will need a year or two to catch up with their prices. Despite a potential short-term weakness in share price performance, we believe that the earnings of American and (particularly) European defense companies will continue to increase at a steady, although not necessarily linear, pace and will likely surprise analysts and investors to the upside; and thus the companies will grow into today’s valuations and provide good long-term returns.

Our allocation to defense companies varies from account to account, but as a firm it accounts for about $125 million – a quarter of our assets under management. We opportunistically increased our allocation to this sector over the last twelve months. Though this is a significant allocation to one sector, we are geographically well-diversified – we own defense companies in four countries.

The last couple of years have been good for our stocks. This may or may not persist this or next year. One of our clients said, “Patience is perseverance.” I really like this, as it partially describes investing. Patience, thoughtfulness, and discipline will allow us to persevere.

We really like what we own and are going to make sure that every incremental decision improves the portfolio. Again, when you hear from CNBC or your neighbor that the market is expensive, they are right. The good news is that your portfolio doesn’t look like the market.

Key takeaways

- Global tensions have significantly increased since February 24, 2022, with the Russian invasion of Ukraine, marking the end of the post-Cold War peace dividend and necessitating increased defense spending in Europe and the US.

- The world is fracturing into two camps (Western allies vs. China, Russia, North Korea, and Iran), leading to rising global tensions and the potential for conflict, particularly over Taiwan and its crucial semiconductor industry.

- Global tensions are exacerbated by the actions of Iran and North Korea’s nuclear ambitions, as well as the Houthi attacks in the Red Sea, highlighting the need for stronger naval presence to protect shipping lanes.

- The defense industry is poised for long-term growth due to increasing global tensions, with defense companies benefiting from monopolistic or duopolistic market positions, stable revenues, and growing government spending on military capabilities.

- In response to rising global tensions, your investment portfolio is heavily weighted towards defense companies (about 25% of assets under management), which are expected to see earnings growth and provide good long-term returns despite potential short-term fluctuations.

“However, what we were reawakened to on February 24, 2022 is that a strong military serves as a deterrent when a dictator starts bombing your country, killing your citizens “in order to get rid of the Nazis” in your homeland. If Ukraine had been well-armed, Russia would never have tried to “denazify” it, reeducate it about its history, and force Ukrainians to speak their “real” mother tongue.”

100% agreed

The article and the reality we must face definitely resonated. Appreciate your willingness to take a stand on things that matter in a world focused too much on things that don’t.

The article is excellent. It shows the skill that an investor, with experience and deep knowledge of the market, can have to accurately draw the global geopolitical situation. This is not an easy task.

The analysis of the evolution and perspectives of the military industry have allowed him to make this asset allocation which seems to me a very good strategy for the next decades.

I totally agree with you Vitaliy, the world is now a real powder keg and in Europe we must run out of the utopian world we thought we were living in. It would be better for everyone if we Europeans started to think in other terms.

Thank you for writing such didactic articles.

great article