“I don’t know.” These three words don’t inspire a lot of confidence in the messenger and probably will not get me invited onto CNBC, but that is exactly what I think about the topic I am about to discuss.

I received a few emails from people who had a problem with a phrase in one of my old blog posts. In that article I examined various risks that other investors and I are concerned about. The phrase was “the prospect of higher, maybe even much higher, interest rates.” These readers were convinced that higher interest rates and inflation are not a risk because we are not going to have them for a long, long time, that we are heading into deflation. These readers basically told me that I should worry about the things that will come next, not things that may or may not happen years and years down the road.

I am pretty sure that if that phrase had addressed the risk of deflation and lower interest rates ahead, I’d have gotten as many emails arguing that I was wrong — that we’ll soon have inflation and skyrocketing interest rates, and deflation is not going to happen.

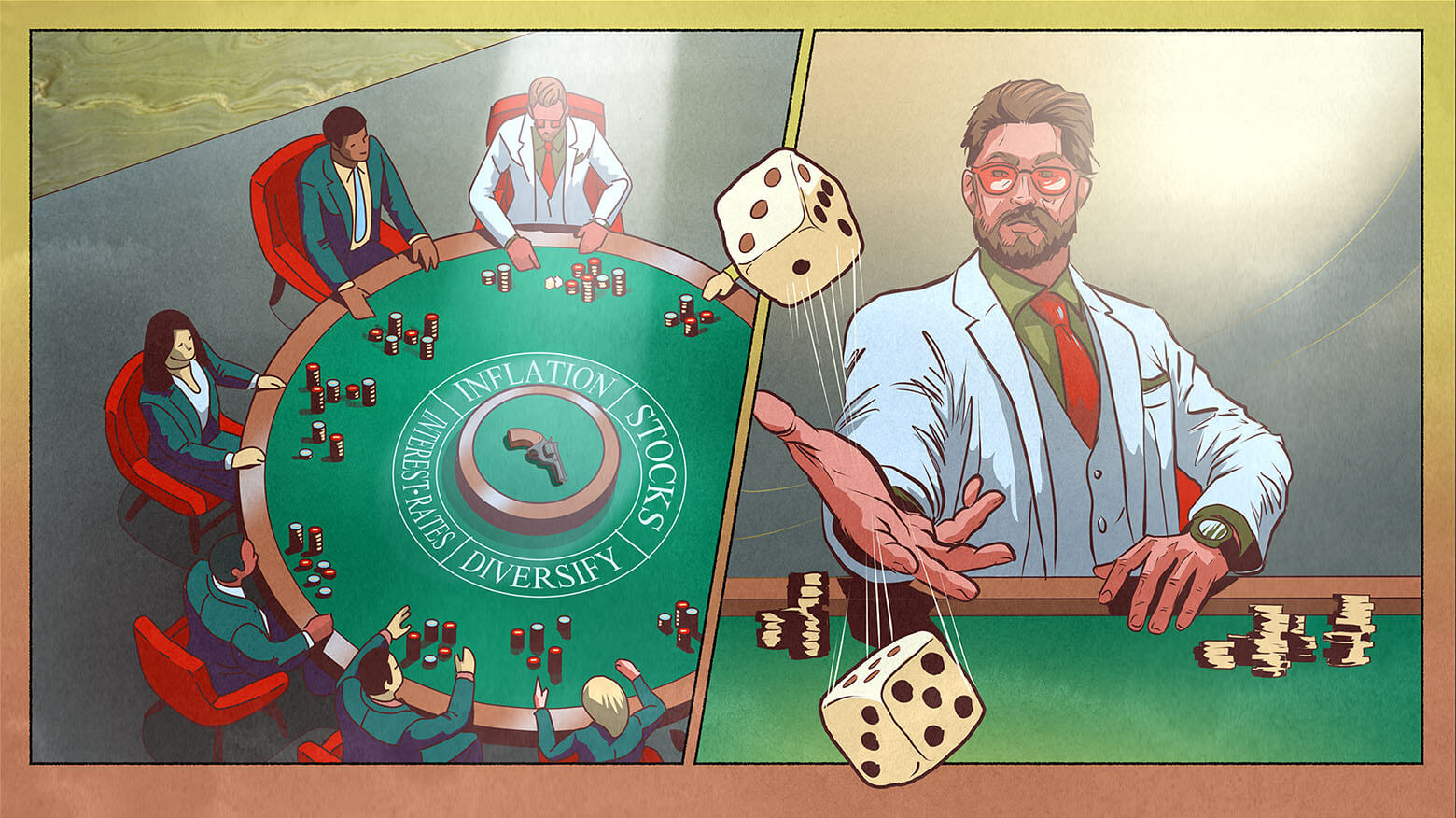

I don’t know whether we are going to have inflation or deflation in the near future. More important, I’d be very careful about trusting my money to anyone holding very strong convictions on this topic and positioning my portfolio on that basis.

Any poker player knows that the worst thing that can happen is to have the second-best hand. If you have a weak hand, you are going to play defensively or fold (unless you are bluffing) and likely won’t lose much. But if you’re pretty confident in your hand, you may bet aggressively (god forbid you go all-in) — after all, you could easily have the winning cards. Four of a kind is a great poker hand unless your opponent has a straight flush.

Generally, the more confident you are in an investment, the larger portion of your portfolio will be placed in that position. Therefore super-convinced inflationists will load up on gold, and super-convinced deflationists will be swimming in long-term bonds. If their predictions are right, they’ll make a boatload of money. If they’re wrong, however, they will have the second-best-hand problem — and lose a lot of money.

The complexity of the global economy has been increased by monetary and fiscal government interventions everywhere. There is no historical example to which you can point and say, “That is what happened in the past, and this time looks just like that.” When was the last time every major global economy was this overlevered and overstimulated? I think never. (Okay almost never, but you have to go back to World War II.) What is going to happen when the Fed unwinds its massive balance sheet? I don’t know.

I don’t want to sink to the level of the one-armed economist — but conversation about inflation and deflation is just that, an “on one hand . . . but on the other hand” discussion.

Just like in poker, second-best hands may be tolerable if, when you went all-in, you did not leverage your house, empty your kid’s college fund or pawn your mother-in-law’s cat. Even if you lost your money, you will live to play another hand — maybe just not today.

In the “I don’t know” world, second-best hands when you bet on inflation or deflation are acceptable on a single stock position level (you can survive them) but are extremely dangerous, maybe fatal, on an overall portfolio level.

Investing in the current environment requires a lot of humility and an acceptance of the fact that we know very little of what the future holds. I’d want the person who manages my money to have some discomfort with his or her economic crystal ball and to construct my portfolio for the “I don’t know” world.

As a writer, you know you are in trouble when you have to quote both Albert Einstein and Mahatma Gandhi in the same paragraph, but when I ask readers to do something as difficult as I am in this column, I need all the help I can get.

“It is unwise to be too sure of one’s own wisdom,” Gandhi said. “It is healthy to be reminded that the strongest might weaken and the wisest might err.” Einstein took the idea a step further: “A true genius admits that he/she knows nothing.” Smarter and humbler people than me were willing to say, “I don’t know,” and it is okay for us mortals to say it too. Repeat after me…

0 comments