A few years back I wrote an article comparing buy-one-suit-get-three-free sales by Jos. A. Bank to the Federal Reserve’s quantitative easing program. Then Jos. A. Bank’s management did something absolutely brilliant: In March 2014 it sold the company for $1.8 billion to Men’s Wearhouse, its closest competitor (and twice its outfit’s size).

Earlier this month Men’s Wearhouse — which in February changed its name to Tailored Brands — owned up to the reality that Jos. A. Bank would have faced on its own if it had not been acquired: that the Jos. A. Bank brand is basically worthless. It was destroyed by endless sales. Any suit-wearing man who was going to buy clothing from Jos. A. Bank already had at least four suits in his closet. Almost two years to the day since it bought Jos. A. Bank, Tailored Brands announced that it is writing down nearly two thirds of the value of the purchase and shutting down a quarter of Jos. A. Bank stores. Tailored Brands’ stock has collapsed, and the Jos. A. Bank story is coming to an unpleasant but predictable finale (especially for Tailored Brands shareholders).

The irony of QE or of Jos. A. Bank’s marketing strategy is that neither started out as an indefinite adventure. QE 1 was launched as a way to restore liquidity and prevent a run on the banks in the midst of the financial crisis. QE 2 and the rest that followed were the Fed’s attempt to engineer greater economic growth. I remember talking to Jos. A. Bank’s CFO in the late 2000s, and he was telling me how its “buy-one-get-X-free” strategy was temporary. However, then the crisis arrived, and slowly, one month at a time, its marketing campaign became permanent. Just as people who try heroin for the first time never intend to become drug addicts, neither the Fed nor Jos. A. Bank management wanted to become QE and “buy-one-get-X-free” junkies.

What do we learn from Jos. A. Bank’s sad story? Temporary-turned-permanent solutions may postpone the inevitable for a long time — to the point where observers like yours truly turn into boring, broken records. (I might shoot myself if I have to write another article about the Fed and QE.)

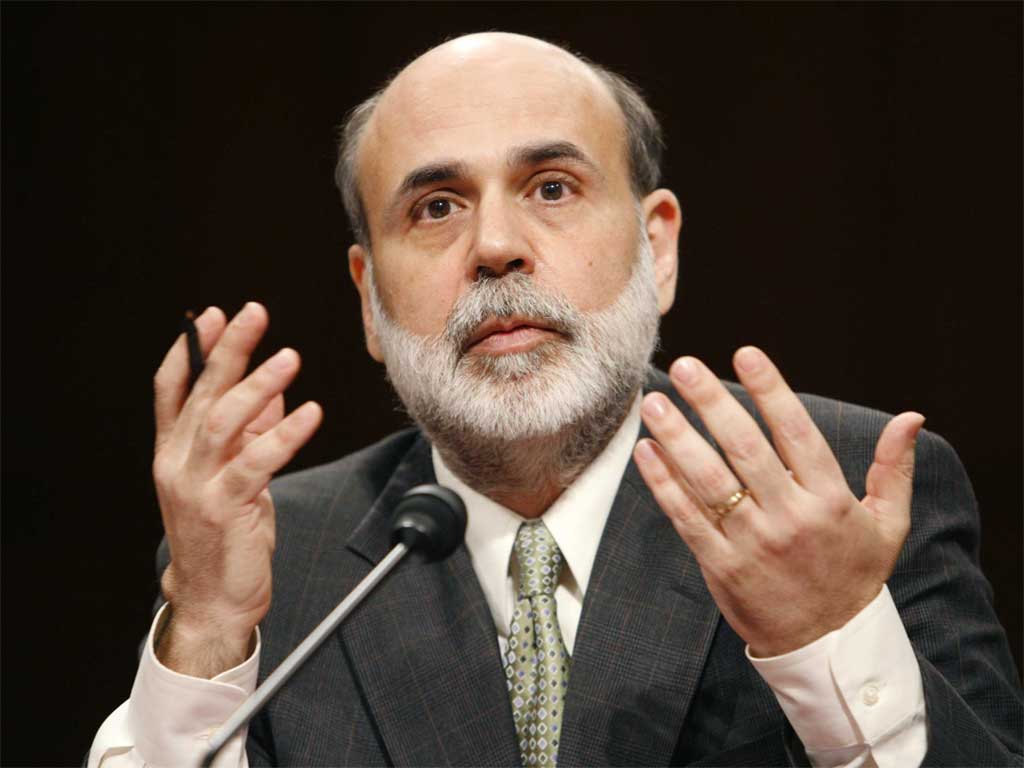

But eventually, temporary-turned-permanent solutions lose their potency, as they are just papering over a core problem that they were never designed to solve, and that ugly reality comes to the surface. Ben Bernanke skillfully passed the Fed chair baton to Janet Yellen in 2014, but, as we learned with Jos. A. Bank, ownership of an unresolved problem doesn’t change the problem.

0 comments