I wanted to share with you some edited excerpts from a Q&A session I held with readers in Omaha during Berkshire Hathaway’s shareholder meeting weekend. Today’s email focuses on crucial investment strategies: diversification and position sizing.

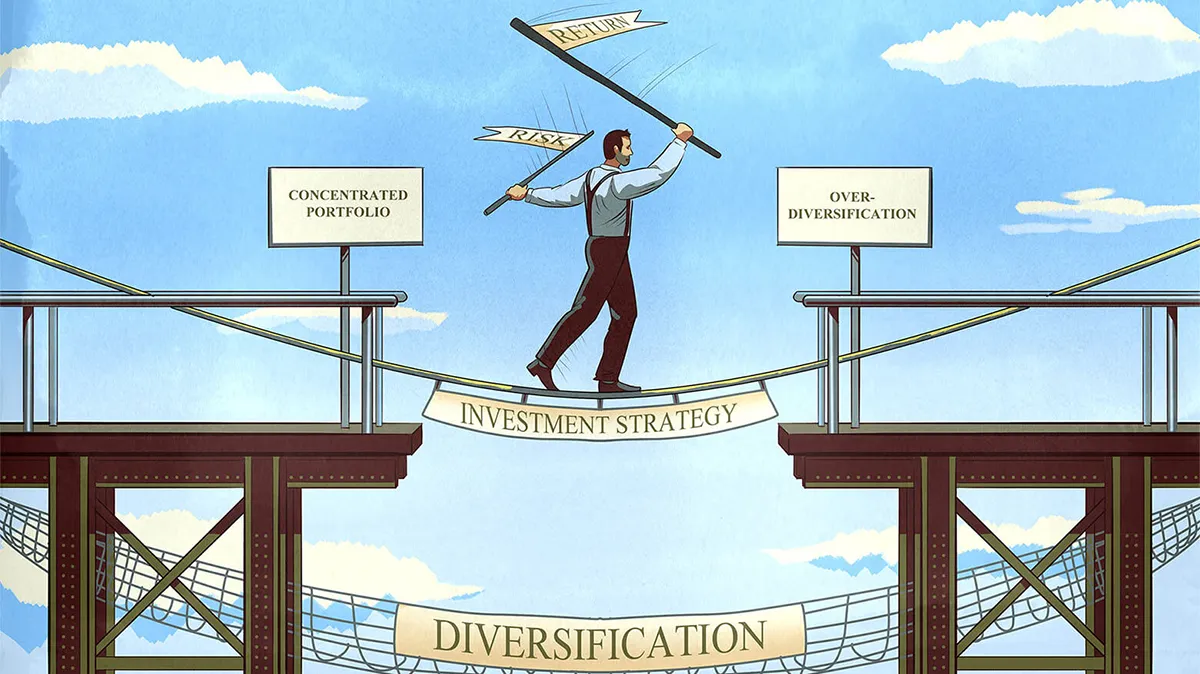

How do you deal with diversification and position sizing?

I remember speaking at the Value Investing Congress in Pasadena in 2008 or so. Here’s a true story from that event.

The night before we spoke, all the speakers went out to dinner. I was sitting next to Mohnish Pabrai, and I asked him, “Mohnish, how can you handle a portfolio of just 10 stocks? Doesn’t volatility drive you crazy?”

He replied, “Vitaliy, don’t look at me. Look at the guy to your left.” (Let’s call him Bill.) Mohnish said, “This guy has only three stocks.”

It gets more interesting. The next day, Bill gives a presentation on the Kelly criterion. It’s a concept from gambling that basically says, if you see the probability of winning as much greater than the probability of losing, you should place disproportionately large bets. It’s about position sizing.

Bill argued that if you calculate the Kelly criterion for a stock, it should be a very large portion of your portfolio – like 60%. So, in his view, there was nothing wrong with a three-stock portfolio.

The problem is, the Kelly criterion is based on gambling, where you have discrete outcomes. You know there are 52 cards in a deck, so you can calculate the probability of drawing an ace. Establishing these probabilities in investing is much more difficult.

To conclude this story, Bill pitched a natural gas stock. At the time, natural gas prices had dropped from $13 to $8, and he argued they couldn’t go below $7. Well, they declined to $1.50, and Bill’s fund completely blew up. His previous five-year returns of 25% annually turned into a negative 90%.

This story illustrates two crucial points. First, surviving is incredibly important. As Warren Buffett says, “To finish first, first you have to finish.”

Second, your strategy has to match your constituency. At IMA, people usually give us most of their wealth. They’re often in their 50s or 60s (not always; sometimes they are in their 30s or 80s), so it’s money they can’t replace. I have to invest as if it’s the only money they’ll ever have.

That’s why I think it would be irresponsible for me to have a three-stock portfolio. Even a ten-stock portfolio would be risky. We typically have 20 to 30 stocks, averaging around 25, and they’re diversified. But remember, diversification isn’t just about negative correlation – each asset should also have good return potential.

We’re lucky at IMA to have a kind of reverse client selection. I tell people up front how we operate. If they want to be part of it, great. If not, that’s okay too. I’m not going to change our approach for anyone.

Key takeaways

- Overconfidence in position sizing, as seen with the Kelly criterion, can lead to catastrophic losses when market conditions don’t align with your probability assessments.

- Survival is the fundamental principle of successful investing – as Buffett says, “To finish first, first you have to finish.”

- Your investment strategy must match your clients’ needs and risk tolerance, especially when managing wealth people cannot replace.

- A well-diversified portfolio (20-30 stocks versus 3-10) provides protection while still allowing for strong returns when each position is carefully selected.

- Having clear investment principles attracts compatible clients, creating a “reverse client selection” where transparency about your approach builds stronger relationships.

0 comments