I wrote the following letter to IMA clients, but I suspect some of you may find it of interest as you may have accounts at Charles Schwab, Fidelity, or TD Ameritrade.

We are sending this email to all our clients. We could have sent it only to those who have money in IMA accounts at Schwab, but in many cases our clients have assets outside of IMA management. Also, though this letter focuses on Schwab, we address TD and Fidelity as well.

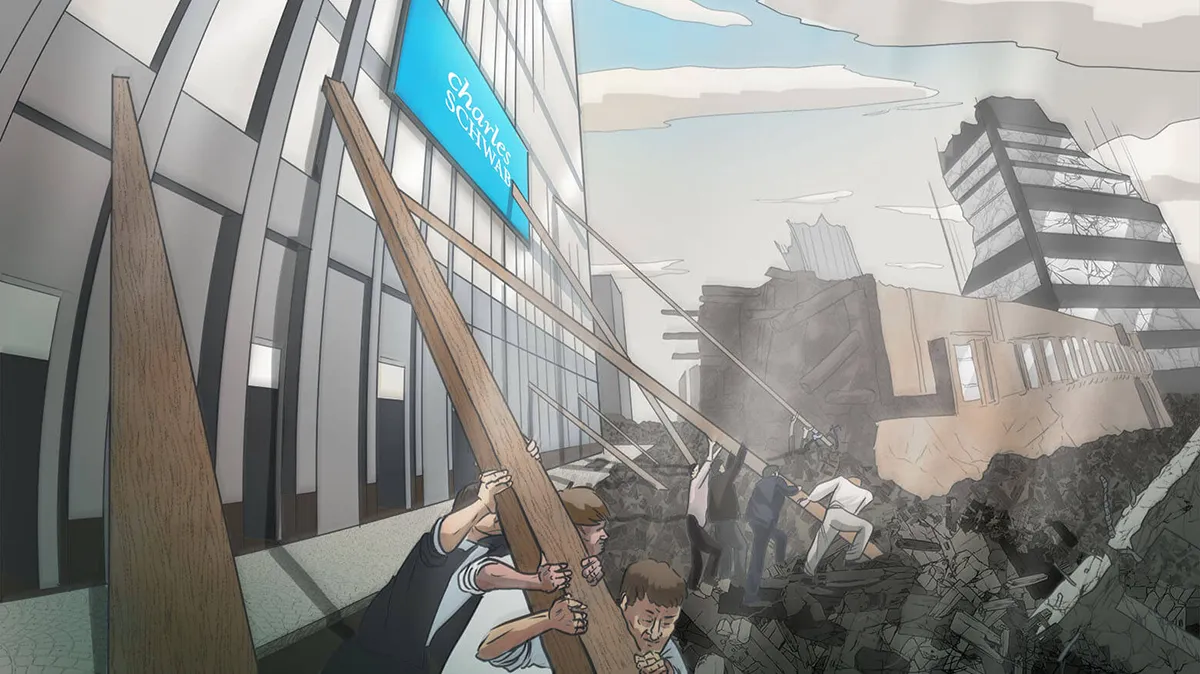

We have received a few inquiries from clients expressing their concern about the safety of their money at Charles Schwab. Schwab has been in the news because the banking side of the business made investments into high-quality, long-term bonds whose prices have declined as interest rates have risen. (Please read the Spring Letter, where I discussed this subject in great detail.)

I could go into a very detailed analysis of Charles Schwab, but I won’t waste your time. The situation is fluid; interest rates can rise, worsening the losses, and deposits can outflow a lot more, deepening the losses further.

I have to be honest; anything I say below this paragraph is a waste of your time. If there is an institution too big to fail, it is Schwab, which has over $7 trillion in assets. If Schwab goes bankrupt and even a single account holder’s money is affected, we will have no economy or stock market. It is that simple. Account holders losing their money would be like dropping a nuclear bomb on the US economy. Investors losing money on the cash at Schwab would create a run on the bank (actually on the economy) like the world has never seen. Schwab’s problems are less severe than those of many other banks, and if necessary the US government will bail out its depositors.

However, for those of you who have some extra time, or maybe just continue reading because you enjoy my writing, here are a few more reasons not to worry.

Your stocks, bonds, and money market funds are registered in your name. For example, shares of Philip Morris or Schwab Treasury Obligations Money Fund (SNOXX) are database entries in your name. Any securities, other than cash, are on Schwab’s custodial side of the business, belong to you, and cannot be taken away from you, even if Schwab was to go bankrupt.

Cash, which is on the bank side of the business, has several layers of insurance. It is FDIC insured up to $500,000 per account registration; IRAs are counted separately from personal accounts, etc. There is also SIPC insurance of $500,000 ($250,000 counted towards cash). Additionally, Schwab has extra insurance that covers cash up to $1.15 million per customer. For more information, please see links at the bottom.

We are striving to keep as little money in pure cash as possible. Most of your cash is in the money market, which, as I mentioned above, is on the custodial (non-bank) side of the business.

All of my and my family’s investable assets are at Schwab and TD Ameritrade. Lately, I have been losing sleep over my chess game (which is getting worse), but not Schwab’s liquidity. Unfortunately, unlike Schwab, I am not too big to lose.

Regarding TD and Fidelity:

TD Ameritrade, merging with Charles Schwab later this year, is both FDIC and SIPC insured. At TD, we minimize the amount of real cash in your accounts by purchasing money market funds which invest in short-duration US Treasuries.

For clients with accounts at Fidelity; it does not have a bank. It is not exposed to the same type of risks as Schwab. Fidelity is also SIPC insured, with additional SIPC insurance covering cash up to $1.9 million per customer.

Here are a few more links for your reference:

- https://www.schwab.com/legal/account-protection

- https://www.schwab.com/legal/fdic-insurance

- https://si2.schwabinstitutional.com/SI2/ASK/Content/secure/ask/servicing-accounts/features-services/account-features/introduction-to-bank-sweep-feature

- https://www.tdameritrade.com/account-protection.html

IMA clients based outside of the US require a slightly different approach to ensure airtight safety of cash and securities.

International clients at all custodians are not eligible for purchase of money market mutual funds, nor are cash balances FDIC insured. However, these accounts are still SIPC insured for securities, and this coverage also extends to cash balances in accounts up to $1.15m and $1.9m at Schwab and Fidelity, respectively.

Further, because we cannot buy money market mutual funds the same way as for domestic clients, we will start purchasing a money market ETF (SGOV) that invests in short-term US Treasuries.

Key takeaways

- Schwab safety is fundamentally assured by its size and systemic importance – with over $7 trillion in assets, it’s considered too big to fail, and any threat to account holders’ money would have catastrophic economic consequences.

- Schwab safety for stocks, bonds, and money market funds is guaranteed as these are registered in the client’s name and cannot be taken away even if Schwab were to go bankrupt.

- Cash at Schwab has multiple layers of safety, including FDIC insurance up to $500,000 per account registration, SIPC insurance, and additional Schwab insurance covering cash up to $1.15 million per customer.

- Your personal confidence in Schwab safety is demonstrated by keeping all your family’s investable assets at Schwab and TD Ameritrade.

- For international clients, while Schwab safety measures differ slightly (no FDIC insurance or money market mutual funds), SIPC insurance still applies, and alternative strategies like purchasing money market ETFs are being implemented to ensure cash safety.

0 comments