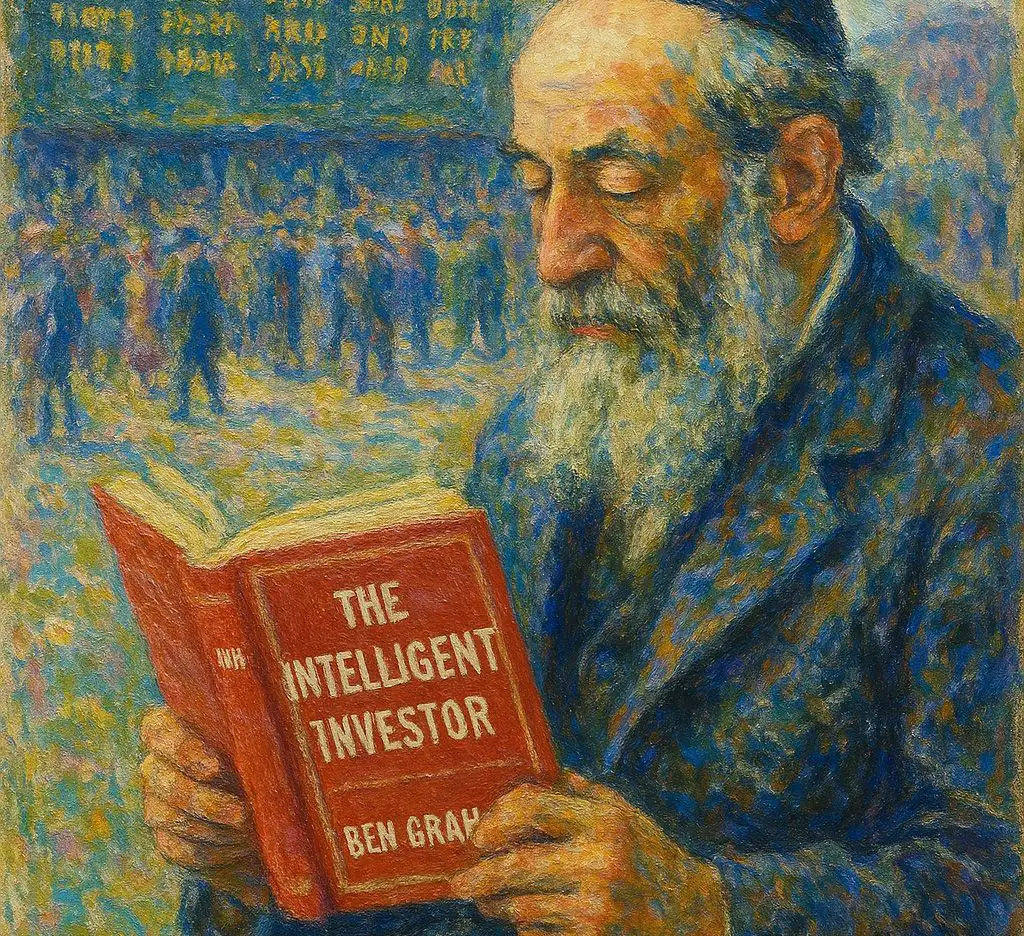

When asked about his money manager, our long-term client Ed, who became a dear friend, proudly stated, “My money is managed by a paranoid Russian Jew.”

This perfectly sums up our approach to investing.

Let me double-click on this a bit.

Historically, Jews were always on the receiving end of the very tip of the spear of adversity. As a result, they had to be more paranoid than the rest of society. My maternal grandfather taught me that when you open a Soviet newspaper, you needed to read between the lines and pay attention not only to what is said but, more importantly, what is not said.

This paranoia is passed from generation to generation. That is what Ed saw in our approach. We pay a lot of attention not just to what is in front of our eyes but to risks (and opportunities) that are lurking around the corners.

Of course, there is healthy and unhealthy paranoia. Unhealthy paranoia is being haunted by shadows everywhere you go. Healthy paranoia is being alert, noticing subtle changes, and paying attention to the health of both the foundational structure of the environment and the inner workings of the system.

Jews have faced adversity for centuries, and their healthy paranoia has helped them to survive. This is precisely how we approach your portfolio. Healthy paranoia is deeply woven into our portfolio construction and visible in our holdings (as I’ve explained in my letters and articles).

Our investing in defense stocks is the latest example of this. The global security environment was changing, and our process allowed us to see that early. We started accumulating these positions before the war in Ukraine (at the time we saw them as extremely cheap, noncyclical, high-quality monopolies providing protection if the relationship with China escalated). We added to them when the war started, during the conflict, and as recently as February (as we kept updating our research).

IMA’s goal is to grow your wealth and for you not to worry about the markets. We want to make you wealthier while minimizing the volatility of your blood pressure. We try to achieve this by ignoring the crowd and focusing on buying high-quality businesses run by excellent management at good prices. As a result, healthy paranoia is an integral part of our process – we pay attention to risks and opportunities that are not in today’s headlines.

We’re guided by our research and are willing to make unpopular decisions. When animal spirits hijack the market, our portfolio will lag. When panic takes over as the market declines, we will hopefully do better than the market (of course, we cannot make any promises). The last five years were a great example of that.

This year is playing out that way so far, too.

At the end of last year, I wrote to you about how while our portfolio delivered objectively good returns on an absolute basis, it didn’t keep pace with the frenzied market. The market was fixated on AI and disregarded valuations. Consequently, despite our businesses performing fundamentally well, their stock prices were left in the dust by the “Magnificent Seven” – terrific but overvalued stocks that became even more overvalued.

Investing is a peculiar endeavor where your decisions in any given year may have little connection to your returns. We haven’t gotten any smarter in 2025, but essentially the same portfolio that did not impress the market in 2024 is now up double digits this year.

There’s a crucial distinction between our portfolio’s gains today and the market’s gains in 2024. In most cases, the market’s average stock valuation went from overvalued to insanely overvalued. These gains were not sustainable, because they happened from expanded valuations and thus borrowed from future returns that have to be paid back. In 2025 our stocks have gone from severely undervalued to simply undervalued, with a few becoming fairly valued (we reduced those or sold them).

Our team typically spends hundreds of hours studying each company before we buy a full position. We have talked to the management team of almost every company we own, and we try to meet with them when we can. A year ago, I attended Babcock’s (our largest holding) investor day in Plymouth, England, met their management, and also had a chance to visit their shipyard. On my recent trip to Switzerland, I had the pleasure of spending time with International Petroleum’s CEO and CFO. And in early April, I’m going on a research trip to visit a few companies we are researching in the Washington, DC area, and I plan to visit Huntington Ingalls shipyards in Norfolk and meet with their management.

But we don’t just talk to companies. For every single stock we own and many we analyzed but don’t own, we build a financial model in which we try to kill the business And of course our research doesn’t stop when we buy a company – in fact it intensifies.

People have been conditioned to think about stocks as “the market,” but your portfolio with IMA today looks nothing like the market. A few months ago, I had a conversation with a good friend who has invested for four decades. We did our usual thing and talked stocks. I went through our top holdings, and he did not know two-thirds of them.

I’ve emphasized this point forever but it still bears repeating: The overall market is overvalued. It was overvalued last year, and it is still overvalued today. The average stock is at one of the highest valuations in modern history. But we don’t own the market. Our portfolio is two dozen carefully placed investments in high-quality businesses run by good management teams. We made these research-driven decisions at the time of our choosing when our analysis led us to conclude these businesses were undervalued – when we were buying $1 for 50 cents or less.

I am comfortable admitting that we’ll be wrong on some of these investments – we are dealing with imperfect information and occasionally life will simply happen to some of these companies. But as long as we stay disciplined, process-driven, and employ healthy paranoia, our strategy should work over the long run. I put my money where my mouth is, and my family and I own the same stocks you do.

Over the next few weeks, I’ll share excerpts from the latest letter in which I answer questions from IMA clients. In the past I’d rewrite the letter into an article, sanitizing it for readers. I feel that my relationship with you has reached the point that I don’t need to do that, so I’ll leave it as is.

The letter is 18 pages long, so I’ll break it up into smaller, more digestible chunks. However, if you want to inhale the whole letter in one go, you can download it below (requires entering your email address).

Key takeaways

- Our investing approach is perfectly summed up by our client Ed’s description: “My money is managed by a paranoid Russian Jew”—embodying the healthy paranoia that pays attention not just to what’s visible, but to risks and opportunities “lurking around the corners.”

- This investing approach involves being process-driven and research-intensive, typically spending “hundreds of hours studying each company,” meeting management teams in person, and building financial models “in which we try to kill the business.”

- Our investing approach embraces unpopularity and willingly diverges from market trends—when “animal spirits hijack the market, our portfolio will lag,” but during market panics, we typically outperform.

- The investing approach is producing results in 2025 as our portfolio is “up double digits this year” with stocks moving “from severely undervalued to simply undervalued,” unlike the 2024 market where valuations went “from overvalued to insanely overvalued.”

- Unlike owning “the market” (which remains “at one of the highest valuations in modern history”), our investing approach creates “two dozen carefully placed investments” where we’re “buying $1 for 50 cents or less”—and I back this conviction by ensuring “my family and I own the same stocks you do.”

Great meeting you at the Creighton event in Omaha, and for the insight here

Thanks for the update

“A paranoid might be defined as someone who has some idea as to what is actually going on.’ – W. Burroughs