This is part one of the winter seasonal letter I wrote to IMA clients, sharing my thoughts about the economy and the market. I tried something I’ve never done before. Instead of conveying my message through storytelling, I tried to compress my thoughts into short sentences. I summarized some 50,000 words into about 1,000 (a compression ratio of 50 to 1!).

The Stock Market

- Stock market math: Total returns = earnings per share growth + P/E change + dividends. This formula applies to any stock and any stock market.

- Stock market returns over the last 100+ years have followed a pattern: long-term bull markets (15 +/- years) followed by sideways markets (15 +/- years), not bear markets. The Great Depression was the only exception.

- Sideways markets, though, have a flat slope consisting of mini bull, bear, and sideways markets – a lot of volatility but no real returns.

- If the stock market P/E never changed, stayed at 15x, there would be no market cycles. The stock market would appreciate with earnings growth (4-6% a year) + dividends (4-5% a year).

- Human behavior causes and follows a pendulumlike momentum – excitement leads to more excitement (CNBC on all day long) 🡪 bull market. When momentum breaks, stock declines lead to more declines (CNBC off) 🡪 sideways market.

- Historically, economic growth was similar during bull and sideways markets. Changes in P/E were the cause of bull and sideways markets.

- Bull markets start when P/E is much below average: P/E increase + earnings growth 🡪 high (above-average) returns.

- At the end of bull markets P/E stops expanding, stagnates, declines. The expectation of endless nirvana is broken – welcome to sideways markets.

- Sideways markets start when P/E is much above average (end of bull market): P/E decline + earnings growth 🡪 low or no returns.

- Current valuations: If we normalize for high profit margins, P/Es are very high. P/Es are likely to decline for a long-time.

- Low interest rates boosted P/Es; higher interest rates take P/Es down.

- Profit margins are likely to decline for several reasons: selective deglobalization (widgets made in Ohio more expensive than ones made in Shanghai), higher interest rates, likely higher taxes.

- If we are lucky, we will have a sideways market.

- If unlucky, and economy goes into long-term stagnation, we’ll have a secular bear market. The most recent secular bear market was in Japan: Both P/Es and earnings declined for a long time. We are not Japan, but nor was Japan “Japan” in the early 1990s.

The Economy

- The economy is still difficult to analyze. It has been impacted by Covid distortions – too much/too little demand, supply chain disruptions, $5 trillion of debt issued by the US government.

- Tailwinds: Historically, a bet against the US consumer and US economy was a losing one. The consumer has a lot of pandemic cash. Unemployment is low. The financial/banking system is in great shape from the perspective of reserves and credit quality. Selective deglobalization will bring some jobs to the US.

- Major headwind: rising interest rates. The economy is addicted to low interest rates. It will take time and pain to readjust from zero rates to average/above average rates.

- Trillions of dollars of long-term, low-coupon debt have been issued, which will bring pain to holders who will be taking realized or unrealized losses. First-, second-, and third-order effects will be surfacing in the financial system. (The Silicon Valley Bank bankruptcy leaps to mind here.)

- Corporate debt is at an all-time high – debt paydown will take place at the expense of share buybacks, fewer capital investments, less growth.

- Housing market good news: Most mortgages are fixed-rate, not impacted by higher rates. If homeowners don’t move, they don’t feel the impact of high rates. End of good news.

- Home prices in relation to income are at an all-time high. Unless income skyrockets, homes are unaffordable to new buyers. Declining home prices will erode home equity and consumer confidence.

- The number of transactions in the housing market will reset to a semi-permanent lower level. At the new, higher rates, if you sell your house and buy one next door, your mortgage payment doubles. This also impairs workforce mobility.

- It’s unclear if unemployment will stay low. Tech companies have just started laying off high-earning workers; a lot more pain is likely.

- This is the worst geopolitical environment is generations: war in Europe and China soon to be the largest economy but not a friend. Defense spending increases are almost a certainty.

- US debt-to-GDP is 130% (the highest level since WWII) – higher interest rates will lead to more money printing to pay for higher interest payments and increases in defense spending.

- Companies are choosing resilience of supply chains over efficiency. Selective deglobalization leads to higher costs – and adds to inflation.

- Inflation leads to the reduction of purchasing power, lower savings, decline in production., which causes stagflation.

- Higher corporate and income taxes are likely – it’s almost irrelevant who runs the country. High taxes are de-stimulative and lower growth. Higher unemployment is likely.

Possible outcomes

- Inflation gradually subsides: The economy slows down a little but is still growing. Interest rates normalize at a semi-normal level. That’s a Nirvana 1.0 outcome, a garden-variety sideways market. Or event better…

- Corporate margins don’t deflate but stay at current all-time high levels. That is the Nirvana 2.0 outcome. Market appreciation more or less matches the growth of the economy.

- Inflation persists: Inflationary sideways market – nominal earnings growth + declining P/Es. Eventually, inflation breaks by itself through stagflation or with the help of the Fed. See next.

- Inflation is broken: Economy in short-term recession – short-term bear market, long-term sideways market.

- Inflation leads to deflation or long-term recession: Bear market rhyming with the one in Japan or, if interest rates go negative, shoot-the-moon bull market!

- An outcome I did not think of.

To summarize the above, long-term stock market returns have two sources: earnings growth, which is under pressure for a longer list of reasons than usual + valuations, which are at historical highs and also under pressure.

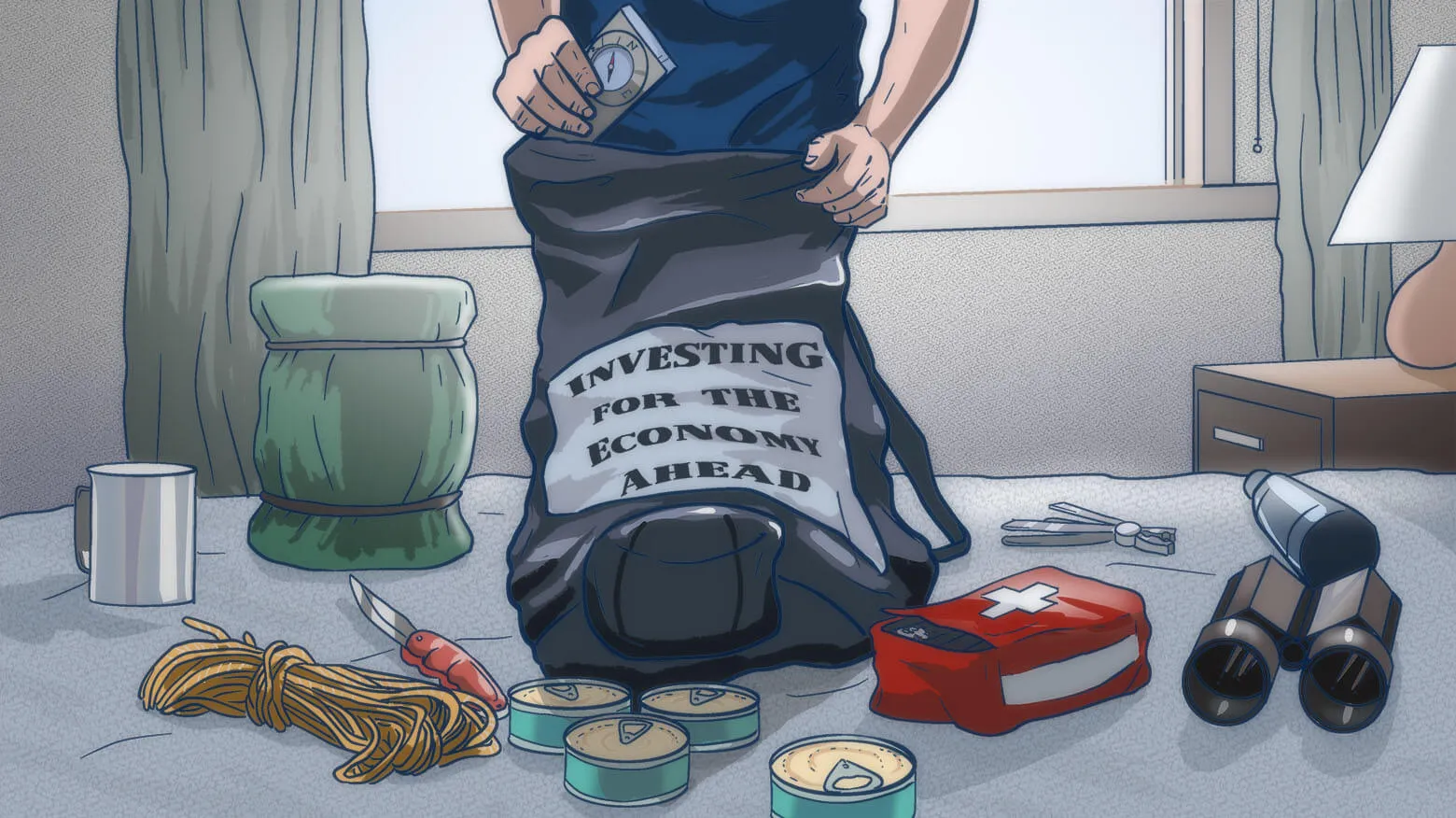

How to invest

Worry macro, this is what I did above, invest micro – this is what I’ll discuss next:

- Look for companies that can survive and prosper in all of the above scenarios.

- Be process-driven – the market will likely be more bipolar than usual. Know what you own, why own it, how much it is worth.

- You need to have patience – wait for opportunities to come to you.

- Competitive intensity will likely increase when the economic pie is not growing. Stick to high-quality companies run by great people.

- Increase your margin of safety – you’ll need it.

- Don’t be afraid of cash (short-term bonds) when you don’t find opportunities. Cash is better than overvalued stocks or low-quality companies – or especially the combination of the two.

- Look for stocks in other markets – they expand choice greatly.

- Don’t time markets; it’s impossible to put market timing into a process. Buy undervalued companies and sell them when they are dear.

- “Sell” is a four-letter word in secular bull markets; it is an important practice during sideways markets.

Until my father read my book, Active Value Investing, he thought investing was a legalized form of gambling and that I should do something “real”, such as open a bagel store or doughnut shop. He even offered to help. After writing this, I realized that over the next decade or two, there will be times when I wish I had taken my father up on his offer. Investing will be challenging as the stock market and economy enter a phase of repaying for the excesses of the past. I am fortunate to have a passion for investing, not bagels.

P.S. I asked IMA clients for feedback on this style of writing. Some appreciated the conciseness of the format. One client, a software engineer, suggested that I reduce the compression rate from 50:1 to 10:1. However, most felt that storytelling is what attracted them originally to my writing. I have to confess, though I enjoyed the challenge of compressing thoughts into compact sentences, the highlight of the essay for me was writing about the bagel shop.

Key takeaways

- How to invest in the current market environment involves focusing on companies that can survive and prosper across various economic scenarios, rather than trying to time the market.

- When considering how to invest, be process-driven and patient. Know what you own, why you own it, and its worth, especially as the market becomes more volatile.

- How to invest wisely includes increasing your margin of safety and sticking to high-quality companies run by great people, particularly as competitive intensity increases in a potentially stagnant economy.

- In terms of how to invest, don’t be afraid of holding cash or short-term bonds when opportunities are scarce. This is preferable to investing in overvalued or low-quality companies.

- How to invest successfully in the coming years may involve looking beyond domestic markets and being prepared to sell – a practice that becomes more important during sideways markets than in bull markets.

My dad owned a bagel shop. You made the right choice.

I don’t think I can afford the management fee but on the other hand, if I am losing money, maybe having some help would lead to better overall results even after subtracting the management fee.

thank you for the concise analysis However I really enjoy your writng so maybe you could do the compressed summary as an introduction the the longer version after . It would provide the option to read the summary or read both. I would always read both.

Your conciseness is refreshing and thoughtful. Investing is not telling a story but the analysis of mathematical data. Whereas there is variability to translating that data, story telling can by misleading. Thanks