Our investment process is both qualitatively and quantitatively intensive. Throughout the course of a year we look at hundreds of companies. Most of them receive only a cursory look – we don’t like the business, the valuation is too stretched, or we simply have no insight into the business. We usually glance at them and move on. But if we really like the business and/or its valuation, we build a model. Often, just from a cursory look we know that the stock is not cheap enough, but if we really (really!) like the business we’ll invest the time to model it so we can understand it better and set a price at which we want to buy it (and then wait).

We build a lot of models. I went back and looked, and we built over a hundred models last year (we bought only a handful of stocks). Building models is important for us; they help us to understand businesses better. They provide insights as to which metrics matter and which don’t. They allow us stress test the business: we don’t just look at the upside but spend a lot of times looking at the downside – we try to “kill” the business. We usually try to drill down to essential operating metrics. If it is a convenience store retailer, we’ll look into gallons of gas sold and profit per gallon. If it is a driller, we look at utilization rates, rigs in service, average revenue per rig per day, etc.

In the past, when we owned Joseph A. Banks, a model helped us understand the impact maturation of its new stores had on same-store sales. Half of JOSB’s stores were less than five years old, and their maturation drove significant same-store sales increase for years.

We looked at American Express before the crisis, which gave us insight into inflated profit margins of the financial sector, and thus we avoided for the most part the carnage in the financials. We thought Amex stock was not cheap enough at the time, but we learned that Amex’s high swipe-fee revenue provided an important buffer to help the company absorb significant loan losses. Amex could have withstood over 10% loan losses on its credit card portfolio and still have remained profitable. This insight gave us the confidence to buy Amex during the crisis.

Models are important because they help us remain rational. It is only the matter of time before a stock we own will “blow up” (or, in layman’s terms, decline). We can go back to our model and assess whether the decline is warranted. The model then gives us the confidence to make a rational (very key word) decision: buy more, do nothing, or sell.

Sometimes we build a model and then, though the stock may look statistically cheap, we move on. Six months ago we looked at Herbalife and Verifone. With Herbalife – and this was before the Ackman fireworks – we could not get comfortable with the company’s business model, as I wrote. And in the case of Verifone, after we did a lot of qualitative research, even though the stock looked cheap, we discarded the idea because we felt that smart devices like iPods and iPads diminished the value of Verifone’s machines. Whether we were right or wrong, time will tell, but Verifone was not our company.

Models are frameworks that help us think about the businesses we analyze. We are always aware of John Maynard Keynes’ expression, “I’d rather be vaguely right than precisely wrong.” Models are not a panacea, but they are an important and often invaluable tool. However, models are only as good as their builders and the inputs to them.

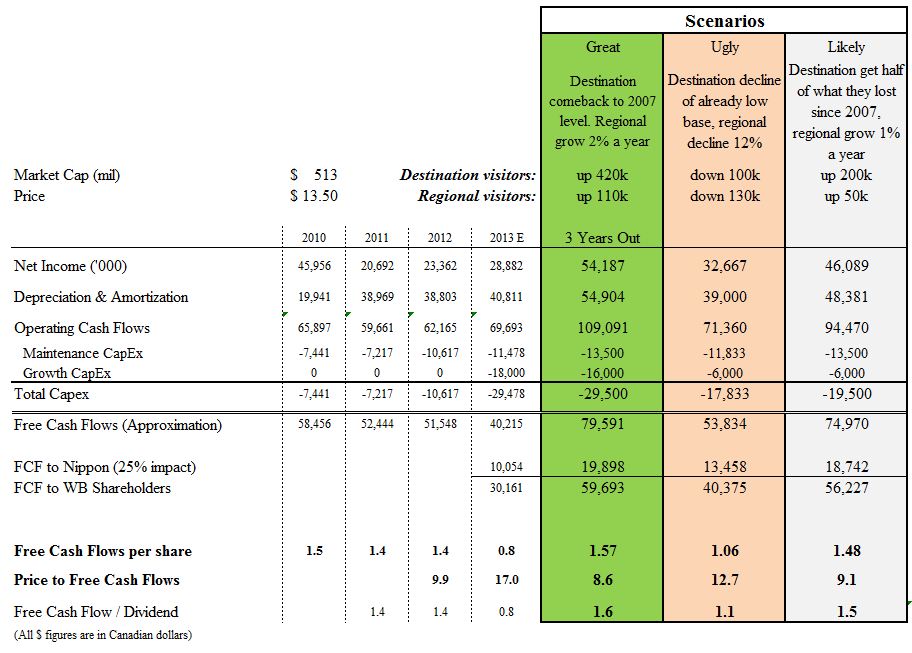

Here comes mea culpa time: I’ve made a mistake in my Whistler Blackcomb model. We built a fairly simple yet a very comprehensive model that helped us understand the dynamics of WB’s business: the importance of destination visitors vs. regional visitors, the value of WB’s ability to raise prices, the distortion that depreciation expense has on WB’s net income. The model helped us in our avid attempts to “kill” WB’s business. When we could not, our model also brought to light WB’s potential earnings power if destination visitors came back to pre-recession levels. So far so good.

However, WB’s common shareholders own only 75% of the total business, and the other 25% is owned by Nippon Cable. Our income-statement model captured a deduction for Nipon Cable’s minority interest. However, when I went to compute free cash flows I linked to the wrong cell. Instead of linking to net income attributable to WB shareholders (i.e., net income less Nipon Cable’s minority income) I linked to net income to the firm (a higher number).

I never thought I’d be making Reinhart and Rogoff-like Excel mistakes, but I did. This goof led to an overstatement of free cash flows by at least 25%. However, that mistake was partially cancelled out by my next mistake. I was working on the scenario template for my Value Investing Congress presentation on my laptop while in Omaha. In the “Likely” scenario analysis, a reasonably conservative scenario was that WB’s regional visits would continue to grow at 1% a year and WB would gain back half of the destination visits it lost since the recession set in: they would go up by 200,000. I did not, however, increase destination visits by 200,000, but rather indicated no growth. Therefore, net income and depreciation should have been about $6 million and $5 million higher, respectively. Bottom line, net net, instead of “likely” free cash flow per share of $1.70 a share, it should have been $1.61.

But that is not where the story ends. Because of the minority interest I should have computed free cash flows differently. I should not have just taken post-minority interest net income, added depreciation, and subtracted total capital expenditures. By doing so, I ignored the value of depreciation to the minority shareholder; and that value is significant, considering that depreciation exceeds total net income.

The right approach was to compute free cash flows to the firm and then deduct Nippon Cable’s portion of the cash flows. In all honesty, this is the only right way to compute WB’s free cash flows (so I suggest you ignore the $1.61 “likely” scenario number above). This reduces WB’s free cash flows in the likely case to $1.50 a share (that number in presentation exhibit is $1.48 because of the tax shield impact in my model).

I am attaching corrected scenario analysis, and I am providing our WB Excel model so you can scrutinize it at your pleasure. Priced at $14 today, or about 10x “likely” free cash flows and about 13x this year’s free cash flows (normalized for growth capital expenditures), WB is still an attractive stock. Its dividend is still well-covered, and considering that many REITs of much lower quality have much less pricing power (yielding in the low single digits) WB is a still an attractive stock. But yes, it is 15-20% less attractive than I originally thought.

There is a lesson here that goes beyond my making a mistake on a spreadsheet. This lesson was graciously called to my attention by the Whopper Investments blog, whose proprietor did not take my Whistler Blackcomb presentation as the ending point of his analysis but as the starting point. He (I am assuming it is a he, knowing the ratio of men to women in value investing) tried to reconstruct my numbers and found my aforementioned mistake. He posted a great write-up pointing out my mistake and making a very simple but important point: always do your own homework. Anyone can make a mistake.

0 comments