A lot of times I won’t have an insight into a business because I don’t understand it or because it’s too complex. General Electric is a great example. As a value investor I should be all over this iconic stock, which is making a generational low.

Not at all. I have looked at GE at least half a dozen times over the years, and always have walked away without understanding the business or what it is worth.

To make things worse, despite GE’s being one of the most-admired companies in the U.S., I have always hated its culture. Former CEO Jack Welch went into the corporate history books as the best American CEO ever. I’d argue that this history needs some serious rewriting.

Welch built a company with a “beat this quarter” culture. Welch’s GE was not in the business of building moats and investing for the long run; he was in the business of beating quarters. In his book, Welch raved that from the early 2000s GE always beat Wall Street estimates. He was proud of how managers of one division were able to “come up with” a few more cents of earnings if another division fell short of its forecast. I kid you not — reread that sentence, three times. If I was at the SEC I’d investigating GE’s accounting.

GE played games with its earnings for a long time, but in reality its cash flows couldn’t cover its dividend, which was supposedly half of its earnings, and that triggered a wake-up call for investors. GE is another reminder that it is incredibly dangerous to own a stock just because you like the dividend. Consistency of recurrence of dividend payments creates an optical illusion that the dividend will always will be there. Just think about it: GE’s dividend of 96 cents was half of what the company was expected to earn and it still couldn’t afford to pay it.

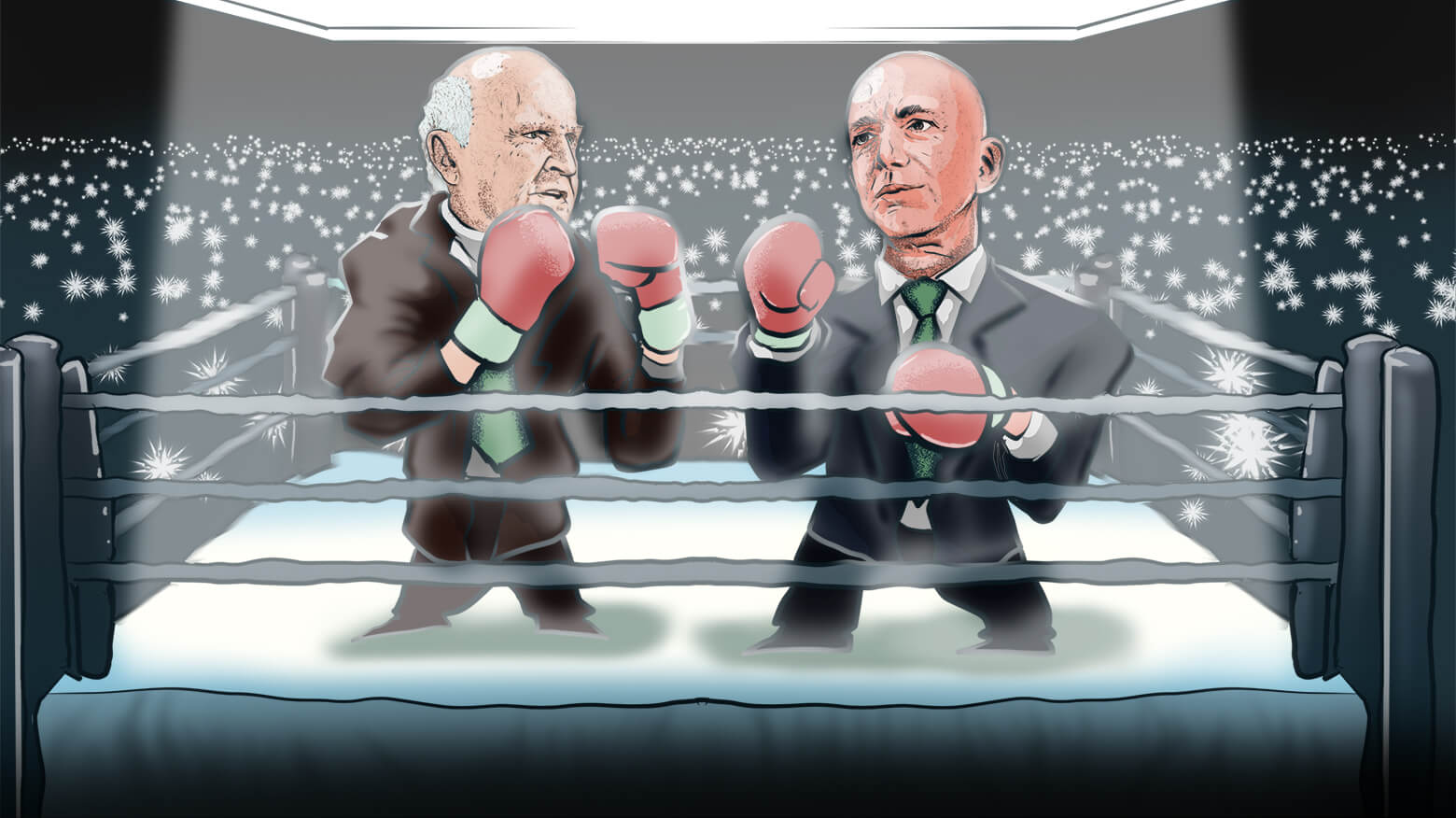

Welch is on the opposite end of the spectrum from Jeff Bezos, CEO of Amazon.com. Bezos doesn’t even know how to spell quarterly earnings. Amazon’s founder once explained that Amazon makes decisions years out. So the current quarter’s report reflects decisions Amazon made several years ago.

As an investor, I don’t want to own companies that are run by the likes of Welch, but my firm does have positions in a few companies with CEOs who have similar approaches as Bezos does to running a business. (We don’t own Amazon shares, though.) Whenever you hear management praise their ability to beat last quarter’s earnings, run.

GE was ultimately destroyed by enormous capital misallocation. Management assumed anything they touched with Six Sigma (a process designed to improve a company’s operations) would turn to gold, regardless of the price they paid. Accordingly, GE wasn’t concerned with how much it paid for acquisitions.

There is another lesson here. As an investor, simplicity and transparency from a company is key. If a company’s business is complex and opaque, move on. One of the most important things in investing is what you do in-between buying or selling a stock. After you buy it is just a matter of time before your initial assumptions come under fire. Maintaining rationality throughout your ownership of the company is paramount, and to do that you need to understand the business well. That’s why I have no opinion on GE shares now.

Once in a while, after my firm has done extensive research on a business we understand, I may have an opinion that runs contrary to the market’s. In those few situations you can drive a truck between the stock price and what we believe the company’s value is, and this is when we dig in and become contrarian-driven buyers.

Above all, never make a decision based solely on someone else’s research; use it as a starting point for your own investigation. (Tips on how to do this are included in this article). And keep in mind that any media reports, or even sophisticated brokerage research, about a company are just snapshots of the moment. If the facts change, be able to change your mind.

0 comments