This article was originally written in 2020, but it still rings true today.

Party like it’s 1999 – this was the theme of our IMA annual meeting in 2019. This is how the stock market feels to us today. No, there are no dot-coms, though temporarily we had dot-cannabis and dot-fake-beef bubbles which got popped. Near zero interest rates, abundant liquidity, and a perceived absence of risk (and fear) turn money into a crude instrument of bubble creation. This is why the stock market is experiencing a lighter version of the previous millennial lunacy.

Growth stocks are incredibly expensive. Value stocks have underperformed growth stocks for the last ten years. The last time this underperformance was this extreme was… wait for it… 1999.

Historically, value stocks have outperformed growth stocks by a significant margin. But they have gone through painful bouts of underperformance in the past.

Value stocks have however shown some signs of life lately. (We are whispering – we don’t want to tempt the stock market gods).

Growth stocks have outperformed for several reasons. Low interest rates favor the bird in the bush (distant future cash flows) not the bird in hand (high current cash flows). Negative interest rates paradoxically make $100 ten years in the future more valuable than $100 already in your pocket. (Yes, chew on this.)

Investors in search of yield have driven the prices of just about everything skyward, and especially anything that has even the superficial appearance of a bond. We are talking about dividend-paying stocks (the likes of Coke and Kimberly Clark), which are treated as bond substitutes. Anything that resembles a services stock is trading at a dot-comish valuation. These companies have enviable recurring revenues, of which they trade at a 20-25x multiple, and investors cannot get enough of them. (Not earnings, revenues.) This is another example that bubbles are just a good thing taken too far (in this case a great thing).

Passive investing through index funds and ETFs benefits expensive companies, as they have a much larger slot in the indices that are put together based on market capitalization. This will end in tears: An ever-rising stock market and investor feelings of safety, either through owning iconic brand stocks or diversification by means of index funds or ETFs, results in complacency and thus underappreciation of the risk embedded in the Average Joe’s portfolio.

If economic growth continues to march along at the current rate and valuations go on expanding, then the market terrain will continue to be smooth. A race car (a more aggressive strategy) will finish the race faster than a four-wheel-drive (all-terrain) vehicle. But if the investing terrain turns rocky, the race car won’t even finish the race, while the all-terrain vehicle plows on through.

The problem is that we have no idea what terrain lies ahead of us, so we’ll always err on the side of durability over speed.

We are not excited about the stock market or the economy; but we don’t own the stock market, we own high-quality companies acquired at cheap to fair valuations. Most of our companies (with one or two exceptions) are non-cyclical. We hold plenty of cash, and where we can, we hedge. So no, this is not your garden-variety portfolio, but we believe we are prepared for whatever future terrain we find ourselves in.

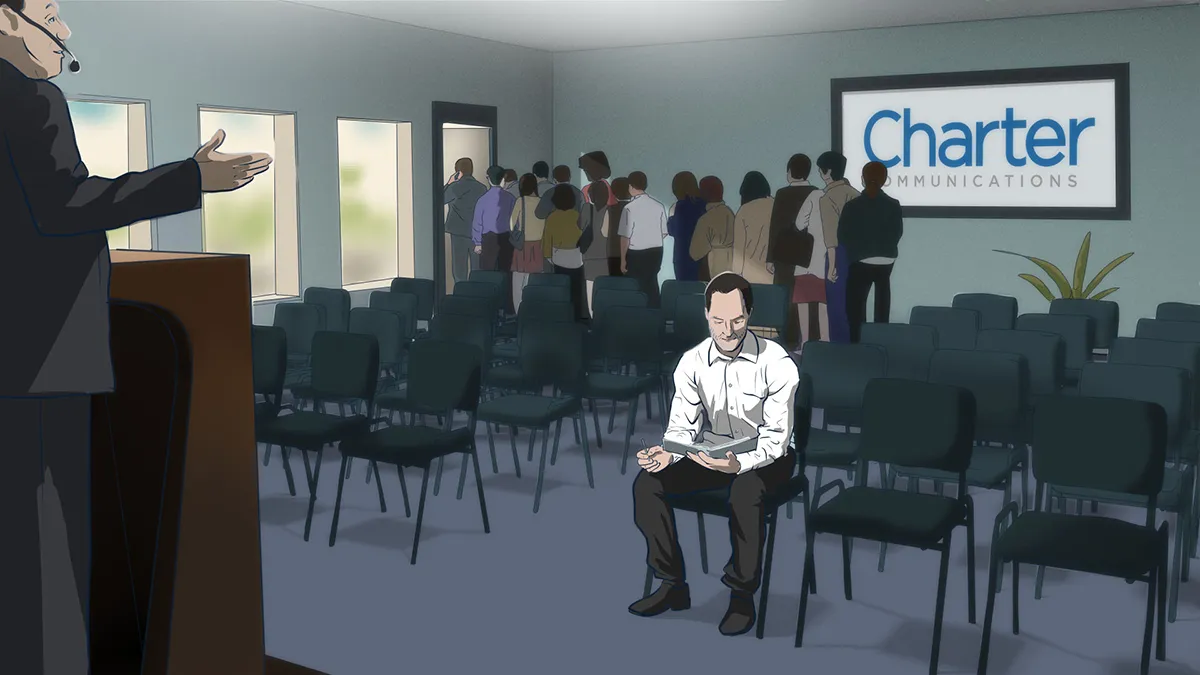

We feel a bit like sober, not-so-popular kids with eczema at a party where everyone else is drunk on the spiked punch and having a great time. We may feel a little envy right now, and – let’s be honest – we are not having a great time. The more commonsensical and rational you are, the less fun you have been having at this party.

But the party will end (they always do), and we are going to be the designated drivers getting our dates safely home. When the music stops and it’s time to go home, the drunk kids will be carried out and suffer giant hangovers. Just sayin’…. That’s what happened in 2001 and countless other times in history, and it will happen this time, too. We just don’t quite know when.

0 comments