Government intervention in the financial system via the Troubled Asset Relief Program made me sick to my stomach, but without it, there is a real possibility that our economy would have come to a screeching halt as trust in the financial system was strained to the point of breaking. Confidence among depositors and banks alike needed to be restored.

The putative bailout of Detroit’s “Big Three” automakers is quite different from TARP, as it will only postpone the inevitable. No matter how much money you throw at them, the Big Three, or at least General Motors, will most likely still go bankrupt. They have managed to lose billions in good times and bad times.

Their business models were broken before the financial crisis hit; the crisis just accelerated the inevitable. The only questions are how soon and how much of the taxpayer’s money they’ll consume before they face their fate, since they have structural problems that will not be resolved until they go bankrupt.

In the 1980s, when the Big Three had virtually no competition, they sold their souls to the devil unions, signing contracts that put them at an incredible competitive disadvantage in today’s environment where consumers don’t have to buy American and have plenty of choices.Unfortunately, these companies are run for and by the unions that have very different objectives than for-profit enterprises. These contracts, for instance, forced GM to run factories at 80% utilization, whether there was adequate demand or not. This, in turn, forced GM to sell cars to car rental companies at cost, killing future demand for its cars as it was only a matter of months before these cars made their way into the used car market.

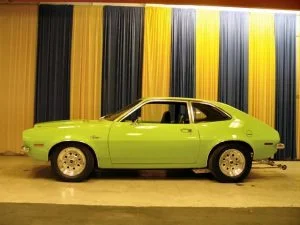

It is hard to judge the true quality of their management as their unions made management’s job impossible. But management is at fault of being stuck in the past and producing gas guzzlers (SUVs and trucks) when consumers clearly demanded fuel efficient vehicles. To its discredit, GM spends half as much on research and development as does Toyota and for three times as many nameplates. This is not a sustainable business model.

Bankruptcy is a blessing, not a curse. Contrary to common perception, bankruptcy doesn’t mean that the Big Three will disappear. Not at all, and quite the opposite. It will insure that they’ll be around 50 years from now. While in bankruptcy, they will be able to break contracts with unions that are choking them, lower their debt burdens by turning debt holders into equity holders (and regrettably wiping out existing shareholders). Their hands will be untied to right-size by shrinking their operations, cutting costs and becoming competitive again.

Jobs will be lost, factories will be closed, benefits cut. Yes, all these things will take place, but the layers of fat that these companies accumulated over the decades need to be shed to confront the marketplace that is only getting more competitive. Today, the Big Three compete mostly with Japanese and European automakers. But competition will only intensify as the world flattens, the quality of Korean cars improves (in many cases, it already has), and Chinese and Indian cars come to the U.S. and the rest of the developed world.

An automaker bailout is simply bad for capitalism. It will put competitors at an unfair disadvantage. It will cost taxpayers money, which at some point will lead to higher interest rates and higher taxes. It will lower economic growth, and it will send an army of other failing companies lobbying to Washington asking the taxpayers to bail them out (though this will likely happen anyway). Finally, and most importantly, it will raise the likelihood of a Japanese-like 15-year recession. We’ll be repeating their mistakes by not letting failed companies go bankrupt and thereby creating an economy full of zombie-like, semi-dead companies.

Capitalism is what needs a bailout. Though we often don’t appreciate it, capitalism is what made this country great. It allows for the fit to succeed by allowing the unfit to fail. Let’s bail capitalism out by letting the Big Three face their fates and not allowing them to become leeches on the backs of the U.S. taxpayer and our economy.

0 comments