Linear thinking is dangerous. It is the easiest form of reasoning, lying on the path of least resistance. The simpler the path, the more readily people will march along it. Linear arguments are easy to make, as they require the least amount of evidence — past data points with a straight line drawn through them. However, the larger the crowd that follows the wrong line of reasoning, the more people pile in, and the greater the consequences if they are proved wrong.

A lot of things in nature, and thus in investing, are not linear. A past trend may or may not persist into the future. Events don’t happen in a vacuum; they are observed, studied and capitalized on — which in the case of investing may preclude a company’s future from resembling its past. As I write this, I think of successful companies whose achievements attracted competition, which then marginalized them.

Some things are inherently nonlinear, their behavior reminiscent of a pendulum’s: The further they swing in one direction, the harder they’ll go in the opposite direction. It is very dangerous to default to linearity with such nonlinear phenomena, as the more confident we become in the swing (the more linearity we observe), the closer we are to the pendulum’s reversing course.

Price-earnings ratios often follow a pendulum behavior. If you look at high-quality dividend-paying stocks — the Coca-Colas and Procter & Gambles of the world — they are now changing hands at more than 20 times earnings. Their recent performance has driven linear thinkers to pile into them, expecting more of the same in the future. Don’t! These stocks were beneficiaries of a swing in the P/E pendulum as it went from low to average and then to above-average levels.

Pattern recognition is an important contributor to success in investing. Mark Twain once said that history doesn’t repeat itself, but it rhymes. If you can identify a rhyme (that is, see a pattern) relating to the current situation, then you can develop a framework to analyze and forecast it. But what if the current situation is very different — if it doesn’t rhyme with anything in the past? This is where the ability to draw parallels becomes helpful. It allows you to overlay rhymes (patterns) from other companies, industries or even fields. Building analogous frameworks is a cure for linear thinking; it helps us see nonlinearity and facilitates the creation of nonlinear mental models.

Then there is pseudolinearity: things that seem to be linear but are forced into linearity by extrinsic factors. This was a subtopic of my presentation at the Valuex Vail investing conference in June. I drew a parallel between two entities that suddenly looked analogous: Jos. A. Bank Clothiers, a Hampstead, Maryland–based retailer of men’s apparel, and the Federal Reserve.

Jos. A. Bank has always been a very promotional retailer. It would jack up prices, then run sales for consumers happy to be deceived — a typical American retail tale. But sometime in 2008, Jos. A. Bank went promotional on steroids. You could not watch CNBC for an hour without seeing one of its ads. The company started out by encouraging you to buy one suit and get one free. Then you got two free suits. Finally, it started giving away Android phones with suit purchases. For a while this past March, Jos. A. Bank offered consumers the opportunity to buy one suit and get three free.

There are several problems with the strategy: It does not emphasize the quality of the suits or the company’s great service, and the ads aren’t helping to build a brand but are intended just to pimp sales at Jos. A. Bank, as if it were a grocery store with USDA choice beef on sale.

This brings us to the latest quarter. Jos. A. Bank’s same-store sales dropped 8 percent, but what really piqued my interest was this explanation by its CEO, R. Neal Black, during its earnings call in June: “Since 2008, at the beginning of the financial crisis and the recession, the overall sales picture has been one of volatility, and strong promotional activity has been consistently and effectively driving our sales increases. This strategy was designed with 18 to 24 months of effectiveness in mind, and we stuck with it for more than 60 months since — as the economy remained weak. Now the strategy has become less effective.”

What Jos. A. Bank has really been doing since the financial crisis is running its own version of quantitative easing. The company had a temporary strategy that was supposed to get people into its stores during the recession — much like the Fed’s original QE, which was designed to provide liquidity in a time of crisis — but the recovery that ensued was not to Jos. A. Bank’s liking. So just as the Fed implemented QE2, and then QE3 when the economy did not improve to its satisfaction, the retailer followed with more QE.

It is understandable why Jos. A. Bank’s management did what it did. The company was being responsible to its employees — it didn’t want to close stores or have layoffs — and it had to report quarterly to shareholders. The focus shifted from building a long-term sustainable franchise to using short-term measures to grow earnings the next quarter and the quarter after that.

There are many lessons that one can draw from the parallels between Jos. A. Bank’s behavior and the Fed’s handling of our economy. First, it is very hard to challenge someone who has a linear argument. Let’s say that a year ago you talked to Jos. A. Bank’s management and raised the question of the sustainability of their advertising strategy. They’d have pointed to four years of success, and they’d have been right, at least up to that moment. They would have had four years of data points and a bulletproof linear argument, and you would have had your common sense and little else.

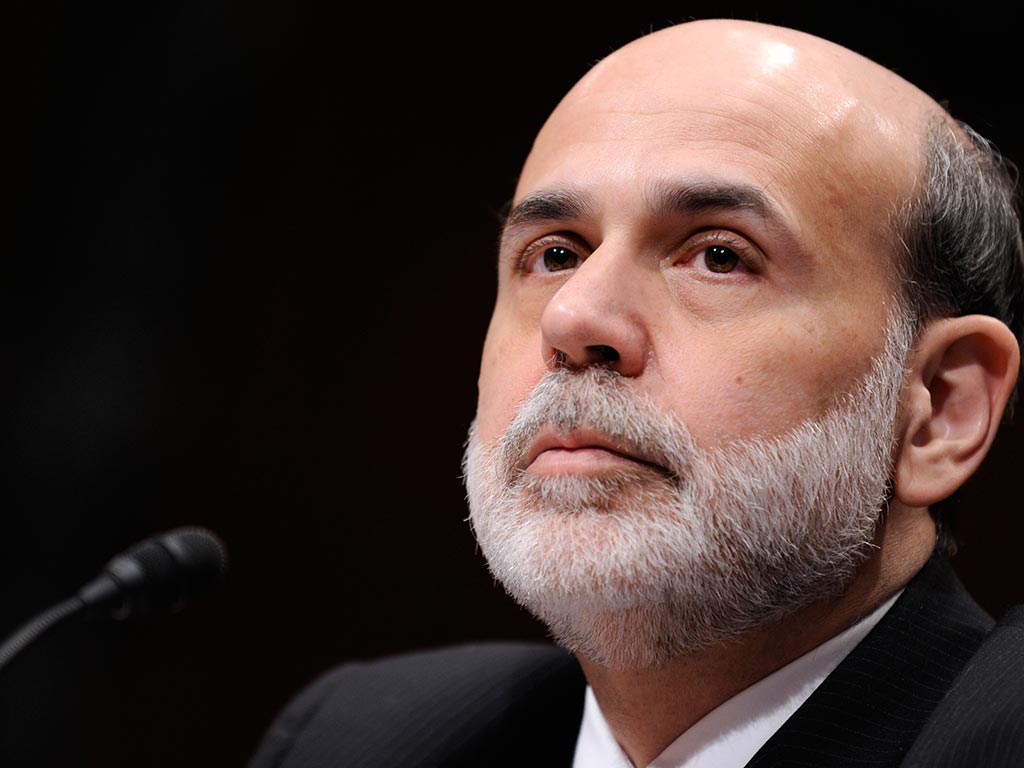

Right now Ben Bernanke looks like a genius. He can show you all the data points in the recovery, but so could Jos. A. Bank, and this leads us to a second lesson: Pain is postponable, but it is cumulative. During Jos. A. Bank’s quarterly call, its CEO also said: “The decline in traffic is because existing customers are returning slightly less frequently. . . . It makes sense when you consider the saturating effect of our intense promotional activity over the past several years.”

With every sale Jos. A. Bank stole its future purchases, because when you buy one suit and get three for free, you may not need to buy another one for a while. But there is also a snowball effect that you cannot ignore: Every ad chipped away at the company’s brand. Now when you show someone that you wear a Jos. A. Bank suit, they don’t think about its quality, just that you have two or three more suits in your closet.

There is a cost to our recovery — a bloated Federal Reserve balance sheet and our addiction to low interest rates. Of course, we spread that addiction globally. According to Hugh Hendry, founding partner and CIO of London-based hedge fund firm Eclectica Asset Management, rising U.S. bond yields have driven global yields higher. “In Brazil for instance, the biggest emerging debt market, no company has been able to raise debt abroad since mid-May as borrowing costs soared to a four-year high in June, at 7.1 percent,” he wrote in a recent investment letter.

The Fed is betting on George Soros’ theory of reflexivity, in which people’s biases and actions can change the economy: Instead of the wagon being towed by the horse, the wagon, in expectation that it will be towed by the horse, starts moving on its own, thereby motivating the horse to start towing the wagon. Lower interest rates drive people to riskier assets, and as asset values go up, people feel confident and spend money, and the economy grows. But this policy puts us on very shaky ground, because reflexivity cuts both ways: If asset prices start to decline, confidence declines — and so will the economy. Now there are a lot more savers owning riskier assets than they otherwise would have, and their wealth is at risk of getting wiped out.

The third lesson from the parallels between the Fed and Jos. A. Bank: We are in the midst of a game of musical chairs, and when the music stops, no one wants to be left standing around holding risky assets. Everyone is focused on the Fed’s tapering, and they are right to do so. Just as we saw with Jos. A. Bank, economic promotions cannot go on forever. With every sale the company had to increase the ante, giving away more and more to get people to come into its stores. The Fed may continue to buy Treasuries and mortgage securities, but the purchases will be less and less effective. And the music may stop on its own, without the Fed doing anything about it.

Last, pseudolinearity eventually leads to high uncertainty and thus lower valuations. Put yourself in the shoes of an investor analyzing Jos. A. Bank today. Before buying the stock, you’d have to answer the following questions: What is the company’s earnings power? How much did its promotional strategy damage the brand? And how much in future sales did that strategy steal?

In the wake of Jos. A. Bank’s own five-year, nonstop version of QE, it is difficult to answer these questions with confidence. The company’s earnings power is uncertain, and investors will be willing to pay less for a dollar of uncertain earnings, thus resulting in a lower P/E. At some point, when U.S. economic activity weakens, investors will have to answer similar questions about the U.S. and global economies. And as they look for answers, they’ll be putting a lower P/E on U.S. stocks.

0 comments