Berkshire Hathaway buying Heinz is unlike any deal Buffett has ever done. In his past deals he was always a passive owner – he let existing management continue to run the company. In this case 3G, a private equity firm that has done terrific turnarounds in the past, will be the new management. They are putting in $1 billion of capital for half of ownership, but also a lot of sweat capital. On the surface Buffett is paying 20 times earnings, a fairly high multiple even for this high-quality business, but 3G involvement will likely elevate the earnings power of Heinz significantly over time. So this is a classic Buffett deal in one respect: Buffett is saying, I’m willing to pay a premium for a quality business that has long-term pricing power. (Heinz scores great on both counts). Buffett is willing to pay a premium for it, but this time the premium is less than it appears on the surface.

Please read the following important disclosure here.

Enjoyed this read?

Share it with someone who’d love it too!

New to investing?

Explore these valuable guides to get started.

Related Articles

Q&A Series: Managing Market Pressures and Evaluating Serial Acquirers

I held a Q&A session with readers a while back. In this email, we'll discuss how to handle market pressures and our view on serial acquirers.

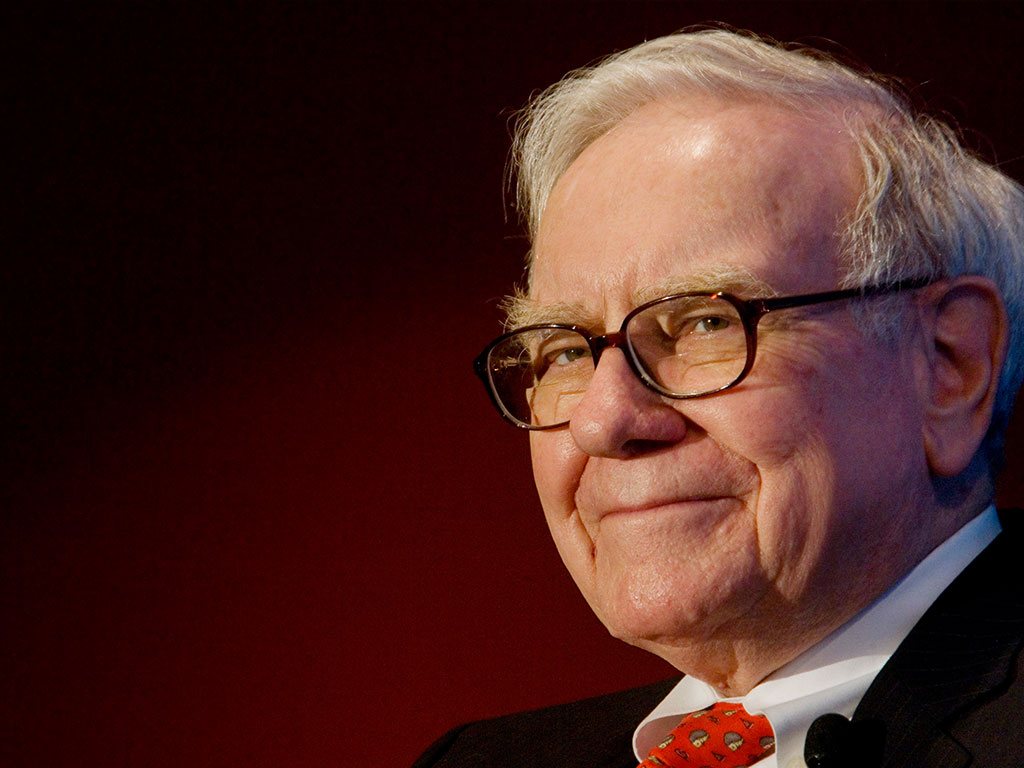

Warren Buffett and the Berkshire Hathaway Paradox

Trip to Omaha has everything and nothing to do with Warren Buffett. The main event that draws everyone to Omaha – the Berkshire Hathaway (BRK) annual meeting – is actually the least important part.

Redefine “value” in this era of the US stock market

Do we need to redefine “value” in this era of the US stock market, or should we continue to sit on the sidelines if traditional metrics show equities to be overvalued?

A Brief Rant on Tesla & Musk

Last week, I received a lot of responses to my article about Tesla. They ranged from “Stop spewing your anti-right propaganda and stick to data” to “You don’t like Tesla stock. Are you saying your next car won’t be a Tesla?”

0 comments