Stock Analysis

What I Learned from the J.C. Penney Fiasco

In this article I would like to put salt in the open wound and talk about what I learned from the J.C. Penney fiasco.

Interview with The Disciplined Investor Podcast

I was a guest on Andrew Horowitz's the Disciplined Investor podcast.

Stansberry Radio With Dr. David Eifrig

I was interviewed by Dr. David Eifrig on Stansberry Radio (to listen, click here):

How to Capitalize on the Bakken Oil Boom

Oil production in the Bakken Shale region of North Dakota has soared from 400,000 barrels (bbl) per day in 2011 to 1 million bbl per day in 2013.

Time to Buy Former Retailing Darling Tesco

I’ve been solving the puzzle of Tesco since Warren Buffett bought a stake in the grocer a few years back. The pieces I gathered piqued my interest.

Germany, Europe and Mother Russia – Excerpts from VALUEx Vail

I always look forward to Hendrik Leber's presentations. Hendrik runs a value investment fund named Acatis Investment out of Frankfurt, but he invests globally.

The Process – from VALUEx Vail

Investing is a peculiar industry because randomness is so deeply embedded in everything we do. I am always fascinated by the investment processes of other successful firms.

Why Investors Hate Apple — and Are Dead Wrong

In this article I don’t discuss Apple’s valuation, balance sheet, or financials. I covered these topics in great detail in these articles a few months ago.

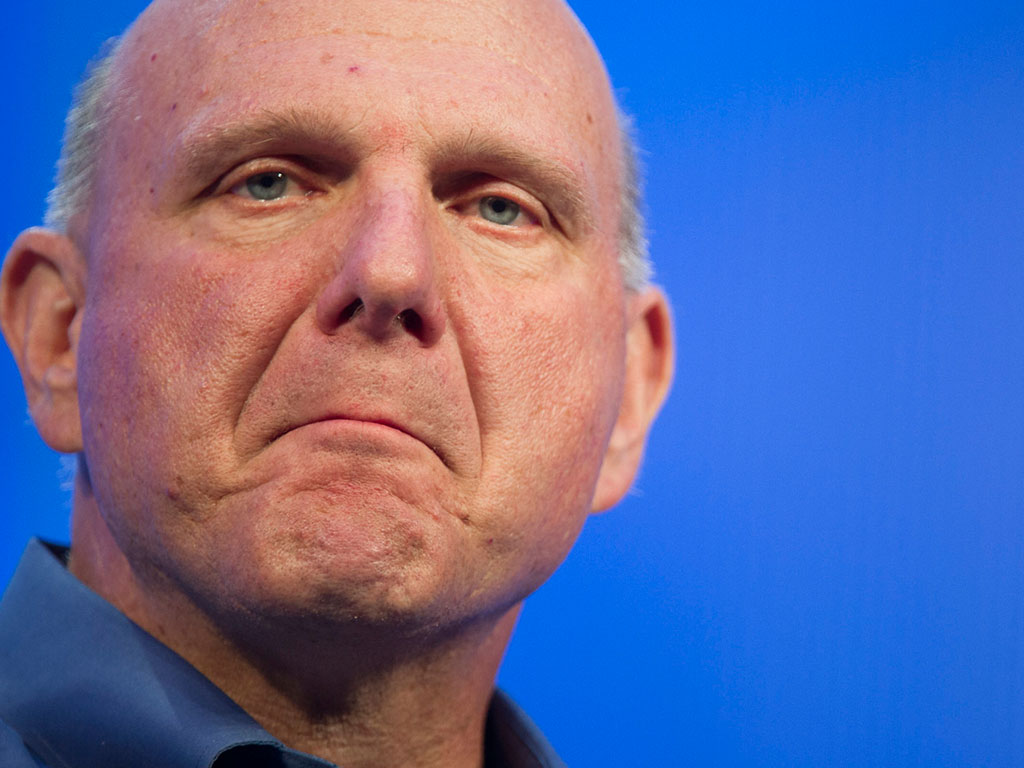

Nokia Deal Could Mark the Last Chapter for Microsoft

Microsoft needs a new CEO who is an outsider and not entangled in internal politics. It is in desperate need of a Lou Gerstner-like leader

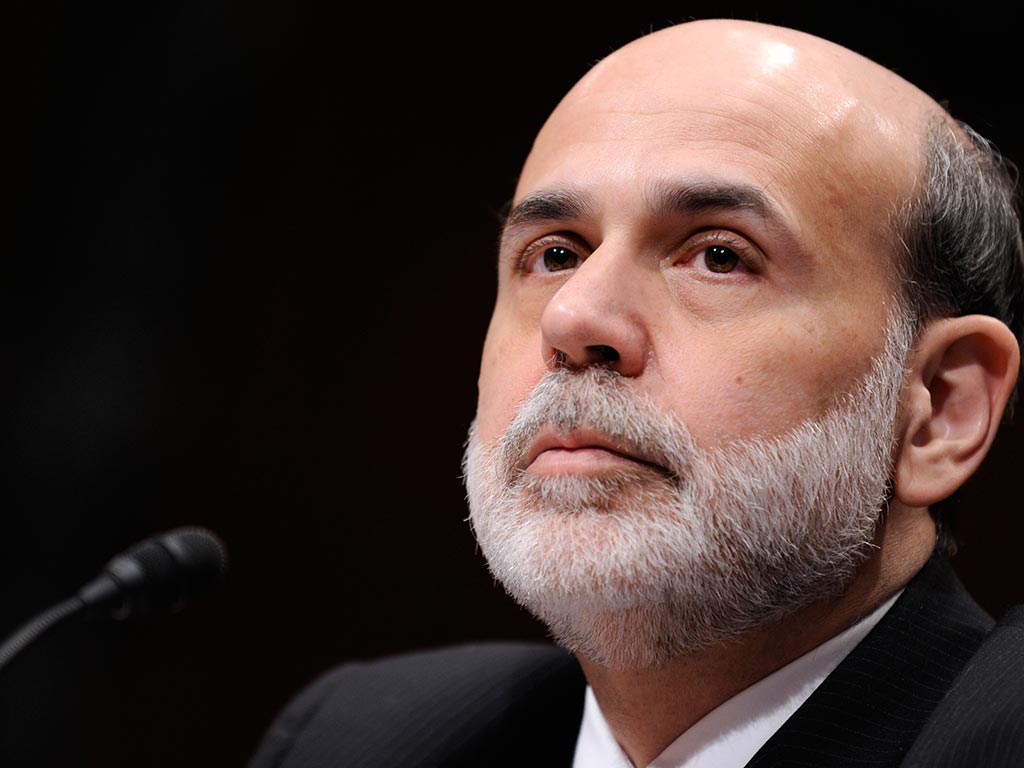

Ben Bernanke: Buy One Suit, Get Three Free

Linear thinking is dangerous. It is the easiest form of reasoning, lying on the path of least resistance. The simpler the path, the more readily people will march along it.

Canada’s China Problem Is Greater than Its Housing Problem

I keep hearing that Canada is in the midst of its own real estate bubble, and I wonder if our northern neighbor will have its own banking crisis soon.

Jim Chanos and the Commodities Supercycle at Valuex Vail

This year James Chanos gave the Valuex Vail attendees an update on the Chinese bubble: It is alive and kicking. Jim estimates that Chinese spending on residential construction is currently running at 20 percent of GDP.

Jesse Livermore: Parallels Between 1920s and Today

There are lot of similarities between the 1920s and today. In fact Livermore’s quote says it all: “There is never anything new on Wall Street, because speculation is as old as the hills.” Jon talked about how the 1924-1929 bull market was rigged by stock manipulators.

Valuex Vail: Coming at Shale Oil from a Different Angle

The U.S. oil market, which is going through one of its largest transformations in decades. In fact, watching this market is like watching the invisible hand of a maestro conduct a gigantic orchestra within the constraints imposed by various laws and regulations.

Deep Thoughts from the Valuex Vail Conference

Valuex Vail is over. The three days of this investing conference, which I organize, are probably the most stimulating three days of the year for me.

Presentations from VALUEx Vail 2013

I've written a series of five articles sharing my thoughts from the VALUEx Vail conference. They will be published over next few week on Institutional Investor.

Finding Investment Value Outside the U.S.

U.S. investors have been brainwashed into thinking that whenever we venture beyond our shores we take on more risk.

Are We There Yet?

Are we still in the grip of a treacherous sideways market, or we are now entering into a secular bull market?

Tweets from Warren Buffett’s Woodstock

Over the years, the beginning of May has turned into a wonderful tradition: a trip to Omaha to Buffett’s Berkshire Hathaway annual meeting.

Mea Culpa – Whistler Blackcomb

Our investment process is both qualitatively and quantitatively intensive. Throughout the course of a year we look at hundreds of companies.

Whistler Blackcomb Beckons for Investors

I recently stumbled on another, no-less-intriguing ski resort: Whistler Blackcomb in British Columbia.