Stock Analysis

Video: I Like Big Dividends and I Cannot Lie

This song was part of Vitaliy Katsenelson's presentation at the Value Investing Congress in Las Vegas in 2013. The theme of the presentation - I Like Big Dividends and I Cannot Lie.

I Like Big… and I Cannot Lie – Presentation

My presentation at Value Investing Congress in Las Vegas in 2013

See You in Omaha, Again!

Over the years the beginning of May has turned into a wonderful tradition: the trip to Omaha to Buffett’s Berkshire Hathaway annual meeting.

Finding Yield and Value in Dividend-Paying Stocks

If I were a dividend, I’d fire my press agent. I’d be jealous and feel neglected because stock prices get a lot more attention than they deserve.

How HP Can Navigate the Information Superhighway

Когда Hewlett-Packard Co. обсуждается в средствах массовой информации, она изображается как компьютерная компания. На первый взгляд, это имеет смысл: HP ...

No Kodak Moment for Hewlett-Packard

After the shares of Hewlett-Packard Co. had been halved from about $48 earlier that year, I made a case for the stock.

Michael Dell, Who’s Your Daddy?

Michael Dell should ask himself: "Who is my daddy?" His current daddy makes it impossible for him to transform Dell from a PC maker into a technology services company.

Buffett Buying Heinz – Not As Expensive as Appears

Berkshire Hathaway buying Heinz is unlike any deal Buffett has ever done. In his past deals he was always a passive owner.

How Much Would You Pay for the Apple Ecosystem?

Apple’s ecosystem is an important and durable competitive advantage; it creates a tangible switching cost after Apple has locked you into the i-ecosystem.

Understanding Apple Requires an Analysis of Fundamentals and Psychology

What makes Apple stock difficult to own is psychology. The company’s success since 2000 is a black swan.

Looking for “Herbal” in Herbalife

Months before the recent Sturm und Drang surrounding nutritional-supplement maker Herbalife, my firm took a long, hard look at the company.

On Y! Breakout – Apple (not yet)

I was on Yahoo! Breakout with terrific Jeff Macke discussing Apple ….

Bargain Hunting at J.C. Penney

J.C. Penney Co. is a classic short-term pain arbitrage stock. There is a lot of uncertainty about what the retailer’s sales will do in the near future.

Finding Value in HMOs

HMOs appear to be perfect stocks for today’s market. They have good balance sheets, terrific free cash flows and recurring, highly economics-insensitive revenues.

Electronic Arts – Revenge of the Nerd

Electronic Arts stock is scratching 52-week lows. It is unloved, but for some good reasons: its sales have stagnated for years.

Helmerich & Payne Analysis

I took a serious look at Helmerich & Payne and, though we really liked the company, my conclusion was not to buy the stock at this price.

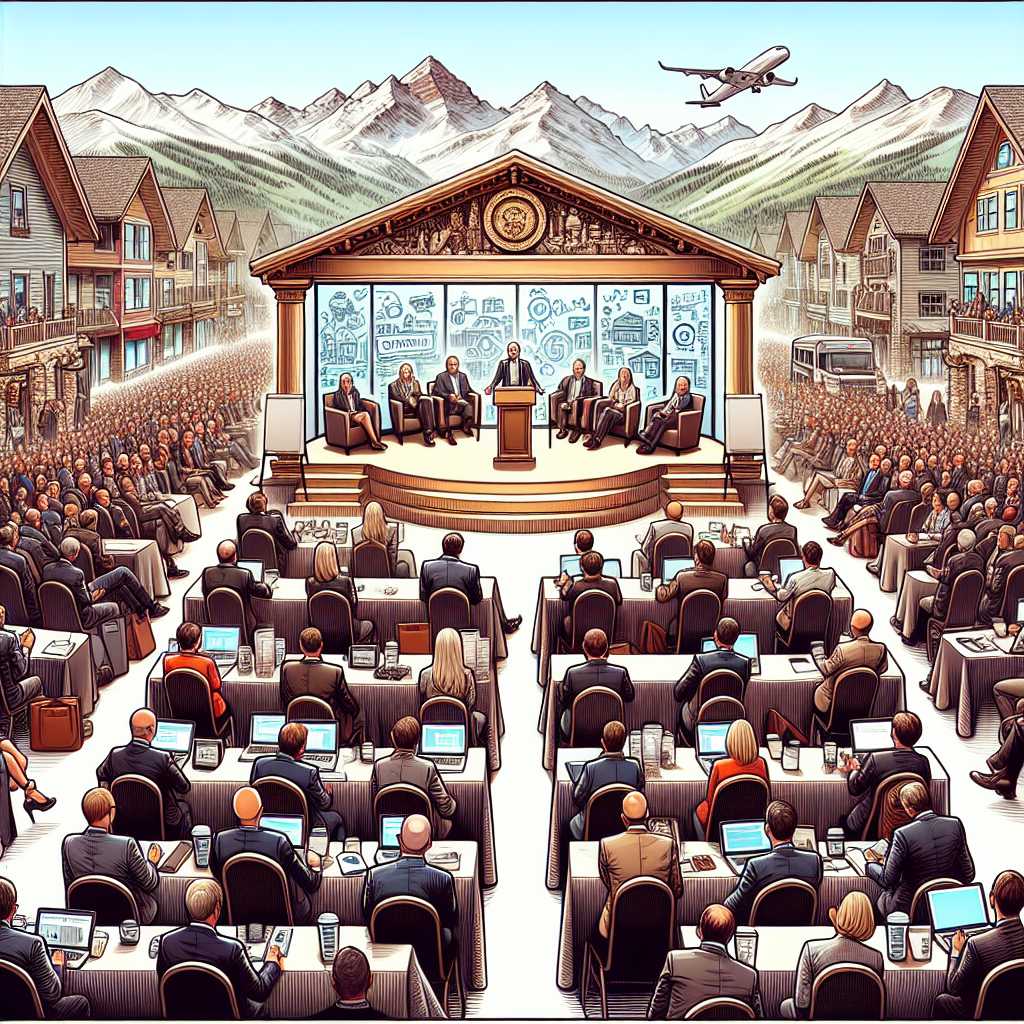

Thoughts from VALUEx Vail 2012 Conference

VALUEx Vail is not your typical conference. It is a not-for-profit (but for-learning), by-invitation-only (you have to apply to be invited) conference.

VALUEx Vail 2012 – Amazon’s Valuation

In this series of several articles I’ll discuss my thoughts from the VALUEx Vail conference. The idea for this conference came to me when I attended VALUEx Zurich

The China Syndrome

MOST PEOPLE are convinced by now that there is a fixed-asset bubble in China that is on the verge of bursting. The question is, what is next?

Why Windows 8 Made Me Sell MSFT

A few weeks ago we sold our shares of Microsoft. Because we believe the stock is undervalued, that decision was not easy. What changed?

Everyone Who Says Facebook’s IPO Failed Is Wrong

I wrote that Facebook stock was overvalued, while last week I wrote that Facebook’s valuation at IPO was fair. Those statements are not contradictory.