Stock Analysis

Speaking, Travel and See you in Omaha

I’ll be giving a talk about Active Value Investing to the Bermuda CFA Society on February 11th. On the way to Bermuda my wife and I will spend three days in NYC.

Even Capitalist Pigs Should Love Bank Regulation

I am a Capitalist Pig, and proud of it, thus you would not expect me to support government interference and more strenuous regulation of financial institutions – after all, capitalism (free markets) and tight regulation don't mix well.

Chinese Quest for Shortcut to Greatness

The Chinese economy must be getting out of control, because the Chinese government is doing the unthinkable: It is desperately trying to put the brakes on the economy.

The case for Pfizer

I understand why investors don’t want to own Pfizer (PFE); there is little excitement in the stock.

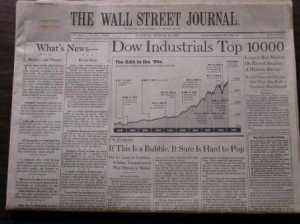

Welcome to Another Lost Decade

The stock market’s performance over the next decade will be very similar to the one since 2000: the WSJ appropriately named it “the lost decade.”

Barron’s: Economic Steroids Are Toxic, Too

The global economy is like a marathon runner who ran too hard and hurt himself. This runner has been injected with some industrial-quality steroids

China vs. the World

Investors have a healthy distrust, and rightly so, of governments running banks in the US and UK, but for a very strange reason are comfortable with the Chinese government wheeling and dealing with Chinese banks.

Q&A with FT:Investing in Range-Bound Markets

In the bull market that preceded the collapse of Lehman Brothers and the ensuing financial crisis, equity valuations reached some very frothy levels.

Dubai’s Shot to the Moon

Dubai’s plan to diversify away from petrochemicals made sense. Maybe it is even destined to become the Las Vegas of the Middle East, the Mecca of business travel and luxury.

Our Steroidally Challenged Economy

The global economy reminds me of a marathon runner who runs too hard and hurts himself. But now he has another race to run. So he’s injected with some serious, industrial-quality steroids, and away he goes.

IMS Health is being stolen

It was announced Thursday that IMS Health was to be stolen from its shareholders for $4 billion or about $22 share; a private equity firm will buy them out.

Will Japan drive our interest rates higher?

In investing, it's important to think unconventionally and creatively while at the same time considering risks - no matter how remote or unmanageable they are.

Is American Express (and financial stocks) still cheap?

There are very few financial companies that one can actually analyze and thus value -- American Express (AXP) is one of them, and I believe it's a great proxy for other financial stocks.

September – the worst month for stocks

September 1st is a very strange day for me. In Russia the school year across the whole country started on September 1st. I vividly remember myself as a child on that day throughout my childhood.

Healthcare Game

In his healthcare proposal President Obama is using a tactic described in behavioral finance as anchoring.

Reappraising China’s ‘Staggering’ Growth

I am not writing this under duress, neither my family nor I were kidnapped by the Chinese government; I simply made a mistake in my last note about China.

IMS Health – Think Longer-term

IMS Health (RX) did not have a spectacular quarter to put it mildly. Revenue decline (on constant currency basis) accelerated to 4% from a 2% decline last quarter.

Microsoft – Is Not Over Until it is Over

I’ve received a few emails asking my thoughts on Microsoft’s (MSFT) quarter. Here is my take: this is probably the least meaningful quarter in the company’s recent history.

Caterpillar’s Earnings

It is interesting to observe the excitement the Street has with Caterpillar's (CAT) earnings. They were better than company thought last quarter.

Random thoughts, Stocks for the Long-Run, no more

Today I’ve caught up on my last three BusinessWeek podcasts, called “Story Behind the Story.” John Burns, BW’s editor, interviews the reporter who wrote this week’s cover story.