Stock Analysis

War in Ukraine: Part 2 – The New World

Just as 9/11 dramatically changed the flow of history, resulting in two wars and hundreds of thousands of deaths and millions of lives ruined, so too will Putin’s invasion of Ukraine. Right now, we are seeing only the first effects and getting glimpses of second-order effects. The broad third-order effects will not be visible for a long time, though they’ll be obvious in hindsight.

War in Ukraine: Why I Was Blindsided, Part 1

Eight days before Russia invaded Ukraine, I wrote an article saying there would be no war. I was certain of it. I was wrong. Why I was blindsided? The more you knew about the situation, the more likely you were to get it wrong.

See More Clearly With These Two Mental Models

I'm a big fan of mental models. They allow you to think through analogy, often folding complex concepts into simple ones and transporting them from one discipline to another. They're thinking shortcuts. If you arm yourself with mental models, you’ll often see what others don’t.

COVID, Inflation, and Value Investing: Answers to “Millenial Investing”

I was recently interviewed by Millennial Investors podcast. They sent me questions ahead of time that they wanted to ask me “on the air”. I found some of the questions very interesting and wanted to explore deeper. This article is that exploration.

Not So Quiet on the Eastern European Front

To understand the situation, we have to at least attempt to understand the Russian perspective. After the collapse of the Soviet Union, the US and Western allies made a promise to Russia that NATO would not expand its membership to countries that had borders with Russia. In the US we are spoiled by our geography; we feel secure. Russia sees Ukraine joining NATO as a clear and present danger to its national security.

How to Build a Portfolio for Today’s Crazy Markets

We don’t know what the stock market will do next. We have opinions and hunches, and we never act on them. We never try to predict the market’s next move. Neither we nor anyone else is good at it. The only thing we can do is to trim the sails of our portfolio to align with the winds of inflation.

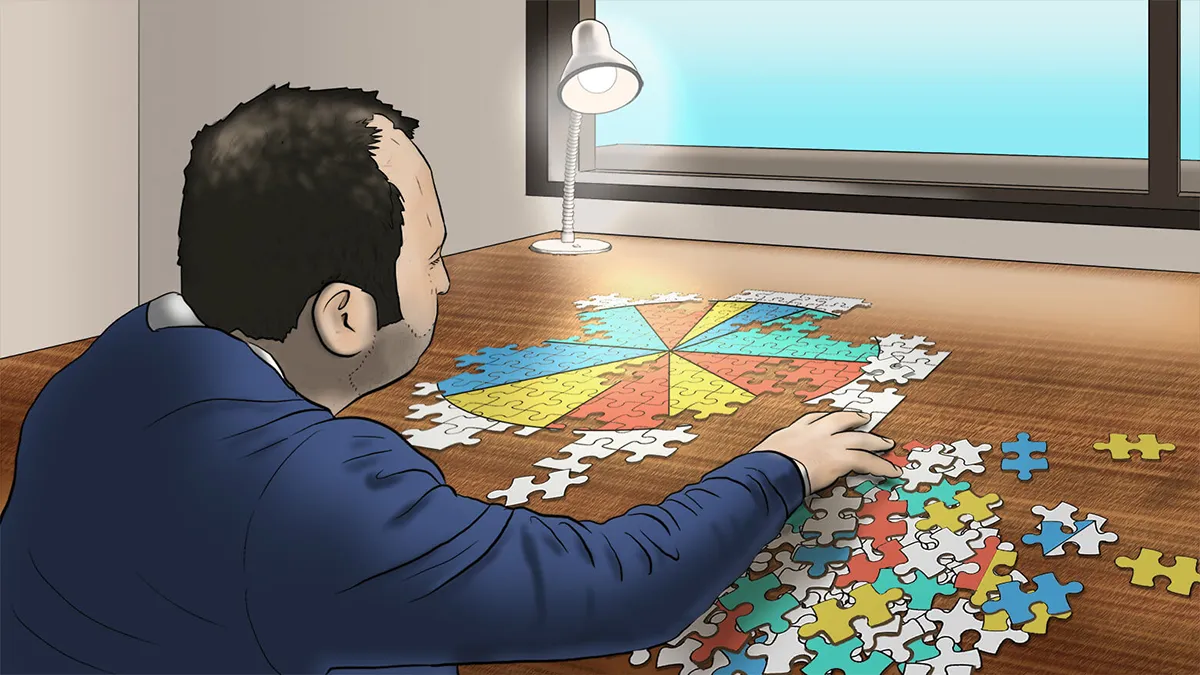

Position Sizing: How to Construct Portfolios That Protect You

Some investors think the fewer positions you own, the cooler you are. I remember meeting two investors at a conference. One had a seven-stock portfolio, the other had three stocks. Sadly, the financial crisis humbled both. On the other hand, too many positions breeds indifference. At IMA, our portfolio construction process is built from a first-principles perspective.

Why Green Energy is a Luxury Belief – But Won’t Be One Forever

Being a rich country has allowed us to develop what some call “luxury beliefs” – ideas that make us feel good but that fail upon contact with objective reality. We ignore inconvenient truths about green energy and keep marching on, trying to convert an even larger portion of our economy to wind and solar, without contemplating the related costs. When it comes to electricity generation, luxury beliefs can be dangerous.

McKesson: Why the Best is Yet to Come

What we have today in MCK is the largest drug distributor in the US, with a very stable and growing business. It is very cash-generative, doesn’t need much capital to grow, and has a very high return on capital. Owning the stock was very stressful at times but also very rewarding. But the best is yet to come for MCK.

I Kid You Not Crazy

It seems that every year I think we have finally reached the peak of crazy, only to be proven wrong the next year. The stock market and thus index funds, just like real estate, have only gone one way – up. Index funds became the blunt instrument of choice in an always-rising market. But you don’t have to be a stock market junkie to notice the pervasive feeling of euphoria.

How to Invest When There’s Nowhere to Hide

I was having lunch with a close friend of mine. He mentioned that he had accumulated a significant sum of money and did not know what to do with it. It was sitting in bonds, and inflation was eating its purchasing power at a very rapid rate.

This Holiday, Will Mr. Market Eat Too Much Pi?

There happens to be a cryptocurrency, one of thousands, that is also named Omicron. I still cannot grasp the logic behind it, but that cryptocurrency was up 900% on the day the South African variant was christened. There must have been a trading algorithm or a lot of bored investors looking for the next gamble, to drive something seemingly worthless up 900%.

Inflation Update: Not Transitory Yet!

Today we are experiencing a perfect storm of inflation. A perfect storm is formed by seemingly small factors. Each one on its own may not be particularly significant, but once combined they result in an event that significantly exceeds the sum of all parts. I provide an update on my previous two inflation articles, and the risks I see on the horizon in the next few quarters.

Inflation Update: Not Transitory Yet!

Today we are experiencing a perfect storm of inflation. A perfect storm is formed by seemingly small factors. Each one on its own may not be particularly significant, but once combined they result in an event that significantly exceeds the sum of all parts. I provide an update on my previous two inflation articles, and the risks I see on the horizon in the next few quarters.

Beloved Country. Unloved Hedge. (Updated)

My thinking on gold, the US Dollar, our national debt and our reserve currency status has not really changed much since August 2020, except that at IMA we have been increasing our exposure to foreign companies whose business is not tied to the US. We still have a small hedge in gold – I am as unexcited about it as I was when I wrote this article.

Our Analysis of UBER (Updated)

I re-share and update my analysis of Uber, and why it remains an attractive investment. I provide a mental model of how to analyze companies that may appear expensive but have yet to reach escape velocity in their cost structure and have a large market addressable market that they’ll likely dominate.

US and China: In the Foothills of Cold War (Updated)

In this article, I update my views about the US and China, and include my original article going over the risks posed by tensions between the two nations. I also discuss and share an update on IMA's investment in defense stocks, in light of the current geopolitical climate.

The Softer Side of Value Investing

Culture matters. I share how I evolved from an analyst purely focused on numbers to an investor and CEO focused on people. Using two stories from IMA's own past, I recount how running the business made me a better investor.

Fool’s Gambit

In investing, there are many "games to play". There are a lot of ways to try to make money in the market, and not all of them are good, rational, or productive over the long term.

Sideways Market

I go over why we may be entering a sideways market (I wrote two books on this subject), as well as how to invest in them.

How To Invest In Inflation

Finding investments to weather the storm. Strategies and ways to mitigate inflation risk, including investing in businesses with pricing power, capital intensity, and investing abroad.