Cryptocurrencies were supposed to offer a new, virtual alternative to the current, mundane, “corrupt” system, in which a few dozen bureaucrats in conference rooms around the world – central bankers – manipulate the most important commodity of all – interest rates – the price of money.

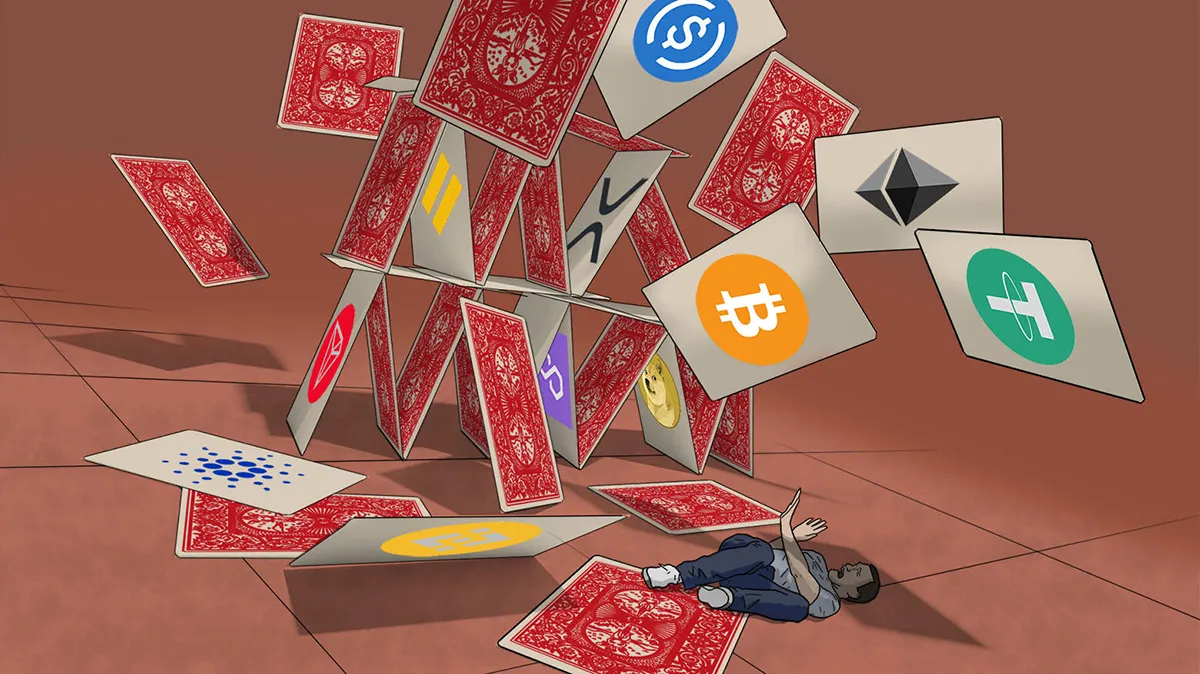

The collapse of FTX (a cryptocurrency exchange that was valued at $30 billion just a few months ago) and the subsequent bankruptcies revealed what may have started as a kernel of sincere libertarian ideas to stand up to endless money printing and debt creation in our financial system, has been hijacked by what appears to be an immutable flaw of the human condition: our greed and desire to get rich fast.

The cryptocurrency world transformed into an even more corrupt and leveraged system than the one it was attempting to replace. Theft committed by thousands of cryptocurrency and NFT creators made Wall Street, which society loves to hate, look like a group of nuns, as they were stealing money from the public in broad daylight.

With every bubble, we are reminded that there is nothing new under the sun. The most recent iteration has benefited from technology and social media which just expedited the ascent and widened the reach of its perpetrators.

Sam Bankman-Fried (SBF), a twenty-something nobody, stepped into the bright spotlight of the media and began buying off politicians by the dozen. In fact, SBF made Madoff, the reclusive chairman of NASDAQ who had been lurking in the shadows for decades, look like an amateur. What took Madoff decades, SBF accomplished in a few years.

By calling the zeros and ones stored in a decentralized database a currency, our society has normalized something that has no intrinsic value, as it has no cash flows and limited utility. Yes, the words we use matter; just because something is limited in quantity does not automatically make it valuable and turn it into a medium of exchange for goods and services (that is, a currency) or valuable art (referring to NFTs here).

Crypto tulips were touted as a decentralized, grass-roots alternative to the centralized, regulated government-run system that was involved in endless QE and money printing. Though the crypto ledger (the database) is decentralized, unless you are going to store the digital key that unlocks your digital treasure on a USB stick and risk losing it, you’ll have to rely on exchanges and digital wallets that are unregulated, expensive to use, and have proven to be a significant point of weakness.

As you look through the ruins of the crypto collapse, you will find that the crypto tulip market is nothing more than a giant, unregulated, leveraged casino, whose sole purpose is not to improve the world or deliver technology of the future, but to enrich its creators and provide degenerate gamblers with an avenue to speculate or offer a get-rich-quick opportunity disguised as investing. This is the entire reason for the existence of the crypto world.

Leverage drove speculation and prices upwards. Conversely, it is driving prices downwards and destroying confidence in the system which was built on the quicksand of hope and greed. It is fracturing the narrative that was the only thing crypto tulips had going for them.

The collapse of FTX may have been a “Lehman moment” for the crypto universe, but it is unlikely to have a significant impact on our financial system. It will spill into the real world, but only on the margins. Unfortunately, many everyday people were infatuated by the prospect of getting rich quickly and predictably lost their life savings. Some venture capitalists will lose other people’s money and their own reputation. The crypto decline will reduce the demand for microchips that were used to produce crypto garbage, as well as digital advertising which was used to spread the lie. There will be some other second- and third-order effects that will become obvious in hindsight.

Ironically, as much as I criticize the current flawed system, the collapse of crypto was a fascinating experiment. It showed that leaving the financial system to complete anarchy without safeguards, regulation and a fear of the law brings out the worst in us and thus results in thievery and complete chaos.

Key takeaways

- The crypto market crash, exemplified by the FTX collapse, revealed that cryptocurrencies had evolved from a libertarian ideal into a corrupt, leveraged system worse than the traditional financial system it aimed to replace.

- The crypto market crash exposed the dangers of unregulated financial systems, with theft and fraud becoming rampant in the cryptocurrency and NFT space.

- The crypto market crash was driven by excessive leverage, which initially propelled prices upward but is now causing a downward spiral and destroying confidence in the entire crypto ecosystem.

- The FTX collapse may be a “Lehman moment” for the crypto market crash, but its impact on the broader financial system is likely to be limited, mostly affecting individual investors and some venture capitalists.

- Ironically, the crypto market crash demonstrated that a completely unregulated financial system leads to chaos and theft, highlighting the need for some level of oversight and regulation in financial markets.

Update us on Russia/Ukraine? I tuned in to a podcast with Maajid Nawaz on http://www.Odysee.com and it was quite disturbing as to the real reasons this game continues….What if anything do you know about FTX laundering money via crypto from all the tax payor funded aid approved by our US democratic controlled Congress in 2022 and prior to?

Do you consider that Bitcoin can replace USD as reserve currency?

Another superb article! I’ve been a reader for years. Your contributions to value investing and education are legendary.