I made a case for Boise, Idaho–based chip maker Micron Technology in April 2014. For a while I looked brilliant: The stock went vertical from $22, peaking at $36. Nine months later its price halved, giving me two opportunities: Buy more Micron, and write more about it. In fact, this write-up comes with a bonus — a product review.

In 2014 my thesis for Micron was simple: The structure of the memory industry has changed. It went from dozens of state-subsidized players to just three in DRAM (more formally known as dynamic random-access memory) and four in NAND (memory that goes into solid-state drives, or SSDs). Each remaining player has sufficient scale and is focused on profitability and return on capital. Additional capacity will be added very cautiously, which in turn will result in industry growth and much more profitable business for everyone, including Micron.

I wrote: “The gross margins of all memory companies have been gradually rising and still have significant room to grow. If Micron achieves its target margin level, in the mid- to high 40s, its earnings will hit $4 to $6 per share in a few years.”

For a while, as I said, I was brilliant: Micron was on its way to earning somewhere around $4 in 2016. But then the PC market, which everybody expected to continue to grow, suddenly declined. PC sales at the retailer level fell 10 percent; however, orders for DRAM chips tumbled 20 percent as PC makers aggressively reduced their inventories.

DRAM manufacturers suddenly found themselves with an overcapacity of PC DRAM. What is important to note is that this overcapacity was not caused by irresponsible behavior on the part of the manufacturers but by the precipitous drop in PC demand. It takes a few months for these companies to retool their production lines; in the meantime, the PC DRAM market was oversupplied, and prices collapsed. PCs are not going away, but they are not a growing market anymore. In addition, current demand for PCs has been muddied by Microsoft’s introduction of Windows 10 (or, as I like to call it, Windows 8-fixed). Since Microsoft is providing it as a free upgrade, I’m not exactly sure of the impact it will have on PC sales — it may actually postpone the upgrade cycle by a year or two.

But here’s the good news. Micron’s success in the DRAM space doesn’t depend heavily on future PC sales. PC DRAM accounts for a little bit more than 20 percent of Micron’s DRAM sales. And Micron’s reliance on PCs is decreasing fast because of the insatiable demand for DRAM in mobile phones. As smartphones increase their IQ, they require more and more DRAM, and the number of smartphones is growing rapidly. Smartphones already represent more than 30 percent of DRAM sales.

Over time, as supply and demand for DRAM equalize, we believe chip prices will normalize and Micron’s per-share earnings will reach our expected $4 to $6 range.

It is also important to note the significance of NAND to Micron. I never thought I’d be making product recommendations, but I think you and your family will thank me for the following one — and it will demonstrate the future value of NAND.

A few weeks ago I discovered Google Photos. I have three kids, and when I found out that Google Photos provides unlimited storage backup for my 400 gigabytes of photos and videos, I couldn’t resist. We have four iPhones in our family (only my 16-month-old daughter, Mia Sarah, doesn’t have one — yet), and we take a few gigabytes of video and pictures a week. I almost feel that I’m failing as a father if I don’t document every new expression that Mia Sarah comes up with. In addition, we have Canon digital SLR and GoPro cameras, so backing up pictures and videos online was cumbersome. Google Photos solved this.

Now when I take videos on my iPhone, they go directly to Google Photos, and I don’t have to worry about the space they use up on my external drives at home. But this alone would not cause me to write about Google Photos. It’s what Google does with the pictures and videos once they are uploaded to its servers that is really interesting.

If you go to your Google Photos page in your browser or smartphone app, you’ll encounter the product’s incredible magic. First, its facial recognition software allows you to view every photo of a particular family member or friend. Suddenly, pictures from ten years ago come back to life. Google also lets you search images by keyword. If I type “bike” in the search field, Google’s object recognition algorithm returns pictures of my kids learning to ride bikes and video I took of my mother-in-law trying out a tricycle in a cycling store. It will also find you pictures with “snow,” “sunset,” “rain” and “boat” keywords. It can even search photos by location.

But that’s not all. Under the Assistant tab Google Photos creates home videos, stories, interactive JPEGs and collages for you. Google Photos selected pictures and videos from our trip to Florida last November, added music and created a one-minute highlight video of the trip. You would never believe that it had been completely created by a computer without any human meddling.

All our photos and videos are displayed in the browser. You would think that loading videos and searching through hundreds of thousands of pictures for faces, landmarks and other objects would be a very clunky experience in the browser. It isn’t.

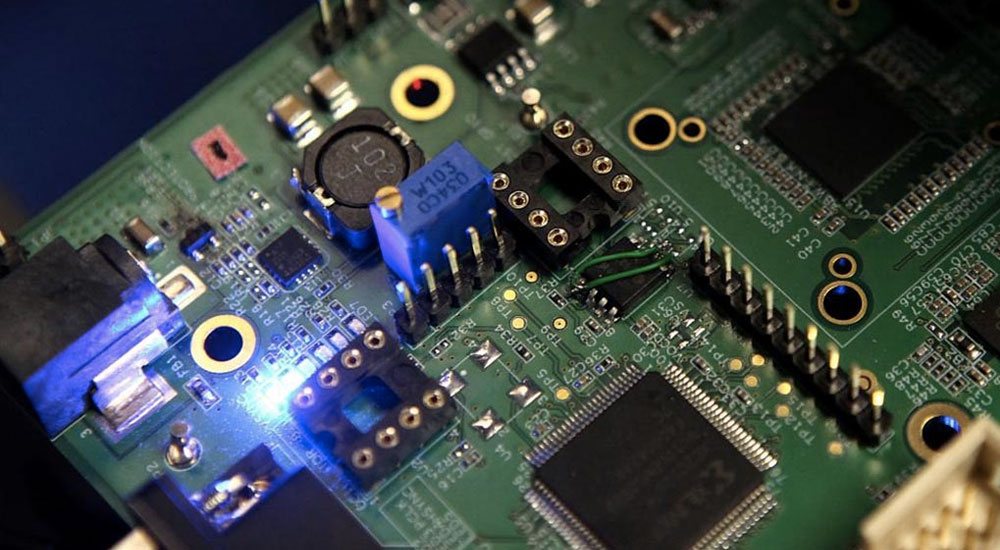

This is where Micron and NAND come in. NAND memory is used in making solid-state drives. SSDs have many advantages over traditional, hard disk drives (HDDs): They consume less energy, are lighter and break less frequently — all important features for laptops — but most important, they are much faster.

By offering unlimited storage, Google basically started a space race with Apple, Microsoft, Yahoo and other companies. The problem is that SSDs are still more expensive than hard drives; but for services like Google Photos to be robust, a larger portion of data in Google’s massive data centers has to reside on SSDs than on HDDs. As their prices continue to fall, SSDs will continue to take a lot of “space” share from hard drives in data centers. SSDs are unlikely to get 100 percent of that space, but demand for them from Google and the like will increase exponentially for years to come.

Micron and its DRAM and NAND brethren will be significant beneficiaries of constant improvement of video quality (that is, larger files) and what will simply be a tremendous surge in the amount of data we generate as consumers. My youngest child is not even two years old, but I bet she is responsible for two thirds of the video and photo data my family has generated over the past 15 years. Also, data is cumulative: As it is, we rarely delete any content we create; now, since Google has made picture and video storage free, we have no incentive to delete at all.

When it comes to Micron stock, I don’t know where earnings are going to be over the next six months or a year, though we think the company will earn at least $2 a share in 2016 (so that it will still be a cheap stock at the current valuation). But over the next few years, Micron’s earnings will likely be a lot higher. We think $4 to $6 is still achievable; and at a 12 to 15 earnings multiple, someday it should be a $48 to $90 stock. In the meantime, do yourself and your family a favor: Install Google Photos.

0 comments