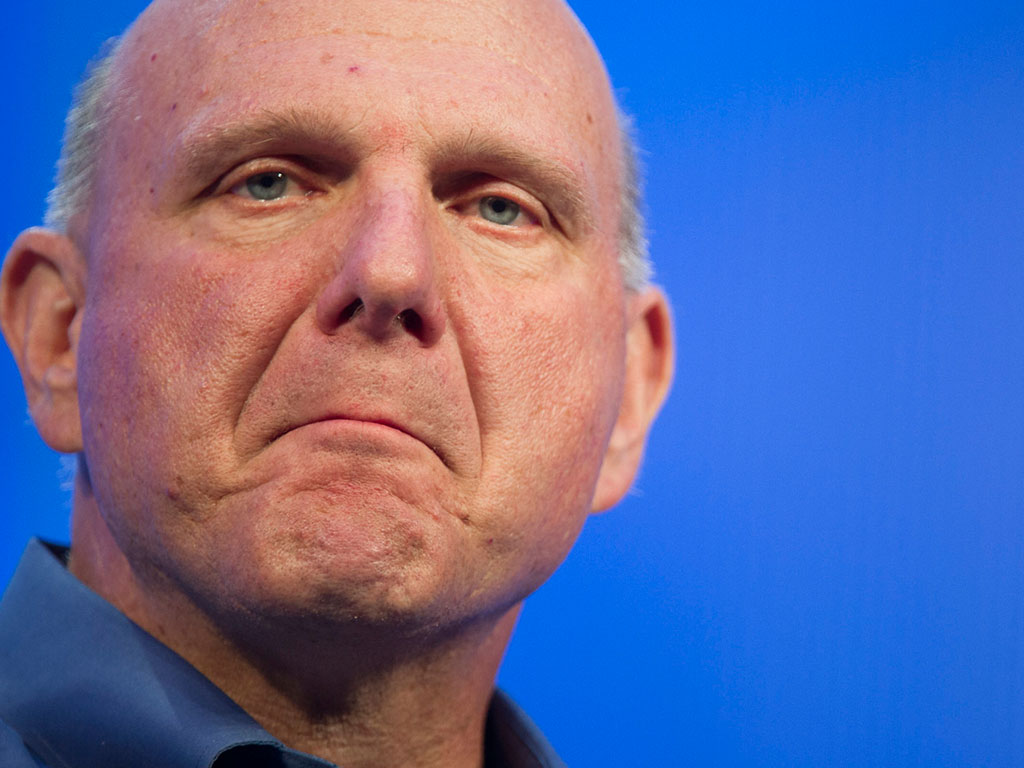

On Monday night I sat down to put my thoughts to paper. I was going to pontificate on CEO Steve Ballmer’s departure from Microsoft, saying something along the lines of “With Steve Ballmer gone, at least Microsoft’s capital allocation will be better — no more multibillion-dollar acquisitions and consequent write-offs.” I opened my Chrome browser (I gave up using Internet Explorer a long time ago), and the first piece of news I saw: Microsoft had just paid $7.2 billion for Nokia’s handset business.

Before I get into the Nokia acquisition, let me talk about the two Microsofts: the Bill Gates Microsoft that died in 2000 when Gates retired as CEO, and the Microsoft that was born when Steve Ballmer took over.

Bill Gates built an enormous, one-of-a-kind company with insurmountable competitive advantages. It was not great at innovation but was terrific at copying; it would take a product made by someone else and make it much better. WordPerfect, Lotus 1-2-3, Novel, Lotus Notes, Borland Paradox — all these products and the companies that made them were replicated out of existence by Bill Gates’s Microsoft.

Bill’s Microsoft was not perfect. It almost slept through the Internet revolution, but when it woke up it marched on with a vengeance and reclaimed its relevancy.

Bill Gates retired as CEO in 2000. Although he remained chairman, his focus was on how to give away rather than make money. Steve Ballmer, his former Harvard University dorm mate and fateful No. 2, became CEO. The irony of Ballmer’s Microsoft is that although revenues and earnings have almost tripled since he became CEO — not a sign of a failing leadership or mismanaged company — Microsoft nevertheless became less relevant, missed significant technological transitions, and lost its market dominance in mobile to Apple and Google. It allowed Apple to take over the tablet market; and despite spending over $10 billion on search, its market share in search pales in comparison to Google’s. Yes, the company’s financials look impressive, but they were delivered on autopilot by the Microsoft created by Bill Gates. Microsoft is an air carrier that gained speed in the ’80s and the ’90s, and has been coasting on momentum (inertia) ever since. But momentum is finite, and there are always storms en route.

0 comments