Of course, there are many critics of the Fed who say the second round of quantitative easing is wrong and even harmful. “The failure of QE2 doesn’t worry me. It’s the success that worries me,” says Vitaliy Katsenelson of Investment Management Associates.

“I think it’s criminal,” he tells Aaron in the accompanying clip. “They’re forcing people that should not be taking risk to take risk.” The fear is the Fed is repeating its past mistakes — helping to build an asset bubble that will eventually burst with grave consequences.

Even if the Fed is successful in keeping down rates, Katsenelson doesn’t believe it will have any positive economic effect. On the contrary, he says it will lead to a period of “stagflation” as the Fed simply monetizes the debt, lowering the value of the dollar and failing to create economic growth.

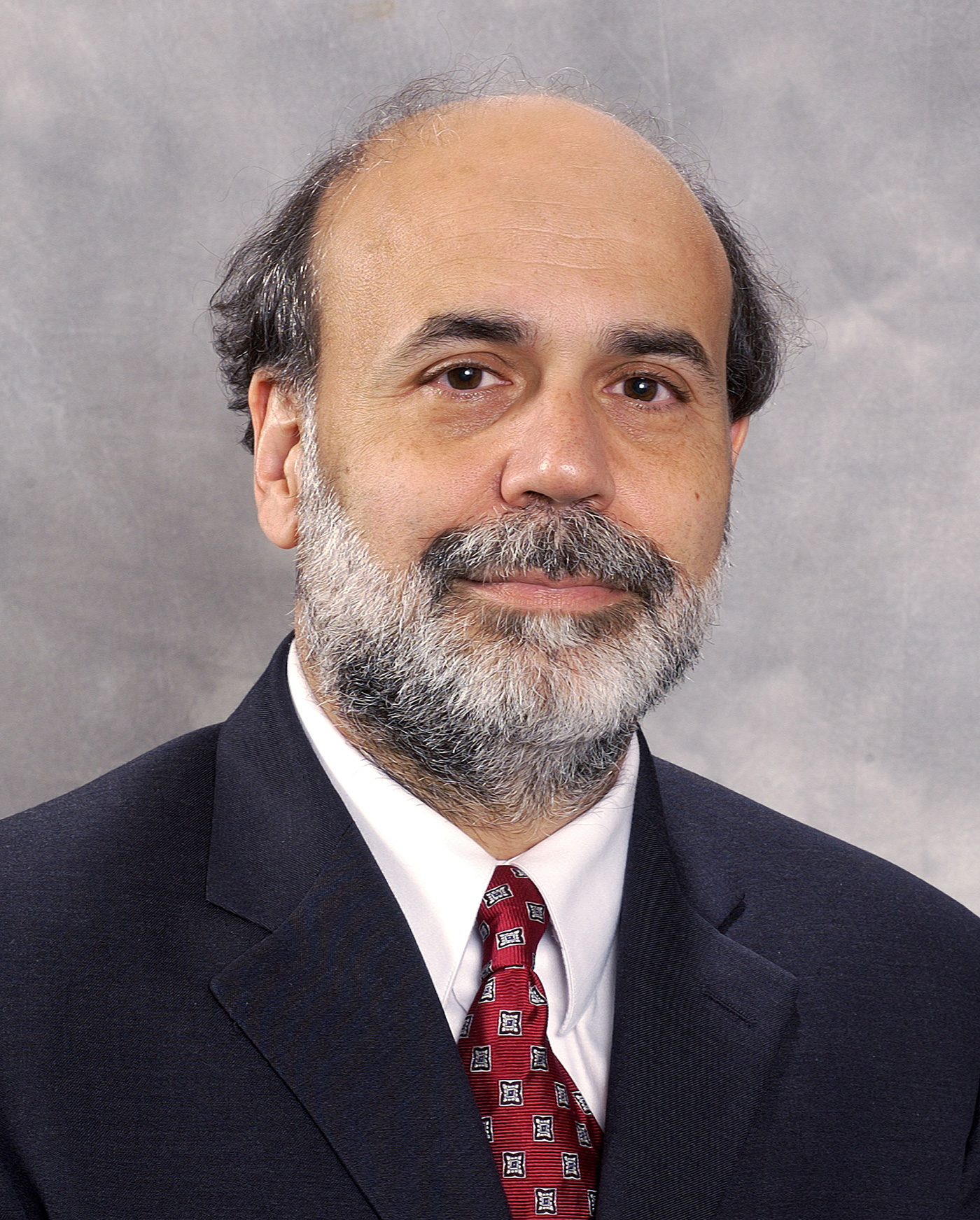

This story is far from over. The Fed meets Dec. 14 to discuss a potential plan to extend Treasury purchases, something Bernanke already hinted at in his recent “60 Minutes” interview.

0 comments