Today, I will share part four of what has become a five-part summer letter to IMA clients. The letter is quite lengthy, so for easier reading, I have divided it into smaller parts. In the previous three parts, I discussed the economy, the Magnificent 7 and past booms and busts. In this part, I will discuss investments in EVs, spurred by the following question from a client:

Question: I’ve read Vitaliy’s thoughts on EVs. As a Rivian owner, I agree they’ll upend the auto industry once battery, charging, and cost issues are solved. How can IMA invest to benefit from the EV industry?

In the remaining part, I will cover AI, as well as the impact AI will have on the economy.

In these client letters, I am not selling anything; they are written to IMA clients, who have already bought into what we are doing. I don’t like sanitizing my letters (rewriting them into articles), as I don’t learn anything from doing it, so I am leaving them as I wrote them.

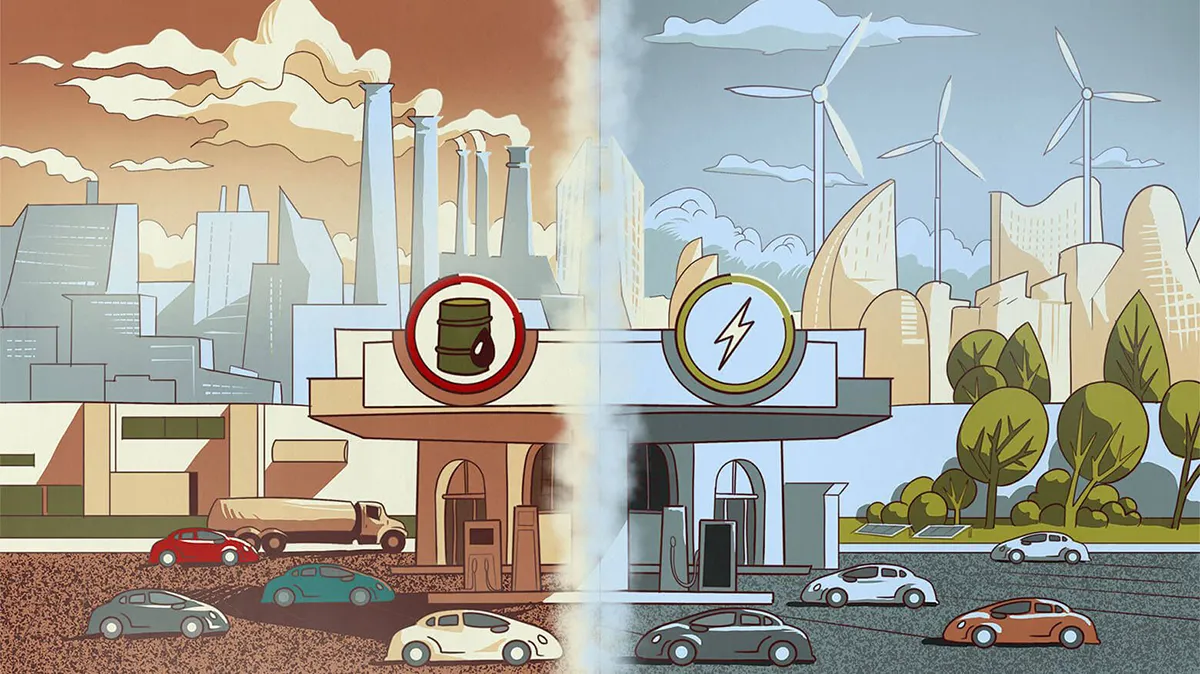

Investment Strategies in the Age of EVs

When we see a new trend in the economy, we think about how to benefit from it and, crucially, how to not get run over by it. The key is not just identifying the “wind” but finding good businesses that will ride the wind, and as importantly, making sure that these businesses are undervalued.

This was the case with our investments in defense stocks. We saw building global tensions and found defense companies that met our quality and valuation criteria.

The EV Industry Landscape

Now, let’s talk about EVs.

We could play EVs by buying traditional companies. Making cars is a very difficult business with high fixed costs and very cyclical revenues. Cars are expensive and need to be financed, and thus affordability is impacted by the level of interest rates. Also, this business has been fundamentally broken by unions. I’ve written on this subject in the past, so I’m not going to belabor this point here, but unions have a call option on these companies’ future profitability. As automakers start making profits, unions strike and demand to share the spoils. Shareholders are unlikely to make much money investing in these businesses.

Also, managing the transition from internal combustion engines to EVs will be very difficult for these companies.

Of course, there is a more obvious choice to participate in EV transition – Tesla.

I wrote a small book on Tesla and the EV industry in 2019. At the time when I wrote the book, Tesla was losing money and had a pile of debt. I wasn’t sure if Tesla would be able to reach escape velocity and profitability. It has. The stock went up a lot and became very expensive.

History cements only one path of what has taken place, but there were many other high- and low-probability alternative historical paths for Tesla, and they were mostly not as glamorous or rewarding as the one that played out. Even Elon Musk confessed that Tesla was on the verge of going bankrupt a few times.

I have smart (a number of them are brilliant) investment friends who are both long and short the stock. Most Tesla bulls recognize that, as a car company, Tesla is overvalued or at best fully valued. They believe today’s investment case in Tesla is future cash flow streams from AI, semitrucks, robotaxis, the charging network, and robots. I hope my bull friends are right about Tesla’s success in these areas, as that would benefit society as a whole. But at this point, most of their investment thesis is based on hopium.

Out of all these businesses, the only one that actually exists and is making money now is the charging infrastructure – but Tesla has announced significant cutbacks to the expansion of its charging network.

Then, my friends who are short the stock will point to Musk’s flawed ethics, his distractedness with his growing business empire – I keep losing count of how many Sci-Fi companies he is running now. They’ll point out significant competition from Chinese EVs (which many argue are superior to Tesla’s current offerings). And, though Tesla would like you to believe otherwise, it is still a cyclical car business. By the way, those Chinese EVs are also a potential threat to traditional automakers – GM and Ford sell a lot of cars in China. And Chinese EVs are making their way to Europe and Latin America, too.

Also, up to this point, Tesla was able to escape unions because it gave out stock options to its employees – the stock went up, so employees were happy. But a stagnating – or, God forbid, declining – stock could send employees into the arms of unions, who are constantly camping outside of Tesla HQ. I don’t want to write another book about Tesla; but at this valuation, which still exceeds that of the US and European automotive industry combined, it is not of interest to us. At a much lower price, we’d be willing to give it another look.

Then there is Rivian, which is losing tens of thousands of dollars on every car it makes. We have little insight as to whether this company will be around tomorrow or not.

We have a small position in Dowlais (a spinoff from Melrose Industries), an automotive supplier that makes transmission components and motors for EVs. They are number one or two in the markets they compete in. It’s a very profitable, conservatively managed business that is currently on the wrong side of the automotive cycle (the industry is struggling from post-COVID hangover). The company is trading at an extremely undemanding 3–4 times earnings – it could potentially double or triple from its current level. The transition to EVs is a net positive for Dowlais, but it is just icing on this undervalued cake. We keep this position intentionally small – we like the company; we are not fans of the industry.

Energy Infrastructure and EVs

The adoption of EVs and AI will both result in high electricity consumption.

The world is coming to terms with the fact that we’ll need to use more nuclear energy, but this transition will take decades. One of our companies (Babcock International) has exposure to nuclear. Modular nuclear reactors may actually be the future, but we have not found a good way to invest in them.

In the meantime, most incremental electricity will be generated by natural gas. We own two stocks (in most accounts where we’re allowed to own them) that are positioned to benefit from increasing demand for natural gas: Blackstone Minerals (BSM) and Kinder Morgan (KMI).

BSM is a royalty trust structured as a master limited partnership (MLP) for tax reasons. It is one of the largest mineral rights owners in the US. Energy (oil and gas) companies drill on its land and pay BSM a quarter of their revenues for this privilege. About one-third of BSM revenues come from natural gas. KMI operates a large network of (mostly natural gas) pipelines. Both companies are paying handsome dividends while the transition to higher natural gas consumption takes place.

We have looked into energy infrastructure and found a lot of good companies, but we were unable to find stocks that meet our criteria (everything is very expensive). We have a few of them on the watch list – a code word for we’d like to own them but at lower prices.

by Jonah Katsenelson

Key takeaways

- The EV industry presents both opportunities and challenges for investors. It’s crucial to not only identify the trend but also find undervalued, quality businesses that can benefit from it.

- Traditional automakers face significant hurdles in the EV transition, including high fixed costs, cyclical revenues, and union pressures, making them less attractive investment options.

- Tesla, while successful, is currently overvalued as a car company. The investment case for Tesla now relies heavily on speculative future revenue streams from AI, semitrucks, robotaxis, and other ventures.

- Chinese EVs pose a significant threat to both Tesla and traditional automakers, potentially disrupting the global automotive market.

- The EV industry’s growth will likely boost demand for electricity, benefiting companies in natural gas and energy infrastructure. However, finding undervalued stocks in this sector remains challenging.

I agree with you that the increased adoption of EVs and AI will both result in high electricity consumption. I would like to suggest the Solar, wind and geo thermal are comparatively cleaner energy sources that can be adopted at a more faster rate than nuclear is continents where there is abundance like Africa.

>> As automakers start making profits, unions strike and demand to share the spoils. <<

Yes, the unions always want to share in the profits when the companies are making money. But where are they when the companies are incurring massive losses? I never hear about them wanting to share in that.

Vitaly, what’s your view on KARS ETF tracking Bloombers EV index and covering full value chain, including metals, batteries, car manufacturers…?

If you have an interest learning more about Tesla follow Ron Baron too!

Also, Tesla does make money on each car they sell. In your article you made a point that the charging stations infrastructure was the only division making money for Tesla.

I will also argue with you in respect to your statement “I keep losing count of how many Sci-Fi companies he is running now. SpaceX is sci fi! What the heck do you think the company is doing to advance space exploration.

i disclose I am not an investor in the Baron funds.

You state that “but there were many other high- and low-probability alternative historical paths for Tesla, and they were mostly not as glamorous or rewarding as the one that played out.” That is true to some extent. But I think you are leaving out a major factor which was responsible for their success. Their people, rate of technological innovation, and systems in place. I think this is relevant to how one views Tesla going forward from now. If one went back in time and listed the possible outcomes and put a probability on each of the outcomes factoring in the people and systems they had in place I believe that one would have seen that the successful outcome that happened would have been be the most probable.

Similarly now one should do the same looking forward. Tesla is probably fully priced for their EV business. But they still have this magnificent technical team and can continue to attract the top talent in the world. Speaking as an engineer, I see that they are still innovating in a remarkable way and are way ahead of the rest of the car industry. For instance having moved to 48V and ethernet in-car communication on the Cybertruck, and they have taken the steps to go to unboxed production for a new level of productivity on their new model. Yes they are still a car company, but battery storage is growing at something like 36% a year, and they are well placed to take advantage of this. Elon said years back that storage would become bigger than cars and we are well on the way now. Again they have the smarts. Ditto for robots and semitrucks. It is true that Elon said that “if you don’t believe Tesla will solve full self driving, then you should not be a Tesla shareholder”. We will see. Refer back to my comments about the technical skills in the company. It is people that make things happen.

There is an interesting article in the recent Journal of Financial Planning about AI failing to handle basic FP skills relating to income planning, etc. These were tasks that financial planners handle all the time.

But my main concern is the value that we humans place on our own work–I’m 85-years-old and don’t like not working -if you thought of me as being about 60% retired, you’d be close. Sometimes, when I’m busy, the percentages change and I’m 30 or 40% retired. A wonderful thing about investing–it allows the brain to keep spinning.

So, AI gets better (I have issues with an AI-controlled auto in the mountains when there’s snow and ice), but what does that do for our human need to work? For many, self-worth comes through work and contributions to others. Until we (or AI itself) figure out how to maintain healthy work psyches for humans, it is possible, or even likely, that AI may cause more problems than it solves.

Vitaliy, the painting, as always, is terrific.

As always your articles are very insightful

I probably should invest with you but I am mostly a buy and hold investor for a long time. And I couldn’t raise the money without incurring massive taxes

Best wishes

There may be an opportunity to invest in the supply chain that runs into the EV ecosystem – mining, extraction, refining, etc. To meet the lofty goals that a number of developed countries had set for electrification, there will be a tremendous need for core minerals that are absolutely essential to make that electric dream come close to reality. I have seen some research that suggests that there is enough mineral content in the world to meet this rising demand – but no specific recommendations on how to efficiently or effectively extract it. Copper needs far outstrip supply for the foreseable future. Setting up new mines once a deposit is found can take 10-20 years and in many cases represent opportunities that don’t fit with capital models (too uncertain, too expensive, lack of source capital for infrastructure that will take years to pay off, etc.). But these are sectors that will get more attention, as countries try to link solar and wind (mostly found far from demand) with consumers and need more large scale batteries for storage or grid scale transmission lines to bring the power from the hinterlands. Natural Gas is a great path – plentiful and relatively clean – just not on the priority list for the current US federal govt and selective states that are pushing net zero policies (may be investment opportunities in technologies that you can power with human power as blackouts and brownouts increase in states like CA with rising power needs and continued restriction of power generation sources. Nuclear sounds like the right path, just very out of favor almost everywhere that matters -and at least in the US not a lot of activity other than focus on re-starting shut down assets – someone mentioned that Three Mile Island is under consideration?

I am more interested in your process than in a particular industry. Where do you get the input that allows you a long term perspective? How comfortable are you with anecdotal interpretations of observed trends like ev’s replacing ice vehicles when so many disruptive alternative technologies are in the wings?

Let me help you with the process. Read read and keep reading. Use to manage an investment research department and now manage my family office and spend most of my day reading and researching. There are many books on process and many techniques. READ CHARLIE MUNGERS BOOKS unfortunately he’s no longer with us but has such great wisdom. It’s my opinion that Charlie Munger had more to do with Berkshire Hathaway success then Warren Buffett. Charlie redirected Buffett from looking for cigarette butts,” deep value companies” to more of a growth orientation.

Now about EV’S-there will never be the amount of EV’s projected by most reports and analysts because of one main factor, there is not enough copper now or in the next 10 to 15 years to make all the projected EV’s. They will have to supplement this by making hybrids. Even if they find massive new copper mines – it takes 10 to 15 years to build them. I read an absolutely fantastic research report by a university professor-along with some very well known industry experts that project exactly what I am saying. This is food for thought for your investments in the future. Read read read. ope this helps.

Thanks for the insight Vitaliy, in my very recent experience of EVs, the EV infrastructure – in the UK at least – has room to grow in terms of physical locations and also customer experience. The stepping stone of ‘green’ energy powering EVs places suppliers of recharging stations in a temporary happy place as the energy industry and governments work out how to sell nuclear to us.

I have an ID4 and a charging station powered by a solar installation on the barn roof. I never use a charging station in my normal travels. When on a trip I

plug in at a parking lot with a charging station while at dinner or at a hotel. Commuters can charge at home. Small isolated charging stations are not going to be profit centers. I know of one Tesla charging station that can charge about 30 cars at once that is well used and busy in a key location in Hartford, CT. There is another smaller one in NYC that is busy. Other stations are stranded often in wierd places and are not going to be busy. Investors should be working on creating sun powered charging stations at busy parking lots to avoid paying for power sourced from distant generators delivered over miles of expensive tranmission wires. Every public parking lot should be covered with panels and wired into charging stations. We are far behind where we should be.

Any thoughts on Valaris (VAL) after the drop in price. One of the premier offshore drilling companies.

I am skeptical on Tesla. I leased one for 3&1/2 years. A lot of my driving is 100 miles between vacation house and main residence, also take longer trips. Range anxiety is a big issue. EVs are not for everyone. I have also noticed more promotions from Tesla in my inbox. Was offered a model Y lease for $250 per month. Near term earnings will be a problem. I don’t see how valuation can be sustained in Robo Taxi , AI & robot promotions. Musk also manipulates the stock with these pronouncements/promises. At some point the SEC will crack down on him.