I am going to share with you excerpts from a research paper I wrote in 2018 about Tesla and electrical vehicles (EVs), which I have turned into a small book for reader convenience (it is available for free, here). I want to share these essays with you today because we are at a pivotal moment for traditional carmakers, and these essays, which I have not updated, present an important thinking framework about the industry.

It is easier to convince shareholders and the board of directors to invest money into new factories when the demand for EVs is growing, even if you are losing money per vehicle. At least there is hope that once you get to scale and perfect new technology, the losses will turn into profits.

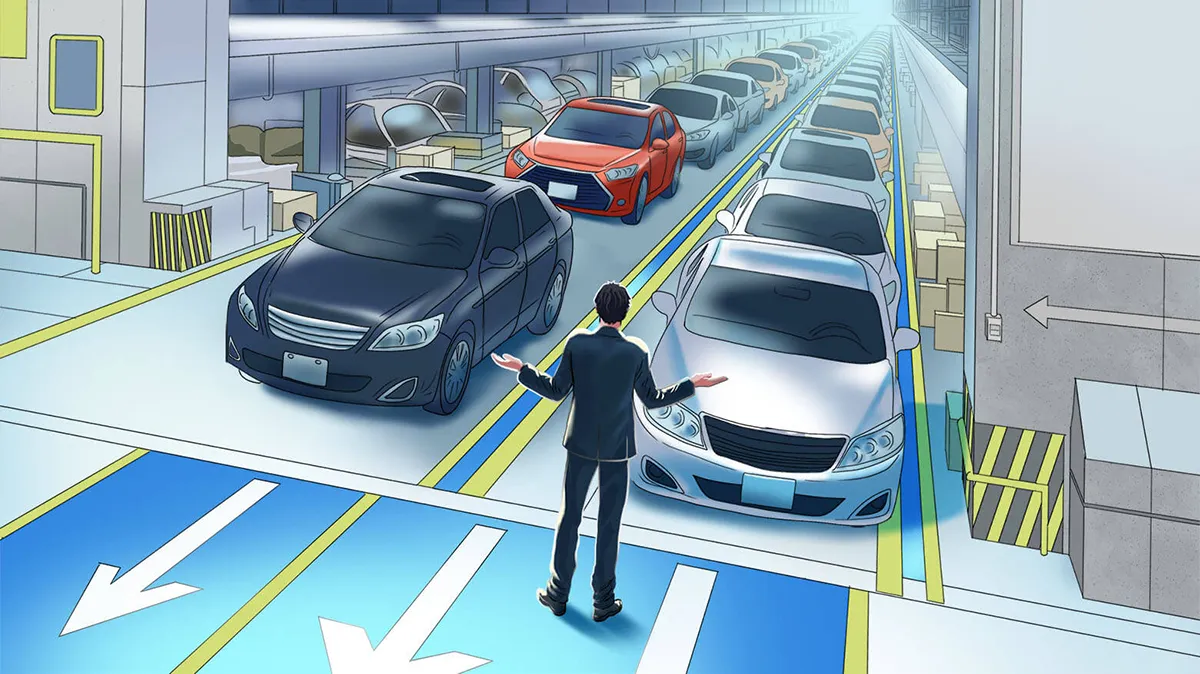

However, when the demand for electrical vehicles stutters and your inventory of EVs starts piling up – which is exactly what is happening right now – investing in EVs becomes very difficult (I wrote about it here). Retreating to what you know, what has worked for almost a century, what doesn’t generate huge losses with every vehicle sold, and what your current workforce is trained for, and comfortable producing, seems like a natural decision. The decisions traditional carmakers will make over the next year or two will be very important for what their future looks like a decade or two from now.

“What you really should have done in 1905 or so, when you saw what was going to happen with the auto is you should have gone short horses. There were 20 million horses in 1900 and there’s about 4 million now. So, it’s easy to figure out the losers; the loser is the horse. The winner was the auto overall. But 2000 companies (carmakers) just about failed.”

– Warren Buffett, speaking to University of Georgia students in 2001

Can traditional automobile companies successfully transition to making EVs?

Today EV sales account for a tiny rounding error of total global car sales. Let’s mentally transport ourselves to the late 1800s, when the streets were still busy with horse-drawn carriages and the occasional passing automobile scared a horse or two.

If you cannot relate to a century-old analogy, let’s go back to something that happened just a bit more than a decade ago. In June 2008, when the iPhone 3G was introduced, Nokia was still the largest phone maker in the world. What we did not know at the time was that Nokia was the largest dumb phone maker and that Apple was about to become the largest smartphone maker – a small but crucially important nuance. What we did know at that time was that smartphones were the future.

In theory, nobody knows more about making cars than the traditional ICE carmakers – the General Motors of the world – and thus EVs made by these companies should be the ones busying our streets a decade from now. A natural continuity from what we already know may be the easiest cognitive model for us to process, but it is not always the most accurate one.

In 2004, Nokia missed the flip phone boom and lost market share to Motorola, which came out with the slick Razr flip phone. Nokia had a few quarters of disappointing sales, the stock declined, and we bought it. Then Nokia came out with its own flip phone and the status quo was restored: The company was again king of the dumb (actually, let’s be politically correct – mentally disadvantaged) phone castle. The flip phone was a technological change, but it was still in Nokia’s domain of core competency. The stock ran up and became fully valued; we made money and sold it. We patted ourselves on the back.

Now, the mistake many investors made, including yours truly, was not seeing that although the iPhone was still called a phone, it was not really a phone but rather a portable computer that, in addition to doing a lot of other smart things, also made phone calls (which the first iPhones were not really good at, but the people who owned them didn’t really care). It was not Apple that dethroned Nokia, not at all. Nokia did it to itself. Nokia should have looked at the iPhone and blown Apple a huge air kiss, thanking it for showing the future of “phone,” and then gone on to develop its own smartphone.

I made the mistake of applying my 2004 mental model to our Nokia purchase in 2008. With the introduction of the iPhone, Apple took a mentally disadvantaged phone and pushed it into a very different domain with a very different ecosystem.

Assets turn into liabilities

Nokia was a very efficient designer and manufacturer of phones that had very little software and limited functionality. In 2008, the company employed thousands of engineers who knew a lot about wireless signals, plastics, moldings, coatings, and so forth. But collectively they knew little about CPUs, software, and user interfaces. Nokia tried to respond to the iPhone the only way it knew how – by taking its Symbian operating system designed for low-IQ phones and trying to remold it into a smartphone operating system. That attempt failed miserably. We realized what was happening later than we should have and gave up a good chunk of our 2004 Nokia gains.

I never thought I’d say this, but knowledge is not always an asset. When you are in the middle of a transition from one domain to another, your knowledge of the past domain may cloud your vision. You’ll be seeing through the lenses you’re used to wearing.

When the first cars were made, they didn’t have steering wheels, they had tillers, because they were made by a horse carriage manufacturer. Though it was possible to transition from making horse carriages to making cars, most companies did not; they were stuck in the old “buggy” domain and did not switch to the new “auto” domain.

It is difficult to kill your cash cow

Clayton Christensen discussed this concept in his book The Innovator’s Dilemma. When your core business is minting money, it is difficult to create another business that may be future-proof but will undermine your core business, especially if the threat is nascent at the time and seems far away. These threats are usually nascent and far away.

When Amazon was practicing e-commerce on books, everyone believed Barnes & Noble would be able to suffocate the tiny company because B&N sold more books in a day than 1997 Amazon sold in months. However, snuffing out Amazon would require Barnes & Noble to lower online and possibly in-store prices, which would hurt its very profitable store business. Well, we all know how that story ended.

The transition from ICE cars to EVs is not just a technological shift within a domain. It is not like the transition from two-wheel-drive sedans to four-wheel-drive SUVs; it is a radical shift into a new domain. I laid out this very extensive domain-shift framework to show that the success of ICE manufacturers in this new domain is anything but guaranteed. Let me expand this framework even further.

ICE cars are low-IQ phones, and Tesla’s Model 3 is an iPhone 3G. Cars last about 12 years and phones two to three, so this transition will happen in slow motion.

Nokia or Samsung? Why a First-Principles Approach Will Be Key for Developing EVs

As I discussed, during the transition from one domain to another, many of the assets and much of the knowledge from the old domain become liabilities in the new one.

Tesla created its cars by entirely breaking out of the domain of existing auto manufacturers. Although this is true for the Model S and the Tesla cars that followed, it was not the case for Tesla’s first car, the Roadster. When Tesla first attempted to make an electric car, it was constrained by resources. It wanted to experiment with battery technology and electric engines and did not want to design a complete car. So, Tesla adapted the body and powertrain of the Lotus Elise, a sporty gasoline car. Later Elon Musk confessed that had been a mistake – he compared it to keeping the outside walls of a house but gutting and rebuilding the inside, including the foundation. You might as well build a new house.

Because Tesla created the EV industry, it had the advantage of acting from first principles. It could start thinking with a blank piece of paper, not redrawing what already existed. In an interview, Musk said, “I tend to approach things from a physics framework … physics teaches you to reason from first principles rather than by analogy.”

Warren Buffett’s version of first principles is “What would Martians do if they landed on our planet?” Not because of Martians’ enormous IQs but because they would be new to our planet and could see with clarity things we often don’t because we’ve been here so long.

The first-principles approach allowed Tesla to build EVs that are free of the limitations of gasoline-car thinking. No gears, a skateboard chassis, two engines, a frunk, a credit card key, a mobile app that works as a key and controls the car, and no start button, among others – Tesla applied first-principles thinking to how its cars would be sold. The Model 3 feels like it was designed starting from a completely blank piece of paper and this thinking extended beyond the car and spilled over to selling and servicing the car.

Today’s ICE auto manufacturers are basically wholesalers of their cars to auto dealers that are their franchisees. This business model is a Great Depression relic that went basically unchallenged until Tesla came along. The model worked well for automakers and dealers for almost a century, though the experience most consumers had did not fit the definition of well.

Tesla decided that the traditional business model was not appropriate for the new EV domain. Instead, it borrowed a model from Apple, which controls the full customer experience, from buying a phone to servicing it to upgrading to a new one. Also, electric vehicles have fewer parts than ICEs and thus should break a lot less (at least in theory – time will tell), so the traditional dealer model that relies on service revenue doesn’t work well for EVs.

This journey of opening its own stores was anything but easy for Tesla. It had to fight opposition by ICE carmakers and local dealers in every state, just as Uber had to fight taxi monopolies.

My purchase of a $51,000 Tesla (in 2018) was as easy as my purchase of a $900 iPhone. I test-drove it. A few days later, I called the Tesla store and told the salesperson that I wanted to buy a car. My information was already in the system; I had to provide it when I placed my deposit in 2015, and I had to confirm it when I scheduled a test drive. I just told the salesperson the configuration I wanted and placed a fully refundable credit card deposit. (I was traveling, but I could have done all this from Tesla’s iPhone app or website.) A few days later, I got an email confirming my Model 3 delivery date and asking me to schedule a time to pick up the car. On June 29 at 9:30 a.m., I appeared for my car; by 9:40 I was driving back home. It was that simple.

Tesla changed how a car is serviced, too. A few weeks after I bought the car, its speakerphone stopped working – people could not hear me. I went into the Tesla iPhone app and requested service. I was given a choice between bringing my car to the Tesla service center or having a service technician come out to me. I chose the latter. Two days later, the technician showed up at my office. I gave him my car key and went back to doing research. An hour later, my car was fixed. Tesla’s technician had simply restarted my computer. In hindsight, I could have called Tesla and my speakerphone issue could have been fixed remotely.

Now compare these buying and servicing experiences with buying and servicing an ICE car.

It is difficult for ICE companies to adapt first-principles thinking, as it requires them to unlearn what made them successful in the old domain. They are going to have to retool their factories (the smallest challenge of all). They will need to go through a significant and painful change of their workforce. Their current employees have a very different skill set and look at the world through petrochemical lenses (which explains why GM’s first foray into electric was the Volt, an electric car with a gasoline engine attached).

Auto dealers, which are an asset to car companies today, will turn into liabilities tomorrow, as Tesla’s direct distribution and service model should provide a cost advantage once it gets to scale. Tesla’s model is more customer-friendly and efficient, allowing the company to capture the profit that ICE carmakers have to share with their dealers. Because a good chunk of Tesla’s cars are built to order, the company doesn’t need massive inventory sitting on giant parking lots. Also, ICE manufacturers may not be able to replicate Tesla’s direct-sales business model because they are stuck with the franchise agreements they signed with their dealers.

It won’t be easy for ICE carmakers to adapt first-principles thinking to their EVs, but they may not need to: They can copy Tesla. The existing players are not automatically doomed. William Durant, who turned struggling Buick into General Motors, originally made his millions on horse-drawn carriages.

Understanding the enormity of the needed investment, carmakers are creating alliances. Ford and Volkswagen are working together on artificial intelligence (AI) and skateboard chassis for EVs. Historically, such alliances in the auto industry have had mixed success.

Traditional car companies have a lot of things going for them. Their strengths are in the designing, assembling, and marketing of cars. They use hundreds of suppliers to make the parts that go into their cars. They can do the same thing when it comes to EVs. They can outsource the battery to LG Chem or Samsung. They can outsource software design to the likes of Cognizant and DXC. They can use Waymo’s self-driving software and Nvidia’s self-driving hardware. The traditional automakers are in their best financial shape in decades and thus have capital to finance the EV adventure. They can afford to make an enormous investment in EVs and take the losses that come with them. But will they? I don’t know.

To some degree, their job is more difficult than Tesla’s. They have to keep innovating as they make horse carriages – sorry, I mean ICE cars – because ICE cars are what pays their bills. At the same time, they have to focus on the future and invest enormous amounts of time and capital building EVs.

When Hernán Cortés invaded Mexico, legend has it, he ordered his army to burn all its boats. He wanted his soldiers to fight as if there was no way back. This is how Tesla is approaching EVs – no boats. ICE companies today seem like tourists in EV-land, with comfortable (ICE) cruise ships waiting for them offshore.

Key takeaways

- Traditional automobile companies face a pivotal moment in transitioning to electric vehicles (EVs), with current market conditions making it challenging to justify continued investment in EV technology.

- The shift from internal combustion engines (ICE) to EVs represents more than a technological change; it’s a domain shift that may render many of the traditional automobile companies’ assets and knowledge obsolete or even liabilities.

- Tesla’s success in the EV market stems from its first-principles approach, which allowed it to break free from conventional automobile industry thinking in both car design and business model.

- Established automobile companies struggle with the “innovator’s dilemma,” finding it difficult to cannibalize their profitable ICE business to fully commit to EV development.

- While traditional automobile companies have strengths in design, assembly, and marketing, their success in the EV market is not guaranteed. They must navigate the challenges of maintaining their ICE business while investing heavily in EV technology, a balancing act that Tesla doesn’t face.

Vitaly, your article was insightful as always. The one point I would disagree with is that Tesla has car service figured out. My friend who purchased a Tesla 3 to 4 yours ago is constantly irritated at how hard it is to get a service appointment. And, if you can get one, the guess is how many weeks out will that be.

The computer & software industry has long honed the market practice of a one shot sale. A customer buys the hardware / software and the manufacturer never wants to talk to them again, unless it is for some ongoing payments. Heck, some companies deliberately hide their phone numbers so they will never ever have to talk to a customer. Tesla would love to have that model but cars don’t really fit into that sell it and hide paradigm.

Like many of the above comments, I am also pessismistic about Tesla as company.

Tomorrow is the result date for Tesla. I am expecting a very bad result. I conspire that Elon did the 10% reduction in workforce to counter their bad result expectation. He also told that he will reduce another 10% workforce. Tesla attrition rate is one of the highest because Elon is more demanding boss. This means there is very less for the institutional knowledge to build. I guess most of the current decisions are done by Key person Elon. I don’t get surprised if something very bad financially will happen to this company in the near future.

Another thing I felt is, you are too much obsessed with this stock. I felt like you have confirmation bias/sunk cost fallacy on this stock.

Mr. Katsenelson,

I have no quarrel with your suggestion that legacy auto companies may go the way of the dodo, but strongly disagree that they will do so if they don’t go 100% EV. To use history and a twisted analogy, going 100% EV would be akin to going to giraffes from horses, not from dumb phones to pocket computers that make telephone calls. You do have much company in believing that transportation will (or should) be all electric. I suggest that you can love your Tesla, that’s fine, but don’t conscript everyone to your preference.

My apology, in advance, for this lengthy comment. You raise excellent points that I need to elaborate on. Why 38% of energy executives still believe in zero carbon by 2050 may be explained by their age, and hence, poor education. For years, our educational systems have been conscripted by propagandists. Basic chemistry, mathematics, and physics, are shunned along with literature. Students have been raised as “activists”, not scientists. Here is the reality of electrification of all things transportation, it will not happen.

I’m not seeing EVs ever taking over the wheeled transportation business, or even equaling what they were at the turn of the twentieth century. That was an attempt in the first version of auto/truck development, with almost one-third of all cars on the road being electric! That reversed, and lost out then for the same reasons as it will today. The energy density of gasoline and diesel is just too overwhelmingly favorable.

The other thing we have to remember is this. Electricity is not a “compound” that exists in nature like hydrocarbons or uranium. It has to be generated by some mechanical means, usually powered by hydrocarbons, in order to exist. Once it comes into existence, it must be either used immediately, or stored in a very inefficient way (battery), and each of these steps is subject to loss from transformation.

Just the gyrations of generation to motive force is unbelievable.

Consider the entire process:

1. Power plants produce alternating current (AC) electricity, that is stepped up to tremendous voltages (155,000 up to as much as 765,000) using transformers for long distance distribution (the grid). Why not Direct Current Generation? Because of HUGE losses of energy over long distance transmission. (This was the origin of Mr. Nikola Tesla, beating his old boss Thomas Edison and winning out with an AC electric distribution standard over Edison’s DC system.)

2. Local transformer stations reduce that voltage for area distribution,

3. Neighborhood transformers either on the pole in your backyard, or in that green box if your neighborhood has underground electrical service, reduce it further to 480,240-, and 120-volt feeds, still all AC, for use.

4. Now comes the Tesla (or any other EV charger) that has to take that AC current and run it through a transformer/rectifier/conditioner that for large loads could even involve mechanical energy rectifiers (like large electric motors) to get the voltage transformed to Direct Current (DC) that is needed to charge the battery. The battery only stores and then gives up direct current (DC). It cannot do anything with Alternating Current.

5. Once the battery is charged, the car’s onboard inverter must convert the high voltage DC from the battery back into high voltage (400-600 volts depending on the brand of car) ALTERNATING CURRENT (AC) to drive the Alternating Current Inductive motors that turn the wheels. Why don’t the EVs just use a DC motor to turn the wheels? Because DC motors that produce a lot of power are much less efficient as compared to AC inductive motors and the solid-state controllers that we have today.

6. Using the brakes in the car turns the Alternating Current (AC) inductive motor into an alternator (an AC current generator) that then runs the AC current through onboard transformers/rectifiers/conditioners to change back to DC current to put back into the battery. This “dynamic braking” is why the friction brake material in EVs lasts much longer than internal combustion engine cars, and lifting your foot off the accelerator pedal is a bit like stepping on the brakes in a conventional internal combustion engine car.

Now, count the steps above, and remember, at each one of them, there is energy loss through heat, mechanical friction, or electrical resistance. You cannot change AC to DC, DC to AC, voltage to current, current to voltage and make all of this happen without significant loss. This isn’t really news. It is just chemistry and physics, neither one of which has changed from the time of the early 1900s.

And all of the above happens AFTER you have spent thousands of gallons of hydrocarbon fuel mining, transporting and refining the cobalt, lithium, antimony and “rare earth elements” that go into EVERY EV battery and EVERY high energy AC inductive motor!

WAY TOO ENERGY INTENSIVE, and WAY TOO DIRTY for the environmentalists who understand this process, and way too expensive economically to be anything but a fool’s dream.

I drive a hybrid. I love it. I will not, however, require or even predict that everyone will or should.

Kevin G. Waspi, CFA

Consider in the Nokia/Apple context Sun Microsystems – very disruptive tech; brilliant engineering; fantastic software – that the corporate customer did not understand and therefore did not buy. In the end they committed suicide: bringing in people from failed competitors (mainly DEC and storagetek) who simply repeated the mistakes that got their original companies killed.

On the other hand.. cars with electric motors can be great – it’s the battery part of the system that sucks. As a result my bet is that Tesla will get bought by someone idiotic like GM and then killed by mismanagement while the first big player (Subaru or Volvo sized at least) to make a range of models using one platform that has electric motors in the wheels and a space up front for something to drive a generator will win massive market share by offering a wide range of generator options and simply updating that as tech (e.g. more efficient ICE or even fuel cells) evolves.

I bought my model 3 shortly after you bought yours. I was blown away by it and assumed Tesla would have iphone – like demand and would sell every car they could produce for many years. And yet 5 years later, 95% of people who buy cars still buy the old dinosaurs that they know. My assumption was wrong. I dont know if it is Elon’s crazy antics, Tesla’s unwillingness to advertise (which has lead to misconceptions about EVs – many of which you can read about here in the comments from people who have never owned one), or what. I do agree that legacy auto is going to have a hell of a time with this transition and most will probably not make it. Unless of course there is no transition, which even thought I typed those words I cannot believe but at this point cannot completely discount.

The EV cars seem not to be the solution for curbing the CO2 emission. Despite the generous subsidies provided by Norvegian government, Norwegians are reluctant to give up their ICE vehicles completely.

https://blog.gorozen.com/blog/the-norwegian-illusion

Comparing the Nokia/Apple or the Barnes and Noble/Amazon transition in the same light as the ICE/EV conversion is not correct. Apple and Amazon had vastly superior products in almost every way than their predecessors. EV vehicles are not superior to ICE vehicles – they provide the same basic transportation utility from point A to B in the same amount of time. The advantages that Tesla has over ICE vehicles, mainly ease of purchase, ease of maintenance, and technological bells and whistles can be replicated for an ICE vehicle. EV vehicles have disadvantages including the convenience of charging and the time required to charge, as well as cost. Without subsidies it is unlikely EV’s will ever be cheaper than ICE vehicles. Charging EV’s in a rapidly growing market will become a major problem. Generation capacity and transmission is already a problem and is getting worse. The cost of what will be needed and the time to build it will take decades.

The growth of Apple and Amazon was fast. It was rapid because the consumer knew a superior product when they saw one, and everybody wanted it. That is not happening with EV’s. After many years in the market the market share is low, and now the sales growth is waning. Many consumers don’t want one. The transition to EV’s may be coming, but it will take decades and will likely never reach 100%

EVs, for *some* owners, can have an *advantage* of convenience of charging. With 240V in the owner’s garage, an around-town car can charge during nighttime; no stops at gas stations.

Mike, I was going to respond to Vitaliy and then read your response and don’t need to. You said it extremely well. I’ll add a little: Because of network benefits, the Smartphone of today is an “appreciating” asset. Every time we add a new app to the system, our phones are worth more. Every new phone added to the system makes ours worth more…and now with Starlink turning our smartphones into satellite phones, they will become worth more again. An EV will be always be a “depreciating” asset, just like an ICE vehicle. Finally, as you allude, we didn’t need subsidies to buy smartphones. We knew immediately that they were superior. EV’s are not superior…maybe driverless cars will be superior, but they can run on any fuel available, not just batteries, and even they just go from point A to point B.

Any updates regarding the earlier article on Charter Communication company? Thank you.

Another old company that missed the boat into the new world order was Kodak. Even though Kodak invented digital photography, they couldn’t envision a world beyond the film that made them rich. They assumed a slow adoption curve with perhaps decades of transition from film to digital. First their traditional film sales declined rapidly, far more rapidly than they anticipated, then the consumer digital cameras they marketed fell out of favor vs the more ubiquitous smartphone. They literally invented the technology that precipitated their own demise because they failed to recognize its implications.

Used to work in product development at one of the Big 3 domestic vehicle manufacturers many years ago. I was asked to do an analysis of EV potential in the US, as manufacturers were concerned about meeting CAFE fuel economy requirements. At the time, battery technology wasn’t where it needed to be, driving range was limited, there was no charging network, and so on. The recommendation was “not yet” on a national basis, possibly fleet sales, in warmer climates, for fleet vehicles that returned to their home base each day, to be used as a test case to improve the technology and user experience. In other words, it was not economically or commercially viable at that time.

There have been some advancements, but driving range and charging network availability and reliability are still issues, particularly in the western states. Vehicle prices are too expensive for the average consumer, unless subsidized through tax credits, and tax credits are only available on certain qualifying vehicles. Safety issues are a concern. Homes may need electrical panel upgrades. Used vehicle technology ages quickly. Batteries are expensive to replace. These can all be barriers to adoption by the average consumer. There are questions about lithium resources going forward.

Other random thoughts:

Tesla was founded in 2003. Six years later, it had built just ~150 (as in one-five-zero) cars against roughly $190 million in investor funding. In 2009, it got a boost in the form of a $465 million loan from DOE. In other words, taxpayers stepped in to rescue it. The loan was repaid several years after it launched its IPO. In more recent years, it has generated more profits from regulatory tax credits than it has from the car sales themselves. (That represents an opportunity cost, again to taxpayers, who might want tax receipts directed toward other “investments”.)

Traditional vehicle manufacturers are locked into existing dealer relationships. So one advantage Musk had was that he didn’t have to honor existing dealer contracts. He also didn’t have to concern himself with labor agreements and the UAW. Ditto for the millions of people employed by the industry, including those employed by suppliers.

Another advantage Musk has is the public perception that he is some kind of eccentric “bad boy” genius. I will cede the points regarding “eccentric” and “bad boy”, but he has benefited from the rise of a certain type of culture, for want of a better term, particularly as it exists among investors and the media, and their fascination with shiny new objects. He’s been lucky, but poor judgment has also been an ongoing issue.

And there have been serious missteps, including poor forecasting/scheduling/underestimation of production capacity, Autopilot/”Full Self Driving” vehicles and safety issues, the Bitcoin foray, etc. The new Cybertruck stainless steel model apparently attracts surface rust particles, which affects its appearance unless regularly removed or sealed with an overcoat application. The fallout from his handling of the Twitter acquisition and subsequent X business decisions, as well as his withdrawal of Starlink support in Ukraine have cast a shadow over his other projects.

Finally, people often view a car or SUV as an expression of themselves. This could affect whether they want to appear to be supporting a company or individual who may not represent their personal values. I believe this will continue to adversely affect sales. Jmo.

Here is a “new” but old problem. Tires wear out, and the resulting pollution of tire wear and brake pad wear create more “emissions” than ICE cars exhaust these days. EVs of comparable sizes typically weigh about 30% more than ICE vehicles, so they have more “wear” and EVs create more micro-plastic pollution than ICE vehicles. CA ignores the problem by giving both vehicles the same “wear and tear” of plastic pollution because “EV’s might get lighter one day”. That’s all, just something we’ll start hearing about – the articles are appearing in CNN and WSJ.

https://www.cnn.com/2022/08/16/world/tyre-collective-microplastic-rubber-waste-climate-hnk-spc-intl/index.html

RE- “Tesla’s model is more customer-friendly” I know many thousands if not millions of drivers who dispute that. In fact I loved the Teslas I tested but held off buying due in part to all the horror stories I heard about service. Cars sitting for weeks awaiting parts or an appointment. All service must be set thru app- no phone calls allowed. Even Elon admitted the manufacturing got ahead of servicing.

Thanks for introducing the concept of the First Principles Model and subsequently applying it to the examples of smartphones and EVs. Is Toyota trying to split the middle by devoting so many resources to hybrids? Is that the right approach at least for the next 20 years?

Great article on EV cars. You are just as lucid as Warren Buffet

I understand your pleasure with your Tesla purchase, however I believe Tesla is a short lived investment. There are so many short comings with an EV it is difficult to begin. Just to start there are not enough earth elements available to produce EV’s at scale, with a price point that is affordable. The battery technology is woefully inadequate for the task it is chosen to perform. The national grid is far from able to charge all the EV vehicles Tesla and others wish to produce and it probably will be very far into the future before that will be a possibility. The latest info is that the making of EV vehicles produce more pollution than a gasoline vehicle. I get the dream but reality gets in the way. I see EV vehicles as a niche business for the wealthy, not the every day motorist. Right now Dealers are screaming at the manufacturers to stop sending them EV’s because they do not sell. I don’t see this getting better for either party. This is a result of another failed government program which is forcing people to buy the EV when no one wants one or needs one, and using incentives as a prop.

I am following this long-lasting reasoning of yours, Vitaliy. It is really a pleasure. I am thankful for that.

However.

Elon says he starts from physics, from first-principles.

One of the first-principles is the physics related to squeezing electrons into a battery. And it does take time.

On February 24, 2022; I was happily leaving a very good life in beautiful Kiev (I still pronounce it in Russian, both because I speak the language and because I do not believe all russians are evil) but had to take my Diesel powered Audi Allroad, stuff inside it my family of four, grandma, some of our belongings and two cats and leave for Italy circling a long and winding course around the advancing russian armies. Luck had I just had refilled (in 1 min) the 80-litre tank so I could make it safely all the way down to the Moldovan border, and refill the tank, after some 56 hours of almost uninterrupted drive. What we saw and experienced made the trip the experience of a lifetime.

However: what if I had owned a Tesla, also considering that nighttime temperatures were around -7° celsius and that no superchargers were to be found on Ukraine’s dusty secondary roads? We would have remained stuck someplace in the freezing cold nothingness after the first 10 hours.

Let’s go back to the horse/car debate (or the dumb/smart phone). My opinion the EV is a great, great idea if you live, let’s say, in Milan, have your supercharger in the garage, and use the car as a commuter. For a summer trip to Sicily, however, I would take an ICE. Unless a solution to a physics problem is found.

So I believe the ICE brands are going to stay, and some of them are at bargain prices. Those that will be able to use their brand to turn their products into luxury items (BMW? Audi? Lexus?) will also be able to sell less vehicles but at a higher price, maybe, turning advanced ICE cars into objects of desire even more than they are now.

I’d be glad to hear yours on the above,

Many thanks,

Marco

Another point about Amazon: they make $$$$ today being a one-stop shop for almost everything. I hardly go to stores anymore because why waste time looking in half a dozen brick-n-mortar retailers looking for a specific item they likely won’t stock when I can go to Amazon, put it in the search box and have it on its way to my home in a matter of minutes? OK, the joke here is that Sears & Roebuck had that business model down pat for more than a century. Before there was the internet, Sears had catalogs. And back before anyone heard of a computer, my parents wouldn’t bother going to stores looking for that specific item, they would find it in the Sears catalog, fill out and mail an order blank (or phone it in) and have it at the house in a few days. Wouldn’t you know it but Sears gave up that business model in the mid 1980s. Maybe they were right at the time but 15 years later that business is back with avengence and Sears is now a historical reference. They jumped off that horse at the wrong time.

So what’s to say the ICE car or something like it, perhaps powered by some exotic technology that has all of the advantages and none of the disadvantages of battery/electric, won’t make a comeback in a similar way? Maybe the ICE carmakers ought to start thinking out of those boxes as well?