Stock Analysis

Searching for Yield?

This piece was written in the fall of 2016, but many of its core lessons remain true to this today. ...

SoftBank CEO Masayoshi Son Banks on Exponential Growth

I am about to go out on very thin ice. I am a value investor, but I’ll probably get banned ...

The Values of Value Investing

I organize a conference every summer called VALUEx Vail. Vail is a quaint, beautiful, ritzy ski resort town tucked away ...

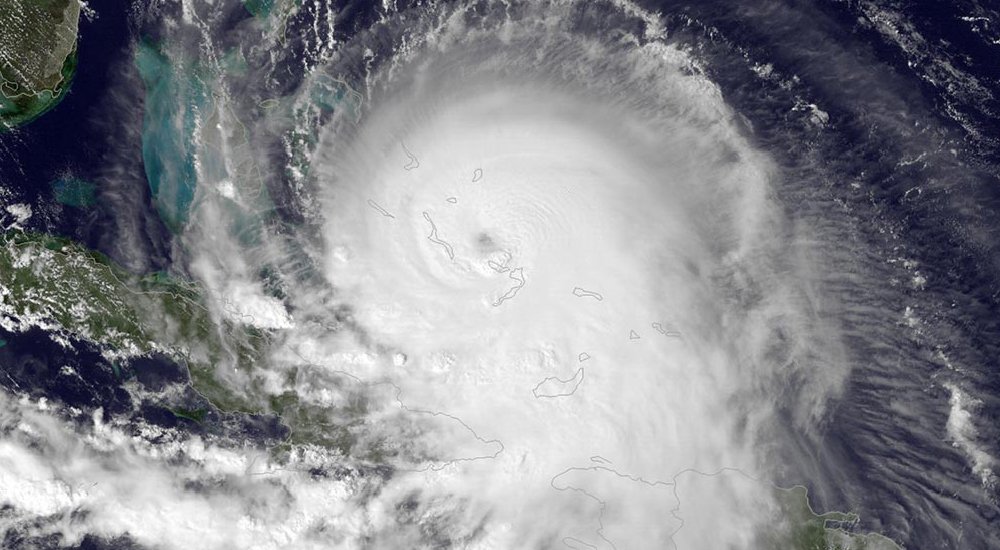

Time for an All-Terrain Investment Portfolio

As investors today we feel something like a traveler preparing to drive across an unknown continent. A look in the ...

For Investors, Discovering Truth Takes Time

The Roman philosopher, playwright, statesman and occasional satirist Lucius Annaeus Seneca wasn’t talking about the stock market when he wrote ...

Jos. A. Bank and the Folly of Quantitative Easing

A few years back I wrote an article comparing buy-one-suit-get-three-free sales by Jos. A. Bank to the Federal Reserve’s quantitative ...

Whatever Happened to the Invisible Hand of Capitalism?

I originally wrote this piece in 2016, but it continues to be relevant to this day. When I was growing ...

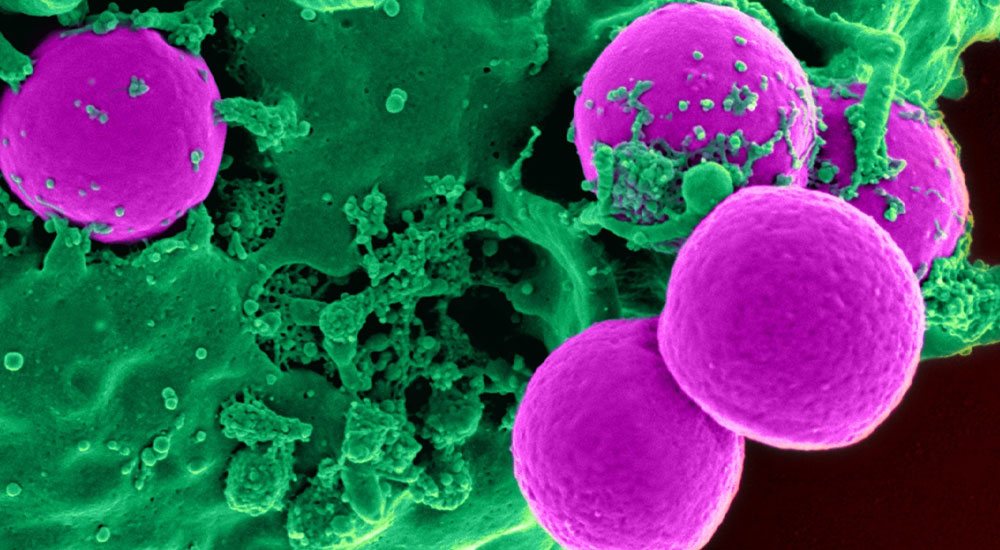

Gilead Sciences’ Miracle Drug Combination

It was 1986. I was a junior high school student in Soviet Russia. In political information (propaganda) class, the teacher ...

How Investors Should Deal With The Overwhelming Problem Of Understanding The World Economy

January 2016 The article is very long. It is long for two reasons: first, it is was originally a two-part article ...

Downhill Racing Meets Value Investing

I am a skier. When someone says this, you assume he or she is good. Well, I thought I was good. I was not Lindsey Vonn, but I had the technique down. I’d be the fastest person going down the mountain, always waiting for my friends at the bottom

What I Learned from Value Investor Guy Spier

Guy Spier is a tremendous value investor who happens to be a good friend whose company I truly enjoy. He is the most cosmopolitan person I know. He was born in South Africa, spent his childhood in Iran and Israel

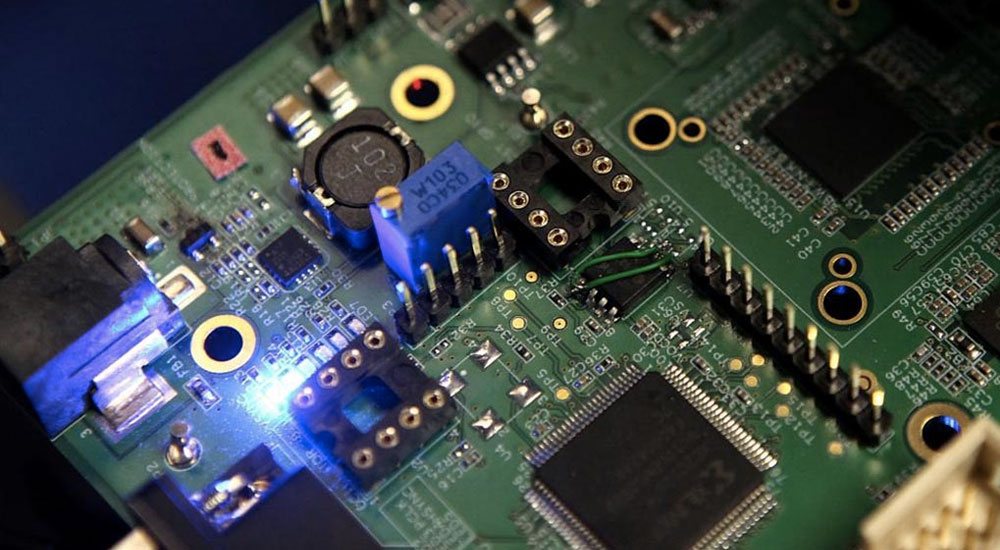

Making the Case — Again — for Micron

I made a case for Boise, Idaho–based chip maker Micron Technology in April 2014. For a while I looked brilliant: The stock went vertical from $22, peaking at $36.

Zurich Presentation & Romantic Road

Guy Spier and I presented and did a joint Q&A with the UK CFA Society, and then the next day we flew to Zürich. There we did another presentation, this time for the Zürich CFA.

Apple’s Electric Car and Its Consequences

I was on Bloomberg Radio with Cory Johnson and Carol Massar, discussing my latest article on Apple’s electric car and its consequences.

Shadow Over Asia

Five years ago, almost to the day, I was interviewed by David Galland, who worked at Casey Research at the time. This interview covered three topics: the Chinese overcapacity bubble, the Japanese debt bubble, and my sideways markets thesis. Five years is a long time, but with the exception of updating some statistics I really would not change anything.

Apple, Amazon, Tesla and the Changing Dynamics of the Car Industry

Writing is a very weird experience for me. Sometimes it feels almost like an act of divine intervention. Not because of the divinity of it, but because of the intervention part.

Thoughts on iPhone 6s

I spent the weekend with an iPhone 6s. I didn’t find many differences between the 6 and 6s.

Innovation is Alive and Well at Apple

Can Apple still come up with breakthrough innovations? In September Apple introduced an iPhone with 3-D touch, Apple TV that has been turned into a gaming device and a larger iPad with a stylus that will take the tech giant into new niches.

Manifesto – The Values of Value Investing

I rarely share letters we write to IMA’s clients, but I decided to share this “Value Investor’s Manifesto”.

The Apple Watch Is More Than a Cool Gadget

“You know how difficult it is to explain to a nonparent the joy of having kids? The Apple Watch is the same thing. It’s hard to explain how great it is to someone who has never worn one.”

The Conn’s Paradox, or the Synergy of Awful

I expected to see inverse synergy at Conn’s when we started analyzing it; after all, the company consists of two pretty awful businesses.